Get the free General Partnership for Business template

Show details

The parties desire to enter into a general partnership agreement. Simultaneously with the execution of this Agreement, each partner shall be obligated to contribute to the capital of the partnership,

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is general partnership for business

A general partnership for business is a legal agreement where two or more individuals share ownership and operation of a business, along with the associated liabilities and profits.

pdfFiller scores top ratings on review platforms

While it is neat, it is a bit sticky and could be a bit smoother.

seamless and very helpful

My experience have not been shorter than amazing!

I've been very happy with pdffiller.com. but I cannot afford a subscription.

The PDFfiller saves me time on edits.

just a learning curve, but figuring it out is not hard

Who needs general partnership for business?

Explore how professionals across industries use pdfFiller.

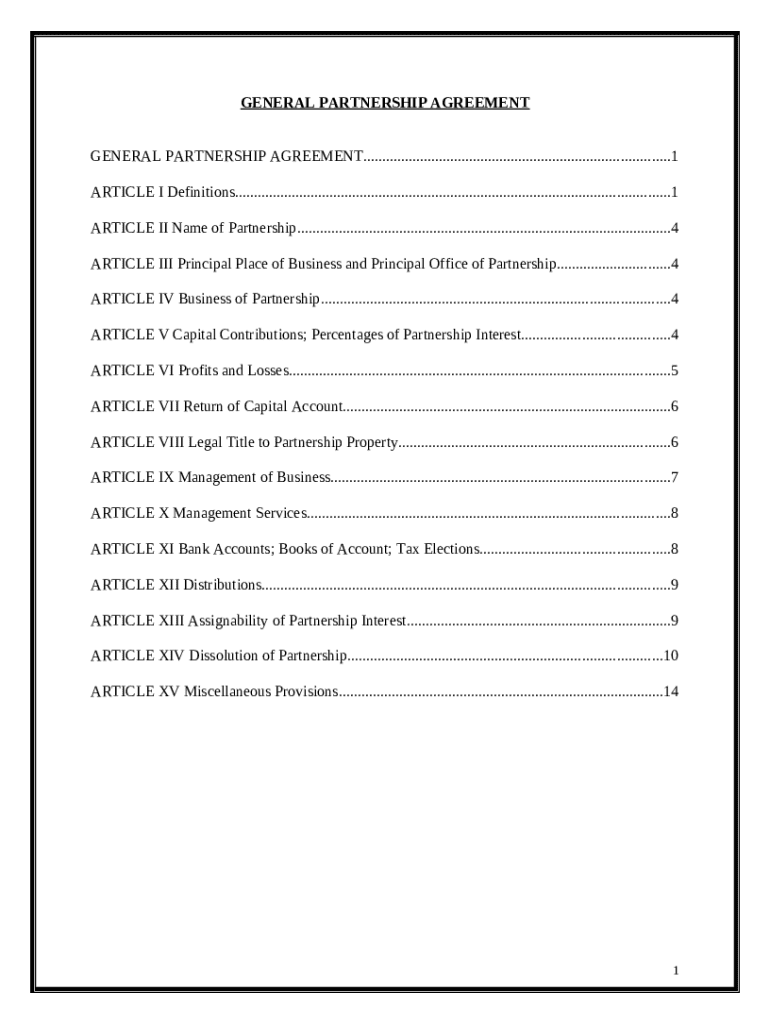

Understanding General Partnership Agreements: Your Comprehensive Guide

When forming a general partnership for business, it is crucial to understand the necessary agreements and legal frameworks involved. This guide provides everything you need to know about creating a general partnership, from definitions to legal considerations.

What are the key terms in general partnerships?

A general partnership is a business structure where two or more individuals share ownership and operational responsibilities. Understanding partnership terms like 'Capital Account' and 'Partner's Interest' is vital. These terms define how profits and responsibilities are shared among partners, making them crucial in any legally binding agreement.

How do you choose a name for your partnership?

Selecting a business name is not just about creativity; it involves legal compliance. Ensure that the name adheres to your region's regulations and is not already in use. Consider branding factors to make the partnership name memorable and effective in attracting clients.

-

Research existing names to avoid confusion and potential legal issues.

-

Check domain availability if you plan to create an online presence.

What are the criteria for establishing the principal place of business?

Choosing the principal place of business has significant implications for legal compliance and logistical operations. This location should be central to your target market and accessible for clients and partners. Understanding local regulations regarding business establishments is also paramount.

How do you define the business objectives of your partnership?

Defining business objectives is critical for guiding your partnership's direction. This outline should detail the scope of your business activities and offer legal protections. Common objectives often include providing services, expanding market reach, or developing products.

What should you understand about capital contributions and partnership interests?

Each partner's capital contribution defines their investment percentage in the partnership, affecting profit distribution. Clear understanding of these interests is essential, as they determine the financial rights of each partner.

-

Outline the initial investments and contributions clearly in partnership agreements.

-

Consider consulting with a financial advisor to ensure fair evaluations.

How are profits and losses navigated in partnerships?

Distribution of profits and losses must be clearly outlined in your partnership agreement. The Capital Account plays a vital role in tracking the financial equity of each partner, affecting tax implications and responsibilities.

What are best practices for managing your partnership's financial accounts?

Best practices include separating personal and business finances by establishing a dedicated bank account. Regular record-keeping is necessary to maintain transparency and aid in tax preparations.

-

Implement a clear system for tracking all income and expenses.

-

Explore tax elections that could benefit the partnership fiscally.

How are distributions and assignability of partnership interests managed?

Understanding how to calculate distributions of profits or losses among partners is essential for maintaining equity. It's important for all partners to agree on the guidelines for transferring interests, as these can have legal ramifications.

What are the key considerations when planning for the dissolution of your partnership?

Dissolution requires clear agreements on procedures for asset division and debt settlement. Forming legal documentation helps ensure all partners are protected during this phase.

How are miscellaneous provisions incorporated in your agreement?

Incorporating miscellaneous provisions, such as amendments or force majeure clauses, can safeguard your partnership against unexpected events. Tailoring these agreements to meet specific needs is crucial for long-term success.

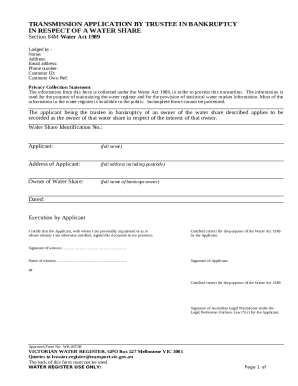

How to fill out the general partnership for business

-

1.Open your preferred PDF reader and upload the general partnership form.

-

2.Begin by entering the names and addresses of all partners in the designated fields.

-

3.Specify the business name and its principal address.

-

4.Indicate the purpose of the partnership, providing a brief description of the business activities.

-

5.Enter the start date of the partnership and any specific duration if applicable.

-

6.Outline the percentage of ownership for each partner and their roles within the business.

-

7.Include terms regarding profit sharing, losses, and any capital contributions.

-

8.Review the agreement for accuracy and completeness before moving on to signatures.

-

9.Ensure each partner reads and signs the document in the appropriate signature fields.

-

10.Finally, save a copy of the completed document for your records and distribute copies to all partners.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.