Get the free Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Powe...

Show details

Residual interest is the interest which an investor receives after all the required regular interest within high priority tranches. A residual interest continues to accrue to the credit card balance

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is marital-deduction residuary trust with

A marital-deduction residuary trust is an estate planning tool that allows a surviving spouse to benefit from the trust assets while deferring estate taxes until their death.

pdfFiller scores top ratings on review platforms

Just awsome...must I say more....nope im busy editing my pdf...a must try

Easy to use. Up & printed prior year W-2 in less than 5 minutes.

took a while to figure out since I'm not computer savvy....but finally got it.

It's a wonderful tool, saves me a lot of time.

The cost is a little more then I would like to pay but as a MAC user this program is awesome.

Seemed very simple, at least once I familiarized myself with various functions available.

Who needs marital-deduction residuary trust with?

Explore how professionals across industries use pdfFiller.

The Complete Guide to Marital-Deduction Residuary Trusts

This guide explores how to effectively navigate the complexities of a marital-deduction residuary trust. You will learn how to create one and manage its form and functionality.

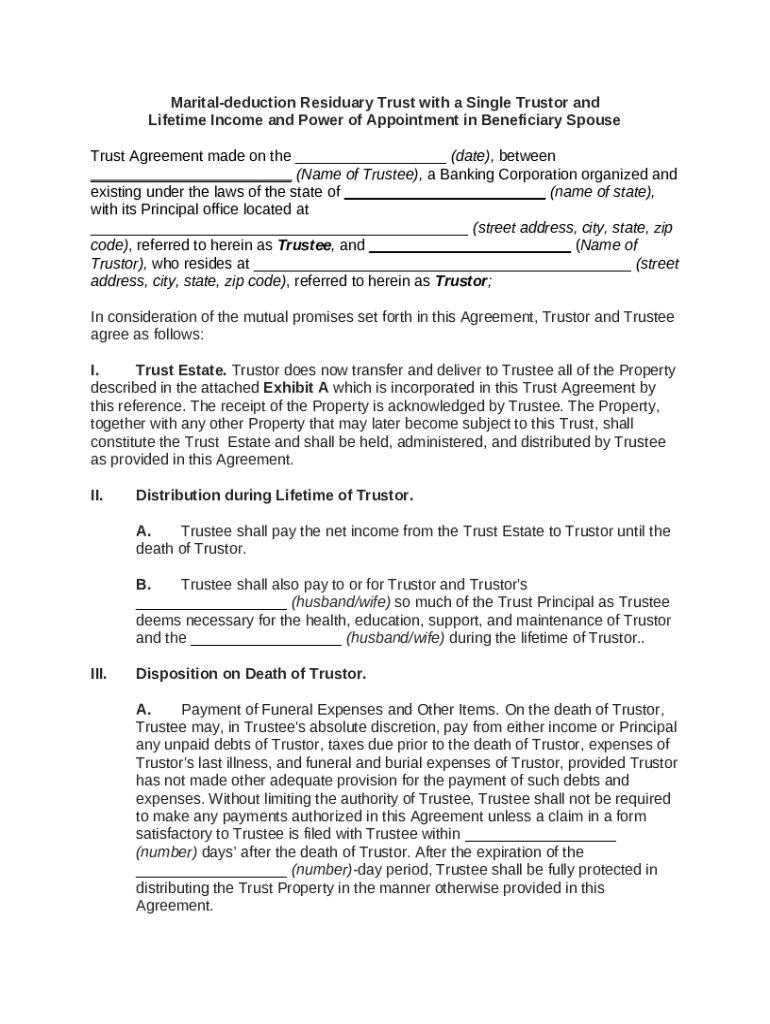

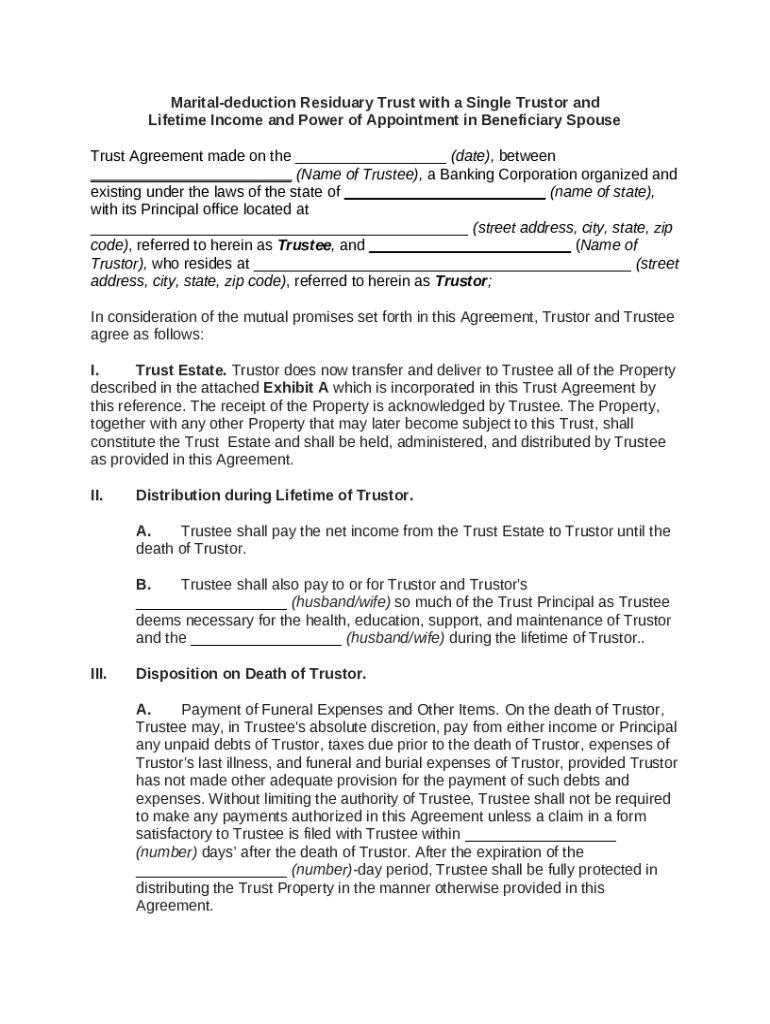

What is a marital-deduction residuary trust?

A marital-deduction residuary trust is a type of trust designed to benefit a surviving spouse while considering tax advantages. It plays a crucial role in efficient estate planning by allowing assets to be exempt from estate taxes until the death of the surviving spouse. This mechanism reduces the financial burden on the surviving spouse and ensures orderly distribution of the estate.

-

To defer estate taxes until the surviving spouse's death.

-

Primarily benefits the surviving spouse.

-

Remaining estate assets are distributed according to the trust terms after the surviving spouse's death.

What are the key components of the trust agreement?

A trust agreement outlines the terms and conditions of the marital-deduction residuary trust, establishing responsibilities and expectations for all parties involved.

-

The trustor creates the trust, while the trustee manages it according to specified terms.

-

Details the assets held within the trust, including properties and investments.

-

Clarifies which specific assets are included in the trust.

How are distributions managed during the lifetime of the trustor?

Understanding distribution mechanisms is vital for effective trust management. During the trustor's lifetime, income distributions and principal amounts can be made for specific purposes.

-

Trust income flows to the trustor for personal use, providing financial support.

-

Sets guidelines for withdrawal related to health, education, and maintenance, ensuring responsible financial management.

-

Acts on behalf of the trustor to implement financial decisions regarding the trust assets.

What happens upon the trustor's death?

Upon the trustor's death, the distribution process shifts focus to resolving debts and dividing trust assets. The trustee plays an essential role in carrying out these functions.

-

The trustee can pay for expenses directly from the trust.

-

Ensures that all unpaid debts, including taxes, are settled before asset distribution.

-

Details on how remaining assets are distributed to beneficiaries as per trust terms.

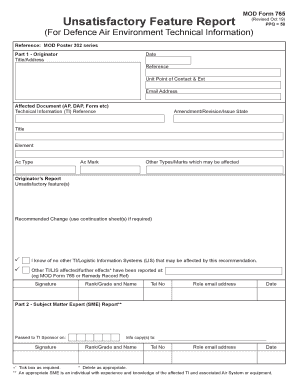

How do you fill out the marital-deduction residuary trust form?

Filling out the marital-deduction trust form requires attention to detail to ensure compliance and accuracy. The process can be simplified using online tools.

-

Follow clear instructions on filling out your form on pdfFiller to avoid mistakes.

-

Utilize pdfFiller’s features for editing and managing your documents effectively.

-

There are easy steps for electronically signing the trust agreement for security.

What are the best practices for managing your marital-deduction residuary trust?

Ongoing management and updates are crucial for maintaining the effectiveness of your marital-deduction residuary trust.

-

Regularly review and update trust documents to reflect changes in family circumstances or the law.

-

Engage estate planning advisors for informed decision-making and implementation.

-

Leverage pdfFiller to handle all documentation related to the trust efficiently.

What compliance considerations should you keep in mind?

Navigating state-specific regulations is essential for compliance in trust agreements and distributions.

-

Identify and adhere to laws governing trusts in your location to avoid penalties.

-

Understand how your trust impacts tax obligations for both the trust and its beneficiaries.

-

Ensure that all trust agreements adhere to local laws and best practices to maintain validity.

How to fill out the marital-deduction residuary trust with

-

1.Open the PDF document of the marital-deduction residuary trust form on pdfFiller.

-

2.Begin by filling in the name of the trust and the date it was established at the top of the document.

-

3.Input the names and details of the grantor(s) and the trustee(s) in the designated sections.

-

4.Fill in the information about the beneficiaries, noting their relationship to the grantor and the specifics of their inheritance.

-

5.Clearly outline the terms of the trust, specifying how the assets will be managed and distributed over time.

-

6.Double-check all entries for accuracy, ensuring that all required fields are filled out.

-

7.Once completed, save your document to retain the information, and consider printing or sharing it as necessary.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.