Last updated on Feb 17, 2026

Get the free Escrow Agreement and Instructions template

Show details

An escrow account refers to a bank account held in the name of the depositor or an escrow agent which does not belong to the depositor, but is returnable to the depositor on the performance of certain

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

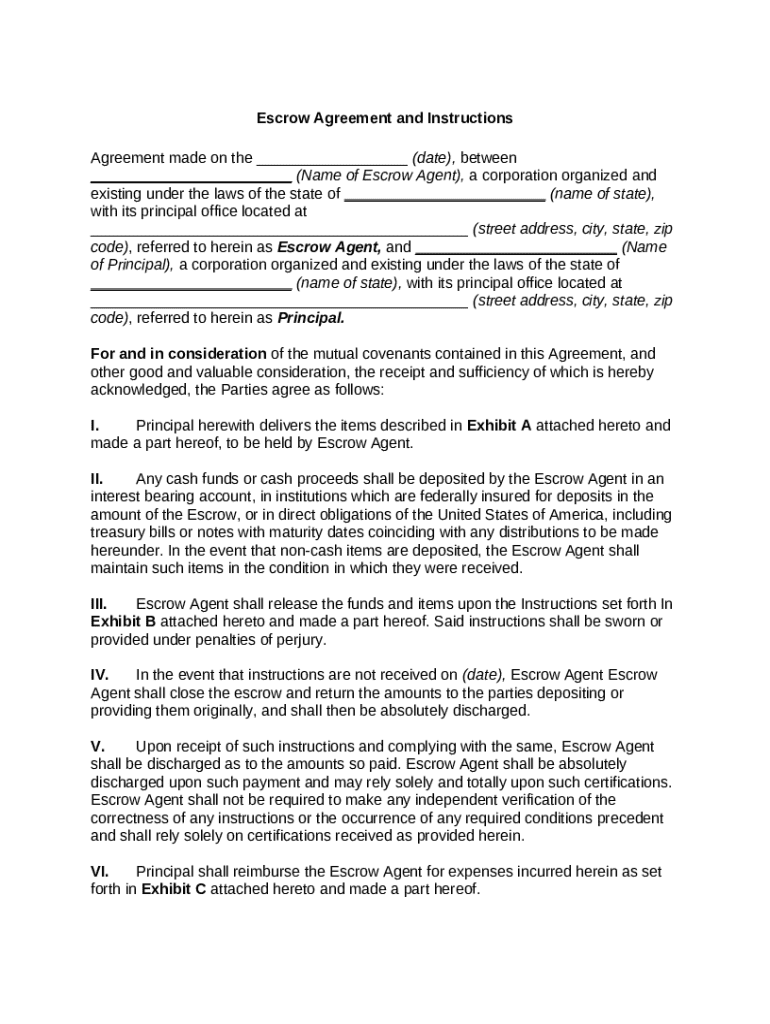

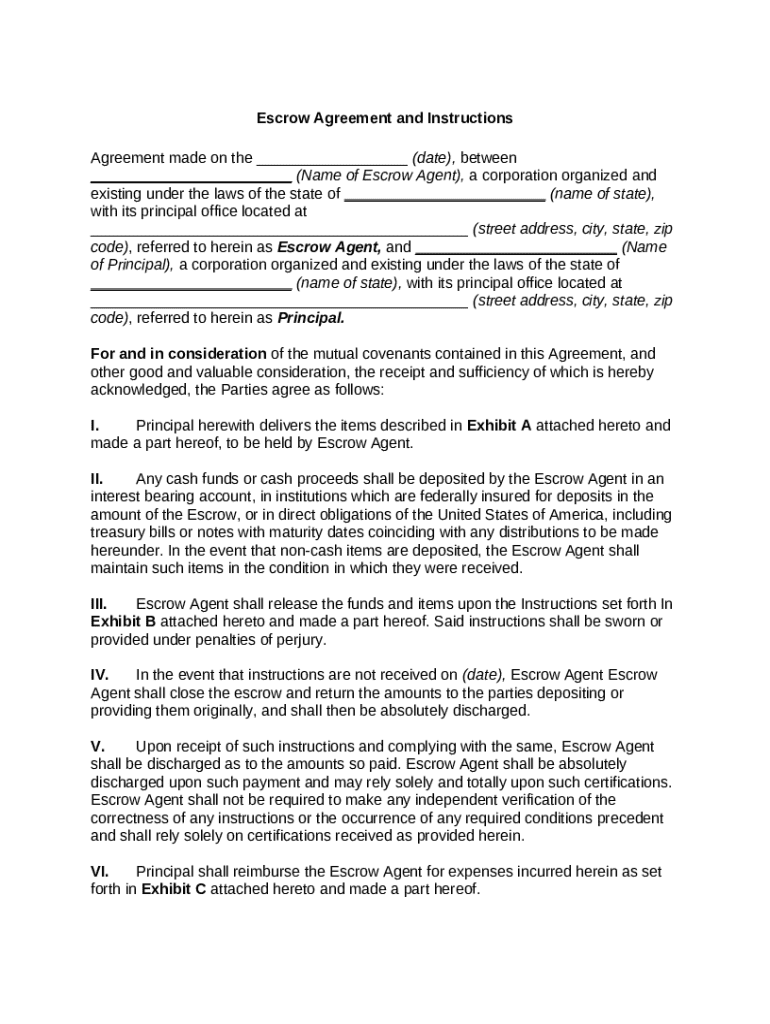

What is escrow agreement and instructions

An escrow agreement and instructions are legal documents that outline the terms under which a third party holds funds or assets until the fulfillment of specified conditions.

pdfFiller scores top ratings on review platforms

I was asking them for a refund as I…

I was asking them for a refund as I don’t need the subscription to get through as I am on maternity leave which means I will no longer use it. Bruce through online support helped me smoothly.

I absolutely love pgfFiller!

I really enjoy how user friendly the program is. If I had any complaints, it would be that I have to change the size of the font if I am updating a previous document that I edit.

Very fast conversion and easy to use

A good product that I would definitely recommend.

.

Who needs escrow agreement and instructions?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to the Escrow Agreement and Instructions Form

How can you understand an escrow agreement?

An escrow agreement is a legally binding document that facilitates transactions by allowing a neutral third party, the escrow agent, to hold funds or assets until specific conditions are met. This agreement is crucial because it creates a sense of security for both parties involved—buyers and sellers—by outlining their obligations and protecting their interests during high-stakes transactions.

-

An escrow agreement is a contract stipulating the terms under which an escrow agent—often a bank or title company—will hold assets until specific conditions for their release are met.

-

The main parties in an escrow agreement are the principals, typically the buyer and seller, and the escrow agent, who manages and oversees the transaction.

-

Escrow agreements ensure that buyers do not lose their money without receiving their purchased goods, while sellers can feel secure that their assets are only accessible upon fulfilling their obligations.

What are the core components of an escrow agreement?

An escrow agreement consists of essential components that define the roles, responsibilities, and terms of the agreement. Understanding these elements is critical for parties entering into an escrow arrangement, as they outline the expectations and legal framework governing the transaction.

-

The escrow agent must be clearly identified in the agreement with legal requirements, including their name, address, and state of incorporation.

-

Details regarding the principal are vital, including their responsibilities and obligations to ensure agreement compliance.

-

Items held in escrow should be clearly described, typically listed in an exhibit alongside the agreement (e.g., Exhibit A), to ensure transparency.

What kind of financial transactions occur within the escrow process?

Financial transactions within the escrow frame are integral to securing the assets involved in negotiations. The escrow agent holds funds and manages the terms defined in the agreement, ensuring that the handling of cash and non-cash items comply with stipulated guidelines.

-

The escrow agent manages various types of funds, organizing them according to the stipulated conditions of the escrow agreement.

-

Funds held in escrow must typically be maintained in interest-bearing accounts at federally insured institutions to ensure security.

-

Clear guidelines must be established for both cash and non-cash items, specifying how each type of asset is treated throughout the escrow process.

What are the instructions for disbursement of escrow items?

Instructions on the disbursement of escrow items detail the conditions under which the escrow agent will release funds and assets to the appropriate party. Compliance with these instructions is crucial to avoid potential delays or disputes.

-

Release conditions are specific scenarios under which the escrow items will be disbursed, as laid out in an exhibit, often referred to as Exhibit B.

-

Instructions must often be sworn or provided under penalties of perjury to validate their legitimacy, adding an extra layer of security in the transaction.

-

Failing to provide disbursement instructions on time may lead to legal complications or delays, jeopardizing the transaction's success.

How do escrow agreement clauses affect transactions?

Escrow agreements may include several clauses, each serving a specific purpose that can significantly influence transaction outcomes. Understanding these clauses is imperative for both parties to mitigate risks and clarify expectations.

-

These may include clauses related to default, termination, and confidentiality, each governing different aspects of the agreement.

-

Clause interpretations may vary based on state laws, meaning it is essential to seek legal advice to comprehend their implications fully.

-

Well-drafted clauses can protect both parties, while poorly structured clauses can lead to disputes or financial loss.

What are the options for dispute resolution in escrow agreements?

Dispute resolution is a critical aspect of escrow agreements, providing parties with methods to resolve conflicts that may arise. Understanding these options can help mitigate risks and facilitate smoother transactions.

-

Common methods include mediation, arbitration, and litigation, each offering different paths to settle disagreements.

-

Disputes involving escrow agreements may involve legal ramifications, making it essential to choose a resolution strategy carefully.

-

Common scenarios requiring dispute resolution include failure to fulfill obligations or miscommunications about disbursement instructions.

How do you fill out the escrow agreement and instructions form?

Filling out the escrow agreement and instructions form can seem daunting, but utilizing tools like pdfFiller significantly simplifies the process. Users can edit, eSign, and collaborate on forms effectively on a cloud-based platform.

-

Follow an easy step-by-step guide for completing the form, ensuring that all required fields are accurately filled.

-

pdfFiller offers interactive features that enhance the form filling and signing process, making it user-friendly.

-

Make sure your submissions are accurate and comply with legal standards by reviewing each section thoroughly before finalizing the document.

What resources are available for escrow agreements?

Accessing helpful resources and templates about escrow agreements can guide individuals and teams through their documentation needs. These resources often include FAQs, instructional content, and user guides that can enhance the understanding of escrow agreements.

-

Resources available on pdfFiller provide access to various templates related to escrow agreements for different use cases.

-

Find answers to commonly posed questions about escrow agreements, shedding light on common concerns.

-

Explore options for further assistance, ensuring you have all necessary information to navigate escrow agreements efficiently.

How to fill out the escrow agreement and instructions

-

1.Open the PDF document for the escrow agreement and instructions on pdfFiller.

-

2.Begin by entering the names and contact information of all parties involved in the agreement at the designated fields.

-

3.Clearly define the purpose of the escrow agreement in the allocated section, detailing what assets or funds are being held in escrow.

-

4.Specify the conditions that must be met for the release of the escrowed funds or assets, ensuring clarity on all stipulations.

-

5.Fill in the escrow amount or describe the asset to be held, provided there is a dedicated space for this information.

-

6.Include the timeline for the escrow agreement, indicating any crucial deadlines related to the transaction.

-

7.If necessary, add any additional clauses or agreements that further outline the responsibilities of each party.

-

8.Review the document for any errors and ensure all required fields are completed.

-

9.Once confirmed, sign and date the agreement in the relevant sections, and have all parties do the same.

-

10.Finally, save your completed document and share it with all parties involved to finalize the escrow process.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.