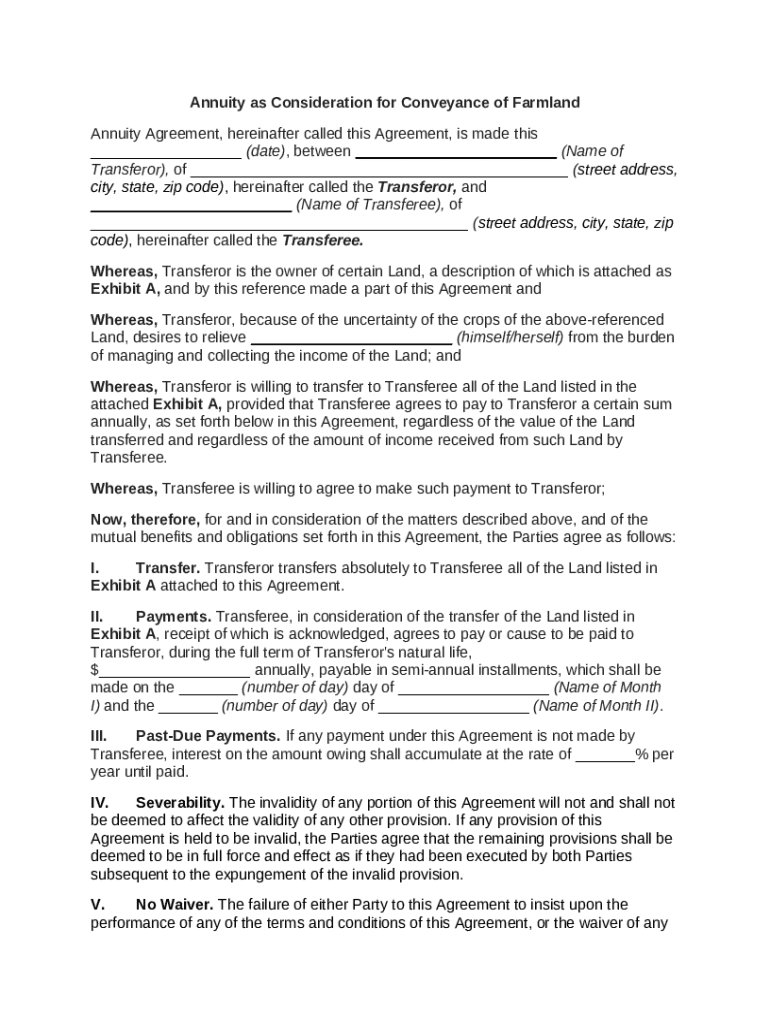

Get the free Annuity as Consideration for Conveyance of Farmland template

Show details

An annuity is a contract that pays periodic income benefits for a specific period of time or over the course of an annuitant’s lifetime. These payments can be made annually, quarterly or monthly.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is annuity as consideration for

Annuity as consideration for refers to using an annuity contract as a form of payment in a transaction, often in real estate or legal settlements.

pdfFiller scores top ratings on review platforms

I need more time with pdfFiller to see how I feel

excellent pdf editor

It works but expensive fee.

Excellent

Very Nice & Good Features in this pdffilter

Very useful and easy to learn

Who needs annuity as consideration for?

Explore how professionals across industries use pdfFiller.

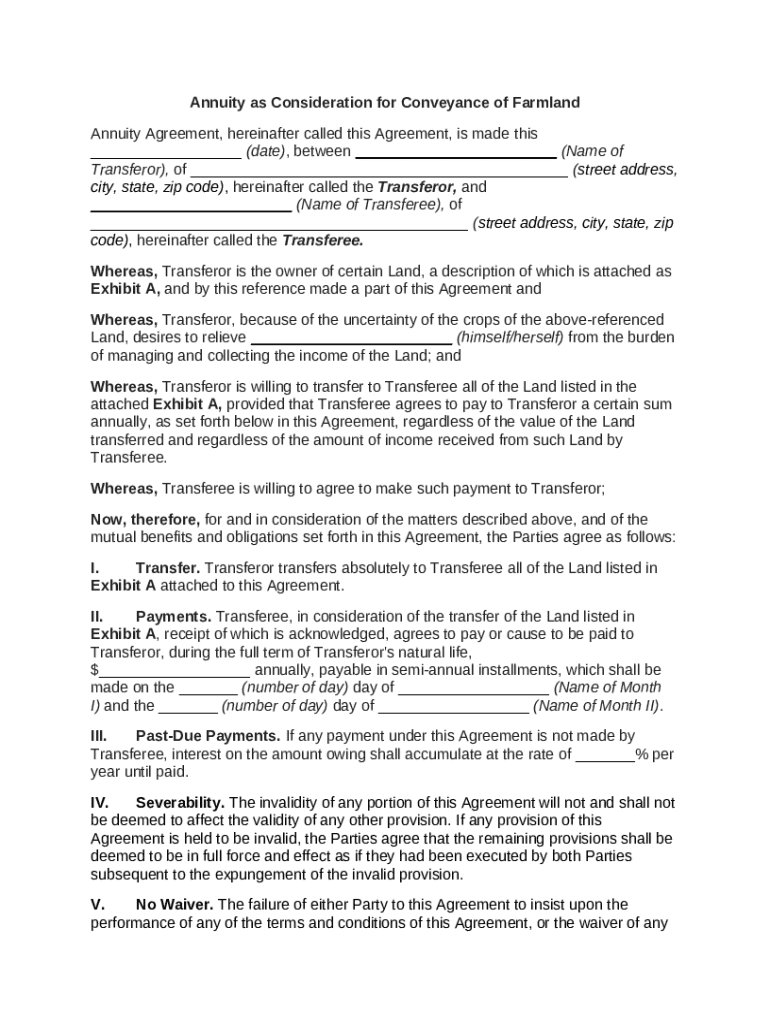

Understanding annuity as consideration for conveyance of farmland

How does an annuity work in farmland transactions?

An annuity can serve as a form of consideration in transactions involving farmland. Essentially, it is a financial arrangement where the transferee makes regular payments to the transferor in exchange for the land. This method is particularly useful when immediate cash payment is not feasible for land conveyance.

-

An annuity is a series of payments made at equal intervals and can be structured over a specific term or for the lifetime of the transferor.

-

Annuities provide flexibility in payment structure, making it easier for the transferee to acquire land without a significant upfront financial burden.

-

Unlike an outright cash payment, an annuity allows for gradual ownership transfers, similar to loans but usually without interest.

What are the key elements of the annuity agreement?

An annuity agreement includes various critical elements that outline the responsibilities and expectations of both parties involved. Clarity in these elements can help prevent disputes and ensure smooth transactions.

-

The transferor is the current landowner, while the transferee is the individual or entity acquiring the farmland.

-

Necessary details often include names, addresses, and precise legal descriptions of the land being conveyed.

-

This typically includes an attached detailed description of the land, which clarifies exactly what is being transferred.

How to structure annuity payments effectively?

Structuring annuity payments involves several factors that both parties must agree upon to ensure fairness and clarity in the financial agreement.

-

Payments should be calculated based on the value of the farmland and the agreed-upon term of the annuity.

-

Typically, payments can be made in semi-annual installments, allowing flexibility for the transferee's cash flow.

-

It is essential to clarify that the transferee must honor these payment commitments regardless of the agricultural income from the land.

What are the legal obligations within the annuity agreement?

The legal framework surrounding the annuity agreement defines the obligations and rights of both parties, ensuring adherence to the terms outlined.

-

Failure to meet payment obligations can lead to legal actions such as foreclosure or seizure of land.

-

Both transferor and transferee have specific rights, such as right to timely payments and maintenance of land value.

-

The contract should include clauses for enforcement and the process for making any modifications to the payment terms.

How to fill out the annuity agreement form using pdfFiller?

Filling out an annuity agreement form efficiently can be done with tools provided by pdfFiller, streamlining the process.

-

Follow the outlined steps to complete the form accurately, ensuring all required fields are filled in.

-

Leverage editing, signing, and eSending features to make long-distance transactions simpler.

-

Utilize interactive tools in pdfFiller to customize the agreement as per your specific needs.

What are best practices for managing annuity agreements?

Managing annuity agreements effectively can lead to favorable outcomes for both parties involved, ensuring the arrangement is beneficial throughout its duration.

-

Conducting regular financial reviews can help both parties stay updated on payment schedules and terms.

-

Tracking changes in property value ensures both parties are aware of the worth of their investment.

-

Nurturing open lines of communication between parties fosters trust and swift resolution of potential issues.

How to fill out the annuity as consideration for

-

1.Start by accessing the pdfFiller platform and logging into your account.

-

2.Locate the ‘Annuity as Consideration For’ template by searching in the templates library.

-

3.Click on the template to open it, and review the fields required to be filled out.

-

4.Begin entering the necessary details in the personal information section, ensuring you include the full name and contact details of the parties involved.

-

5.Move to the financial details section to specify the annuity amount, payment schedule, and any other financial terms relevant to the agreement.

-

6.If there are terms related to legal obligations or conditions, complete that section accurately.

-

7.Review the entire document for correctness, ensuring that all fields are filled correctly and that there are no missing details.

-

8.Once finished, save your changes and prepare the document for signing, either through electronic signatures offered by pdfFiller or by downloading it for manual signing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.