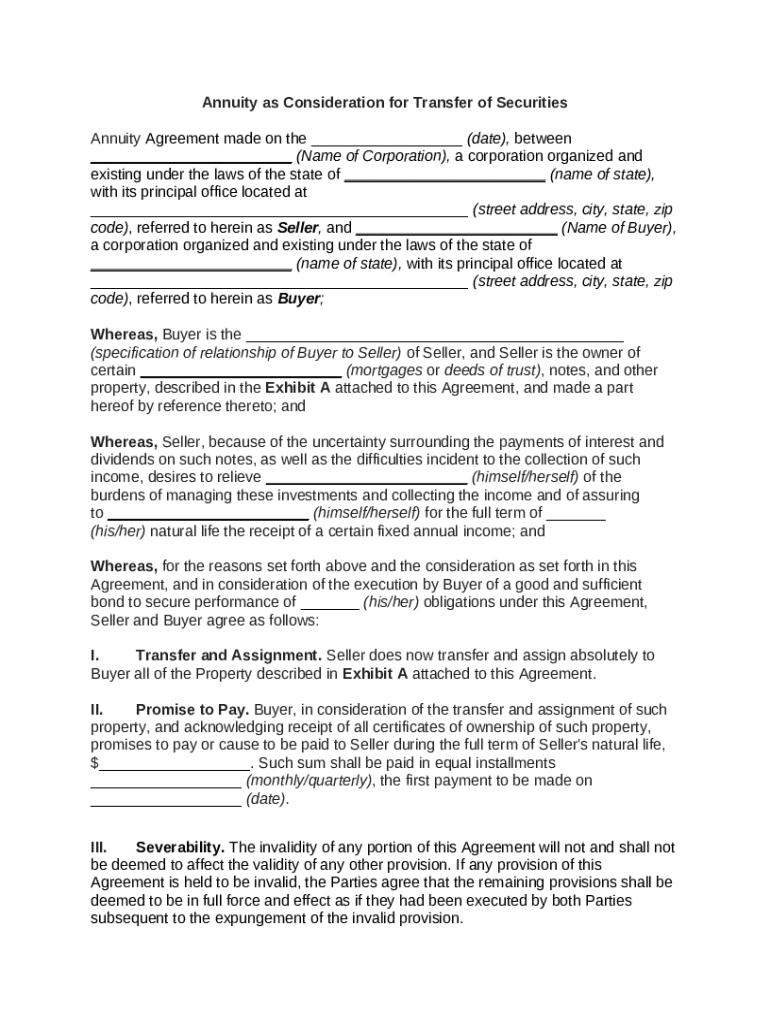

Get the free Annuity as Consideration for Transfer of Securities template

Show details

An annuity is a life insurance company contract that pays periodic income benefits for a specific period of time or over the course of the annuitant's lifetime. These payments can be made annually,

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is annuity as consideration for

An annuity as consideration for is a financial arrangement where annuity payments are used as compensation or exchange for a specified obligation or service.

pdfFiller scores top ratings on review platforms

great

this is a really great program! well worth it!

Great software!!

Great software!!

It's great!

Everything works as described.

Great very easy to use

Great very easy to use

Easy and simple tool to use

Easy and simple tool to use, very efficient.

Easy to use and convenient

Easy to use and convenient

Who needs annuity as consideration for?

Explore how professionals across industries use pdfFiller.

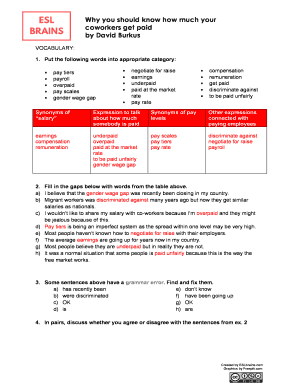

How to fill out an annuity as consideration for form form

Understanding annuities as consideration

Annuities are financial products that provide a series of payments over time, often in exchange for an upfront investment. They play a crucial role in transferring securities and real estate, allowing for structured payouts in a secured format. Using annuities as consideration in agreements presents both opportunities and implications, including possible tax benefits and long-term financial planning strategies.

-

An annuity is a contract between a buyer and an insurance company, wherein the buyer makes a lump sum payment in return for regular payments for a specified period or for the buyer's lifetime.

-

Annuities can facilitate the direct transfer of assets, providing security to the seller while offering income benefits to the buyer.

-

When using annuities as consideration, it’s essential to understand their effect on contract terms, tax implications, and the parties’ long-term obligations.

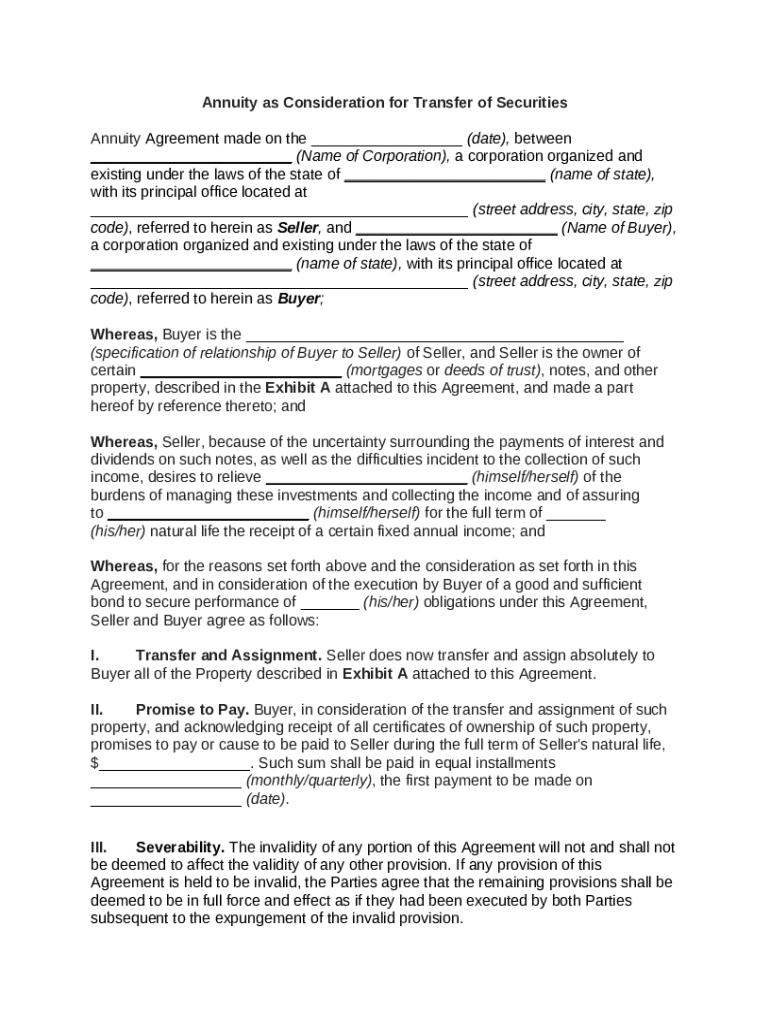

Overview of the annuity agreement structure

Annuity agreements are structured legal documents that specify key components and obligations of the parties involved. The seller and buyer must be clearly identified, including relevant entity details such as corporation names and addresses, as well as pertinent state laws that may affect the agreement.

-

Essential sections in an annuity agreement include payment terms, duration of the annuity, investment details, and other obligations of both parties.

-

Accurate identification of both the seller and buyer, including legal entities, is crucial for enforceability and clarity within the agreement.

-

Including addresses and compliance with state regulations helps to mitigate legal risks in the enforcement of the agreement.

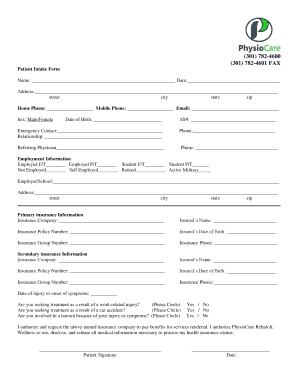

Filling out the annuity transfer form

Filling out an annuity transfer form is essential for formalizing the agreement and ensuring that all legal requirements are met. Users should follow a systematic approach, entering detailed information about the seller and buyer, as well as outlining the specific property involved in the transaction.

-

Accurately include full names and contact details to establish identities and minimize disputes.

-

Clarify the nature of the relationship between the buyer and seller to provide context and avoid misunderstandings.

-

Specify the annuity or properties involved in the transaction fully to mitigate any future ambiguity.

-

Detail the payment schedule and obligations to ensure both parties are aware of their financial commitments throughout the annuity's lifespan.

Importance of legal considerations

Legal considerations are paramount when dealing with annuity agreements. The legal framework surrounding these contracts varies by jurisdiction, making compliance a primary concern to ensure enforceability and avoid legal pitfalls.

-

Understanding the laws applicable in the jurisdiction of the agreement is essential for compliance.

-

Different jurisdictions have varying requirements for legal documents, and fulfilling these is essential to avoid disputes.

-

Failing to comply with legal standards can lead to unenforceable agreements and financial loss for both parties.

Benefits of using pdfFiller for annuity forms

Utilizing pdfFiller for annuity forms streamlines the editing and signing process, making document management easier. Its interactive tools enhance collaboration and allow for seamless electronic signatures, which significantly speed up the transaction process.

-

pdfFiller provides interactive tools that facilitate the editing of PDF forms, allowing users to make changes in real time.

-

With cloud-based access, multiple parties can view, edit, and sign documents simultaneously, promoting efficiency.

-

Accessing documents from any device ensures that you can manage your annuity forms whenever necessary.

Managing your annuity agreements

Proper management of annuity agreements is critical for maintaining compliance and ensuring all parties fulfill their obligations. Establishing best practices for storing documents and regularly updating agreements contributes to effective management.

-

Use secure digital storage solutions to keep your annuity documents safe and easily retrievable.

-

Regularly review agreements for relevance and compliance with current laws and practices.

-

Effective communication and transparency between buyers and sellers help to foster trust and sustain ongoing relationships.

Comparative analysis of annuities and other financial instruments

Annuities can offer unique benefits compared to traditional investment options, particularly for retirement planning. By exploring scenarios that contrast annuities with other financial instruments, users can better understand their advantages.

-

Annuities may provide guaranteed income, while traditional investments can be subject to market volatility.

-

Annuities can ensure a steady income stream during retirement, reducing dependency on fluctuating markets.

-

Hypothetical scenarios show how selecting annuities can yield long-term financial security versus other investment options.

How to fill out the annuity as consideration for

-

1.1. Start by accessing pdfFiller and uploading the 'annuity as consideration for' document.

-

2.2. Review the document to understand all sections that require input.

-

3.3. Locate the fields designated for the annuitant's personal information, including name, address, and social security number.

-

4.4. Fill in the details accurately, ensuring all information matches official documents.

-

5.5. Proceed to the section where the details of the annuity arrangement are required.

-

6.6. Enter specifics regarding the annuity, such as the amount, payment frequency, and any special conditions.

-

7.7. If necessary, attach supporting documentation, such as consent forms or previous agreements.

-

8.8. Review all provided information for accuracy, spelling, and completeness.

-

9.9. Save the filled document and consider using pdfFiller's option to send it electronically or print it for physical submission.

-

10.10. Finally, ensure that all required signatures are completed before the final submission.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.