Get the free Agreement and Plan of Merger for conversion of corporation into Maryland Real Estate...

Show details

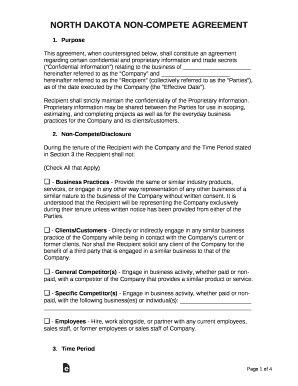

This is an Agreement and Plan of Merger, to be used across the United States. It is an Agreement and Plan of Merger for conversion of a corporation into a Maryland Real Estate Investment Trust.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is agreement and plan of

An 'agreement and plan of' is a formal document outlining the terms and conditions agreed upon by parties involved in a particular project or transaction.

pdfFiller scores top ratings on review platforms

great help for filing and maintaining information and keeping records

its been great. I used it to create 1099s and also P&L and balance sheets most recently.

My navigational around the software needs to be demonstrated more friendly

I am not the most computer literate person, and PDF filler has been great for me. Very user friendly.

I like this program and would be interested in learning how to fully utilize it.

PDFfiller has been very helpful for my tax preparation needs. Your site is well-organized and easy to navigate. Thank you for being there.

Who needs agreement and plan of?

Explore how professionals across industries use pdfFiller.

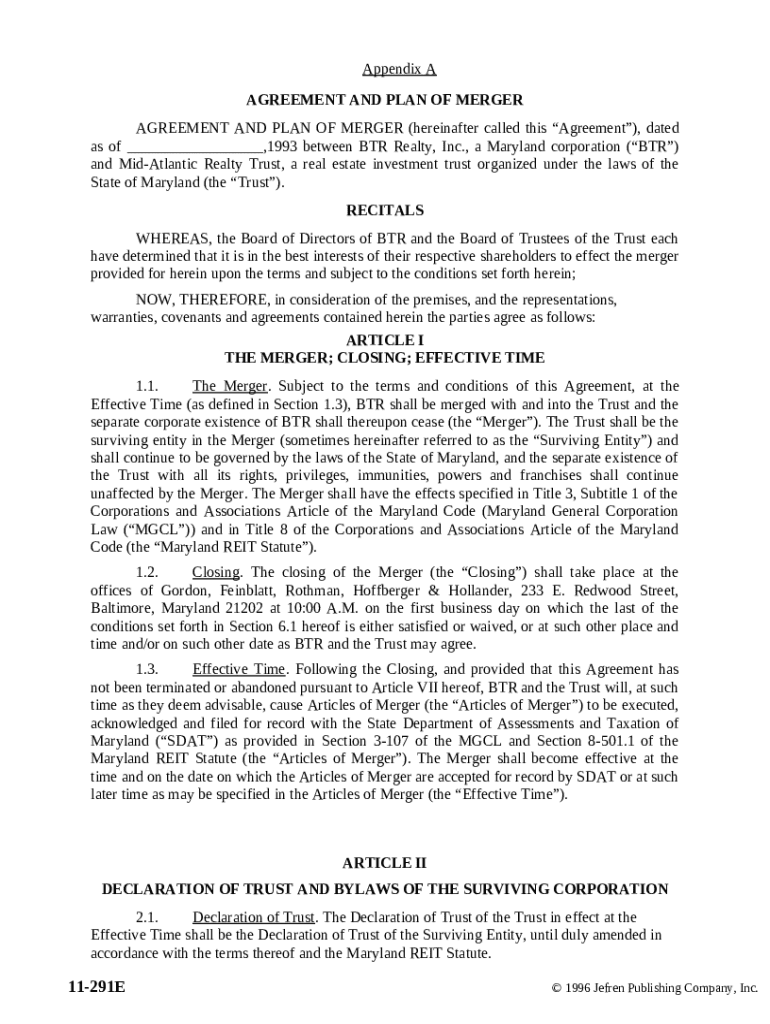

Comprehensive Guide to the Agreement and Plan of Merger

What is an agreement and plan of merger?

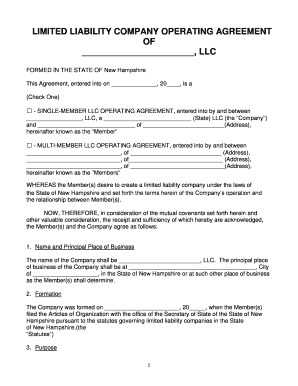

An agreement and plan of merger is a legal document that outlines the terms and conditions under which two or more companies will combine into a single entity. This form is crucial for ensuring that all parties are clear on the objectives of the merger and the processes involved. To fill out a merger agreement form, stakeholders must provide specific details about their organizations, the financial arrangements, and the regulatory compliance required.

-

A merger occurs when two companies combine to form one new company, enhancing their competitive advantage.

-

This agreement ensures compliance with corporate laws and protects the interests of shareholders.

Who are the key parties involved in the merger?

The primary participants in a merger are typically the boards of directors and shareholders of the merging companies. In our example, BTR Realty Inc. and Mid-Atlantic Realty Trust play vital roles in the negotiation and execution of the agreement. Understanding their individual interests and obligations is critical for a successful merger.

-

A key player in the merger, responsible for driving the integration process.

-

This entity must align its goals with BTR to ensure a seamless transition.

-

Tasked with overseeing the merger process, ensuring fiduciary responsibilities are met.

What are recitals in a merger agreement?

Recitals provide the background and purpose of the merger. They articulate the reasoning behind the agreement, critically framing the context and goals of the merger from both parties' perspectives. Properly drafted recitals can significantly affect the interpretation of the agreement.

-

To create synergies and enhance competitive positioning in the market.

-

Highlight how the merger benefits shareholders, such as through increased value or dividends.

-

Reflects on the decisions that led to the merger discussion, influencing investor confidence.

What articles are essential in the merger agreement?

Articles within the agreement detail the specific terms of the merger, including the description of the merger, the legal effects, and the timeline for execution. Article I often describes the merger structure and gives legal continuity to the surviving entity, which is essential for both parties.

-

Details the nature of the merger, including the merging companies and their business operations.

-

Specifies when the merger becomes legally binding.

-

Identifies which company will continue post-merger, retaining rights and obligations.

How does the closing process work in a merger?

The closing process involves executing the final agreement and formalizing the merger. This includes the timing of the closing, documentation, and any regulatory approvals needed. Understanding these steps simplifies the transition and helps prevent delays.

-

Involves coordinated actions from both parties to finalize the merger.

-

Some mergers may depend on the geographic location of the entities involved.

-

Includes the finalized merger agreement and any required regulatory filings.

How to edit and sign your merger agreement?

Editing and signing the merger agreement can be streamlined using tools like pdfFiller. The platform offers capabilities for editing documents, eSigning, and collaboration, making it efficient for stakeholders to manage the merger documentation.

-

Allows for easy editing of the merger agreement to reflect any necessary changes.

-

Detailed procedures to ensure that all relevant parties sign electronically, ensuring compliance.

-

Encourages teams to communicate effectively about document management to avoid confusion.

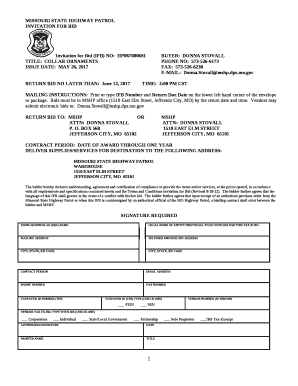

What are Maryland's compliance requirements for mergers?

Maryland law sets specific compliance requirements that must be met during mergers. Understanding these regulations is crucial for avoiding legal complications and ensuring that the merger proceeds smoothly.

-

A comprehensive understanding of the state regulations affecting corporate mergers.

-

Itemizes the necessary steps to secure state approval for the merger.

-

Clarifies the risks associated with failing to meet legal obligations during the merger.

How to manage post-merger effectively?

Post-merger integration is vital for the success of the new entity. This phase involves aligning management strategies, stakeholder interests, and ongoing legal obligations. Proactively managing these elements can lead to a successful merger outcome and retained value.

-

Focusing on unifying operations and cultures of the two companies.

-

Addressing the concerns of employees, investors, and clients during the transition.

-

Highlighting the regulatory and legal responsibilities that continue post-merger.

What interactive tools are available for document handling?

pdfFiller offers various interactive tools to assist in the management of merger documents. These cloud-based solutions facilitate ease of access and collaboration, essential for teams working remotely or in different locations.

-

Interactive options that streamline editing, signing, and sharing documents.

-

Enables teams to manage documents from anywhere, enhancing flexibility and efficiency.

-

Ensures that all necessary forms are readily available, aiding in timely decision-making.

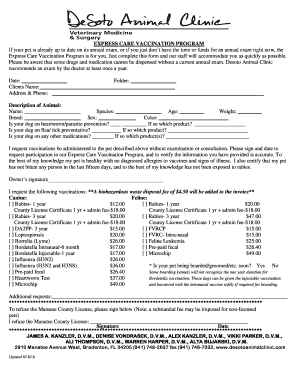

How to fill out the agreement and plan of

-

1.Open the pdfFiller platform and log in to your account.

-

2.Locate the 'agreement and plan of' template from the available documents.

-

3.Click on the template to open it for editing.

-

4.Fill in the necessary fields, including the names of all parties involved and their respective roles.

-

5.Specify the terms of the agreement, detailing obligations and expectations for all parties.

-

6.Add any appendices or additional terms necessary for clarity, if applicable.

-

7.Review the document to ensure all information is accurate and clearly stated.

-

8.Once you are satisfied with the content, save your changes.

-

9.Export the document or send it directly for signature through pdfFiller's features.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.