Get the free Final Notice of Past Due Account template

Show details

The final notice is intended to be the last communication between a client regarding the amount past due.The point of the final notice is to let the delinquent client know you are no longer going

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

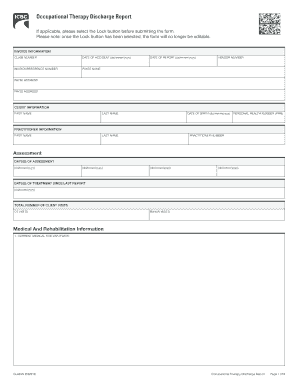

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is final notice of past

A final notice of past is a formal communication sent to inform an individual or business about overdue payments or debts that require immediate attention.

pdfFiller scores top ratings on review platforms

Does exactly what I need to do very easily!!!!

The outputs of the system are great ... just your opening page is a bit confusing. I just wanted to look convert a document but couldn't see conversion icons - finally worked out that I have to use Add New button - remember people are coming to your website from other portals they have used before - and like me they look for a document conversion tool!

It works incredibly well and saves your time.

NEW TO SERVICE - I'LL LET YOU KNOW - FILLING OUT FORM FOR COST OF MEDICATION ASSISTANCE

Generaly everything is OK. I would like though more choices on the fonts.

Very easy to complete a form, it’s not so easy to manipulate the form to fit the page

Who needs final notice of past?

Explore how professionals across industries use pdfFiller.

Full guide on creating a final notice of past due account

How important is a final notice?

Sending a final notice of past due account serves as a crucial step in the debt collection process. It not only serves as a reminder for payment but also provides legal grounding should collection efforts escalate. A well-crafted notice can help maintain customer relationships by clearly communicating the seriousness of the situation without being overly aggressive.

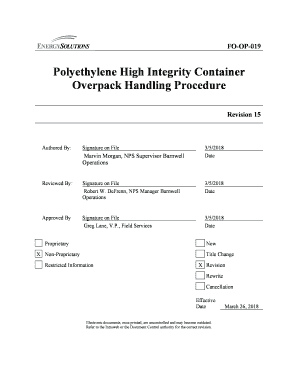

What are the key components of a final notice?

An effective final notice must include certain essential fields to convey the urgency and information clearly. This includes:

-

Indicates when the notice was sent to set clear timelines.

-

Ensures the recipient knows the notice is for them, reducing confusion.

-

Clearly states the total balance due, making it easier for the customer to recognize their debt.

-

Includes a specified number of days for the customer to respond to the notice.

-

Encourages immediate payment or to arrange a discussion on repayment options.

How do craft my message effectively?

Using professional yet empathetic language is key in a final notice. A clear outline of payment options and potential consequences of inaction can help motivate prompt responses. Furthermore, encouraging customers to discuss payment arrangements can foster a more amiable connection and potentially resolve issues without further escalation.

What steps should follow to fill out the final notice?

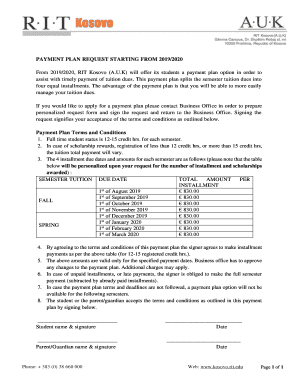

Filling out the final notice form can be streamlined using tools like pdfFiller. Here’s a step-by-step guide:

-

Navigate to pdfFiller and choose the appropriate final notice template.

-

Complete the notice with the necessary information including date, name, address, and amount owing.

-

Tailor the notice to your communication style and relationship with the customer.

-

Once completed, save your work and export the document for distribution.

How can edit and customize my final notice?

Personalization can significantly enhance the effectiveness of your final notice. Here are a few tips:

-

Consider each client’s payment history and relationship to better connect.

-

Utilizing eSignature and collaboration tools can add credibility and streamline communication.

-

Getting input from team members can ensure that the document is comprehensive and professional.

What follow-up actions should take after sending the notice?

After sending a final notice, establishing a timeline for follow-ups is essential. Utilize tools like pdfFiller to track responses and payments proactively. If payment is still not received after your notice, plan your next steps, which could involve further communication or potential escalation.

How do ensure compliance with local regulations?

Complying with regulations related to debt collection is critical. Familiarize yourself with the laws affecting your region, which might include specific wording in your notices or required timelines. Ensure your final notice includes compliance language to protect your business and provide resources for customers who may want to learn more.

What benefits does pdfFiller provide for document management?

pdfFiller offers robust features that enhance document management. You can streamline invoicing processes and access various document types, making it easier to manage your business effectively. Its cloud-based platform allows you to edit PDFs, eSign, and collaborate seamlessly, ensuring you stay organized.

How to fill out the final notice of past

-

1.Open the pdfFiller website and log in to your account.

-

2.Search for 'final notice of past' in the templates section.

-

3.Select the desired template and click on 'Fill' to start editing.

-

4.Enter the debtor's name and contact information in the appropriate fields.

-

5.Specify the outstanding amount and include any relevant reference numbers.

-

6.Set a clear deadline date for payment to be made.

-

7.Add any additional notes or terms regarding the debt as necessary.

-

8.Review the completed notice to ensure all information is accurate and clear.

-

9.Once finished, click on 'Save' and select your desired format for download or send it directly to the debtor via email.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.