Get the free pdffiller

Show details

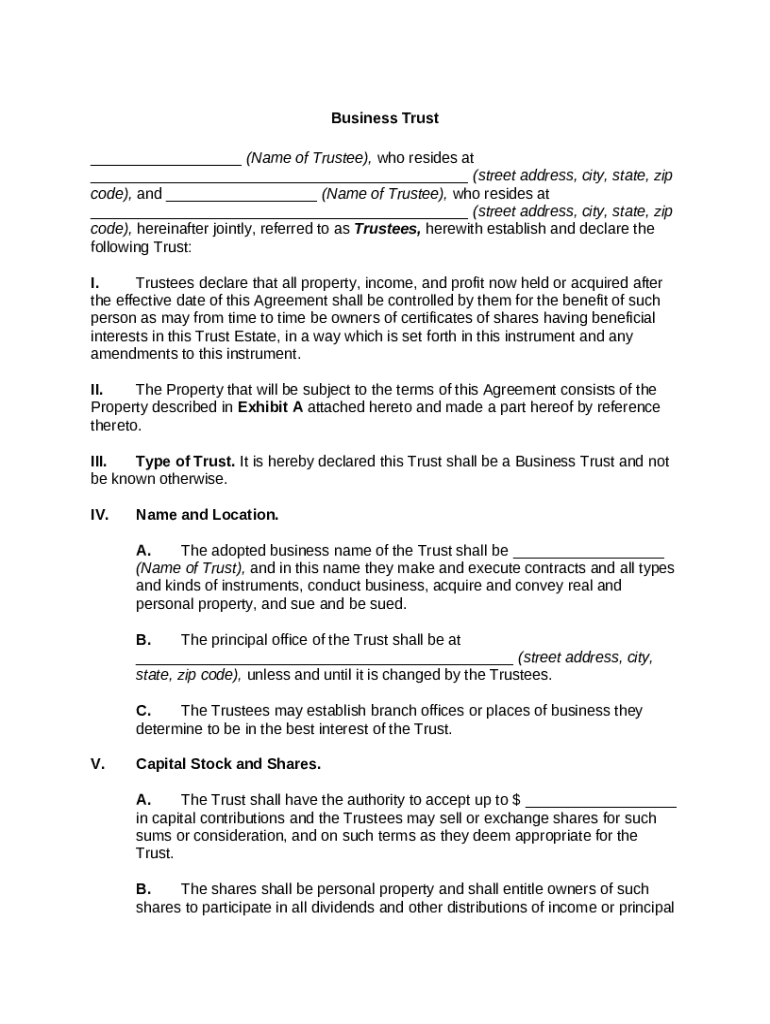

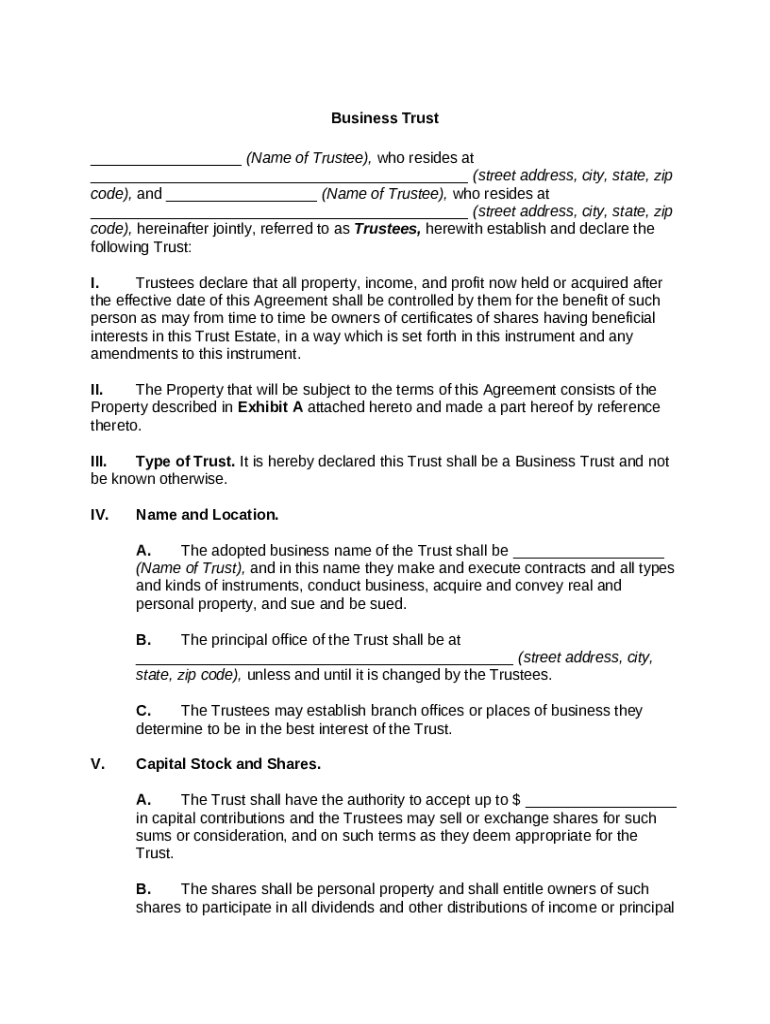

This form is used to set up a business trust. A Business Trust is a form of business organization which is similar to a corporation, in which investors receive transferable certificates of beneficial

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

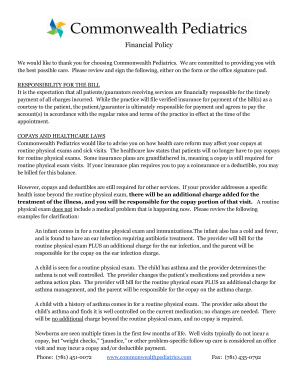

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is business trust

A business trust is a legal entity created to hold and manage assets for the benefit of designated beneficiaries, often used for business operations and investment purposes.

pdfFiller scores top ratings on review platforms

Fast and easy communication

Fast and easy communication. Friendly and helpfully customer service.

Excellent

Excellent, powerful, easy to use, reasonably priced

I am really pleased with the help that…

I am really pleased with the help that I got it from the live chat pdf support. The person name is sam and he was very helpful in solving my problems. I would like to say a big thanks to him.

cool system

cool system, i like it

Best Service :)

Thank you so much for such good hospitality. Most companies would not offer a refund so easily for an automatic subscription and so fast as well. This shows such good ethics as a company. I really appreciate that! As well if I ever did have the need to use this service, makes me happy to come back and also recommend it to others!

Awesome tool

Used this for some pertinent business documents, worked exactly as needed. GREAT product and even BETTER customer service

Who needs pdffiller template?

Explore how professionals across industries use pdfFiller.

How to complete a business trust form effectively

Filling out a business trust form involves understanding the nature of business trusts, the roles of trustees, and the procedural steps necessary for proper documentation. This guide provides a comprehensive roadmap to assist individuals and teams in effectively completing and managing their business trust forms.

Understanding business trusts

-

A business trust is a fiduciary relationship where one party holds property for the benefit of another. This structure allows for the management of assets with specific legal rights.

-

Business trusts are distinct because they combine elements of corporations and partnerships, providing flexibility in management and tax treatment, which can be beneficial for asset protection.

-

The main advantages include enhanced privacy, asset protection, and potential tax benefits. Business trusts can facilitate smoother transitions and management of assets across generations.

What are the roles and responsibilities of trustees?

-

Trustees are responsible for managing the trust's assets and ensuring compliance with applicable laws. This includes making prudent investments and distributions.

-

To serve as a trustee, individuals typically must be of legal age and not have any disqualifying factors like felony convictions. Trust agreements may specify additional qualifications.

-

Trustees must maintain accurate records, handle trust finances prudently, and communicate regularly with beneficiaries. This transparency helps to prevent disputes and fosters trust.

How do you create a business trust?

-

Selecting an appropriate name that reflects the purpose of the trust while complying with local regulations is crucial. Additionally, the jurisdiction can affect tax and legal obligations.

-

This document should outline the trustees' names, the purpose of the trust, and rules governing its operation. It's essential to be thorough and consult legal advice.

-

Depending on your region, specific filings may be necessary to establish a business trust legally. Ensure compliance with local laws to avoid penalties and ensure operational legitimacy.

How to complete the business trust form

-

The business trust form will typically require details about the trust's name, trustee information, and the nature of the trust assets.

-

Using tools like pdfFiller can simplify the completion process. You can upload the form, fill it out interactively, and save your progress.

-

Always double-check your completed form for accuracy. Utilize pdfFiller's editing features to make any necessary adjustments before finalizing your submission.

Managing your business trust after creation

-

It's important to stay compliant with local laws regarding trust reporting and financial disclosures. Regular meetings with beneficiaries can maintain transparent communication.

-

Trustees can modify the trust agreement by following the procedures set out in the original document, which may include documenting changes and obtaining consents from beneficiaries.

-

pdfFiller offers eSignature capabilities, which facilitate quick modifications and approvals of trust documents without needing to print and scan.

What is involved in the financial administration of a business trust?

-

This includes any financial assets provided to the trust by the beneficiaries or trustees. It’s vital to document these contributions accurately for tax purposes.

-

Trustees are tasked with ensuring that trust income is correctly distributed according to the terms set forth in the trust agreement. Responsible management helps ensure recipient satisfaction.

-

Regular financial reporting helps maintain transparency and allows beneficiaries to understand how trust assets are being managed and what distributions can be expected.

What legal challenges can arise for business trusts?

-

Trustees may encounter challenges, such as disagreements among beneficiaries or claims against trust assets. It’s essential to have conflict resolution mechanisms in place.

-

These disputes can often require legal intervention, especially if beneficiaries have differing interpretations of the trust’s terms.

-

It’s advisable to have access to legal resources specific to your region. Organizations often provide assistance in navigating the complexities of trust law.

What resources can assist in business trust management?

-

Utilizing dedicated trust management software can streamline tracking and reporting, ensuring that all activities are documented effectively.

-

pdfFiller’s collaborative features allow multiple stakeholders to interact with the document, enhancing workflow efficiency.

-

Online resources and platforms dedicated to trust education can provide ongoing insights into best practices in trust management.

How to fill out the pdffiller template

-

1.Access the pdfFiller platform and log in to your account or create a new one if necessary.

-

2.Search for the 'business trust' document template in the templates section.

-

3.Once found, select the template to begin filling it out.

-

4.Enter the name of the trust at the top of the document as instructed.

-

5.Provide the names and addresses of all trustees and beneficiaries in the designated fields.

-

6.Fill in details regarding the trust property, such as descriptions, values, and locations.

-

7.Specify the purposes of the trust and any particular powers granted to trustees.

-

8.Review all entered information for accuracy and completeness.

-

9.Utilize the editing tools to make any necessary adjustments before finalizing.

-

10.Save your work as a draft if edits are needed, or proceed to print or share the completed trust document.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.