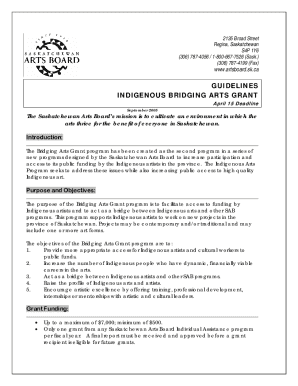

Get the free Exchange Agreement, Brokerage Arrangement template

Show details

A brokerage provides intermediary services in various areas, e.g., investing, obtaining a loan, or purchasing real estate. A broker is an intermediary who connects a seller and a buyer to facilitate

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is exchange agreement brokerage arrangement

An exchange agreement brokerage arrangement is a formal contract between two parties to facilitate the trading or exchange of assets through a broker.

pdfFiller scores top ratings on review platforms

I think this is a great place to get…

I think this is a great place to get legal documents to fit your needs.

great for business!

great for business!

This app is a life saver

This app is a life saver, it has saved me so much money and time by not having to print, a document, fill out the document and then fax it back.

GREAT TO USE FOR EDITING PDF FILES

GREAT TO USE FOR EDITING PDF FILES

Great program

Great program, no problems!

I love this product

I love this product

Who needs exchange agreement brokerage arrangement?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to the Exchange Agreement Brokerage Arrangement Form

What is an exchange agreement brokerage arrangement?

An exchange agreement brokerage arrangement form is a legal document that formalizes the understanding between a broker and a client for real estate transactions, particularly in exchanges where properties are swapped rather than sold. This form outlines the roles and responsibilities of each party, facilitating smoother transactions. Understanding this document is crucial for ensuring compliance and maximizing benefits in property exchanges.

-

The exchange agreement serves as a formal contract between a broker and client, detailing terms of the exchange transaction.

-

Its main purpose is to ensure all parties involved have a clear understanding of their obligations and rights, thus minimizing disputes.

-

Key components include broker and owner details, property descriptions, commission structures, and legal provisions.

How does a broker facilitate exchange arrangements?

Brokers play a vital role as exclusive agents in exchange agreements, acting as intermediaries between property owners. Their primary responsibility is to ensure that the interests of their clients are represented throughout the transaction. A broker's expertise can streamline processes, enhance negotiations, and lead to successful property exchanges, often exemplified by successful partnerships.

-

Brokers must present all offers, manage negotiations, and ensure legal compliance throughout the process.

-

They facilitate the exchange process by providing necessary market insights and connecting sellers with potential buyers.

-

Many successful broker-client partnerships are grounded in trust and effective communication, resulting in beneficial exchanges.

How do you complete the exchange agreement brokerage arrangement form?

Filling out the exchange agreement brokerage arrangement form accurately is essential for legal validity. It requires specific information about both the broker and the owner, along with complete property descriptions and terms of agreement. Understanding key fields and avoiding common mistakes can save time and prevent legal issues.

-

Essential fields include broker name, owner’s name, and property descriptions to establish clear identification.

-

Detailed guidance is crucial for entering relevant terms and ensuring the document reflects the intentions of both parties.

-

Errors such as omitting signatures or unclear property descriptions can lead to complications in transactions.

What are the different types of broker agreements?

Broker agreements can vary significantly, often categorized into exclusive and non-exclusive types. Each type serves different transaction needs and understanding when to opt for each can enhance transaction outcomes. Real-life scenarios exemplifying these agreements can provide valuable insights.

-

These agreements grant one broker the sole rights to represent a property, offering them incentives to invest efforts in marketing and negotiating.

-

Allowing multiple brokers to work on the same transaction, they can open diverse marketing strategies but might dilute individual broker efforts.

How are compensation structures defined in exchange agreements?

Compensation structures often hinge on factors like commission rates and additional fees. Understanding the minimum commission and potential 'boot' received can clarify broker compensation. Utilizing illustrative examples can further elucidate how compensation is calculated in real scenarios.

-

Usually set as a percentage of the total transaction value, it ensures brokers are compensated for their services.

-

Factors affecting compensation might include market conditions, property value, and the complexity of the exchange.

-

An example can show how commission is calculated, such as a broker receiving a percentage of the sale price in a typical real estate transaction.

Why are severability and no waiver clauses important?

Severability and no waiver clauses are critical in exchange agreements as they protect parties' interests. Severability ensures that if one provision of the agreement is invalid, the rest remains enforceable. No waiver clauses help parties avoid unintentionally relinquishing their rights.

-

It maintains the validity of an agreement even if specific terms are struck down by a court.

-

It clarifies that failure to enforce a provision does not constitute a waiver of rights, preserving each party's position.

When should you use an exchange agreement?

Identifying the ideal circumstances for utilizing an exchange agreement is essential for effective property transactions. Key legal considerations and compliance notes for specific regions can impact the effectiveness of these agreements. Understanding the benefits can enhance decision-making in real estate ventures.

-

Ideal for property swaps where direct sales are less feasible, facilitating smoother transactions.

-

Awareness of local laws and tax implications is crucial to ensure compliance and avoid penalties.

-

Using an exchange agreement can yield tax benefits, save time, and simplify the transaction process.

What alternatives exist to the exchange agreement?

While exchange agreements are powerful tools, there are situations where alternatives might be more suitable. Understanding these related documents can aid buyers and sellers in making informed decisions. Accessing templates and forms available on pdfFiller can streamline the process.

-

Documents such as traditional sales agreements, lease options, or swap agreements may be applicable.

-

Various scenarios may necessitate alternative forms, particularly where direct exchanges aren't feasible.

-

pdfFiller provides a range of templates and forms to assist with different real estate documentation needs.

How to fill out the exchange agreement brokerage arrangement

-

1.Start by obtaining the exchange agreement brokerage arrangement template from pdfFiller.

-

2.Open the template in pdfFiller and review all provided fields for accuracy.

-

3.Begin filling in the parties involved by entering their names and contact information in the designated sections.

-

4.Input the details of the assets or services to be exchanged, clearly specifying each party's obligations.

-

5.Provide the effective dates of the agreement, ensuring the timeline is realistic and documented.

-

6.Include any specific terms or conditions agreed upon by both parties, detailing performance criteria if necessary.

-

7.Review all filled information to ensure it is correct and complete, checking for any missing data.

-

8.Once finalized, save the document and consider using the e-signature feature to acquire necessary signatures from all parties.

-

9.Submit or send the completed agreement to all parties, retaining a copy for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.