Last updated on Feb 17, 2026

Get the free Worksheet Analyzing a Self-Employed Independent Contractor template

Show details

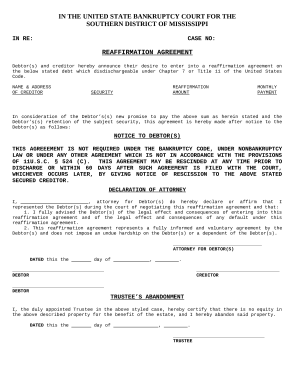

This AHI worksheet is used to analyze an independent contractor. This form will help the company decide if this independent contractor is right for the company.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is worksheet analyzing a self-employed

A worksheet analyzing a self-employed allows individuals to assess their business performance and financial standing.

pdfFiller scores top ratings on review platforms

I need fast turnarounds for information as I do not have time to convert content from other platforms. I have little time and money to do things. The PDF filler is cost effective and enables me to convert content in a matter of seconds, rather than hours in some cases.

I wish it was as user-friendly as Adobe Fill and Sign.

5TS REA3 G66D

Just started.

Excellent

1st time as a sender, 2nd time as a signer.

Who needs worksheet analyzing a self-employed?

Explore how professionals across industries use pdfFiller.

Worksheet analyzing a self-employed form

Filling out a worksheet analyzing a self-employed form can be critical for defining the nature of work relationships. This guide will walk you through the necessary steps and considerations when documenting the characteristics of independent contractors.

What is the role of independent contractors?

Independent contractors are individuals contracted to perform specific tasks or services for a company. Unlike employees, independent contractors retain control over how their work is completed. Understanding this distinction is crucial for both parties to ensure proper classification and compliance with tax regulations.

-

Independent contractors operate as self-employed individuals providing services, contrasting with employees who work under the employer's control and direction.

-

Clear contract agreements help prevent misclassification, which could result in legal penalties for both the contractor and the hiring company.

-

Employers must adhere to specific responsibilities like tax reporting and ensuring fair treatment, even for independent contractors.

What are the key elements of the worksheet?

When filling out the worksheet, it's essential to capture precise information for accurate record-keeping and compliance. Each component serves a specific purpose that supports the overall analysis of the contractor's role.

-

Identifying the responsible party ensures accountability throughout the project and clarifies roles.

-

Maintaining an accurate date record is crucial for compliance and tracking project milestones.

-

Accurate personal identification of the contractor minimizes confusion and aids in future reference.

How do you define project scope and expectations?

Clearly defining the project scope is vital for establishing expectations between the contractor and the hiring company. This clarity helps align efforts and fosters a successful working relationship.

-

Detailing the exact tasks ensures that both parties have a shared understanding of duties and responsibilities.

-

Outlining expected timeframes helps in project planning and resource allocation.

-

Clear expectations can significantly impact the contractor's performance and overall satisfaction with the job.

How to evaluate commitment and dependency?

Assessing the commitment of an independent contractor is essential for understanding the potential long-term relationship. This evaluation provides insights into how dependent the contractor may become on your services.

-

Understanding how long the contractor will be expected to work with your firm can aid in planning and stability.

-

Determining how often services are utilized offers insights into the contractor's role and its importance to your business.

-

Assessing how much discretion the contractor has in performing tasks is vital for differentiating between contractors and employees.

What are the implications of contractor restrictions and conflicts?

Restrictions placed on contractors can significantly influence their long-term viability and satisfaction. It's crucial to analyze these restrictions carefully during the contracting phase.

-

Exclusivity agreements may limit the contractor's ability to work for competitors, which could lead to future tensions.

-

Determining whether the contractor will work solely for your company impacts their financial security and job satisfaction.

-

High levels of dependency can lead to complications in the contractor's income stability, influencing their performance.

Where will the work be performed?

Understanding the work environment is pivotal for establishing expectations and minimizing complications. The location can dramatically affect the contractor's performance and relationship with your firm.

-

Clarifying whether the work will be performed on-site or remotely can help in organizing resources and expectations.

-

Identifying any required training ensures contractors are prepared and capable of fulfilling their roles.

-

Specifying necessary skills aids in the selection process and ensures the contractor can deliver quality work.

What role do company training and development programs play?

Participation in company training programs can enhance the skills of an independent contractor while fostering goodwill and loyalty. This reciprocal development can be beneficial for both parties.

-

Evaluate whether the contractor's participation in training will improve their performance and integration within the company.

-

Continued education can enhance work quality, leading to greater satisfaction for both the contractor and client.

How to use pdfFiller for document management?

Utilizing pdfFiller can streamline the process of managing the independent contractor worksheet. This cloud-based platform offers numerous features that enhance efficiency and collaboration.

-

Use pdfFiller's tools to edit, sign, and customize the independent contractor worksheet according to your specific needs.

-

Benefit from real-time collaboration features that allow multiple stakeholders to provide input and review the document.

-

Explore pdfFiller's interactive tools tailored for the analysis and management of contractor information effectively.

How to fill out the worksheet analyzing a self-employed

-

1.Download the worksheet analyzing a self-employed from pdfFiller.

-

2.Open the PDF document in pdfFiller.

-

3.Begin with section one, entering your basic information, such as name and business type.

-

4.Move to section two, where you will input your income sources and, for each source, detail the amounts earned during the relevant period.

-

5.In section three, enter your total expenses, breaking down the costs by categories like supplies, services, and marketing.

-

6.Be thorough in recording all relevant financial data to ensure accurate analysis.

-

7.After completing income and expense sections, review the form for any missing information.

-

8.Utilize the calculation tools available on pdfFiller to sum totals and derive net income automatically.

-

9.Once all fields are filled, save your completed worksheet.

-

10.Consider printing it or saving it as a PDF for your records or further analysis.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.