Get the free pdffiller

Show details

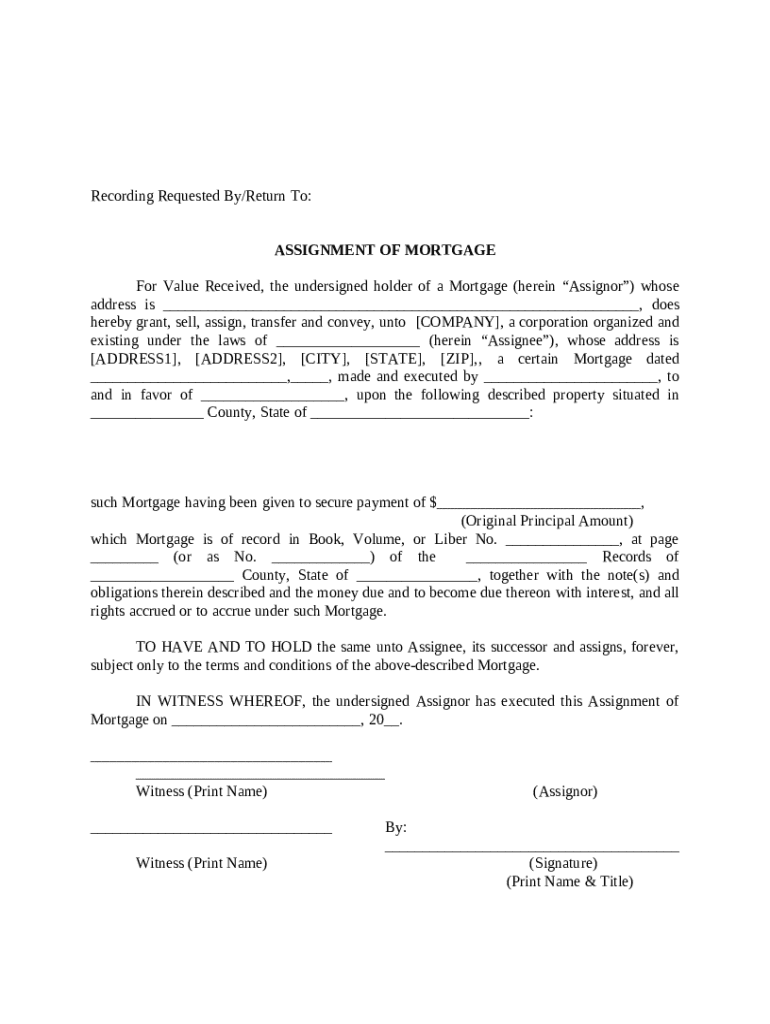

This is a Multistate Assignment of Mortgage for a single family residence which contains a section for property description.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is multistate fannie mae assignment

The multistate Fannie Mae assignment is a legal document used to transfer the rights and responsibilities of a mortgage loan from one party to another across multiple states.

pdfFiller scores top ratings on review platforms

Great site

The site is a little slow to use, but when the documents are printed they look great

Very easy to use

Very easy to download a document, fill in the required fields and electronically sign. When I had a small issue customer service solved it quickly.

It’s great

It’s great it’s so easy to use

Hello

Very happy and I would recommend to you for sure.

awesome

i just stared and im loving it, so easy to download then i can work on it

Excellent PDF Tool

Ease of use with a power of access from every where.Inserting and editing some basic shapes would be awesome.

Who needs pdffiller template?

Explore how professionals across industries use pdfFiller.

How to Complete the Multistate Fannie Mae Assignment Form

How do understand the assignment of mortgage?

The assignment of mortgage is a legal document that transfers the rights of a mortgage from one party to another. Understanding this process is crucial for ensuring compliance with laws governing mortgage documentation, particularly under Fannie Mae's requirements. Key differences between state guidelines also need to be recognized to prevent legal complications or unintentional violations.

-

This refers to the legal act of transferring ownership of a mortgage from the original lender (assignor) to another lender (assignee).

-

It's essential for ensuring that the new lender has the legal right to collect payments and enforce the terms of the mortgage.

-

Fannie Mae has specific guidelines and documentation requirements that must be followed during the assignment process to maintain compliance.

-

Each state may have its own specific requirements for mortgage documentations such as notarization and filing procedures.

What are the essential elements of the form?

Completing the multistate Fannie Mae assignment form requires attention to detail regarding critical components. Each section serves a unique purpose and collecting accurate information ensures the assignment is legally binding and valid.

-

This section specifies who is requesting the recording and where the recorded document should be sent. It should include full contact details.

-

Names and addresses of both the original lender and the new lender must be clearly stated to avoid confusion in ownership.

-

This includes the mortgage date, its value, and any relevant record information that defines the loan terms.

-

The form contains specific language that may require interpretation—a correct understanding is critical to avoid misinterpretation.

How do fill out the form step-by-step?

Filling out the multistate Fannie Mae assignment form can seem daunting, but following a structured approach simplifies the task. Here's how to effectively complete it.

-

Begin by writing down the full name and address of the original lender accurately.

-

Input the assignee's name and address with precision to ensure clarity on new ownership.

-

Detail the property that the mortgage pertains to, including location and any identifying information.

-

Both parties must sign the document, and depending on state laws, it may need to be witnessed or notarized.

How can use pdfFiller to edit and sign the form?

pdfFiller offers an intuitive platform for managing various document types, including the multistate Fannie Mae assignment form. With its comprehensive editing tools, users can seamlessly modify the document and even sign electronically.

-

The platform provides tools to fill out forms, add text, and insert images as necessary.

-

Easily upload the document to pdfFiller, where you can then tailor it to your specifications.

-

Users can utilize pdfFiller’s eSign feature to sign the form electronically, ensuring that it remains legal and secure.

-

pdfFiller also enables teams to collaboratively work on documents, streamlining the review process.

What legal considerations should be aware of?

Before finalizing the multistate Fannie Mae assignment form, it is essential to understand the legal implications surrounding the assignment process. Failure to comply with associated laws can lead to significant consequences.

-

Many states require that the document be notarized for it to be considered valid, hence checking local regulations is critical.

-

It's important to be aware of the specific compliance guidelines set by each state, as failing to adhere could result in legal challenges.

-

Improperly executed assignments can lead to disputes over terms or even foreclosure actions.

-

Safeguard your records by maintaining digital copies and ensuring they are stored securely.

How do finalize the document?

Once the form is completed, ensuring that all sections are filled out accurately is vital for a successful assignment process. Best practices in document management can assist you in maintaining organized records.

-

Double-check all entries for accuracy to prevent issues with processing the assignment.

-

Utilize secure platforms to store forms digitally, keeping backups in case of loss or disputes.

-

Ensure to follow up with any notifications required by your state’s regulations regarding the assignment.

How to fill out the pdffiller template

-

1.Begin by downloading the multistate Fannie Mae assignment template from pdfFiller.

-

2.Open the template in pdfFiller and review the fields that require information.

-

3.Fill in the 'Assignor' section with the name and address of the current mortgage holder or lender.

-

4.Proceed to the 'Assignee' section, entering the name and address of the new mortgage holder.

-

5.Enter the loan information, including the loan number and date of the original mortgage.

-

6.Review the terms of the assignment to ensure accuracy and compliance with local laws.

-

7.Add the signatures of both the assignor and assignee, including the date of signing.

-

8.Once all fields are completed and verified, save the document and download it as needed for records or further processing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.