Get the free General Ledger template

Show details

A general ledger is a book of final entry summarizing all of a company's financial transactions, through offsetting debit and credit accounts. record of a business entity's accounts. The general ledger

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is general ledger

A general ledger is a comprehensive accounting record that consolidates all financial transactions of an organization.

pdfFiller scores top ratings on review platforms

Just started, Awesome so far. Thank You

PDFfiller really makes it easy to fill in forms to make your documents look professional.

PDFfiller is user friendly and excellent.

HAD TO GET HELP FROM SUPPORT AND THEY WAS GREAT

Very smooth and easy to use, definitely recommend!

I don't use it to much but it does everything I need when i do use it.

Who needs general ledger template?

Explore how professionals across industries use pdfFiller.

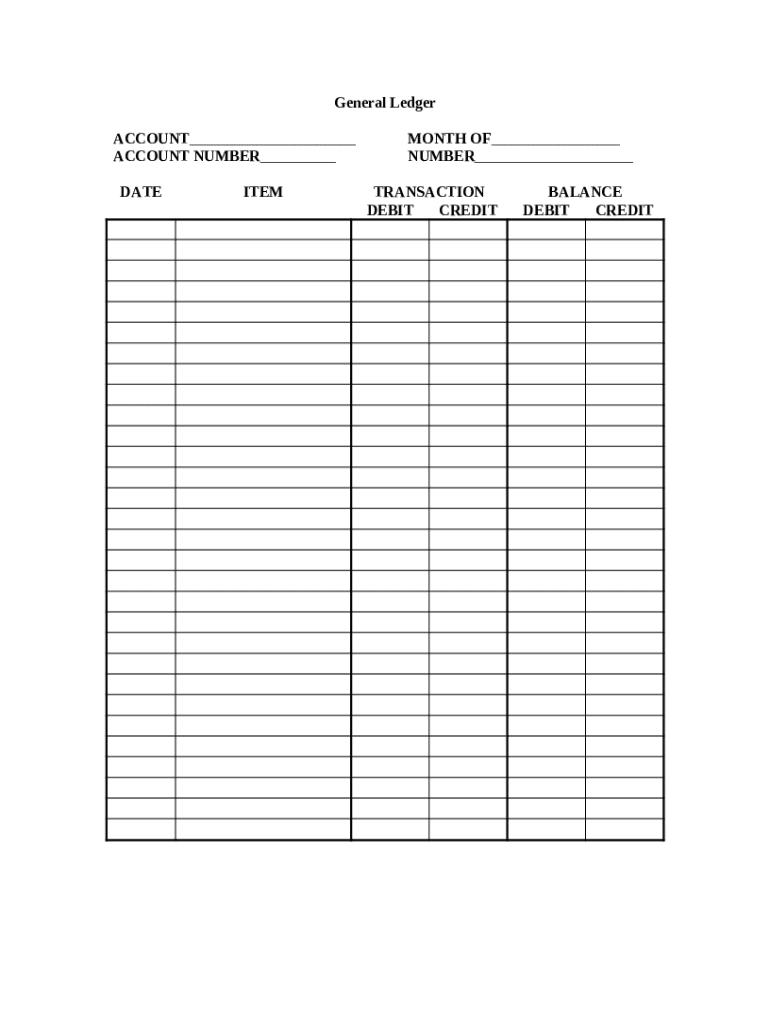

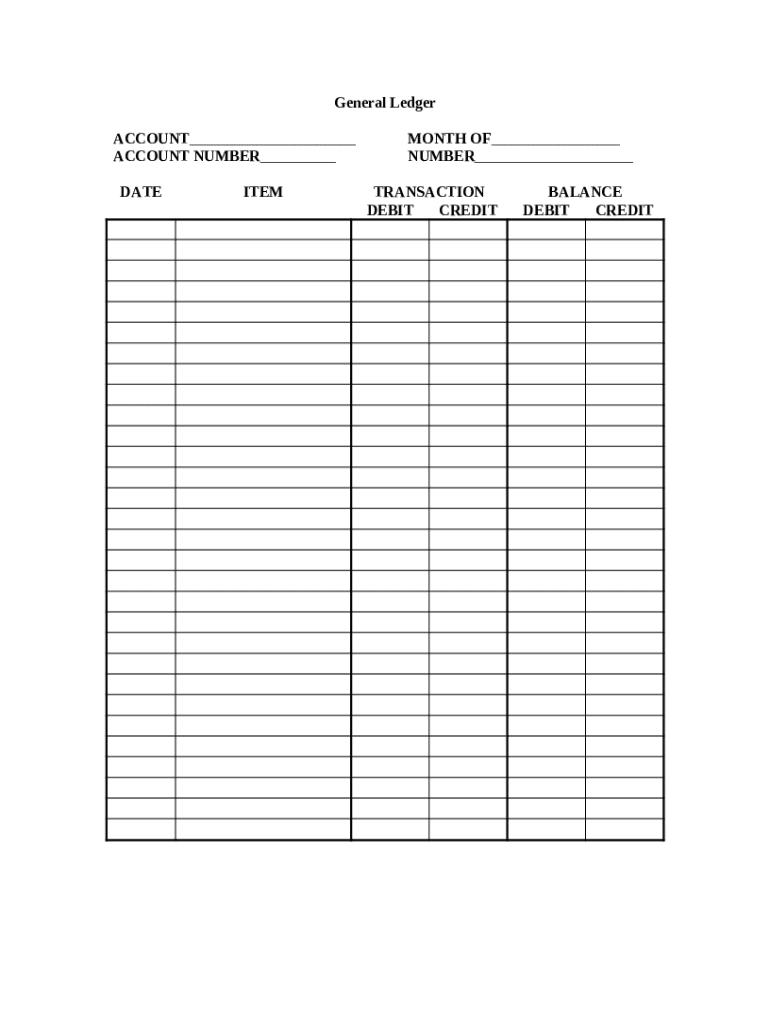

Understanding the General Ledger Form

The general ledger form is an essential accounting tool that enables businesses to maintain accurate records of financial transactions.

Why is maintaining a general ledger important?

A general ledger serves as the backbone of your financial management, providing a comprehensive view of all transactions. This makes it critical for effective budgeting, compliance, and financial reporting.

Key components of the general ledger

-

Each entry in the general ledger should clearly identify the account it pertains to, helping streamline reporting and auditing.

-

Recording transaction dates is vital for tracking the timing of income and expenses, which impacts cash flow analysis.

-

Understanding the difference between debit and credit transactions is crucial, as it affects the overall balance of your accounts.

-

The end balance for each account indicates financial health, guiding decision-making for future expenditures.

How does the general ledger fit into overall financial management?

The general ledger is a fundamental part of your financial management system. It consolidates accounting information and must align with all other financial statements.

Step-by-step instructions to fill out the general ledger form

Filling out the general ledger form requires careful attention to detail to ensure accuracy.

-

Collect invoices, receipts, and bank statements as they provide necessary evidence for each recorded transaction.

-

Begin by entering the corresponding account details. This ensures each transaction is recorded correctly.

-

Indicating the month and establishing a record number will facilitate tracking and revisiting the entries.

-

Every transaction requires an accurate date and specific details to maintain clarity and prevent confusion.

-

Properly categorize transactions as debit or credit, as it affects the account balance and compliance.

-

Finally, for each entry, calculate the balance to reflect the updated figures within your ledger.

Editing and customizing your general ledger in pdfFiller

pdfFiller provides a robust platform for customizing your general ledger templates.

-

Utilize pdfFiller’s editing tools to make adjustments, ensuring the form meets your specific needs.

-

Add any new fields relevant to your business, or remove unnecessary sections for clarity.

-

After customization, save your general ledger template within pdfFiller for easy access and reuse.

How to eSign and collaborate with your general ledger form

pdfFiller makes collaborating on your general ledger easier through eSigning functionalities.

-

You can invite effective collaboration by allowing team members to review and eSign the ledger.

-

Using the collaborative editing feature helps streamline the review process and enhances accuracy.

-

Proper eSigning workflows in pdfFiller ensure that your documents remain compliant with regulations.

How to compare different general ledger templates

Finding the right template is crucial for efficient general ledger management.

-

Evaluate various options to determine what best fits your budget and needs.

-

Consider templates like the General Ledger with Budget Comparison for comprehensive oversight.

-

Opt for a template that aligns with your business type and accounting requirements.

Common mistakes when filling out the general ledger form

Avoiding common pitfalls can elevate the quality of your general ledger entries.

-

Ensuring accurate data input is essential, as mistakes can mislead financial analysis.

-

Regularly updating transactions helps maintain an accurate balance sheet and cash flow forecast.

-

Always attach supporting documents for each transaction; this enhances credibility in financial reporting.

Best practices for managing your general ledger

Implementing best practices can greatly enhance your general ledger management.

-

Keeping your general ledger regularly updated aids in maintaining accuracy.

-

Use pdfFiller’s version control features to back up your files, ensuring you retain previous records.

-

Be flexible in adapting your general ledger format as your business needs evolve over time.

How to fill out the general ledger template

-

1.Start by accessing the PDF document of the general ledger template on pdfFiller.

-

2.Review the sections available for data entry, including dates, account names, debits, and credits.

-

3.Begin with the date of each transaction. Enter the date accurately in the designated field.

-

4.Next, identify and enter the account name associated with each transaction. Ensure spelling matches pre-existing names in your chart of accounts.

-

5.Record the debit amount in the appropriate column for each transaction. If there is no debit for a specific transaction, leave the field blank.

-

6.Then, enter the credit amount for each entry in the designated column. Similar to the debit column, ensure accuracy in figures.

-

7.For total calculations, ensure each transaction's debit equals the corresponding credit to maintain balanced books.

-

8.After filling out each row for transactions, review the general ledger for accuracy and completeness.

-

9.Finally, save your changes on pdfFiller and download a copy for your business records or compliance needs.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.