Get the free Repossession Services Agreement for Automobiles template

Show details

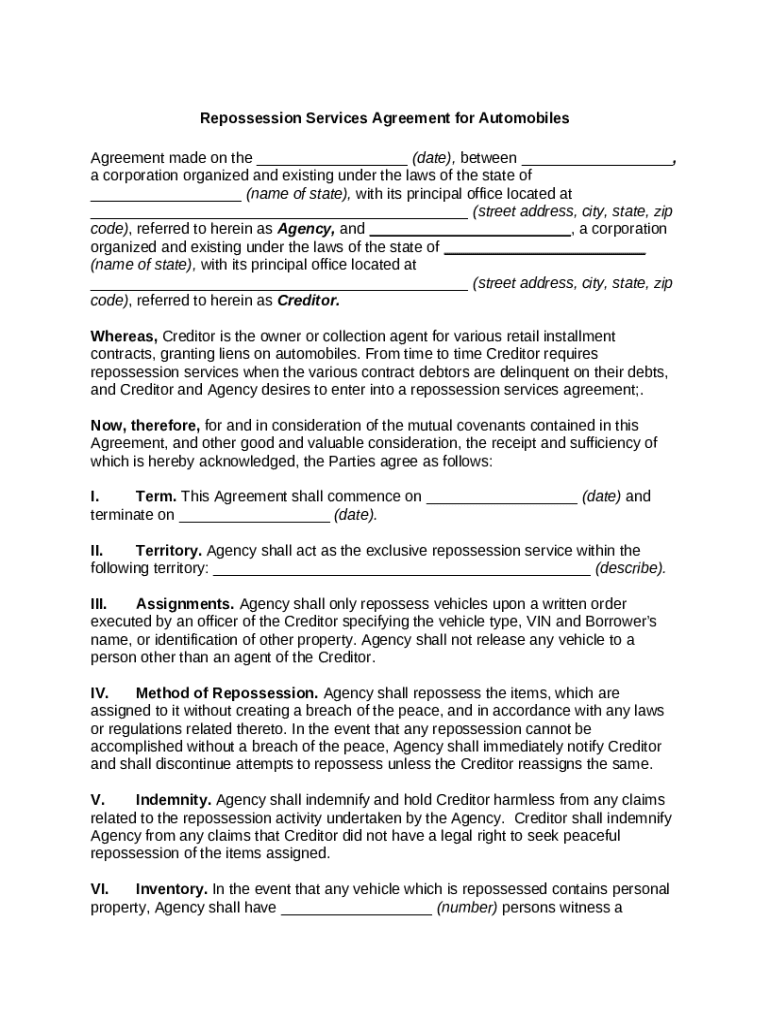

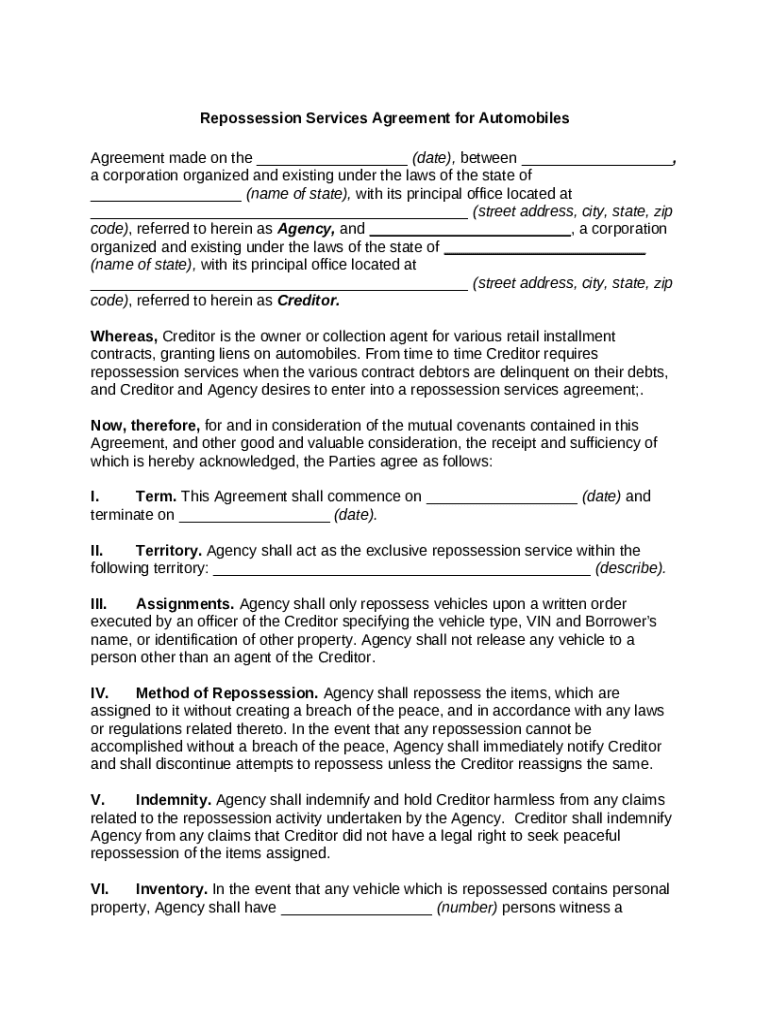

This service contract and agreement outlines the specific terms of the agreement, including method of repossession, territory the repossession agency will cover, repossessor responsibilities and more.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is repossession services agreement for

A repossession services agreement for outlines the terms between a lender and a repossession service provider for recovering collateral from borrowers who default on their loans.

pdfFiller scores top ratings on review platforms

I love using PDF for court documents. it has helped so much, as I have horrible hand writing. looks so professional!

Excellent

Excellent and amazing tools.

.Very good

A little user unfriendly at first, but once I got the hang of it, it was solid.

meet my expectations

Who needs repossession services agreement for?

Explore how professionals across industries use pdfFiller.

A comprehensive guide to repossession services agreements

What is a repossession services agreement?

A repossession services agreement is a legally binding document between a creditor and a repossession agency that outlines the terms and conditions under which the agency can recover property, typically vehicles or assets, from debtors. Understanding the purpose of this agreement is crucial for creditors and agencies in managing delinquent accounts effectively.

Why are repossession services agreements important?

-

Manage risks: These agreements help outline the responsibilities of the repo agency, minimizing legal risks.

-

Clarify expectations: The agreement sets clear expectations for both creditor and agency regarding the repossession process.

-

Ensure compliance: It helps ensure that repossession is carried out according to local laws and regulations.

What are the key components of a repossession services agreement?

-

The agreement should clearly define the roles of both the creditor and the repossession agency.

-

It needs to address the commencement and termination dates of the agreement.

-

It should outline specific areas or territories where repossession can lawfully occur.

What specifications are required for repossession assignments?

-

The agreement must specify conditions under which repossession can take place.

-

It should detail the required documentation for initiating repossession actions.

-

Limitations on vehicle release and custody protocols should be clearly defined.

How to ensure best practices during repossession?

-

Agencies must follow legal guidelines to avoid breaches of peace during repossession.

-

Procedures for aborting repossession attempts safely should be established.

-

Proper communication protocols between the agency and creditor need to be instituted.

What are indemnification and liability issues?

-

Understanding the indemnity clauses within the agreement is crucial.

-

The agreement should outline the responsibilities of the agency during the repossession process.

-

Potential liabilities for both parties must be addressed for various scenarios.

How to customize a repossession services agreement?

pdfFiller provides tools to modify a repossession services agreement template easily. Users can incorporate specific state laws and local requirements, ensuring that the agreement is compliant with regional regulations. Additionally, pdfFiller allows users to collect electronic signatures and collaborate efficiently.

What steps to review and finalize the agreement?

-

Ensure all parties understand the terms set within the agreement thoroughly.

-

Use a checklist to verify compliance and accuracy before signing the document.

-

Employ pdfFiller for final edits and secure storage of the finalized document.

How to manage repossession agreements over time?

-

It’s important to monitor the performance of repossession services to ensure compliance with the agreement.

-

Regularly update agreements as laws change or business needs evolve.

-

Using a centralized document management system like pdfFiller can enhance efficiency in managing these documents.

How to fill out the repossession services agreement for

-

1.Begin by downloading the repossession services agreement template from pdfFiller.

-

2.Open the document in the pdfFiller interface to access the editing tools.

-

3.Fill in the 'Lender Information' section, entering your name, company name, and contact details.

-

4.Next, complete the 'Repossession Service Provider Information' with the provider's details.

-

5.Specify the terms of the agreement, including the scope of services, fees, and payment terms.

-

6.Review the 'Legal Terms' section to ensure all conditions are understood and acceptable to both parties.

-

7.If applicable, add any additional clauses or special requirements pertinent to the repossession process.

-

8.Once all sections are filled, carefully review the document for accuracy and complete details.

-

9.Finally, save the filled agreement and optionally send it for e-signatures through pdfFiller's options.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.