Get the free Letter Ining Debt Collector of False or Misleading Misrepresentations in Collection ...

Show details

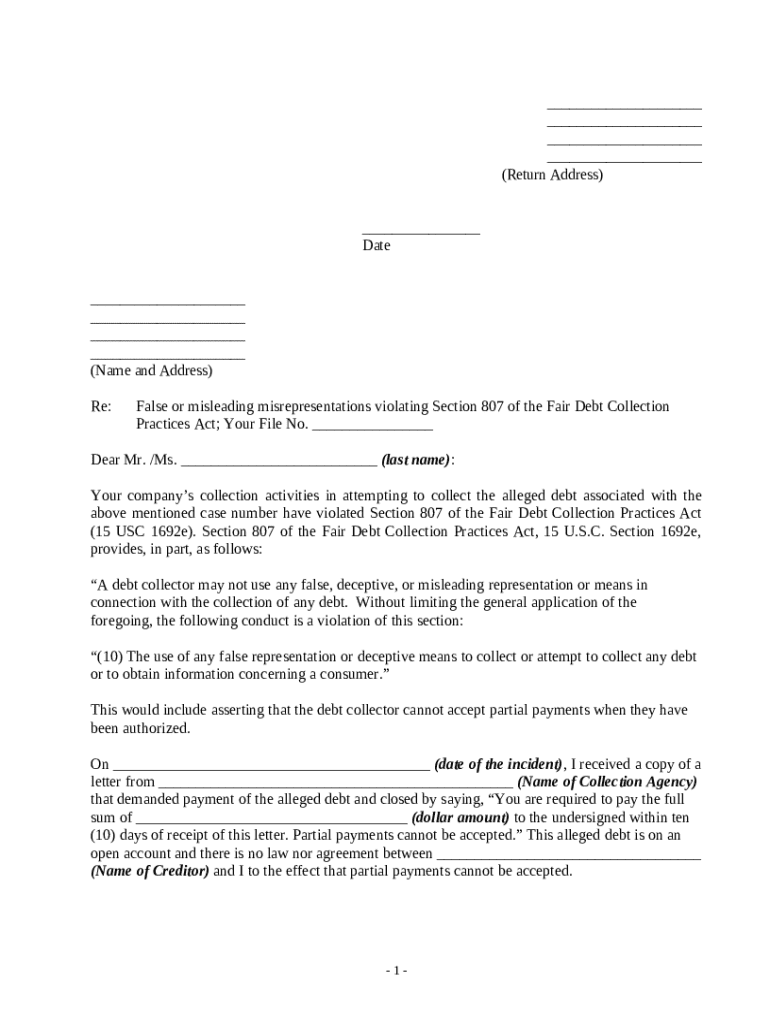

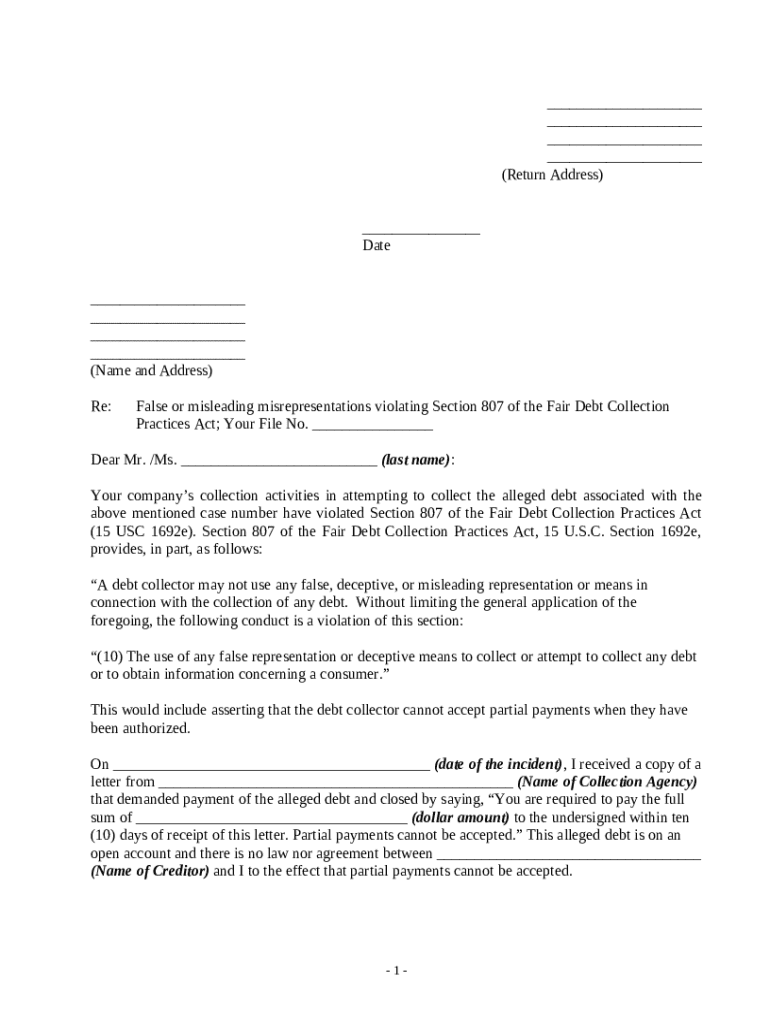

Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692e, provides, in part, as follows: A debt collector may not use any false, deceptive, or misleading representation or means

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is letter informing debt collector

A letter informing a debt collector is a formal communication disputing a debt or requesting specific actions related to debt collection.

pdfFiller scores top ratings on review platforms

Great program

Great program. Can't find anything it doesn't do.

Was able to get started on a project…

Was able to get started on a project easily.

Definitely helps filling out the forms…

Definitely helps filling out the forms so that they look nice and presentable.

love this program

This program is so easy to use and it does everything one needs to get taxes completly done and filed.

I am Mexican

I am Mexican. good experience.

This was the easiest

This was the easiest, most customer friendly service yet!

Who needs letter ining debt collector?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Drafting a Letter Informing Debt Collector

Understanding your rights under the Fair Debt Collection Practices Act (FDCPA)

The FDCPA is a federal law designed to protect consumers from unfair debt collection practices. It prohibits debt collectors from using abusive, deceptive, or unfair tactics, thereby ensuring consumers can contest the legitimacy of debts. Knowing your rights allows you to stand firm against harassment and intimidation from debt collectors.

-

Overview of the FDCPA and its purpose: The FDCPA aims to eliminate abusive practices in debt collection and provides consumers with specific rights.

-

Key protections against abusive debt collection practices: Consumers cannot be contacted at unreasonable hours or through intimidating means.

-

Understanding deceptive representations by debt collectors: Truthfulness is mandated; misrepresentation of the debt or collector's authority is illegal.

When to use a letter informing debt collector

Using a letter to communicate with debt collectors is a crucial step when disputing a debt or clarifying misunderstandings. Formal communication is not only more structured but also medically significant in establishing a record of the dispute.

-

Identifying valid reasons to dispute a debt: If there are inaccuracies in the amount or if the debt doesn't belong to you, a letter is necessary.

-

Importance of formal communication with debt collectors: A letter provides proof that you've formally contested the debt.

-

Guide on documenting interactions with debt collectors: Always take notes during calls and retain any written communications to support your claim.

Key components of your letter

A well-structured letter can significantly impact the resolution of a debt dispute. Each component of the letter serves a purpose that contributes to clarity and effectiveness.

-

Return address - how to format: Your return address should be positioned at the top of the letter to ensure it’s recognized.

-

Date of your correspondence: Always date your letter to document when you sent it.

-

Recipient’s name and address - getting it right: Ensure accuracy to avoid delivery issues.

-

Subject line - ensuring clarity and purpose: Clearly state the reason for the letter for immediate understanding.

-

Opening salutation: Formal vs. informal greetings: A properly addressed letter exudes professionalism that commands respect.

Crafting the body of the letter

The body of the letter is where you articulate your dispute effectively and succinctly. Precision and clarity are essential to convey your stance regarding the debt.

-

Clearly state your dispute regarding the debt: Be explicit about what you disagree with to avoid confusion.

-

Reference specific violations under the FDCPA: Citing breaches can strengthen your position.

-

Cite any past communication from the debt collector: This shows that you've engaged previously and have documented evidence.

-

Make a clear request for resolution or action: Specify what outcome you desire to direct the response.

Formatting your letter properly

Proper formatting establishes credibility and professionalism, making the letter more likely to be taken seriously. Utilizing tools such as pdfFiller can enhance this aspect significantly.

-

Using pdfFiller for document layout and design: This tool helps in ensuring your letter looks polished and official.

-

Best practices for professional presentation: Keep fonts readable and formatting uniform.

-

Essential details to include for authenticity: Always include your name and address for the receiver to verify the legitimacy.

Finalizing the letter: Signatures and contact information

The final touches are critical to ensure your letter is fully complete and ready for submission. This includes your signatures, methods of contact, and how to send the letter.

-

Importance of providing your contact details: Ensure you provide the correct details so they can respond.

-

Digital signatures using pdfFiller: These adds formality and legitimacy to your correspondence.

-

Instructions on sending the letter: mail vs. email: Decide the best method of communication depending on urgency and formality.

What to expect after sending your letter

After sending your letter, it's essential to know what responses to expect from debt collectors. Understanding potential outcomes can prepare you for various scenarios.

-

Possible responses from the debt collector: They may acknowledge your dispute, request further information, or contest your claims.

-

Next steps if the situation escalates: Be prepared to seek legal advice if harassment continues.

-

When to seek legal advice or further assistance: If your rights are violated, contacting a legal professional may be necessary.

Common mistakes to avoid

Being mindful of common pitfalls while drafting your letter can enhance its effectiveness. Avoiding these mistakes ensures a smoother process.

-

Neglecting to document your communications: It's vital to keep a record of all correspondences for reference.

-

Failing to customize your letter to your situation: Personalization makes your letter more impactful.

-

Ignoring timing and legal aspects in responses: Adhering to required timelines can significantly affect your case.

How to fill out the letter ining debt collector

-

1.Open the PDFfiller application and log in to your account or create a new account if you don’t have one.

-

2.Select 'Create New' or 'Upload Document' and find the template for 'letter informing debt collector'.

-

3.Begin by filling in your personal information at the top, including your name, address, and the date.

-

4.Next, enter the debt collector's name and address in the designated section to ensure it arrives at the correct recipient.

-

5.In the body, clearly state your reasons for writing the letter—whether you’re disputing the debt, requesting validation, or asserting your rights.

-

6.Be sure to include any relevant details about the debt, such as the account number and the original creditor's name.

-

7.After drafting, review the letter for clarity and accuracy, making any necessary edits.

-

8.Once satisfied, proceed to save your completed document in your preferred format (PDF, Word, etc.) or print it directly from PDFfiller.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.