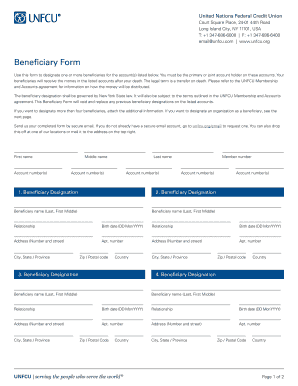

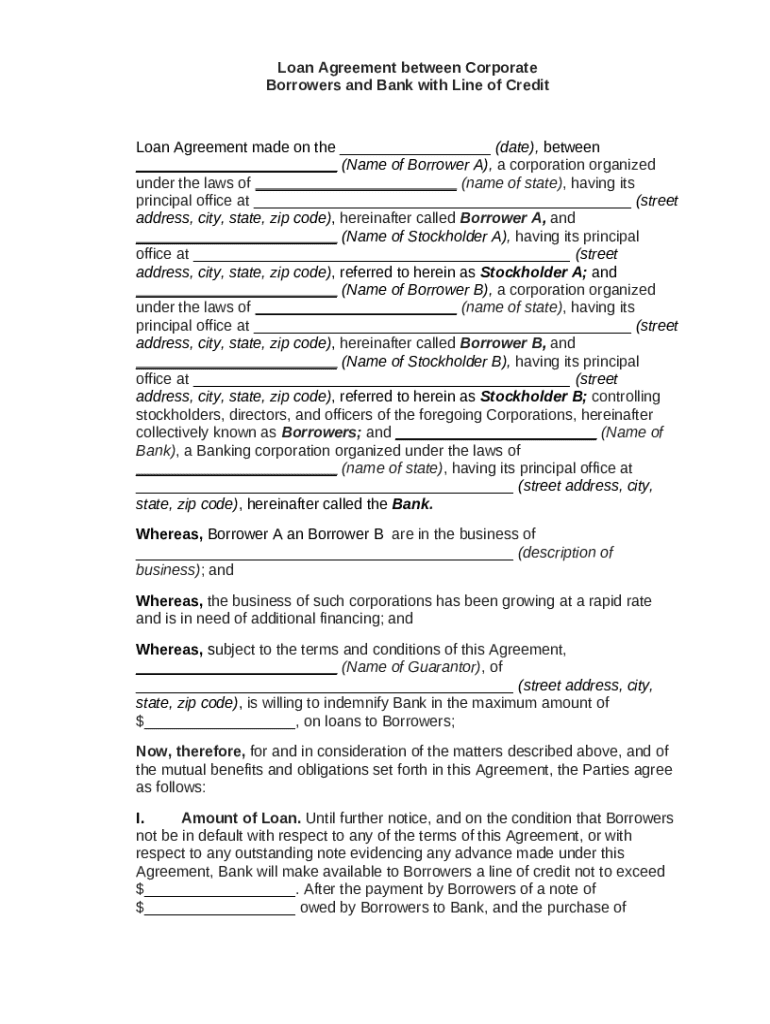

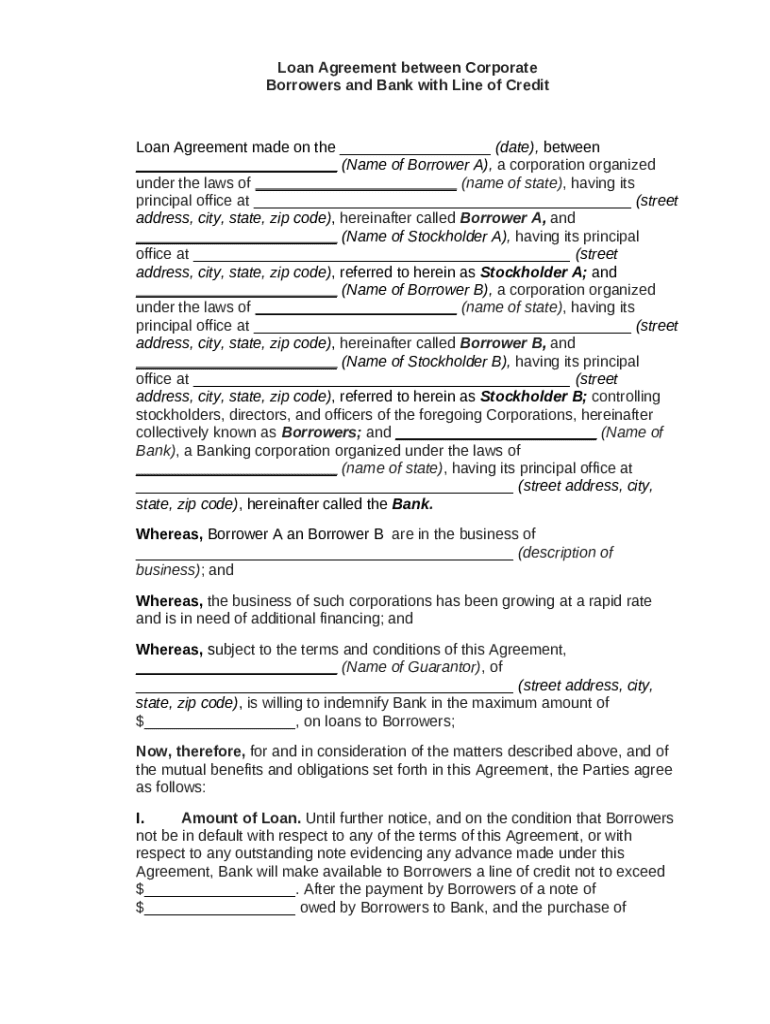

Get the free Loan Agreement between Corporate Borrowers and Bank with Line of Credit template

Show details

An LOC is an arrangement between a financial institution - usually a bank - and a customer that establishes the maximum loan amount that the customer can borrow. The borrower can access funds from

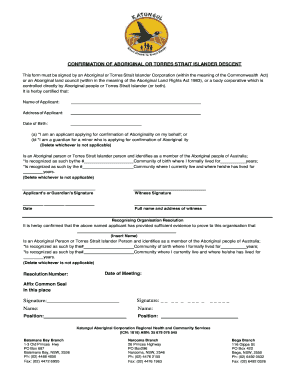

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is loan agreement between corporate

A loan agreement between corporate entities is a legally binding document outlining the terms and conditions of a loan provided by one corporation to another.

pdfFiller scores top ratings on review platforms

Quite easy to use

so far so good

I used the free trial to compile rent due ledgers for the ************** requirement. I did not cancel on time and was charged $180 dollars. I reached out to support and ****** returned my email within minutes. I provided my information to customer service specialist ****** and he fixed the problem. There wasn't any back and forth emails. It was straight to the point. Thank you ****** for being quick and professional.

I used the free trial to compile rent due ledgers for the ************** requirement. I did not cancel on time and was charged $180 dollars. I reached out to support and ****** returned my email within minutes. I provided my information to customer service specialist ****** and he fixed the problem. There wasn't any back and forth emails. It was straight to the point. Thank you ****** for being quick and professional.

I used the free trial to compile rent due ledgers for the ************** requirement. I did not cancel on time and was charged $180 dollars. I reached out to support and ****** returned my email within minutes. I provided my information to customer service specialist ****** and he fixed the problem. There wasn't any back and forth emails. It was straight to the point. Thank you ****** for being quick and professional.

I used the free trial to compile rent due ledgers for the ************** requirement. I did not cancel on time and was charged $180 dollars. I reached out to support and ****** returned my email within minutes. I provided my information to customer service specialist ****** and he fixed the problem. There wasn't any back and forth emails. It was straight to the point. Thank you ****** for being quick and professional.

Who needs loan agreement between corporate?

Explore how professionals across industries use pdfFiller.

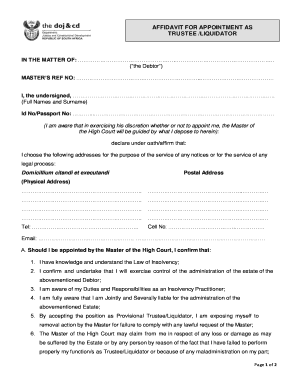

How to Create a Loan Agreement between Corporate Borrowers and Banks

TL;DR: How to fill out a loan agreement between corporate form form

To fill out a loan agreement between corporate borrowers and banks, start by identifying the parties involved: the borrowing corporation and the lending institution. Include essential details like the loan amount, interest rates, and specific terms. Ensure compliance with local regulations and seek legal counsel for clarification.

What is a loan agreement in the corporate context?

A loan agreement is a formal document that outlines the terms under which one party lends money to another. In the corporate context, it's crucial because it provides a legal framework for the borrowing process and sets expectations for both parties involved in the transaction. Accurate loan agreements are essential for smooth business operations and financial accountability.

What are the key components of a corporate loan agreement?

-

A corporate loan agreement must specify the entities involved, including borrowers (corporate entities) and lenders (financial institutions).

-

Clearly state the total loan amount and the interest rates applicable. These figures are critical for understanding repayment obligations.

-

Detail the terms, including repayment schedules, default penalties, and any collateral involved in securing the loan.

How do fill out a loan agreement form?

Filling out a loan agreement form requires precision and attention to detail. Begin by entering the names of the borrower's representatives, stockholders, and bank representatives. It’s important to reference any local compliance requirements specific to your state to ensure that the agreement is recognized legally.

What tips can help when negotiating loan terms?

-

Familiarize yourself with negotiation tactics that cater specifically to corporate financing. This knowledge will empower you during discussions.

-

Present your company's financial needs compellingly against the lender's offerings. Demonstrating strong business fundamentals can help in securing favorable terms.

What legal considerations and risks should be aware of?

It's important to note that this article does not constitute legal advice. Engaging legal counsel is vital when drafting loan agreements to mitigate risks involved with defaults and misunderstandings. Potential risks include lost business opportunities and damage to creditworthiness if obligations are not met.

How do finalize the loan agreement?

-

Before signing, meticulously review the terms to ensure they align with your business’s needs and expectations.

-

Explore eSigning capabilities provided by platforms like pdfFiller for a quick and secure signing process.

-

Implement a cloud-based storage solution for easy access and management of loan agreements after finalization.

What does a sample loan agreement look like?

Having a template for a loan agreement can streamline the preparation process. Look for a standardized sample that includes customizable sections, such as a detailed description of the business and the specific loan terms. Utilizing a template ensures that no critical elements are overlooked.

What common errors should avoid in loan agreements?

-

Providing detailed information about borrowers is crucial; missing details can lead to misunderstandings later.

-

Ambiguous language can cause disputes. Always use clear, concise terms to clearly define responsibilities and expectations.

How to fill out the loan agreement between corporate

-

1.Access pdfFiller and log in to your account.

-

2.Locate the loan agreement template or upload your own document if needed.

-

3.Start filling out the borrower's details, including the corporate name, address, and contact information.

-

4.Input the lender's information in the specified fields.

-

5.Specify the loan amount and the interest rate agreed upon by both parties.

-

6.Define the repayment terms, including duration, schedule, and method of payment.

-

7.Include any additional clauses specific to the agreement, such as collateral or covenants.

-

8.Review the completed sections to ensure all information is accurate and properly filled in.

-

9.Utilize the e-sign feature for both parties to sign the agreement digitally.

-

10.Save the completed document and share it with the other party for their records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.