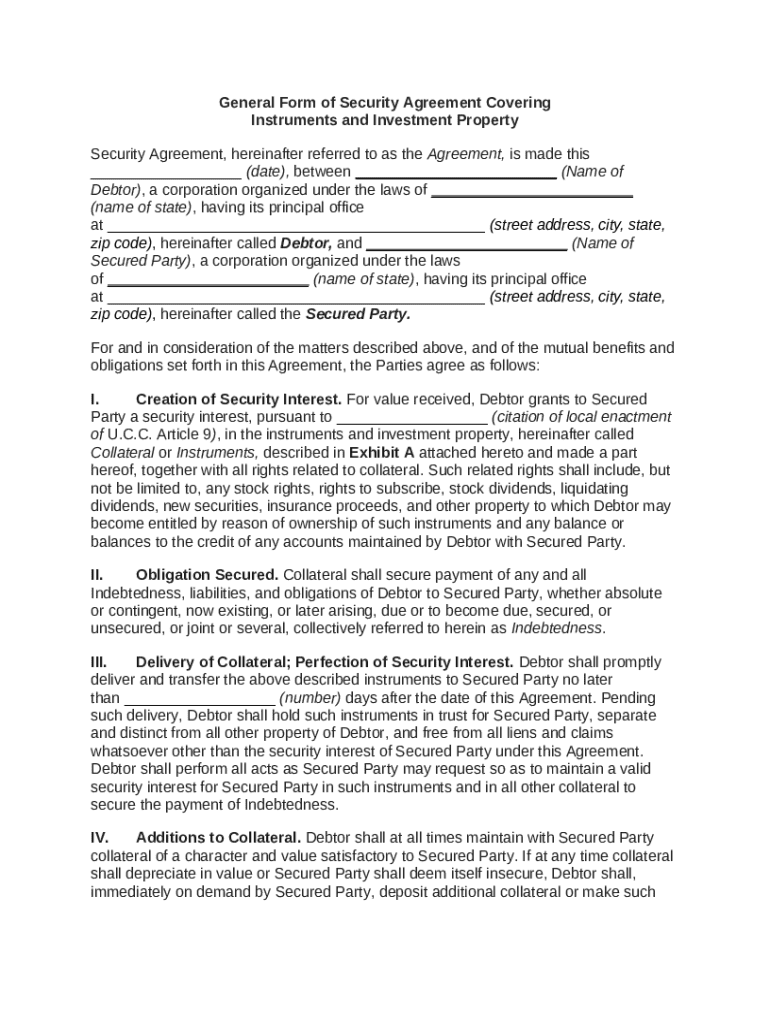

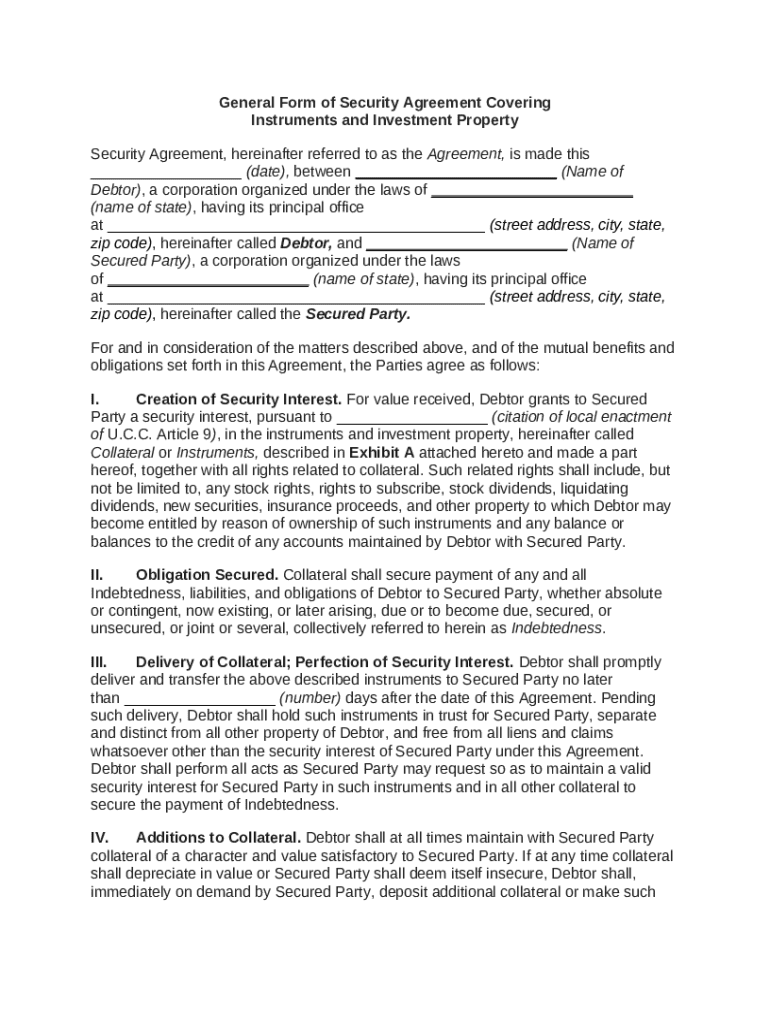

Get the free General of Security Agreement Covering Instruments and Investment Property template

Show details

A secured transaction is created by means of a security agreement in which a lender (the secured party) may take specified collateral owned by the borrower if he or she should default on the loan.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is general form of security

The general form of security is a legal document that establishes a security interest in specific assets to secure a loan or obligation.

pdfFiller scores top ratings on review platforms

great

I'm just a bot

I love the product

I love the product! Its a god send working remotely. I can sign forms, password protect documents with personal information and email them in an instant.

This program has been able to do…

This program has been able to do anything I needed done.

Performs as advertised!

great service.

After a bit of trial and error (I tend…

After a bit of trial and error (I tend to make things harder than they are), I was able to edit my pdf docs nicely. Great service!

Who needs general of security agreement?

Explore how professionals across industries use pdfFiller.

A comprehensive guide to the general form of security agreement

How to fill out a general form of security agreement

Filling out a general form of security agreement involves documenting the security interest, obligations of various parties, and specifics about the collateral. This guide will provide a step-by-step approach, helping you avoid common pitfalls while ensuring compliance with legal standards.

Understanding the general form of security agreement

A general form of security agreement is a legal document granting a creditor a security interest in a debtor's property. This agreement is crucial in financial transactions, as it protects the creditor's investment and outlines obligations for both parties involved.

-

It establishes a legal framework for the transaction, ensuring that both debtor and secured party have clear expectations.

-

The primary parties are the debtor, who owes a debt and provides collateral, and the secured party, who holds a security interest in the collateral until the debt is repaid.

-

These agreements are commonly used in loans, leases, and other financial transactions, providing security for lenders.

What are the key elements of the security agreement?

Understanding the foundational components of a security agreement is essential for effective implementation. These elements ensure that both parties are aware of their rights and responsibilities.

-

This is a legal claim on the collateral that secures the obligation. It includes identifying the collateral and stating the nature of the debt.

-

Both parties must adhere to the terms stated in the agreement, including repayment schedules and conditions of collateral.

-

The process involves the actual transfer of collateral to the secured party or detailing conditions under which the collateral will be managed.

How can you fill out the security form effectively?

Filling out the security form can be daunting, but with clear instructions, it becomes manageable. You can utilize tools like pdfFiller to ensure precision and convenience in completing the form.

-

Begin by filling out basic information about both parties, followed by the description of the collateral and the terms of the agreement.

-

Double-check the accuracy of information and ensure that all necessary fields are completed to prevent legal complications.

-

Take advantage of pdfFiller's editing tools to modify and sign your document electronically, streamlining the process.

How to manage security agreements with pdfFiller?

Managing your security agreements effectively is crucial for ongoing compliance and oversight. pdfFiller offers features that help you store and share documents with ease.

-

Utilize cloud storage to keep your agreements organized and easily accessible from any device.

-

Invite team members to collaborate on documents, providing feedback and making edits in real-time.

-

Cloud-based document management enhances security, ensures version control, and allows for quick retrieval of necessary information.

What are the legal considerations for security agreements?

Understanding the legal framework is critical for compliance when creating a security agreement. Various regulations may apply depending on your location and the nature of your agreement.

-

Be aware of specific laws in your state or locality that may influence the terms of your security agreement.

-

Ensure that your agreement adheres to the Uniform Commercial Code (UCC) as it relates to security interests.

-

Both debtors and secured parties must fully understand their rights and the implications of the collateral involved.

How to lock in your security agreement?

Finalizing your security agreement is a pivotal step in the process. Ensure that all actions are completed properly to solidify the agreement legally.

-

Review the document thoroughly and make any necessary amendments before obtaining signatures.

-

Both parties should sign the document, and any required notary or witness signatures should also be obtained.

-

Ensure that all parties are aware of their responsibilities as outlined in the agreement and maintain communication to avoid disputes.

How to fill out the general of security agreement

-

1.Open the PDF version of the general form of security in pdfFiller.

-

2.Begin by adding the date at the top of the document.

-

3.In the 'Debtor Information' section, enter the legal name and address of the debtor.

-

4.Next, proceed to the 'Secured Party Information' section and fill in the name and address of the secured party.

-

5.In the 'Collateral Description' section, provide a detailed description of the assets securing the obligation.

-

6.Ensure all contact details are accurate and up to date.

-

7.If required, include any additional clauses or information as applicable.

-

8.Review the entire document for accuracy and completeness.

-

9.Once verified, save your changes and download or print the completed form for signing.

-

10.Make copies for both parties involved and ensure proper filing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

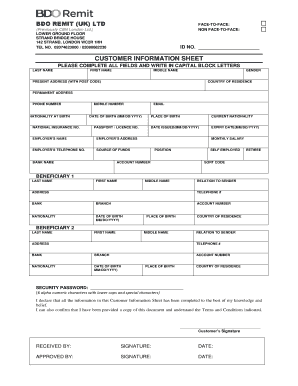

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.