Get the free Employee Stock Option Plan of Texas American Bancshares, Inc. template

Show details

This sample form, a detailed Employee Stock Option Plan, is a model for use in corporate matters. The language is easily adapted to fit your specific circumstances. Available in several standard formats.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is employee stock option plan

An employee stock option plan (ESOP) is a program that allows employees to purchase company stock at a predetermined price, giving them a stake in the company's success.

pdfFiller scores top ratings on review platforms

So far good however I would like more information on how best to use it before the 30 day trial is over.

Awesome Platform, got my offer letter prepared in minutes. I wished I could delete pages easily. overall, I'm satisfied. Also, how can I remove the watermark from my signature?

I liked the website, it was very helpful

Great experiemce... Keep up the good work!!!

So far a pretty intuitive program.

Perfect place to get a lot of docs and get job done

Who needs employee stock option plan?

Explore how professionals across industries use pdfFiller.

Employee Stock Option Plan Form Guide

How to fill out an employee stock option plan form

Filling out an employee stock option plan form requires careful attention to detail and understanding of the option mechanisms. Begin by gathering necessary information about the stock options, including company details and employee eligibility. Use platforms like pdfFiller to easily edit and manage your form.

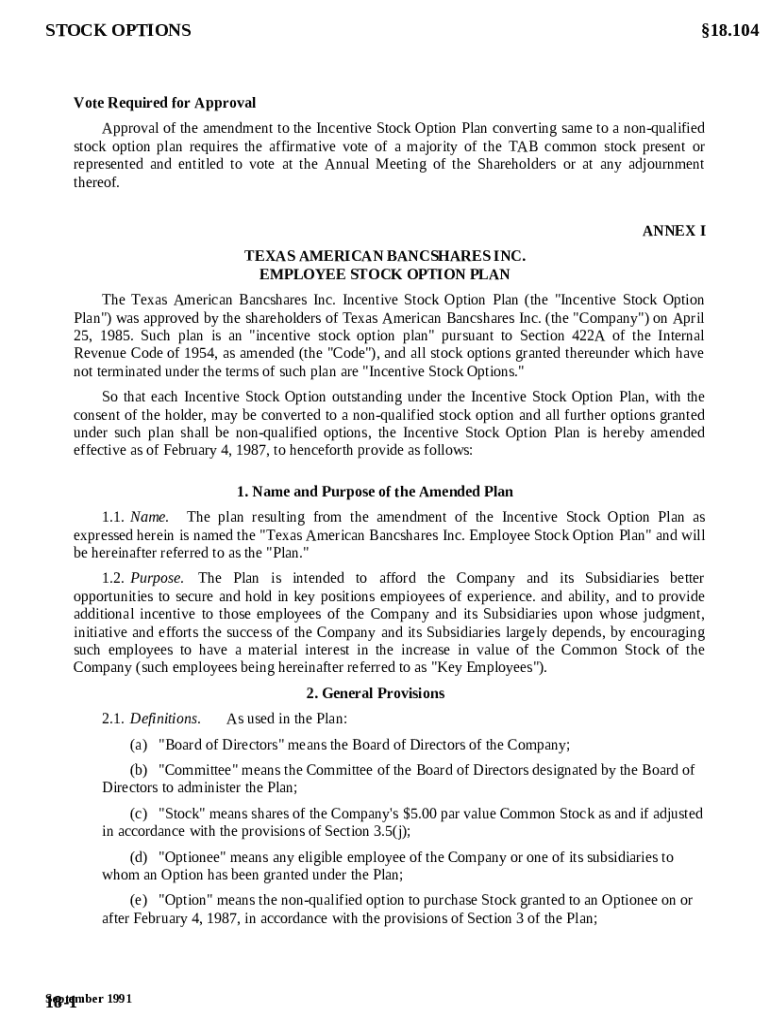

Understanding employee stock option plans

Employee Stock Option Plans (ESOPs) are compensation arrangements that give employees the right to purchase shares in the company. They serve to align the interests of employees and shareholders, fostering a sense of ownership among workers.

-

ESOPs are designed to incentivize employees through ownership stakes, potentially enhancing productivity and job satisfaction.

-

Incentive Stock Options (ISOs) often offer favorable tax treatment; Non-Qualified Stock Options (NSOs), however, do not qualify for special tax benefits.

-

For companies, ESOPs help attract talent and retain employees, while for individuals, they create wealth-building opportunities and benefits.

Key components of an employee stock option plan

A well-structured ESOP includes several critical components that guide its operation and effectiveness.

-

Many ESOPs require a shareholder vote, ensuring broad support for the plan's implementation.

-

Clear documentation is needed to outline the number of options granted and their specific terms.

-

A vesting schedule determines when employees gain full ownership of their options, typically spreading over several years.

-

The exercise mechanism includes processes for employees to purchase shares, including established timelines and prices.

-

Companies must ensure their ESOPs comply with regulatory frameworks and recognize the associated tax implications for exercised options.

Filling out the employee stock option plan form

Properly completing the employee stock option plan form can streamline the granting process and mitigate errors.

-

Start with providing essential information about the employee and the options, filling out each section accurately according to the guidelines.

-

Avoid missing signatures or unclear terms to prevent misunderstandings later.

-

Take advantage of pdfFiller’s editing features that allow real-time collaboration and document management.

Amendments to the employee stock option plan

Making amendments to an ESOP can be necessary for adapting to changing business needs or legal requirements.

-

Amendments often require approval from shareholders, ensuring that changes reflect the interests of stakeholders.

-

Conversion can have tax implications and requires careful planning to understand potential effects.

-

Properly communicated amendments can maintain trust and satisfaction among employees, while aligning with company goals.

Managing employee stock options with pdfFiller

Utilizing pdfFiller facilitates the management of stock option documents, ensuring security and efficiency.

-

E-signatures provide a legally binding way to sign documents electronically, expediting the process.

-

Collaboration tools enable real-time feedback and alterations, enhancing the accuracy of documents.

-

Version control helps keep track of edits and ensures that the latest documents are readily accessible.

Resources for further understanding

Expanding your knowledge about employee stock options can help both employers and employees navigate this complex field.

-

Consult comprehensive articles for deeper insights into ESOP mechanics and regulations.

-

Professional consultations can provide tailored advice essential for optimal ESOP management.

-

Explore pdfFiller’s additional features for creating, editing, and managing various legal documents.

How to fill out the employee stock option plan

-

1.Download the employee stock option plan template from pdfFiller.

-

2.Open the template in pdfFiller to begin editing.

-

3.Fill in the company name and address at the top of the document.

-

4.Enter the details of the stock options being offered, including the number of options, vesting schedule, and exercise price.

-

5.Specify the eligibility criteria for employees to participate in the plan.

-

6.Outline the rights and obligations of the employees regarding the options.

-

7.Include any relevant tax information that employees should be aware of about the options.

-

8.Review the completed document for accuracy and completeness.

-

9.Save your changes and download the finalized document in your desired format.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.