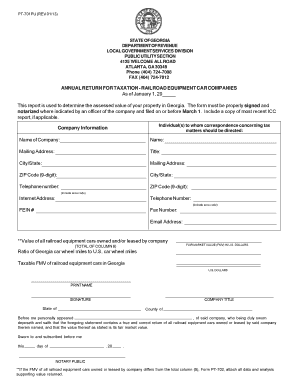

Get the free Letter to Creditor to Dispute Transaction and Advise of ID Theft template

Show details

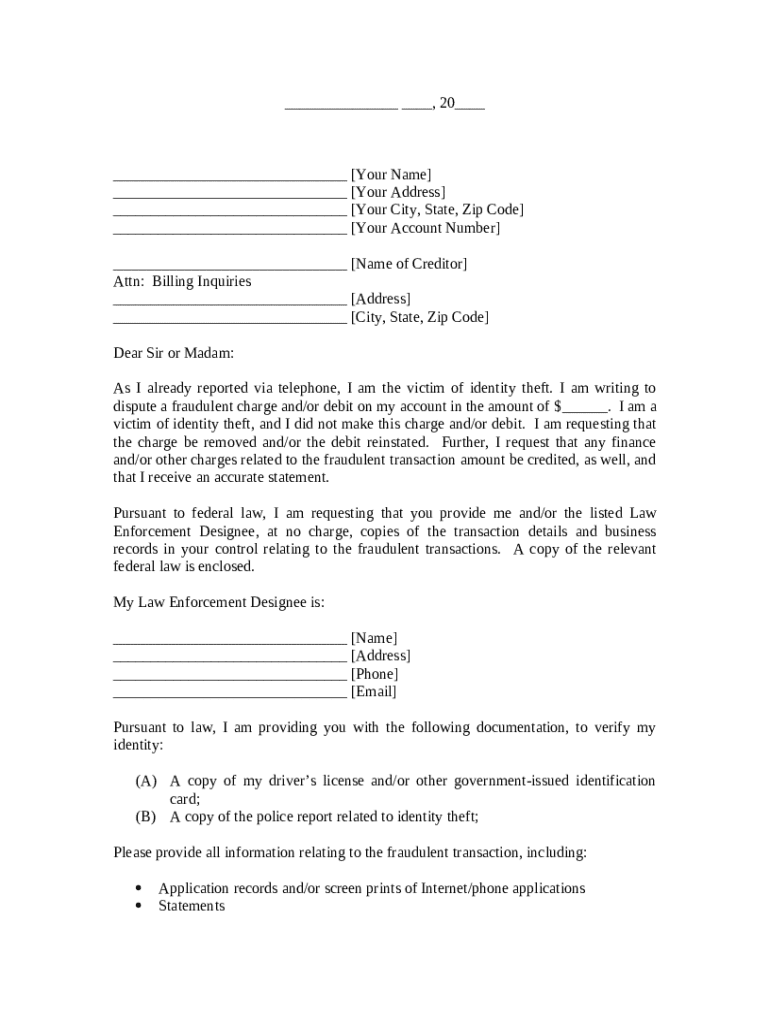

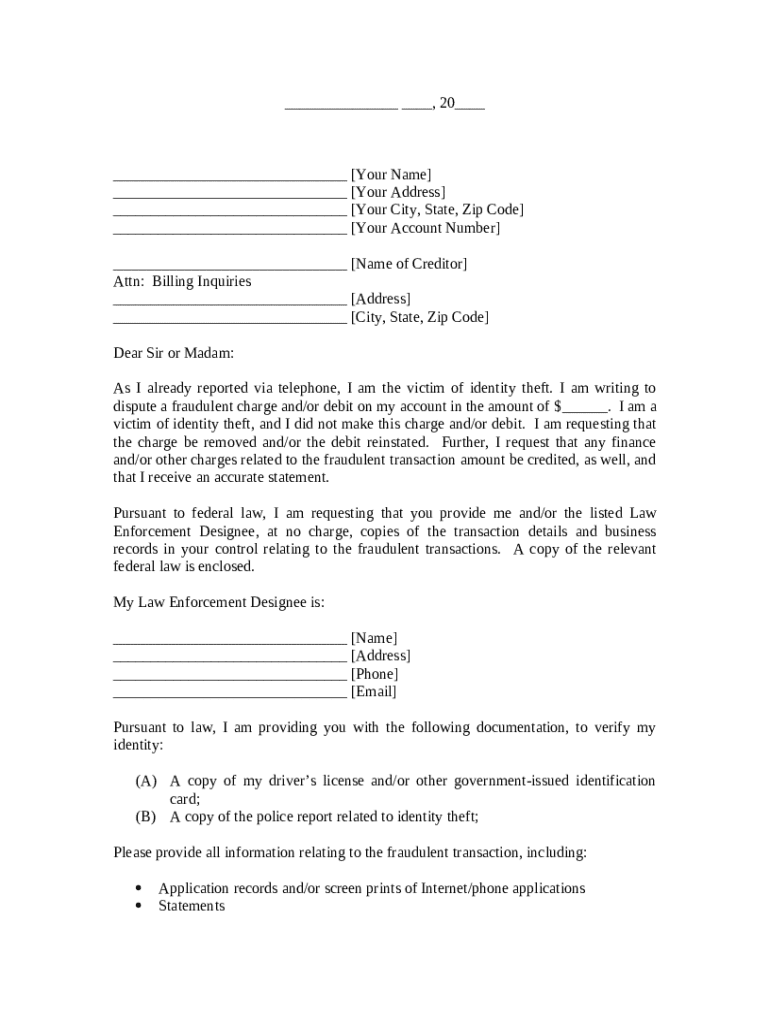

A letter to creditor advising of ID theft and to dispute a transaction on your account.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is letter to creditor to

A letter to creditor is a written communication sent to a creditor to address a financial obligation or dispute.

pdfFiller scores top ratings on review platforms

I have a ton of paperwork to complete in a short amount of time. This service has been a life saver!

Great tool to help with the docs. I would recommend it!

Still trying to figure out some of this and how to use it. Mechanics are having a hard time figuring out how to fill out and send back.

needs to be more accurate, needs little tweeks

This program makes my work so much easier, especially when working with multiple documents over and over again. Makes my life much easier also by saving me time. Thank you PDF Filler...........A++

I had a difficult time with it and it took a long time just to fill out passport forms for my wife and I. I just could not get the hang for it, but someone smarter than me and maybe younger, I am 72, will do much better with PDF filler.

Who needs letter to creditor to?

Explore how professionals across industries use pdfFiller.

How to effectively write a letter to your creditor regarding identity theft

How can you understand your rights when communicating with creditors?

Understanding your consumer rights is crucial when dealing with creditors, especially in cases related to identity theft. The Fair Debt Collection Practices Act (FDCPA) offers protections to consumers against abusive practices by debt collectors. This law ensures that you have the right to dispute debts and request validation.

-

You have the right to know the nature of the debt and demand proof of its validity.

-

If you suspect identity theft, federal law allows you to dispute fraudulent transactions.

-

You can formally dispute charges with your creditor and request resolution through certified mail.

What essential information and documentation should you gather?

Before writing your letter, it's essential to gather all necessary personal information and documents to substantiate your claim. This will not only streamline the process but strengthen your case against fraudulent charges.

-

Include your name, address, and relevant account numbers to identify your account.

-

Gather police reports, identification documents, and any evidence showing the nature of the fraud.

-

Make sure to note your creditor’s name and the specific account details.

How to craft your letter to the creditor?

Writing an effective letter to your creditor is vital for a favorable response. This letter should formally outline your issue and request specific resolutions related to the suspected identity theft.

-

Start with your identification and specify the creditor clearly.

-

Mention the fraudulent charge and include the amount in question.

-

Clarify what outcome you are seeking, such as reversing charges.

-

Provide contact details for your law enforcement officer if they need to reach out directly.

What should you include in your letter?

To make your appeal stronger, you should include key elements in your letter. This not only informs the creditor but also establishes your rights as a victim.

-

Furnish your account number, ensuring your request is directed accurately.

-

Explicitly mention your rights under the identity theft protection laws.

-

Ask for records related to the fraudulent activity.

-

Indicate all documents you are including to assist your claim.

How to provide supporting documentation?

Attaching relevant documents enhances the credibility of your claim. In cases of identity theft, proof is key.

-

Include a copy of your driver’s license or other ID.

-

Attach the police report confirming your claims of identity theft.

-

Provide any additional records that support your case, like bank statements.

How to manage follow-up communications with your creditor?

Tracking your communications with creditors after sending your letter is essential to ensure your dispute is addressed. Establish a systematic way to document everything related to your case.

-

Maintain a log of all correspondence with your creditor for reference.

-

Handle responses efficiently; follow up if you don't receive a timely reply.

-

Keep a record of any follow-up conversations and correspondence.

How can pdfFiller enhance your letter submission?

Using tools like pdfFiller can make the process of creating and submitting your letter much more efficient. This platform provides users with the ability to edit documents seamlessly.

-

Edit and format your document easily with user-centric features.

-

Enable secure and quick electronic signing of your letter.

-

Access and manage your documents anytime and anywhere, simplifying your workflow.

What to expect from your creditor’s response?

After you submit your letter, you can anticipate specific actions and timelines from your creditor. Understanding these expectations can prepare you for the next steps.

-

Creditors typically have a set timeframe to respond to disputes concerning fraud.

-

Your creditor is required to investigate your claims as mandated by law.

-

If your request is denied, know your rights to further escalate your case.

When should you escalate your case if necessary?

In some instances, your initial request may not yield the desired results, leading you to escalation. Knowing when and how to escalate can mean the difference between resolution and further denial.

-

Consider filing complaints with regulatory bodies if the creditor fails to act.

-

Consulting a legal expert may be necessary if the issue remains unresolved.

How to fill out the letter to creditor to

-

1.Open pdfFiller and select the letter to creditor template.

-

2.Begin by entering your personal information at the top of the document, including your name, address, and contact details.

-

3.Include the creditor's information in the designated section, ensuring to include their name, address, and any relevant account numbers.

-

4.Write the date you are sending the letter, which helps keep track of correspondence.

-

5.In the body of the letter, clearly explain your situation or the purpose of the letter, stating any relevant details about the debt or negotiation.

-

6.If you're disputing a debt, attach any supporting documents that validate your claims to the letter.

-

7.Conclude the letter with a respectful closing statement, expressing your desire for communication and resolution.

-

8.Sign the letter electronically using pdfFiller's signature tools.

-

9.Lastly, review the letter for any errors and save it in your preferred format before sending it to the creditor.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.