Get the free Insurance Application by General or Private Limited Partnership template

Show details

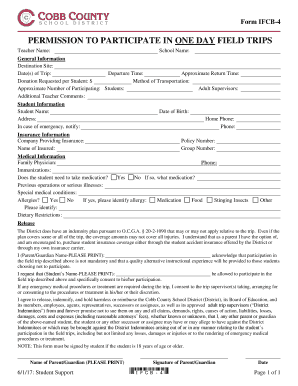

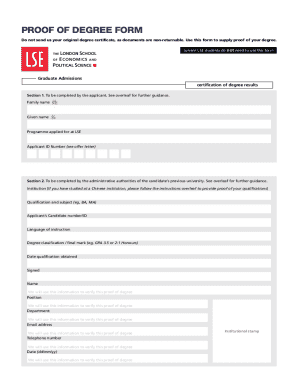

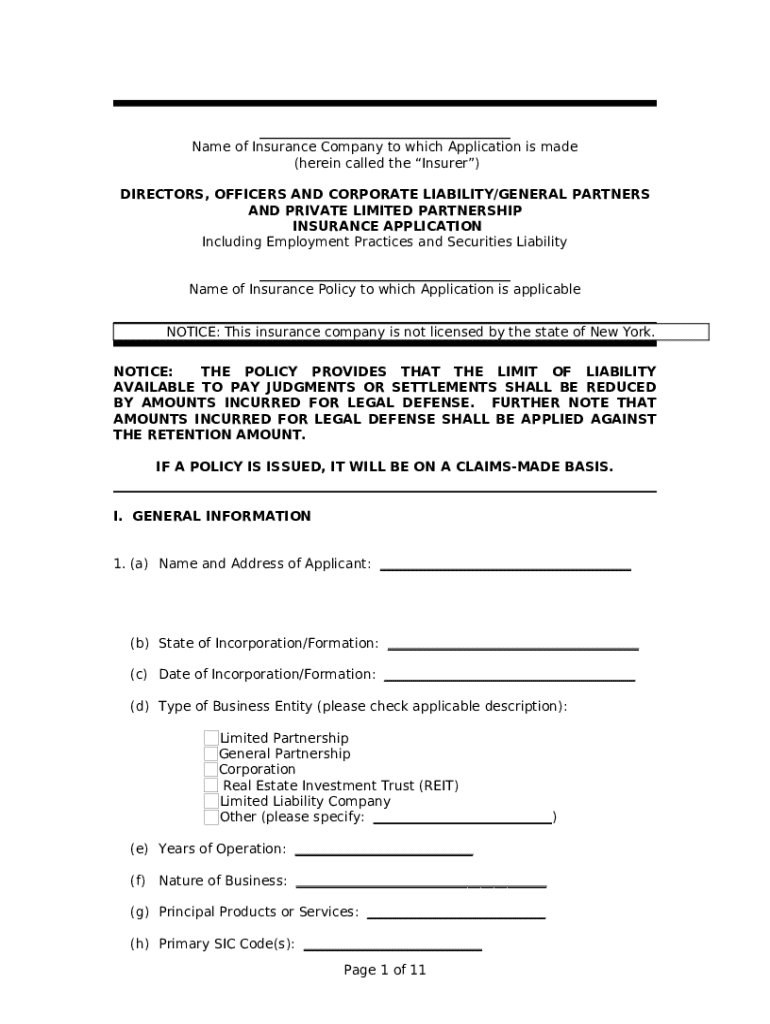

A partnership makes this application to obtain insurance coverage for directors, officers and corporate liability as well as employment practices and securities liability.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is insurance application by general

An insurance application by general is a formal document used to request insurance coverage from a provider for various types of policies.

pdfFiller scores top ratings on review platforms

Easy to use

Easy to use. Alittle confusing first time user.

Always easy to use!

Always easy to use!

So Far o Good.

So Far o Good.

works great when you are in a hurry

works great when you are in a hurry. easy to use.

BEST PDFFILLER TO ME

BEST PDFFILLER TO ME

COULDN'T HAVE DONE IT WITHOUT

I liked the options i have when it comes to completing the document. You won't need anything else other then this!

Who needs insurance application by general?

Explore how professionals across industries use pdfFiller.

Insurance Application by General Form: A Comprehensive Guide

Filling out an insurance application by general form can seem daunting, but it’s essential for securing coverage. This guide will help you understand the nuances of the application process.

What should know about the insurance application process?

Understanding the insurance application process is crucial for consumers and businesses alike. It includes various types of applications tailored to specific insurance products.

-

Overview of insurance application types: Applicants must choose the right application type based on their specific needs, such as liability insurance or property coverage.

-

Importance of the general form application: The general form is an essential tool because it standardizes the submission process, ensuring that all necessary information is collected.

-

How insurance applications protect both applicants and insurers: A well-completed application provides a basis for fair pricing and coverage details, protecting the interests of all parties.

What are the key components of the general form application?

Each section of the general form application includes vital components that help insurers assess risk accurately.

-

Detailed breakdown of application fields: Understanding each field is essential for accurately completing the general form, ensuring nothing is omitted.

-

Essential legal notices and disclaimers: These inform applicants of their obligations and the insurer's rights, which are crucial for compliance.

-

Understanding coverage limits and liability conditions: Knowing these terms will help applicants choose suitable coverage and avoid gaps.

How do fill out the application effectively?

Filling out the application requires attention to detail and providing accurate information to prevent future issues.

-

Required applicant information: Personal details must be complete and accurate to avoid rejection.

-

Business structure options: Different business types, such as sole proprietorships or corporations, can affect premium costs and liabilities.

-

Disclosure of business operations: Applicants must be transparent about their activities to ensure appropriate coverage.

-

Product description necessities: Clearly stated products or services help in the assessment of risk associated with the business.

What are the legal compliance and requirements?

Navigating legal compliance can be complex, especially with state-specific regulations.

-

State-specific considerations: Insurance requirements can vary significantly between states like New York and others.

-

Implications of claims-made policies: Understanding these can affect coverage choices and claim eligibility.

-

Self-insured retention: Knowing retention limits is essential for understanding potential out-of-pocket costs during claims.

What tips can help in submitting my application?

Submitting an application correctly can significantly impact processing times and coverage outcomes.

-

Common mistakes to avoid: Inaccurate information or omissions can lead to delays or denials.

-

Ensuring completeness of the application: Double-check all fields and supporting documentation before submission.

-

Best practices for submitting through pdfFiller: pdfFiller provides tools to help electronically fill out and submit forms.

What role does the insured's representative play?

Having a knowledgeable insured's representative can streamline the application process.

-

Who qualifies as an insured's representative? Typically, this includes agents or brokers with relevant authority.

-

Importance of relationships in the application process: Strong relationships can help clarify details and navigate the underwriting process.

-

Disclosures about parent corporations: Transparency about affiliations can significantly impact underwriting decisions.

What should expect post-submission?

Understanding what happens after submission can reduce anxiety and set appropriate expectations.

-

Typical processing timelines: Knowing how long processing takes can help manage follow-up expectations.

-

Understanding policy issuance: Familiarize yourself with how and when you will receive policy documents.

-

Claims management post-application approval: Understanding how to handle claims can prepare you for future needs.

Why should use pdfFiller for my application process?

pdfFiller offers invaluable tools that can enhance your efficiency throughout the application process.

-

Advantages of using pdfFiller: The platform allows for seamless editing and signing of documents, making the application process smoother.

-

Features that assist in filling applications: With collaborative tools and direct submission options, pdfFiller simplifies document management.

How to fill out the insurance application by general

-

1.Start by downloading the insurance application form from pdfFiller.

-

2.Open the application in pdfFiller's editor to access its editing features.

-

3.Carefully read through the application to understand each section.

-

4.Begin filling in your personal information such as your full name, address, and contact information in the designated fields.

-

5.Provide details pertinent to the type of insurance you are applying for; for example, include your vehicle information for car insurance or property details for homeowners insurance.

-

6.Be sure to answer any specific questions regarding your insurance history or any claims made previously.

-

7.Review the sections related to beneficiaries or additional insured parties, and fill them out as required.

-

8.Check for any required signatures and dates; make sure to sign electronically if the form supports it.

-

9.After completing the form, utilize the save function to store your application electronically.

-

10.Finally, either submit the application through pdfFiller's sending options or download it for physical submission.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.