Get the free Directors Stock Appreciation Rights Plan of American Annuity Group, Inc. template

Show details

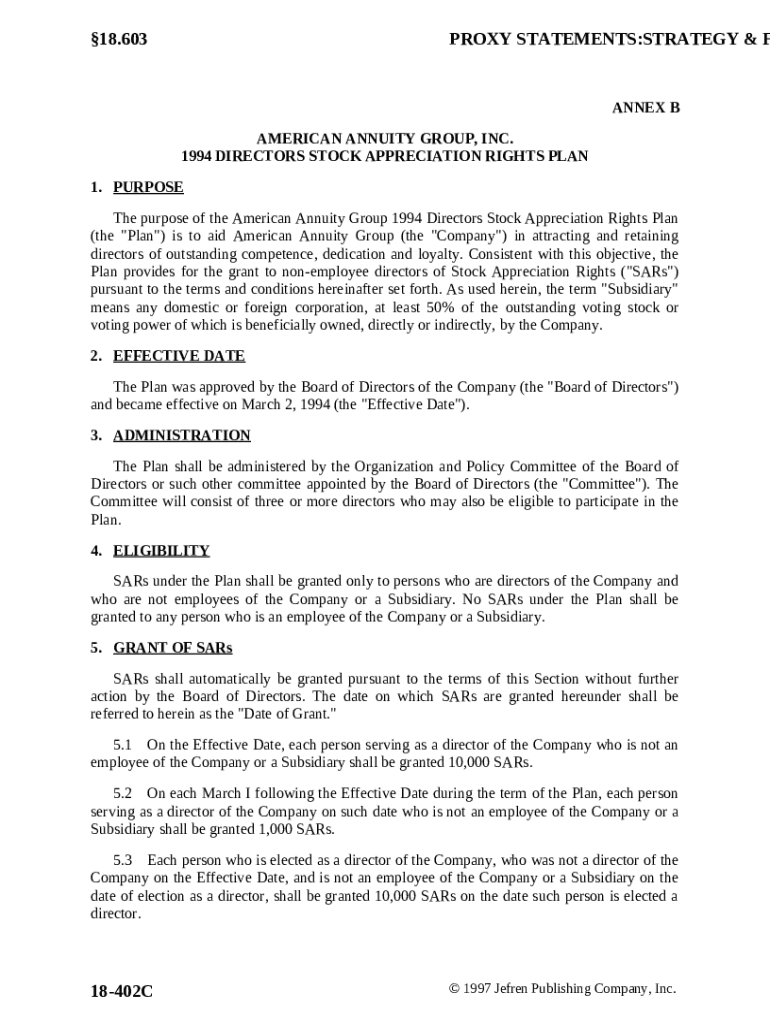

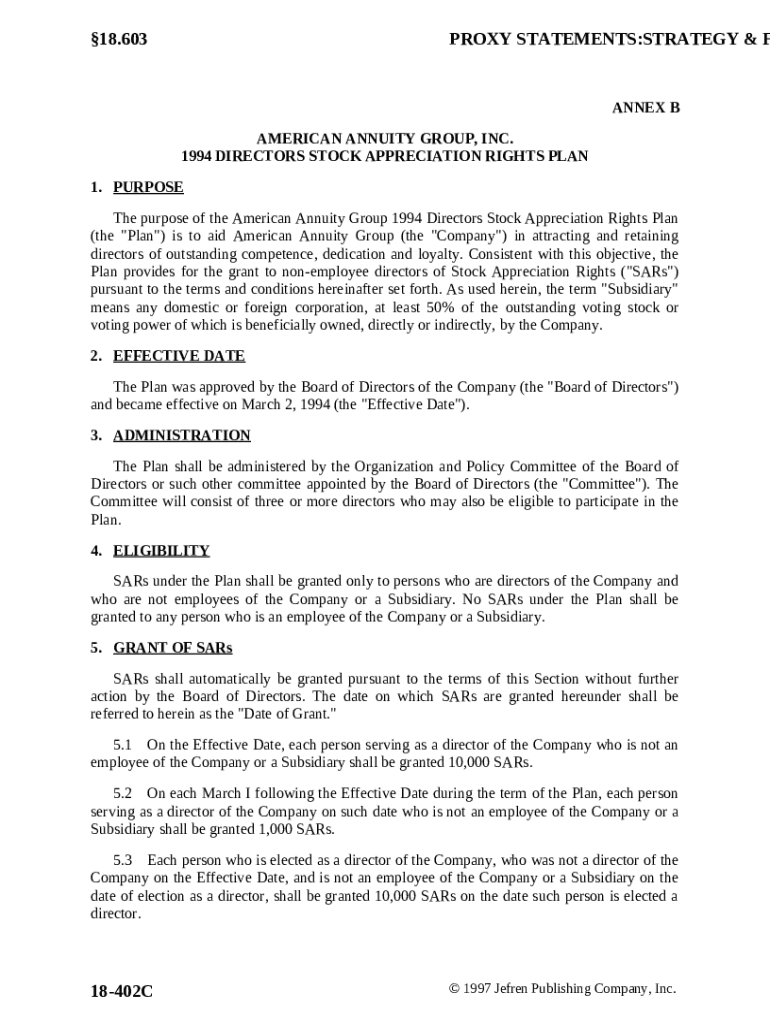

18-402C 18-402C . . . Directors Stock Appreciation Rights Plan which provides for automatic grants of 10,000 SARs to each Non-employee director on effective date of Plan and 1,000 additional SARs

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is directors stock appreciation rights

Directors stock appreciation rights are incentives that allow directors to receive a share of the increase in the value of the company's stock over a specified period.

pdfFiller scores top ratings on review platforms

Awesome application. Definitely saves tons of time. Very easy to use!

Great system no more hand written applications to be filled out. Love It!

I am so glad to become a member. I am a document preparer and PDFfiller makes it so much easier . I love it, especially because you can upload your own forms. Great.

Best website ever, it was so easy doing the 1099's

Very easy to use, wish I knew ahead of time it was a pay service and the google search said it was free

I think its a really great system. So many features on one device and great service

Who needs directors stock appreciation rights?

Explore how professionals across industries use pdfFiller.

Understanding Directors Stock Appreciation Rights Form

Stock Appreciation Rights (SARs) are pivotal in compensating directors by linking their remuneration to the company's performance. This guide explains how to effectively use the directors stock appreciation rights form, ensuring a clear understanding of its components and requirements.

-

This form specifies how directors can benefit from the increase in company stock value.

-

It outlines the eligibility criteria and administrative processes involved.

-

Proper completion ensures compliance with legal and regulatory standards.

What is the purpose of the directors stock appreciation rights plan?

The primary purpose of a directors stock appreciation rights plan is to attract and retain talented directors who contribute positively to the company's success. By offering SARs, companies incentivize directors to enhance shareholder value, aligning their interests with those of the company's stakeholders.

-

SARs are designed to attract competent and dedicated individuals while retaining them within the company for longer periods.

-

The value of SARs increases as the stock price appreciates, providing a direct financial incentive for directors to perform well.

Who is eligible for receiving SARs?

Eligibility for stock appreciation rights is primarily limited to non-employee directors under a typical plan. This restriction ensures that directors, who are accountable for guiding the company, can benefit from the financial performance of the firm without competing interests from employees or those associated with subsidiaries.

-

Only non-employee directors are granted SARs to maintain impartiality and focus on enhancing the company’s long-term viability.

-

Individuals currently employed by the company or its subsidiaries do not qualify for these rights to avoid conflicts of interest.

How is the stock appreciation rights plan administered?

An Organization and Policy Committee typically oversees the administration of the stock appreciation rights plan. This committee ensures compliance with the established policies and monitors the program's integrity, thus safeguarding the interests of both the company and its directors.

-

The Committee is responsible for overseeing the implementation and management of SARs, guaranteeing adherence to the guidelines outlined in the plan.

-

The members of the Committee are selected based on their independence and ability to make decisions that reflect the best practices in corporate governance.

What is the process of granting stock appreciation rights?

Granting stock appreciation rights occurs automatically for directors deemed eligible. Each director receives SARs based on a specific evaluation date, which is known as the 'Date of Grant'. This date is crucial as it establishes the baseline against which the appreciation of the company's stock will be measured.

-

Eligible directors are granted SARs automatically, reducing administrative burden and increasing efficiency.

-

This date is essential for determining the value of SARs, as it marks the point from which stock appreciation is measured for financial gains.

What are the key features of the SARs granted?

Stock appreciation rights provide directors with a financial mechanism to benefit from increasing stock prices without needing to actually purchase stock. SARs establish a right to receive the difference in the stock's value from the granting date to the exercise date, creating a clear financial incentive for enhancing company performance.

-

SARs are linked to the appreciation of stock value, allowing directors to profit from the company's growth.

-

These rights encourage directors to work diligently towards the company's success, benefiting both parties.

What is the effective date of the plan?

The effective date of a stock appreciation rights plan is typically the date on which the Board of Directors approves and enacts the document. This date is pivotal as it informs relevant stakeholders of when the plan is officially in effect and the stipulations it entails.

-

This is the moment the plan formally begins to impact the directors and the company portfolio.

-

Understanding the effective date helps stakeholders gauge the timing of their engagement with the rights offered.

How can pdfFiller help with managing SARs?

pdfFiller provides interactive tools that simplify the process of managing directors' stock appreciation rights forms. Users can fill out, edit, and sign the SARs form conveniently from anywhere, streamlining document management and enhancing collaboration across teams.

-

Easy-to-use tools allow users to fill out and modify the directors' SARs form directly, minimizing time spent on paperwork.

-

pdfFiller enhances teamwork with sharing and collaboration features that enable multiple users to manage documents seamlessly.

What are the compliance and regulatory considerations?

Compliance with local regulations regarding stock appreciation rights is essential for maintaining integrity in the plan. Various jurisdictions may impose different requirements, necessitating careful consideration to ensure adherence to all applicable laws and industry-specific guidelines.

-

Companies must be well-informed about region-specific legal obligations concerning SARs.

-

Ensuring compliance with these guidelines is critical to avoid any legal repercussions for the organization.

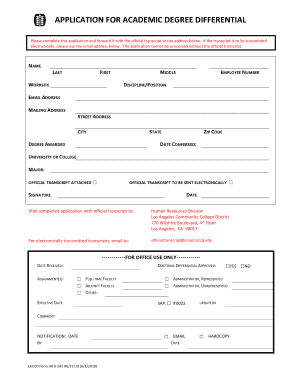

How to fill out the directors stock appreciation rights

-

1.Begin by accessing the PDF document for the directors stock appreciation rights.

-

2.Read through the introductory section to understand the purpose of the document.

-

3.Fill in the company's name and address at the top of the document.

-

4.Complete the section identifying the director by entering their full legal name and title.

-

5.Specify the effective date for the stock appreciation rights grant.

-

6.In the next section, clearly outline the terms, including the total number of rights being granted and the vesting schedule.

-

7.If required, detail any performance targets or conditions that must be met for the rights to vest.

-

8.Provide a signature line for the director, and ensure they sign and date the document to indicate acceptance.

-

9.Review the completed document for accuracy and ensure all sections are filled out correctly.

-

10.Finally, save the completed document and distribute copies to all relevant parties involved.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.