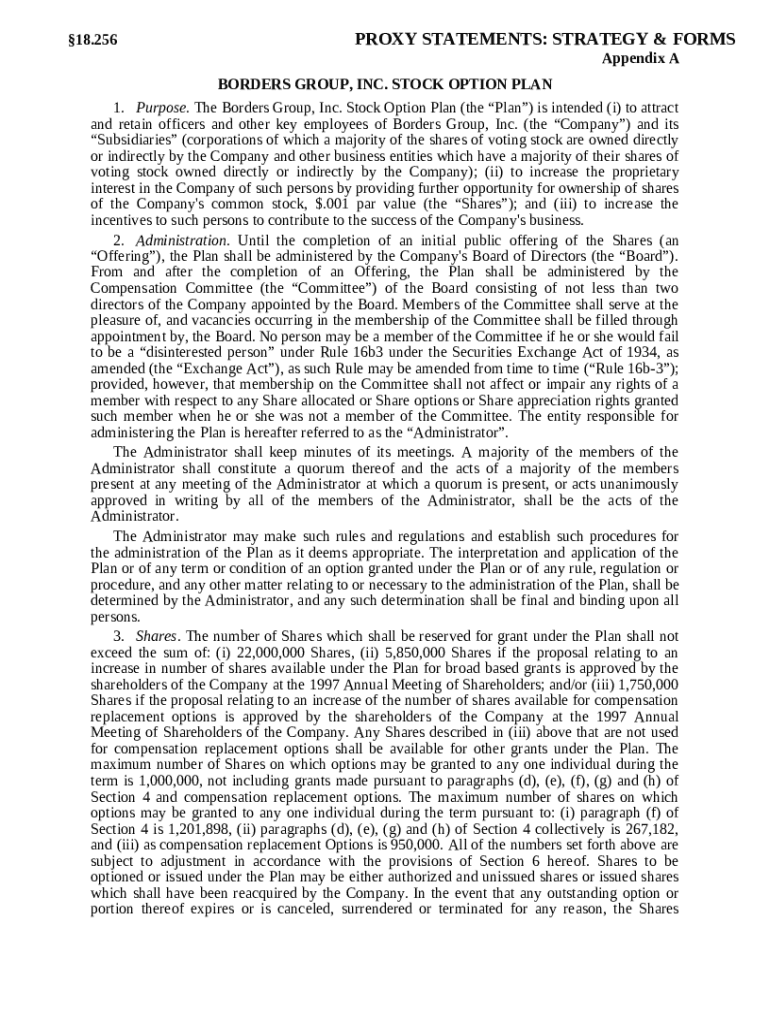

Get the free Stock Option Plan Stock Option Plan which provides for grant of Incentive Stock Opti...

Show details

18-219B 18-219B . . . Stock Option Plan which provides for grant of Incentive Stock Options, (b) Non-qualified Stock Options, and (c) Exchange Options under which employees of the corporation or any

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is stock option plan stock

A stock option plan stock is a compensation strategy that allows employees to purchase company stock at a predetermined price.

pdfFiller scores top ratings on review platforms

I feel very good and happy to do my work on PdfFiller. There is alot of options, which are very helpful to edit pdf files very easily.

It helped me find and submit documents that were important to supporting my family

much better than trying to fill out…

much better than trying to fill out some of these forms by hand or create a form from image using something like Adobe acrobat. Only problem was you should probaby do better quality control on the forms provided. I found your Chapter 7 petition package to be unusable (all or most of the checkboxes use the same variable i.e., check one and you check them all.

Nice application for editing

Nice application for editing. Takes a bit of getting used to but plenty of form filling options.

Easy to download and share files.

Pricing is ok.

Love it

Good

Who needs stock option plan stock?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Stock Option Plans on pdfFiller

What is a stock option plan?

A stock option plan allows employees to purchase shares of the company at a predetermined price, offering them potential financial benefits. This incentivizes employees to contribute to the company's long-term success. The ultimate goal is to align the interests of employees and shareholders, fostering a culture of ownership.

-

Stock option plans provide a mechanism for employees to buy shares of the company at a specified price, known as the exercise price. Such plans can significantly impact employee retention and motivation.

-

The main purpose of implementing a stock option plan is to attract and retain top talent while aligning employee performance with company performance, thereby driving shareholder value.

-

There are Incentive Stock Options (ISOs), which provide tax benefits but are subject to specific regulations, and Nonqualified Stock Options (NSOs), which are more common and flexible but do not offer the same tax advantages.

What are the key components of a stock option plan?

Understanding the components of a stock option plan is crucial for both employers and employees. These elements dictate how options are awarded, vested, and exercised.

-

Eligibility determines who can participate in the stock option plan, often based on job role, seniority, or performance metrics.

-

Vesting schedules define when employees can exercise their options. Common schedules include gradual vesting over several years or immediate vesting upon meeting specific targets.

-

These stipulations guide how and when options can be exercised, including timeframes after leaving the company and the methods of payment for the shares.

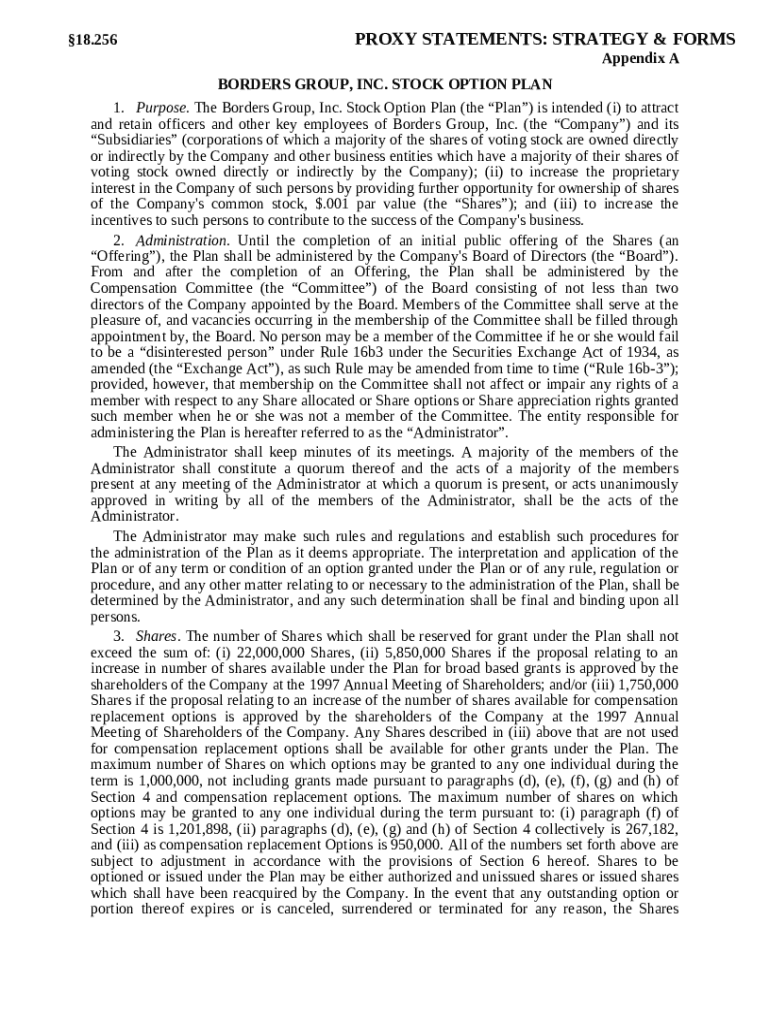

How to comply with the legal framework for stock options?

Navigating the legal landscape surrounding stock options is vital. Companies must adhere to local and federal regulations to minimize risk and maintain compliance.

-

Securities laws govern the issuance of stock options, requiring companies to file documents with regulatory agencies, detailing how the options are structured and presented to employees.

-

Employers must regularly report stock option grants and exercises to tax authorities, ensuring compliance with tax laws to avoid penalties.

-

Different jurisdictions may have unique regulations surrounding stock options, requiring companies to remain informed about local laws to ensure compliance.

What is the process for filling out the stock option plan form?

Completing the stock option plan form accurately is essential for legal and administrative purposes. pdfFiller provides tools to make this process seamless.

-

Begin by gathering necessary information about the employee, followed by selecting the option type, specifying vesting conditions, and reviewing terms.

-

Ensure all fields are properly filled to avoid delays. Double-check eligibility criteria and vesting schedules before submission.

-

Utilize pdfFiller’s online editing tools for a user-friendly experience, allowing for document collaboration and eSigning to streamline the process.

How can companies manage stock options effectively?

Effective management of stock options ensures that the plan remains compliant and provides the intended benefits to employees. Regular audits and updates can enhance this process.

-

Implement a robust tracking system to monitor option awards, vesting schedules, and exercises. Regular reporting can help in compliance and transparency.

-

Maintain thorough records to substantiate compliance with legal and tax obligations. This includes documentation of grants, exercises, and relevant communications.

-

pdfFiller can facilitate document management with its eSigning capabilities, making it easier to collaborate in real-time and maintain organized records.

What do we learn from case studies on stock option plans?

Analyzing case studies offers insights into the practical applications and effectiveness of stock option plans across various sectors.

-

Case studies highlight how various companies have successfully implemented stock option plans, leading to increased employee motivation and retention.

-

Identifying key elements from effective plans allows companies to craft tailored strategies that suit their unique organizational cultures and goals.

-

Organizations can learn how to adapt stock option plans based on employee feedback and changing business environments, ensuring relevance and effectiveness.

What resources are available for employees and employers?

Providing adequate resources ensures that both employees and employers understand stock options and their rights, leading to more effective implementation.

-

Comprehensive guides inform employees of their rights regarding stock options, ensuring they understand the contract terms and their implications.

-

Employers can access valuable resources to aid in structuring and communicating stock option plans, ensuring clarity and transparency.

-

pdfFiller plays a key role in collaborative document editing, making it easy for teams to work together on stock option plans and related documents.

How to fill out the stock option plan stock

-

1.Start by accessing the stock option plan document on pdfFiller.

-

2.Read through the entire document to understand the terms and conditions.

-

3.Locate the section for employee information and fill in your name, position, and start date.

-

4.Find the area designated for stock option quantity and enter the number of options you wish to acquire.

-

5.Input the option price, which is typically given by the company.

-

6.Add any required vesting schedule information, detailing when options become exercisable.

-

7.Review any tax implications mentioned in the document and fill in accordingly.

-

8.Sign and date the document where indicated to acknowledge acceptance of the terms.

-

9.Once completed, save your document and submit it as per your company's submission guidelines.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.