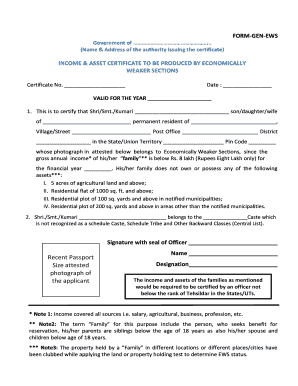

Get the free Note and Mortgage - Partial Purchase Agreement template

Show details

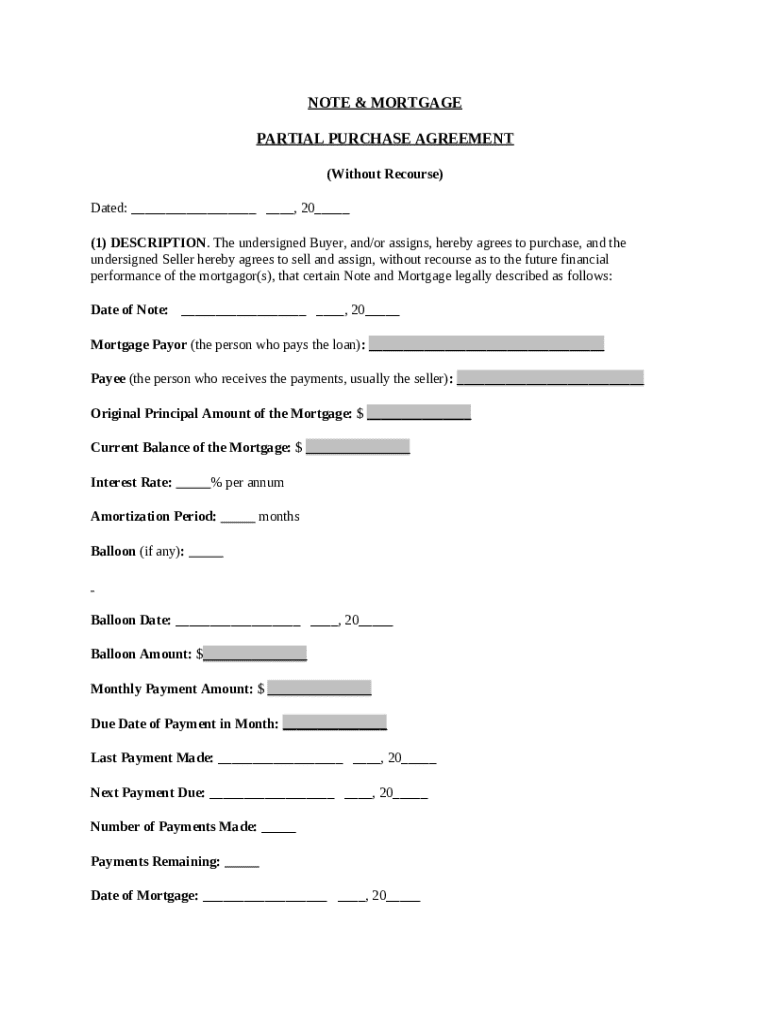

The buyer in this Note and Mortgage Partial Purchase Agreement agrees to purchase without recourse the future financial performance of a certain mortgagor of a Note and Mortgage.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is note and mortgage

A note and mortgage is a legal document that outlines the terms of a loan and secures repayment with the property as collateral.

pdfFiller scores top ratings on review platforms

Easy to use, but some forms are hard to find.

Able to find SSA forms needed for disability application. Very easy to fill out information and save and print forms.

Should be able to save to a thumb drive.

Not a believer when first offer but now PDFfiller is very use flu

LOVING THE ABILITY TO HELP MY SCHOOL CLIENTS CREATE PERSONALIZED FLYERS FOR THEIR PICABOO YEARBOOK SALES.

Although I originally had an issue with getting my document to print, PDFfiller customer service representatives helped me to correct the issue and get access to the information on my document!

Who needs note and mortgage?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to the Note and Mortgage Form

How does understanding the note and mortgage form help me?

Knowing about the note and mortgage form is crucial for anyone involved in financial transactions related to property. A note is a written promise to pay a specified amount, while a mortgage form secures that loan against the property. Together, they create a legally binding agreement that protects both the lender and borrower.

-

A note is a formal agreement where one party promises to pay another. The mortgage form acts as a lien on the property, ensuring the lender has the right to reclaim their investment if the borrower defaults.

-

Essential components include the loan amount, interest rates, payment terms, and signatures from both parties.

-

Legally binding agreements safeguard the interests of both parties involved, ensuring clear terms and reducing potential disputes.

What components are included in the note and mortgage agreement?

The note and mortgage agreement contains several vital components that influence the terms of the financial transaction. Understanding these elements is essential for both parties to ensure clarity and legal compliance.

-

Clearly stating the buyers and sellers involved establishes accountability in the transaction.

-

The payor is responsible for making payments, while the payee is the party that receives them.

-

This is the initial amount borrowed, setting the stage for how future payments will be calculated.

-

The current balance is the remaining amount owed, while the interest rate impacts the total repayment cost.

-

This term refers to the timeframe over which the loan will be repaid, directly affecting monthly payment amounts.

What are the key financial terms explained?

Familiarity with key financial terms can simplify the process of understanding a note and mortgage form. Knowing these terms ensures that both buyers and sellers can engage confidently in their financial agreements.

-

A balloon payment is a large final payment due at the end of a balloon loan, significantly affecting repayment plans.

-

The monthly payment amount affects budgeting and should be clearly defined to avoid late fees.

-

Payment schedules outline how often payments are made, providing clarity for financial planning.

-

Prepayment clauses allow borrowers to pay off their mortgage early, but they may also incur fees, influencing payment strategy.

How do go about filling out the note and mortgage form?

Filling out the note and mortgage form correctly is crucial to avoid mistakes that could complicate the transaction. Adhering to step-by-step instructions can streamline this process.

-

Begin with personal information, including names and addresses, followed by financial specifics like loan amount.

-

Ensure names are spelled correctly, financial figures are accurate, and necessary signatures are included.

-

pdfFiller offers tools that allow you to customize your form to meet specific needs easily.

-

Certain fields, like those for signatures and amounts, should be marked clearly to prevent errors or omissions.

What should consider for managing the note and mortgage throughout the term?

Ongoing management of the loan ensures that all parties are aware of their responsibilities and any changes in conditions. This is vital for maintaining good credit and avoiding defaults.

-

Notify lenders promptly of changes to your address or income that could affect your financial status.

-

Communicate with the lender immediately for options if a payment is missed to avoid negative consequences.

-

Explore refinancing when interest rates drop; an early payoff may save on interest if managed wisely.

-

This allows a lender to assign part of their rights to another party; understanding it is important for future claims.

What are the best practices for document management?

Effective document management practices are crucial for security and accessibility. Utilizing modern solutions can enhance collaboration and reduce risks.

-

pdfFiller facilitates seamless eSigning, allowing parties to collaborate on the document in real-time.

-

Cloud-based storage ensures that your documents are safe, easily accessible, and protected from loss.

-

Adjust your document fields as necessary to accommodate changes in your situation, keeping it relevant.

-

Ensure all parties can access the most current version of the form, fostering better communication and understanding.

What legal considerations and compliance must keep in mind?

Understanding the legal landscape surrounding note and mortgage forms is imperative to ensure compliance and avoid legal pitfalls. Every state may have unique requirements that need to be addressed.

-

Each state has distinct laws governing mortgages; familiarize yourself with these to avoid legal issues.

-

Certain agreements may require notarization or witnesses to be legally binding, thus it is essential to comply with these regulations.

-

This act protects consumers from discriminatory lending practices; understanding it helps in maintaining ethical standards.

-

Specific state laws can influence how forms are filled out; consult with a legal expert if unsure.

How to fill out the note and mortgage

-

1.Open your PDF filler and select the note and mortgage document template.

-

2.Begin at the top of the document by filling in the names and addresses of both the borrower and the lender.

-

3.Next, enter the loan amount, including any down payment details, and the interest rate agreed upon.

-

4.Specify the term of the loan, usually in years, and note the repayment schedule, such as monthly or bi-weekly payments.

-

5.Fill in the property details, including the lot number, physical address, and legal descriptions required.

-

6.Review the section that outlines default conditions and payment penalties, ensuring you understand the terms.

-

7.Include any co-borrowers, if applicable, by filling in their information in the designated sections.

-

8.Lastly, ensure all parties sign and date where required, and include any notary sections if necessary before saving the document.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.