Get the free Insurers Rehabilitation and Liquidation Model Act Legislative History

Show details

Full text of legislative history behind the Insurers Rehabilitation and Liquidation Model Act.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is insurers rehabilitation and liquidation

Insurers rehabilitation and liquidation refers to the process of managing the assets and obligations of an insurance company undergoing financial distress or insolvency.

pdfFiller scores top ratings on review platforms

Great stuff

Great stuff. Easy to use and does the job.

Great program!!!!!!!!

love this app!

Great Tool

Great Tool , User friendly. Easy to use!

I can no longer open from google drive

it is still early but it seesms very easy to use

Who needs insurers rehabilitation and liquidation?

Explore how professionals across industries use pdfFiller.

Complete Guide to Insurers Rehabilitation and Liquidation Form on pdfFiller

How to fill out an insurers rehabilitation and liquidation form?

Filling out an insurers rehabilitation and liquidation form can be straightforward when following the correct steps. Begin by identifying the necessary information about the insurance company undergoing the process, ensuring accuracy throughout. Utilize interactive tools available on pdfFiller to make editing and eSigning easier, enhancing the efficiency of form completion.

Understanding insurers rehabilitation and liquidation

The processes of insurers rehabilitation and liquidation are critical to maintaining the stability of the insurance industry. Rehabilitation refers to restructuring a financially troubled insurance company to return it to good health, while liquidation involves the orderly wind-up of a company’s affairs, ensuring that the remaining assets are distributed fairly among creditors and policyholders.

-

Insurers rehabilitation is the process deployed to restore an insurance company facing financial difficulties to a solvent status.

-

The regulations governing these processes have evolved, particularly after early recommendations by the National Association of Insurance Commissioners (NAIC).

-

Having a uniform act recognized by all states ensures consistency and clarity in the execution of rehabilitation and liquidation processes.

What are the key legislative provisions in the model act?

The Model Act aims to provide a consistent framework for insurers undergoing rehabilitation or liquidation. Its provisions ensure a structured approach while also protecting stakeholders' interests.

-

This service outlines the critical regulatory framework governing rehabilitation and liquidation processes, providing states with a guideline for implementation.

-

The first article defines the act's scope, emphasizing the objectives of protecting policyholders and managing the liquidation process efficiently.

-

Various sections within the model act delve into precise procedures, detailing steps from initiating rehabilitation to final liquidation.

How can interactive tools enhance document management?

pdfFiller's cloud-based platform empowers users to manage their forms effectively. Through its array of features, users can easily edit, eSign, and collaborate with their teams directly on the rehabilitation and liquidation form.

-

Users can make real-time edits on digital forms, streamlining the document update process.

-

Integrations for eSigning facilitate quick approvals without needing physical signatures, speeding up the submission process.

-

Team members can collaborate seamlessly on the form, providing inputs and suggestions to enhance accuracy.

What are common challenges in the rehabilitation process?

Navigating the rehabilitation of insurance companies can present various legal and administrative challenges. For instance, delays in processing paperwork or lack of clarity in regulatory requirements can hinder progress.

-

Common challenges include mismanagement of information and inadequate communication among stakeholders, which can exacerbate financial difficulties.

-

Identifying and proposing amendments is critical, as shown by inputs from the NAIC working group aiming to improve regulatory clarity.

-

pdfFiller simplifies documentation processes by providing tools that mitigate common paperwork issues, thus enhancing workflow efficiency.

How should you utilize the rehabilitation and liquidation form?

Filling out the rehabilitation and liquidation form accurately is vital for proper handling of the situation. Understanding each field’s purpose can significantly improve the efficacy of the submitted forms.

-

Thoroughly reviewing essential fields ensures that critical information about the insurance company is accurately represented.

-

Best practices such as noting down information before starting the form can streamline the process and reduce errors.

-

By leveraging features available on pdfFiller, users can mitigate the risks of submitting incomplete or erroneous forms.

What regional practices should you consider?

Understanding that regional specificities play a key role in the rehabilitation and liquidation processes is crucial. Each state may implement different regulations that affect compliance.

-

Various states may interpret and apply the model act differently, affecting how rehabilitation processes are carried out.

-

Case studies from different regions highlight how local insurers navigated compliance challenges successfully.

-

Utilizing resources available through pdfFiller can assure users adhere to local compliance requirements effectively.

How to maintain control over delinquency proceedings?

Delinquency proceedings are an integral part of the rehabilitation process, influencing how insurance companies can recover. Understanding the management strategies can ensure effective handling of these proceedings.

-

These proceedings involve judicial oversight to ensure that a struggling insurance company is managed properly within the legal framework.

-

Key management factors include timely communication and adherence to procedural requirements as established by the model act.

-

pdfFiller offers features to help keep organized records throughout delinquency processes, facilitating tracking and submission.

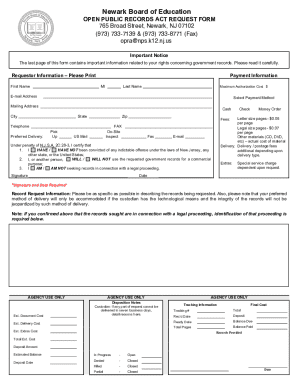

How to fill out the insurers rehabilitation and liquidation

-

1.Obtain the PDF form for the insurers rehabilitation and liquidation.

-

2.Begin by entering the name of the insurance company in the designated field.

-

3.Complete the contact information section with the address, phone number, and email of the insurer.

-

4.Fill in the financial details section, including assets, liabilities, and any existing policyholder claims.

-

5.Ensure all relevant dates concerning liquidation procedures are accurately recorded.

-

6.If there are multiple stakeholders, document their roles and claims on the asset.

-

7.Attach any required supporting documents, such as financial statements or regulatory correspondence.

-

8.Review the completed form thoroughly for accuracy and completeness before submission.

-

9.Submit the filled-out PDF through the appropriate regulatory body or designated online portal.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.