Get the free Directors and Officers Indemnity Trust template

Show details

This sample form, a detailed Directors and Offiers Indemnity Trust, is a model for use in corporate matters. The language is easily adapted to fit your specific circumstances. Available in several

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is directors and officers indemnity

Directors and officers indemnity is a form of insurance that protects individuals serving as directors or officers of a company from personal losses due to legal actions taken against them in their corporate roles.

pdfFiller scores top ratings on review platforms

Everything is easy to use and is saved automatically.

It is great for what I am using it to do, however there is likely much more I don't know about yet.

After 2 weeks, I know much more and find the took extremely valuable. Don't know how I worked without it.

I downloaded because of one form I needed to do online. I don't really use otherwise.

I usually use this program during a translation process when I get a request to translate a document in form of PNG or similar. But I believe that this app can still be further enhanced.

Interesente practico resulve muchos problemas y da muy buenas presentaciones profesionales les felicito muchas gracias

IT HELP ME OUT WITH THE PROBLEM THAT I WERE WORK WITH

Who needs directors and officers indemnity?

Explore how professionals across industries use pdfFiller.

How to fill out a directors and officers indemnity form form

What is directors and officers indemnity?

Directors and Officers (D&O) indemnity is a form of protection granted by a company to its board members and officers. This protection is crucial for businesses as it encourages qualified individuals to serve in these roles without the fear of personal losses due to their actions on behalf of the company. Common scenarios where this indemnity might apply include legal proceedings stemming from alleged breaches of duty.

What are the key components of a directors and officers indemnity program?

-

These establish the framework for the indemnity, detailing how protection is formulated within the organization.

-

This sets out the key contractual terms that define the scope and limits of indemnity provided.

-

While the indemnity agreements provide a form of protection, D&O insurance serves as complementary coverage for financial losses.

What insights can one gather about indemnification agreements?

-

Different forms exist, such as broad-form or narrow-form agreements, each offering varying degrees of protection.

-

Important provisions include the extent of liability covered and any duty to advance legal fees.

-

Indemnity agreements often contain limitations or exclusions around specific actions or scenarios, necessitating careful review.

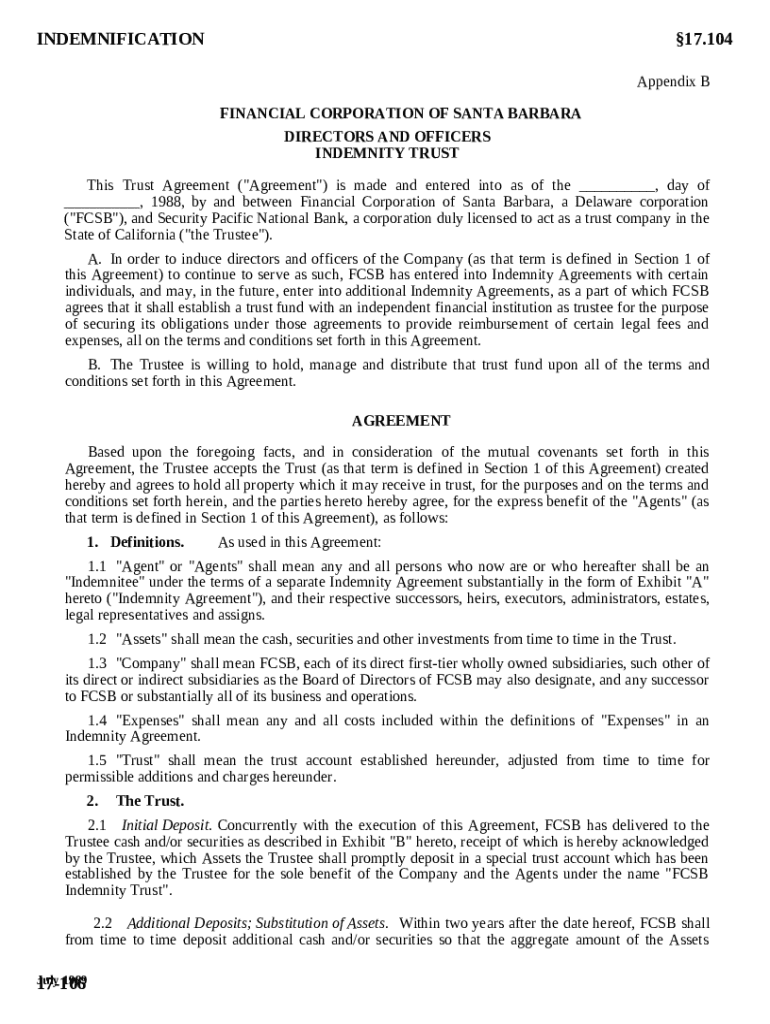

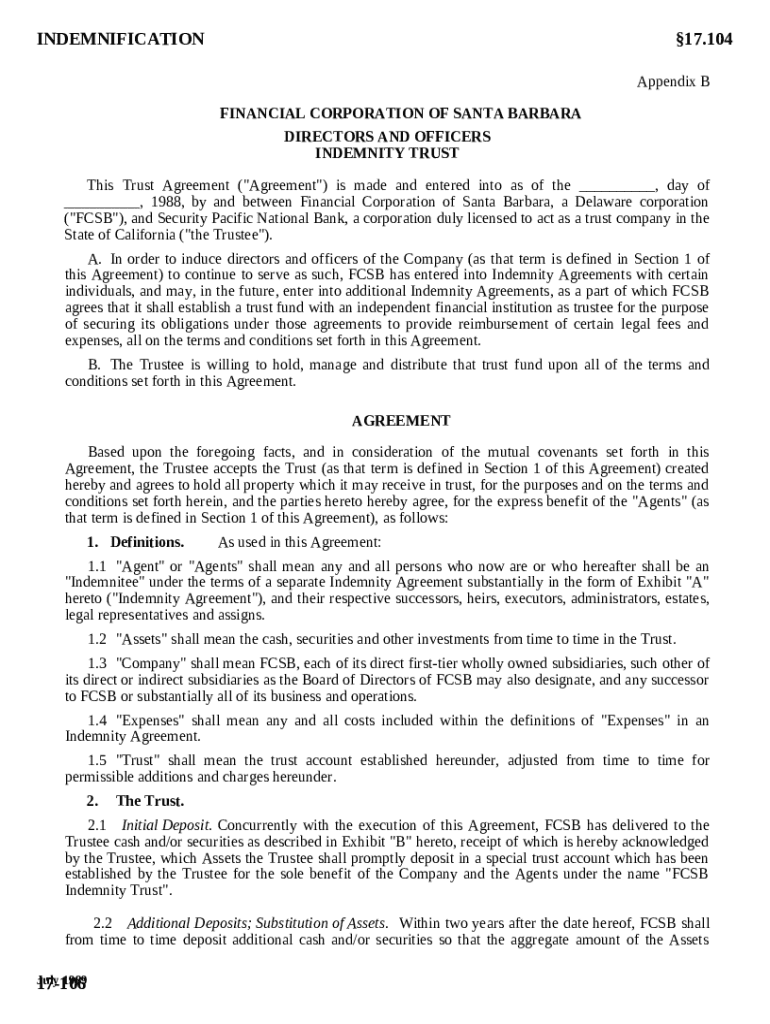

How to understand the directors and officers indemnity trust agreement?

The Directors and Officers Indemnity Trust Agreement can serve to protect the assets of the company on behalf of the indemnified individuals. Reviewing Appendix B of this agreement outlines key roles, where the Trustee is tasked with managing the assets and ensuring compliance with the obligations of both the Financial Corporation and the Trustee.

How to fill out the indemnity form accurately?

-

Follow a structured guide that lays out each section of the form clearly, ensuring no detail is overlooked.

-

Identify frequent errors like incorrect signatures or neglected sections, which can delay the process.

-

Utilize pdfFiller’s interactive tools that allow real-time form management, making the filling process more efficient.

What features does pdfFiller provide for editing and signing the indemnity form?

-

Explore pdfFiller's suite of editing tools designed to help users modify PDF documents easily.

-

eSigning features expedite document completion, ensuring timely submissions and transactions.

-

The platform facilitates collaborative document management, allowing multiple users to interact with the form effectively.

What are best practices for managing indemnity agreements post-submission?

-

Implement best practices for document storage and retrieval to ensure easy access when needed.

-

Regularly monitor compliance with indemnity provisions to avoid disputes or lapses in coverage.

-

Establish a schedule to review and renew indemnity agreements in line with changes to laws or company policies.

How to fill out the directors and officers indemnity

-

1.Begin by accessing the PDF file of the directors and officers indemnity form on pdfFiller.

-

2.Read through the instructions carefully to understand the requirements before filling out the form.

-

3.Enter the name of the insured organization in the designated field at the top of the form.

-

4.Provide details of the directors and officers being covered, including their names, titles, and contact information.

-

5.Specify the coverage limits and any specific endorsements required by selecting the appropriate options from the dropdown menus.

-

6.Fill in the effective date of the policy and any other relevant dates as instructed.

-

7.Attach any necessary documentation, such as minutes from board meetings or resolutions, if required.

-

8.Review all the entered information for accuracy and completeness before submission.

-

9.Once satisfied with the form, save your changes and submit the form through pdfFiller.

-

10.Confirm receipt of the submission and follow up if necessary to ensure processing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.