Last updated on Feb 17, 2026

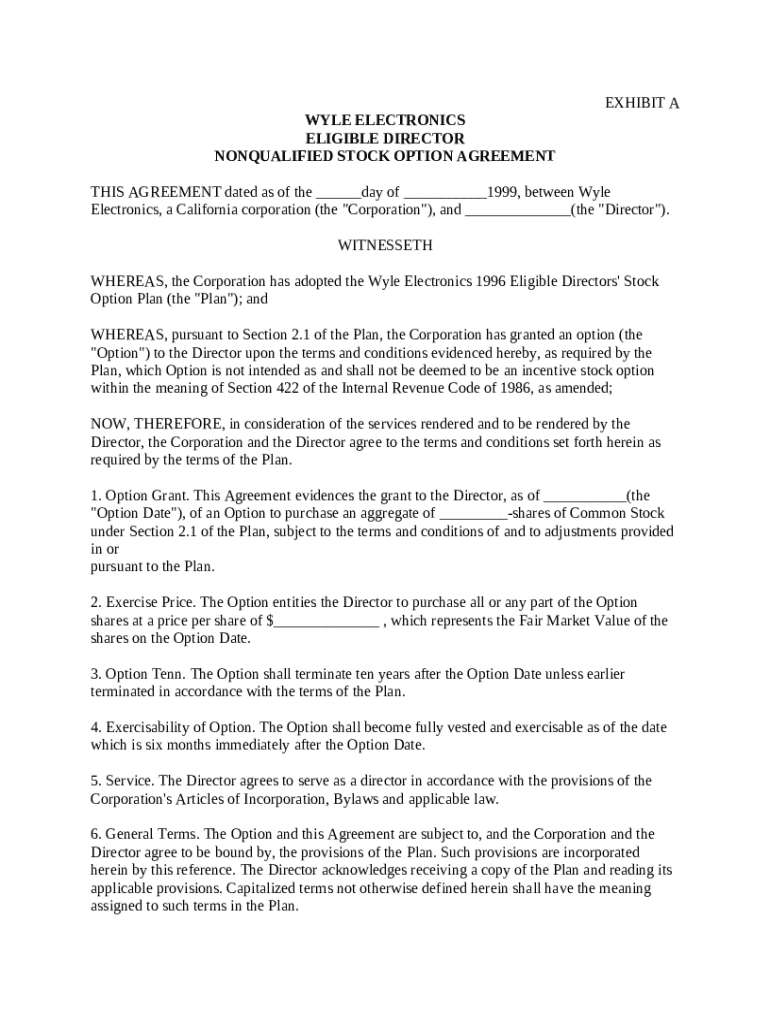

Get the free Eligible Director Nonqualified Stock Option Agreement of Wyle Electronics template

Show details

This sample form, a detailed Nonqualified Stock Option Agreement document, is a model for use in corporate matters. The language is easily adapted to fit your specific circumstances. Available in

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is eligible director nonqualified stock

Eligible director nonqualified stock refers to stock options granted to directors that do not meet the requirements for qualified stock options under tax law.

pdfFiller scores top ratings on review platforms

Great access to online forms, saves time and printing.

Controls are slightly confusing until you are used to them

Is very helpful as I would remotely- and PDFfiller has been very easy to use with minimal instructions- a great investment!

great program - took a few tries to get the hang of it, but overall I am very satisfied with it

I am gradually feeling comfortable with finding and opening my documents.

Very convenient, saves a lot of time when dealing with documentation, environmentally friendly ( no printing and paper waisting).

Who needs eligible director nonqualified stock?

Explore how professionals across industries use pdfFiller.

Guide to eligible director nonqualified stock form on pdfFiller

How to fill out an eligible director nonqualified stock form

To effectively fill out an eligible director nonqualified stock form, one must first gather essential information about the corporation, the director, and the specific stock options involved. This includes defining the stock option details, understanding terms, and complying with IRS regulations for nonqualified stock options. Using pdfFiller's tools simplifies this process, allowing for editing, electronic signing, and document management—all from a single platform.

What are eligible director nonqualified stock options?

Nonqualified stock options (NSOs) are a type of employee stock option that do not meet the requirements set forth by the IRS for qualified options. These options offer flexibility and can serve various purposes, primarily as part of executive compensation. Unlike qualified options, NSOs are taxed as ordinary income upon exercise, making them an essential component for potential tax strategies.

-

NSOs are taxed based on the difference between the exercise price and the fair market value at the time of exercise.

-

Employers can grant NSOs in larger total amounts without regard to specified contribution limits.

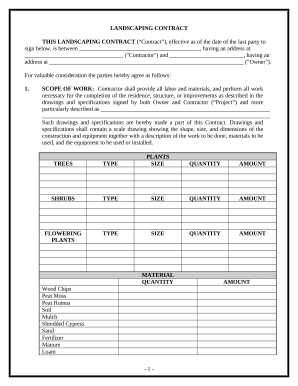

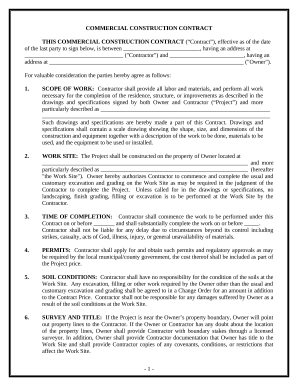

What are the key components of the Wyle Electronics stock option agreement?

The Wyle Electronics stock option agreement outlines crucial elements that govern the terms and conditions of the stock options granted to directors. Understanding this document is vital for both parties involved—the corporation and the director—to avoid any compliance issues or misunderstandings.

-

A summary of the overall plan, which includes information on how stock options are awarded and any associated performance targets.

-

Specific rules surrounding the options, such as vesting schedules, expiration dates, and the process of exercising the options.

-

Clarifies the responsibilities of the corporation in administering the options and the obligations of the director.

How to fill out the stock option agreement: step-by-step instructions

Completing a stock option agreement requires careful attention to detail and accurate input of specific information. This guide will discuss how to effectively fill out the agreement, ensuring compliance, clarity, and accuracy.

-

You will need to input dates, corporation details, and the director's information, which are essential for legal validity.

-

Understanding how to determine the appropriate exercise price is critical to ensure that the options do not create adverse tax implications or dissatisfaction.

-

Thoroughly review and fill in the terms regarding when and how the options can be exercised, including any termination clauses.

What interactive tools can help manage stock options on pdfFiller?

pdfFiller offers an array of interactive tools designed to facilitate the management of stock options efficiently. These tools provide users with the capability to edit documents, eSign, collaborate, and track progress within the same application, enhancing the overall experience.

-

Users can easily personalize stock option agreements to suit the specific needs of the corporation and the director.

-

These features enable safe and secure signing of important documents, ensuring compliance and protecting sensitive information.

-

Collaboration tools help manage options effectively, providing a seamless workflow among all stakeholders.

What are the tax implications and compliance considerations?

Nonqualified stock options come with various tax implications. It’s crucial to understand these, as they impact personal tax liability and compliance with the Internal Revenue Code.

-

The IRS has established specific regulations regarding the taxation of nonqualified stock options which must be followed.

-

Exercise of NSOs can lead to significant tax liabilities, so individuals should consult with tax professionals to navigate compliance.

-

Failure to make timely elections regarding stock options can lead to severe tax consequences, making this a critical area for directors.

What are best practices for directors receiving nonqualified stock options?

Directors receiving nonqualified stock options should adhere to best practices to manage their options adequately and enhance long-term financial success.

-

Directors should engage in open discussions regarding the terms of their options to ensure alignment with their financial goals.

-

Adopting prudent strategies for exercising stock options can optimize the timing and tax implications, benefiting the directors financially.

-

It's essential for directors to incorporate stock options into their overall financial planning, as these can have significant impacts on their personal wealth.

How to fill out the eligible director nonqualified stock

-

1.Begin by accessing the 'Eligible Director Nonqualified Stock' form on pdfFiller.

-

2.Ensure you have your organization's tax identification number and the director's information handy.

-

3.Fill in the director's full name, position, and contact information in the designated fields.

-

4.Input the quantity of nonqualified stock options being granted to the director.

-

5.Specify the grant date and the fair market value of the stock on that date.

-

6.Include any vesting conditions if applicable, detailing when the director can exercise their options.

-

7.Review all entered information for accuracy, ensuring there are no errors.

-

8.Once confirmed, save the form and consider printing a copy for your records.

-

9.Finally, submit the completed form to your organization's appropriate department or the director as needed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.