Last updated on Feb 17, 2026

Get the free Loan Application - Review or Checklist for Loan Secured by Real Property template

Show details

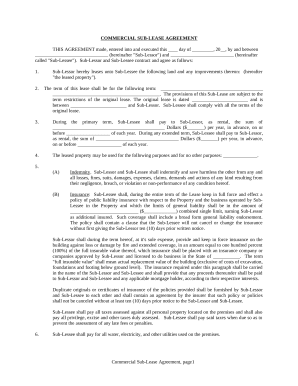

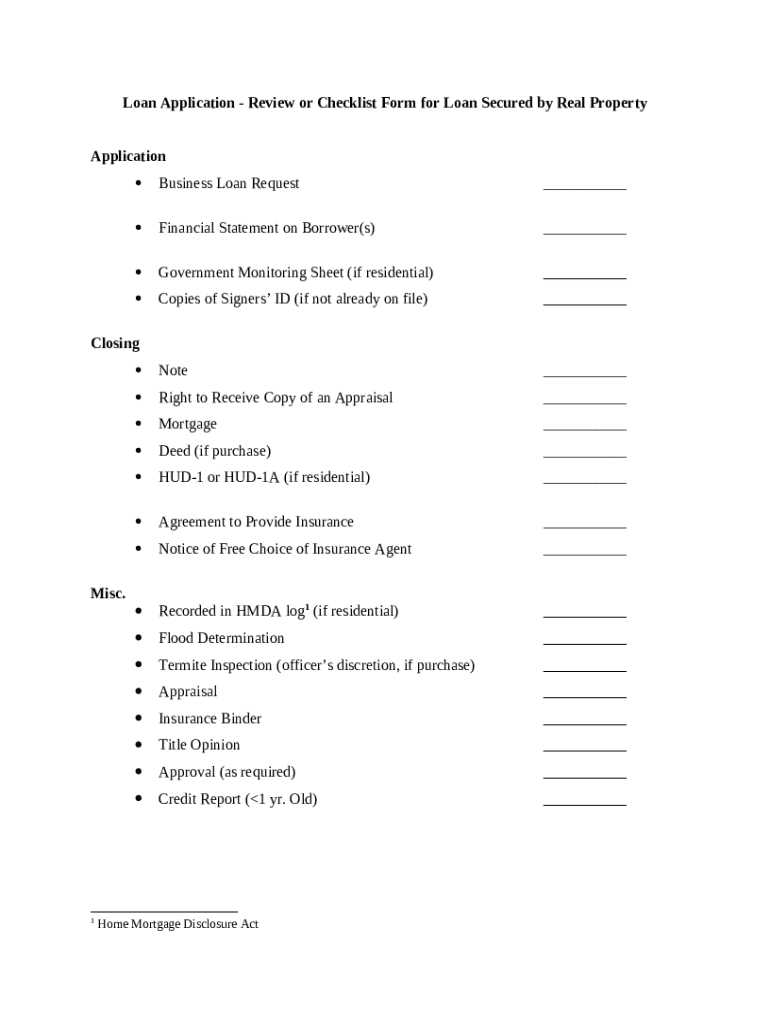

Loan Application ??? Review or Checklist Form for Loan Secured by Real Property

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is loan application - review

A loan application review is the process of evaluating a borrower's application to determine their eligibility for a loan.

pdfFiller scores top ratings on review platforms

Best PDF File sight and submittal site

1st review

Great! No problems.

Very easy to use.

Docs editing

Yes I am satisfied with pdfFiller experience its just quick to edit the docs.

good program

easy to use

easy to use, very reliable to use between machines

Who needs loan application - review?

Explore how professionals across industries use pdfFiller.

Comprehensive Loan Application Review Form Guide

How does understanding loan application essentials help?

Preparing a complete loan application is critical as it can significantly increase your chances of approval. A thorough application packet not only satisfies lender requirements but also helps build trust. Key components typically include personal identification, income verification, and documentation of debts and assets.

-

A well-organized application reflects positively on you, suggesting reliability and seriousness.

-

Make sure to gather necessary documents such as tax returns, bank statements, and proof of employment.

What should be included in the application checklist for secured loans?

Secured loans require specific documents that assure the lender of receiving their funds back. By following a well-defined checklist, you ensure that all necessary information is included, reducing delays in the approval process.

-

Documentation that specifies how loan funds will be utilized can enhance your application.

-

Ensure all financial records are up to date and reflect an accurate picture of your financial health.

-

Especially for residential loans, including required demographic data is crucial.

-

Ensuring that you have valid identification for all applicants is essential to avoid delays.

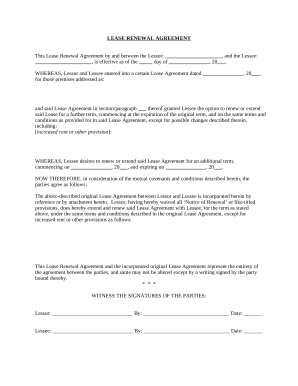

What are the closing documentation requirements?

Closing documentation is vital as it finalizes the loan agreement. Understanding what documents are needed ensures a smooth closing process and helps avoid potential setbacks.

-

These include any loan-related agreements that protect both lender and borrower interests.

-

Knowing what this entails ensures that borrowers are informed about property evaluations.

-

Understanding these processes is essential as they outline ownership and terms of the loan.

-

These documents are crucial for all the financial details and transaction information involved in residential loans.

-

This includes any policies that protect the loan and should be reviewed for completeness.

What miscellaneous documentation might be required for loan applications?

Additional documentation can play a significant role in securing a loan. It's vital to understand what extra items may be needed based on your specific situation.

-

This is particularly important for residential loans and ensures compliance with federal regulations.

-

Being aware of flood zones can affect loan approval and terms.

-

This inspection is typically at the officer's discretion but can have significant implications.

-

Appraisals assess property value; it's important to know how these affect loans.

-

Title opinions verify clear ownership and are crucial for closing.

-

Always provide an up-to-date credit report to reflect your current financial status.

How can pdfFiller enhance document management?

Using pdfFiller’s tools can streamline the loan application process significantly. From editing PDFs to secure eSigning, pdfFiller makes managing your documentation efficient and accessible.

-

pdfFiller allows you to modify your loan application PDF with ease, ensuring accuracy.

-

Easily sign your documents without the need for printing, which can expedite the process.

-

Share documents with your team for collective input, enhancing the submission process.

-

Access your documents from anywhere, ensuring you have the information when you need it.

How can you optimize the loan approval process?

Streamlining the loan application process can improve the chances of approval and reduce waiting times. Implementing specific strategies can enhance the organization of your documentation.

-

Create a system for your paperwork that makes it easy to find information when needed.

-

Build a checklist of necessary documents for faster submissions, tailored to each lender.

-

Regularly update your documents to reflect current circumstances, which lenders appreciate.

-

Self-employed applicants should come prepared with additional financial documentation, such as profit and loss statements.

What are the best practices for maintaining your loan application?

Maintaining an organized loan application can greatly enhance the chances of a smooth approval process. Consistently monitoring the status and ensuring that all documentation is up-to-date is crucial.

-

Keeping your financial data current ensures that you present the most accurate picture to lenders.

-

This enhances your application’s approval speed and minimizes errors.

-

Utilize digital services like pdfFiller to monitor your application status and manage your documents.

How to fill out the loan application - review

-

1.Obtain the loan application form, preferably in PDF format.

-

2.Open the PDF using pdfFiller to enable editing options.

-

3.Begin with your personal information: full name, contact details, and Social Security number.

-

4.Input financial details, including income, employment status, and monthly expenses.

-

5.Provide information about the loan amount requested and purpose of the loan.

-

6.Attach any required documents, such as proof of income or identification, using the upload feature.

-

7.Review all entries for accuracy to avoid delays in processing.

-

8.Use the highlighting tools to mark important sections if needed.

-

9.Sign the application electronically using the signature tool.

-

10.Save your completed application and either print it for physical submission or submit it electronically if applicable.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.