Get the free Sale of Certified Public Accountancy Firm by Asset Purchase Agreement template

Show details

An Asset Purchase Agreement is an agreement between a seller of business assets and a buyer. This Agreement sets the terms of such sale and includes provisions such as payment of purchase price. The

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is sale of certified public

A sale of certified public is a legal document outlining the transfer of ownership of certified public services or assets from one party to another.

pdfFiller scores top ratings on review platforms

Very easy to use, super simple for even a beginner to use.

I like the fact that i can change all files to pdf

It's cheaper than Adobe. It gets the job done and has many options for filling out PDFs. I use it mostly for the Army National Guard and now as a substitute teacher.

I was able to complete the form that I needed

Аз IT professional, with 35 years experience I am very impressed.

east to use and really easy to understand

Who needs sale of certified public?

Explore how professionals across industries use pdfFiller.

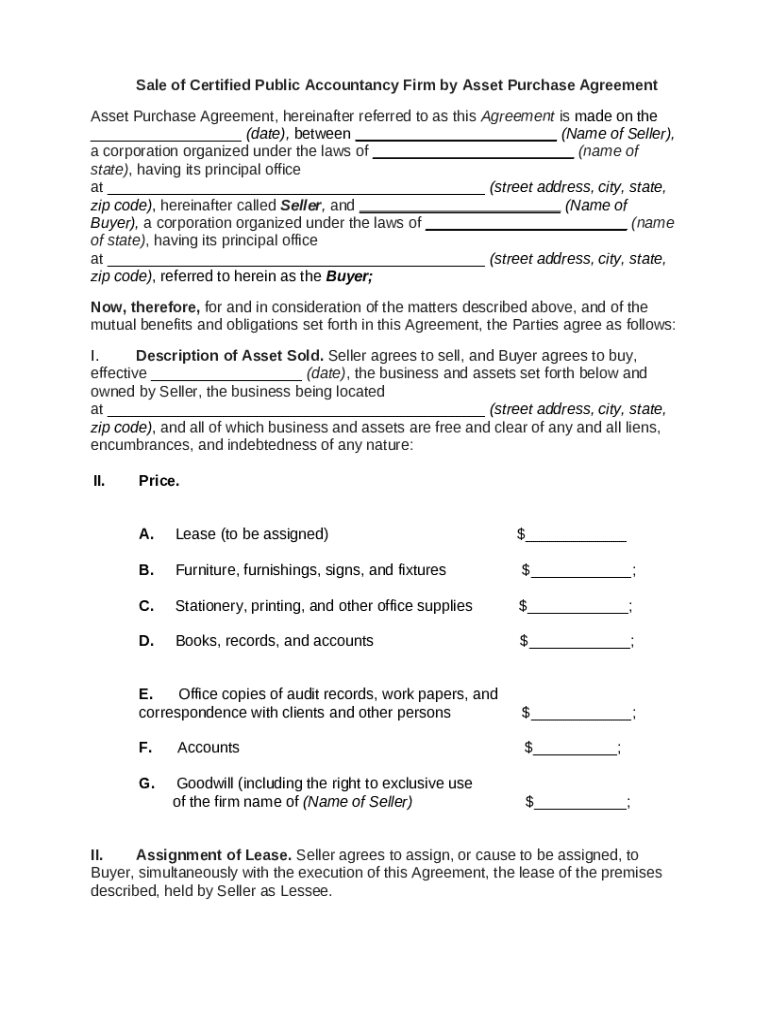

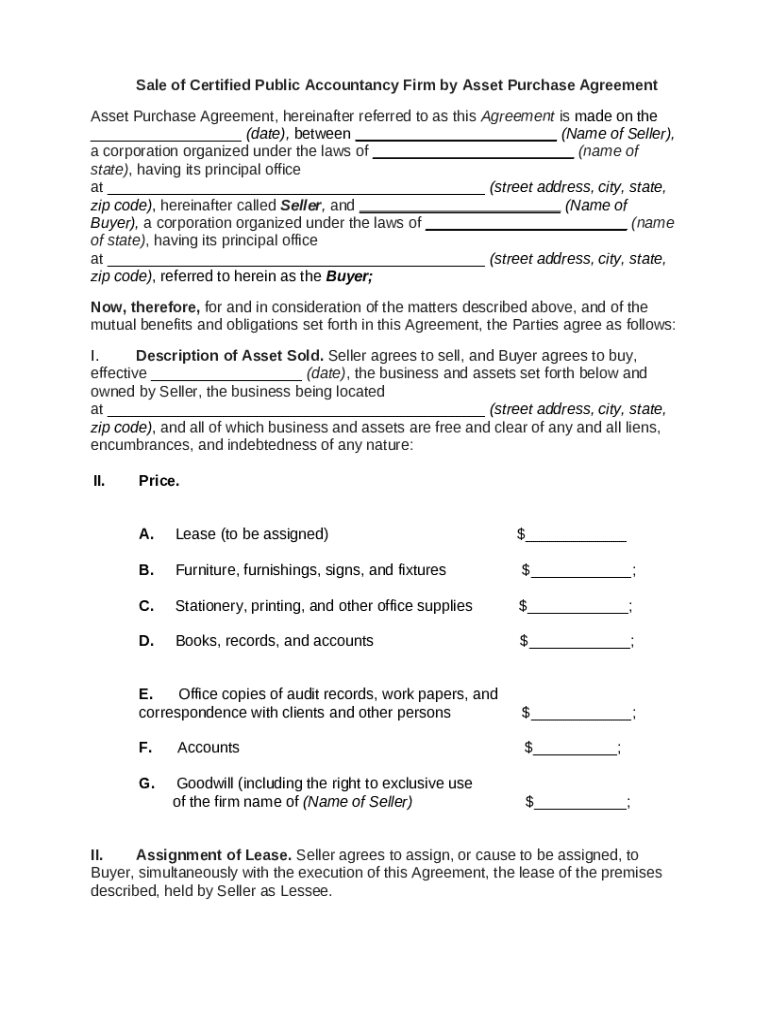

Comprehensive Guide to the Sale of Certified Public Accountancy Firms

What is the sale of certified public accountancy firms?

The sale of certified public accountancy firms refers to the process of transferring ownership of a firm from one party to another. This transaction often involves an asset purchase agreement, which is crucial for defining the terms and conditions of the sale. Understanding this process is essential for both buyers and sellers to ensure a fair transaction.

-

Asset purchase agreements outline the specifics of what is being sold and help protect both parties during the transaction.

-

Several factors must be considered, including asset descriptions, price determinations, and client goodwill.

What are the essential components of an asset purchase agreement?

An asset purchase agreement is a critical document in the sale of certified public accountancy firms. It needs to clearly outline all aspects of the sale to avoid potential disputes.

-

Clearly itemizes all assets being transferred, including tangible and intangible assets.

-

Details the total sale price, payment methods, and any contingencies.

-

Specifies any lease transfers, with responsibilities clearly outlined.

-

Includes provisions for managing existing client relationships and the goodwill associated with the firm.

How do you fill out your asset purchase agreement?

Filling out an asset purchase agreement can seem daunting, but with a structured approach, it can be managed effectively. This involves ensuring that all necessary details are accurately captured.

-

Make sure to clearly identify both parties involved in the transaction, including business names and contact details.

-

Provide detailed descriptions of all assets included in the sale to avoid ambiguities.

-

Clearly outline payment structures, including any upfront payments or financing conditions.

What legal requirements govern the sale of accountancy firms?

Legal compliance is crucial in the sale of certified public accountancy firms. Laws vary by state, emphasizing the importance of understanding local regulations before proceeding.

-

Each state has unique laws that affect the process of selling a CPA firm, such as licensing and taxation regulations.

-

Be informed about regulatory bodies that oversee accounting practices in your region.

-

Identify and mitigate potential liabilities arising from the sale process, such as unresolved client issues.

What are best practices for negotiating the sale?

Effective negotiation can greatly influence the outcome of the sale. By employing sound strategies, parties can secure favorable terms.

-

Focus on understanding the other party's needs and leveraging that awareness to reach a satisfactory agreement.

-

Know which aspects of the agreement you're willing to compromise on versus those that are non-negotiable.

-

Avoid being overly aggressive or unprepared, as this can weaken your position.

How can pdfFiller assist in documentation management?

pdfFiller provides tools for editing and eSigning documents, making it easier to manage asset purchase agreements securely.

-

Utilize pdfFiller's features to make real-time adjustments and gain electronic signatures from involved parties.

-

Teams can work together efficiently, sharing insights and making necessary edits seamlessly.

-

Save and share completed agreements securely to protect sensitive information.

What steps to follow for review and finalization of the contract?

Before completing the sale, a thorough review of the asset purchase agreement is essential to ensure all terms are met.

-

Establish a checklist to verify that all components of the agreement align with previously discussed terms.

-

Consulting with a legal expert can help identify any potential issues before finalization.

-

Ensure all documentation is prepared and that both parties are synchronized on the closing schedule.

What are effective post-sale transition strategies?

After the sale is complete, transitioning ownership smoothly is critical for continued success and client satisfaction.

-

Develop a plan for phased transition of responsibilities to ensure a smooth handover.

-

Communicate with clients about the changes to provide reassurance and continuity.

-

Implement internal processes to manage the transition smoothly and retain key personnel.

How to fill out the sale of certified public

-

1.Access pdfFiller and log in to your account or create a new one.

-

2.Search for the template labeled 'Sale of Certified Public' in the document library.

-

3.Click on the template to open it in the editor.

-

4.Begin filling out the seller's information, including name, address, and contact details.

-

5.Proceed to enter the buyer’s information in the designated fields.

-

6.Detail the terms of the sale, including practice valuation and payment structure.

-

7.Include any additional terms or conditions relevant to the sale in the appropriate section.

-

8.Review the document for accuracy, ensuring all fields are correctly filled and legible.

-

9.Once completed, save the document in your pdfFiller account.

-

10.Finally, download the filled document or share it via email with relevant parties as needed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.