Get the free Appraisal Contingency Clauses: Contract for Real Property template

Show details

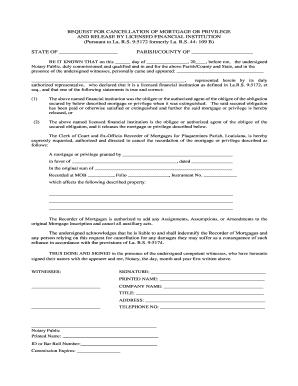

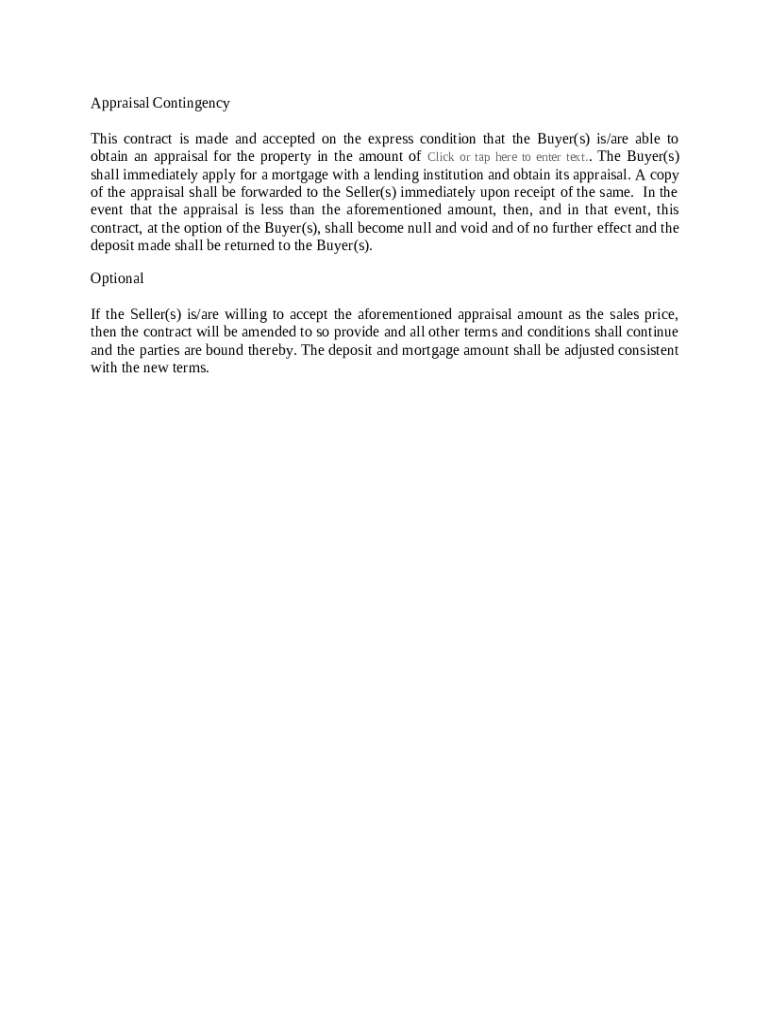

Sample of Appraisal Contingency Clause to be used for a Contract for Real Property. A contingency clause defines a condition or action that a real estate contract must meet to become binding. The

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is appraisal contingency clauses contract

An appraisal contingency clause in a contract is a provision that allows a buyer to back out of the purchase if the property appraisal comes in lower than the agreed purchase price.

pdfFiller scores top ratings on review platforms

Very user friendly and convienienr

Easy site to fix a document

Awesome

the best pdffiller ever would definitely recommend it

Grade A business right highly…

Grade A business right highly recommended

Product works great!

It's very convenient

It's very convenient. But I felt tricked into paying.

Who needs appraisal contingency clauses contract?

Explore how professionals across industries use pdfFiller.

Appraisal contingency clauses: A comprehensive guide

How to fill out an appraisal contingency clause form?

An appraisal contingency clause form ensures that buyers are protected when purchasing real estate. To fill out this form, thoroughly input the agreed appraisal amount, understand the obligations of the buyer and seller, and provide specific instructions on how to handle appraisal results.

Understanding appraisal contingency clauses

An appraisal contingency clause in real estate contracts serves as a safety net for buyers. It ensures that the property is appraised for a certain amount, protecting the buyer from overpaying for a property.

-

An appraisal contingency clause allows buyers to back out of a purchase if the property appraises for less than the agreed purchase price.

-

The main purpose is to protect the buyer’s investment, ensuring they do not pay more than the property's market value.

-

Often used when buyers want assurance that their investment holds its value relative to the loan they are taking.

What are the components of an appraisal contingency clause?

Key elements in an appraisal contingency clause detail the responsibilities of both the buyer and seller.

-

The buyer must obtain an appraisal, while the seller should cooperate with the appraiser.

-

It’s vital to specify this amount in the contract to avoid confusion.

-

The buying agreement may become void if the appraisal is lower than this specified value.

Steps to complete the appraisal contingency form

Filling out the appraisal contingency form accurately is essential for a smooth transaction.

-

Indicate the agreed inspection price clearly to avoid discrepancies later.

-

Seek a reliable lender to ensure funding is secured while obtaining the appraisal.

-

Once the appraisal is completed, promptly send outcomes to the sellers to facilitate further negotiation.

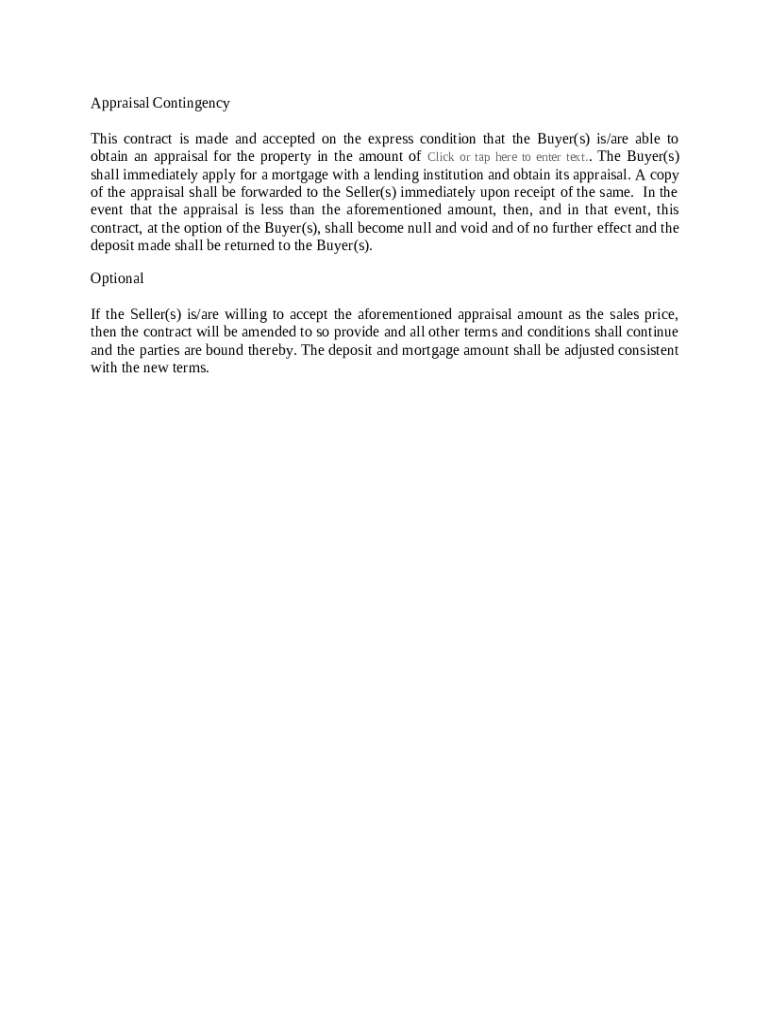

What are the potential outcomes of an appraisal contingency?

When the appraisal reveals a lower value than expected, several scenarios can unfold.

-

If the appraisal is less than the offer price, negotiations can begin for a lower purchase price.

-

The buyer can choose to negotiate, pay the difference, or withdraw from the purchase.

-

Buyers should discuss steps and consider amendments to accommodate the new appraisal findings.

What additional considerations should be made when crafting an appraisal contingency clause?

Crafting a comprehensive appraisal contingency clause involves multiple factors to consider.

-

Consider including terms for the seller's acceptance of the appraisal amount.

-

Review the legal ramifications of appraisal contingencies to ensure compliance.

-

Utilize the pdfFiller platform to create, manage, and edit your appraisal contingency forms seamlessly.

How do appraisal contingency clauses compare with other contingencies?

Understanding how appraisal contingencies differ from other types of contingencies is crucial.

-

Contrasting appraisal contingencies with inspection contingencies helps buyers understand their rights.

-

Different states may have varying regulations regarding appraisal contingencies.

-

Real estate practices may also vary greatly; familiarizing oneself with these ensures informed decisions.

What resources and tools are available for managing appraisal contingencies?

Leveraging the right tools can streamline the appraisal contingency process.

-

Utilize pdfFiller for editing and signing appraisal contingent forms.

-

Take advantage of features for document sharing and collaboration.

-

Stay compliant by using tips for various local regulations regarding appraisal contingencies.

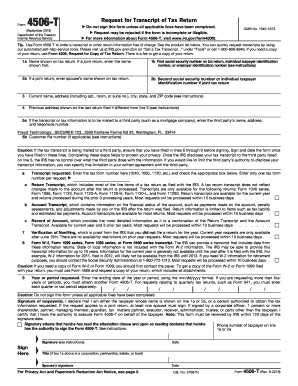

How to fill out the appraisal contingency clauses contract

-

1.Open the pdfFiller application and upload your appraisal contingency clauses contract.

-

2.Begin by entering the date of the agreement at the top of the form.

-

3.Next, fill in the details of the buyer and seller, including names and addresses.

-

4.Specify the property address and the agreed purchase price.

-

5.Look for the section detailing the appraisal contingency clause.

-

6.Indicate the time frame within which the appraisal must be completed.

-

7.Insert the agreed amount for the appraisal, which could be equal to or less than the purchase price.

-

8.Review the conditions under which the buyer can withdraw from the contract if the appraisal is low.

-

9.Ensure all parties sign the document where required and that they also receive a copy of the final contract for their records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.