Get the free Letter Ining Debt Collector of Unfair Practices in Collection Activities template

Show details

A debt collector may not use unfair or unconscionable means to collect or attempt to collect any debt.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is letter informing debt collector

A letter informing a debt collector is a formal notification sent to a debt collection agency asserting that the sender disputes their claim and requests verification of the debt.

pdfFiller scores top ratings on review platforms

I think it goes well with my small business & makes things pretty easy for me. Prices not too bad for my budget either.

I like it but have trouble finding my documents again.

I just started using it but it looks like it can be super helpful to our office.

so far so good if I can find it on my disk

I preveiously gave the program a low rating before technicians showed me that my problem was user error. I find PDFfiller a great addition to my daily work. I can fill the forms in and also go back and edit. Love it!

I am learning about how to use it OJT. Need help.

Who needs letter ining debt collector?

Explore how professionals across industries use pdfFiller.

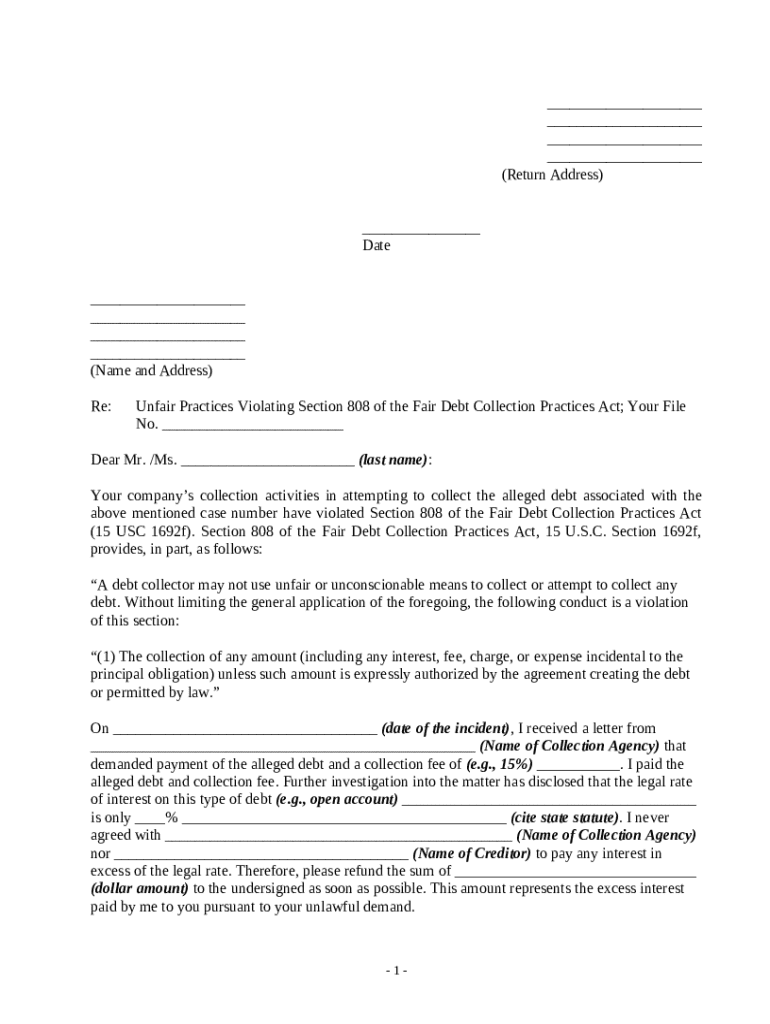

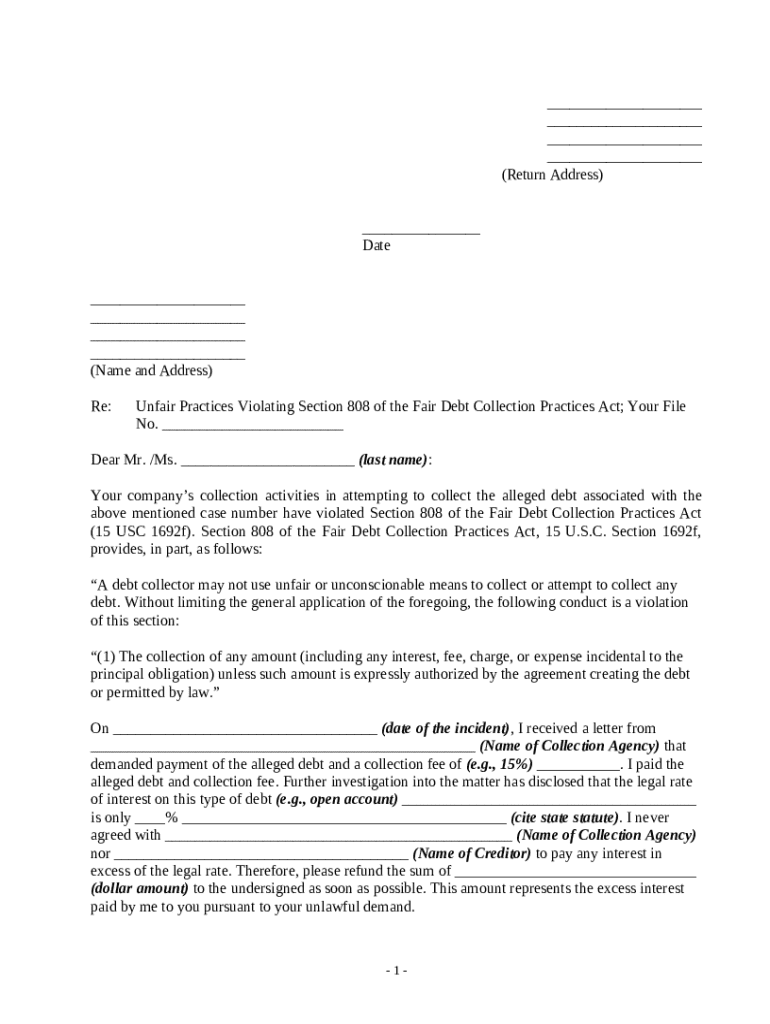

How to fill out a letter informing debt collector form

When dealing with debt collection, knowing how to properly write a letter informing your debt collector is crucial. This form enables you to assert your rights and clarify any misunderstandings regarding debts. Understanding the legal context and proper procedures can empower you to communicate effectively.

Understanding your rights under the Fair Debt Collection Practices Act

The Fair Debt Collection Practices Act (FDCPA) outlines your rights as a debtor. This federal law ensures protection against abusive practices from debt collectors.

-

Overview of the FDCPA - This law restricts how debt collectors can communicate with you.

-

Your rights as a debtor - You have the right to dispute a debt and to receive validation of the debt.

-

Provisions related to unfair practices - The law prohibits practices such as harassment, false statements, and unfair fees.

What to do when contacted by a debt collector

-

Remain calm and gather information - It's important to collect the debt collector's details and information about the alleged debt.

-

Verify the debt - Request written validation of the debt to ensure you owe it.

-

Understand the debt collector's limitations - Know that debt collectors are limited in their practices, especially when it comes to communication.

Preparing your response: the informing debt collector letter

Creating a professional letter can significantly impact your communication with debt collectors. Utilizing tools like pdfFiller can streamline this process.

-

Using pdfFiller to create a professional letter - This platform offers templates and editing capabilities that can enhance your letter.

-

Essential components - Ensure your letter includes your address, the collector's address, the date, and the body of your message.

-

Drafting the 'Return Address' section - It's vital to accurately record your return address for future correspondence.

Filling out the letter: customizing your information

-

Input your personal details accurately - Incorrect or missing details can delay or complicate matters.

-

Specify the recipient's details correctly - Ensure you have the correct name and address for your debt collector.

-

Document all relevant information regarding the debt - Being specific about the debt can help clarify your position.

Citing legal grounds for your dispute

Citing the FDCPA strengthens your case. If you believe the debt collection is unlawful, specific legal references can enhance your letter's authority.

-

Reference Section 808 of the FDCPA - This section outlines what qualifies as an unfair practice.

-

Identify specific unlawful practices - Provide details on any behavior by the collector that violates the law.

-

Explain the legal rate of interest in your state - Disputing interest rates can further substantiate your case.

Finalizing your letter: signatures and dates

-

Importance of a handwritten signature vs. electronic signature - Handwritten signatures add authenticity to your correspondence.

-

Adding the appropriate date - Ensure you date your letter to validate the timeline of communication.

-

Utilizing pdfFiller’s eSigning functionality - The platform allows for easy signing and can expedite the process.

Sending your letter to the debt collector

-

Choose the best sending method (e.g., certified mail) - This provides proof of sending and delivery.

-

Ensure you keep a copy for your records - Documentation is crucial in case disputes arise.

-

Consider tracking your letter for confirmation - Knowing your letter was received can give you peace of mind.

Follow up: what to expect after sending the letter

-

Timeframes for responses from debt collectors - Expect a response within 30 days for validation requests.

-

Next steps if you do not receive a response - If you don’t hear back, consider following up with another letter or seeking legal advice.

-

When to seek legal help - If the debt collector continues to harass or refuses to validate, it's advisable to consult a legal professional.

Continuing to fight back: your ongoing rights and protections

Being proactive in your financial interactions empowers you. Monitoring debt collection practices and knowing your rights means you’re less likely to be taken advantage of.

-

Monitoring debt collection practices - Regularly review your credit reports and any communication.

-

Escalating disputes to the Consumer Financial Protection Bureau (CFPB) - Reporting violations can protect others and help you.

-

Options for reporting harassing behavior - Familiarize yourself with channels to address unfair collection practices.

How to fill out the letter ining debt collector

-

1.Open pdfFiller and upload the 'letter informing debt collector' template.

-

2.Begin by entering your personal information at the top, including your name, address, and date.

-

3.Next, include the debt collector's name and address just below your information.

-

4.Write a clear subject line such as 'Debt Validation Request' or 'Notice of Dispute'.

-

5.In the body of the letter, state that you are disputing the debt and request detailed verification.

-

6.Include any relevant account numbers or reference numbers associated with the debt.

-

7.Mention your rights under the FDCPA to ensure the debt collector takes your request seriously.

-

8.Sign the letter with your handwritten or typed name, adding a line for your signature.

-

9.Review the entire letter for accuracy and completeness before saving.

-

10.Finally, download or send the completed letter to the debt collector using pdfFiller's mailing options.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.