Get the free Sale of Certified Public Accountancy Firm template

Show details

Public Accountancy means offering professional service to the public, and may include, but is not restricted to, services offered by a public accountant as defined under the Public Accountancy Act. It

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is sale of certified public

The sale of certified public is a formal agreement that outlines the transfer of ownership of a public asset from one party to another, ensuring compliance with applicable regulations.

pdfFiller scores top ratings on review platforms

good

Easy to use. No issues. Great for sending my clients documents.

I always have pdf tools and faxing…

I always have pdf tools and faxing capability at my fingertips... With a Scanner at home and access to this site I am able to handle any need me or my family have for communicating documents of all types...

great

I'm just a bot

I love the product

I love the product! Its a god send working remotely. I can sign forms, password protect documents with personal information and email them in an instant.

This program has been able to do…

This program has been able to do anything I needed done.

Who needs sale of certified public?

Explore how professionals across industries use pdfFiller.

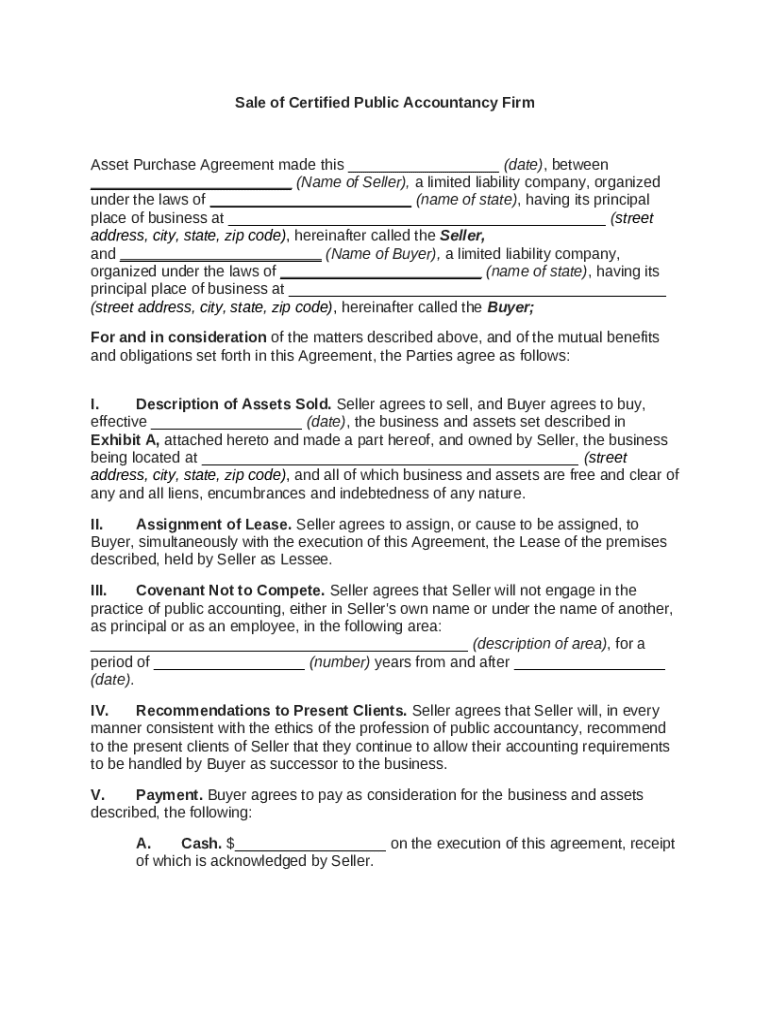

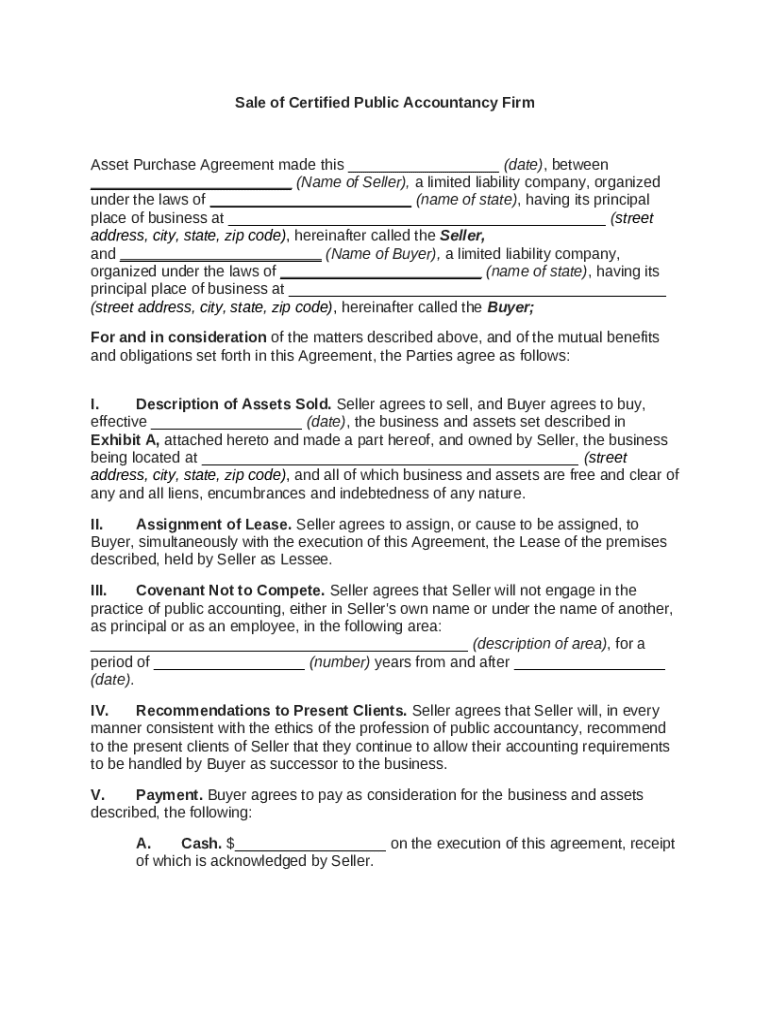

Sale of Certified Public Accountancy Firm Form Guide

How does the sale of a certified public accountancy firm work?

When considering the sale of certified public form form, understanding the fundamental processes involved is essential. This process typically includes creating an asset purchase agreement, which outlines the details of what is being sold, including assets, operations, and client relationships. The legal implications are significant, and prospective sellers should be aware of the regulatory environment surrounding public accounting firms.

-

This agreement serves as the foundation of the sale, defining key terms, assets, and liabilities.

-

Concerns related to the transfer of client engagements and compliance with accounting laws must be considered.

-

The process includes negotiation, due diligence, and finalizing the agreement.

What are the key components of the asset purchase agreement?

An asset purchase agreement not only details the transaction but also safeguards both parties’ interests. It is critically structured to define exactly what is being sold and any obligations that remain post-sale. Understanding these components can help in ensuring a smooth transition.

-

Define the business and assets involved, including client lists and physical assets through a detailed Exhibit A attachment.

-

It's essential to address the lease agreement in the transaction, as it impacts the business's operational continuity.

-

This clause restricts the seller from competing with the firm post-sale, therefore protecting the buyer's interest.

-

Include strategies for maintaining client relationships to ensure a seamless transition and continued business activity.

How do you fill out the asset purchase agreement form?

Filling out the asset purchase agreement form accurately is crucial for legal protection for both parties involved. Ensuring careful attention to detail can prevent costly disputes later on. A step-by-step guide can assist in navigating this process efficiently.

-

Start by carefully inputting the seller and buyer’s details before moving to asset descriptions.

-

Consistency is key; ensure all entries are clear, with all required signatures present to avoid legal issues.

-

Look out for vague descriptions and incomplete information that could lead to disputes in the future.

What should you know about managing post-sale obligations?

After completing the sale of a certified public accountancy firm form, it's crucial to manage any ongoing obligations. These could include follow-ups with former clients and ensuring compliance with the relevant professional standards. A well-structured transition plan can help mitigate complications and ensure continuous operations.

-

Clarify the nature of continuing service expectations to prevent client dissatisfaction.

-

Stay informed about the regulatory frameworks that govern accounting practices in the new model.

-

Have procedures in place for the proper introduction of clients to the new firm after the sale.

How can PDF Filler help with asset purchase agreement management?

Utilizing a tool like PDF Filler can streamline the management of asset purchase agreements. This cloud-based platform allows for easy editing, eSigning, and collaborative efforts, which are essential in ensuring that all parties are aligned.

-

With PDF Filler, adjusting terms or adding additional provisions is simple and efficient.

-

Engage all parties in real-time document management, securing faster approvals.

-

Access to documents from anywhere enhances flexibility and supports seamless retrieval when needed.

What local compliance considerations should you be aware of?

Compliance is crucial when selling a certified public accountancy firm, especially regarding state-specific regulations. Each region may have unique guidelines that influence the structuring and execution of sales transactions.

-

Research local laws to understand the legal frameworks that pertain to the sale of accountancy practices.

-

Be aware of the tax liabilities and benefits that may arise when selling firm assets, affecting your profitability.

-

Ensure all necessary paperwork is prepared in accordance with local regulations to avoid penalties.

How to fill out the sale of certified public

-

1.Access the pdfFiller website and log in to your account.

-

2.Select 'Create New' and choose 'Upload Document' to import the sale of certified public form.

-

3.Once the document is uploaded, review the fields that need to be filled in, such as the seller's and buyer's information.

-

4.Click on the first empty field to type in the necessary details, like names and addresses of both parties.

-

5.Continue filling out the document by entering specific details about the public asset being sold, including its description and purchase price.

-

6.If there are additional clauses or agreements, use the 'Text' tool to input those phrases clearly within the appropriate sections.

-

7.After completing all fields, review the document for accuracy and completeness to ensure all information is included.

-

8.Once satisfied, click on the 'Save' button to store your document and then choose 'Download' to keep a copy or 'Share' to send it electronically.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.