Last updated on Feb 17, 2026

Get the free Nonqualified Stock Option Agreement of Orion Network Systems, Inc. template

Show details

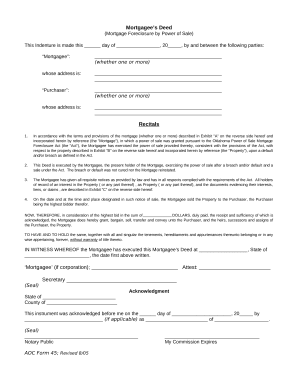

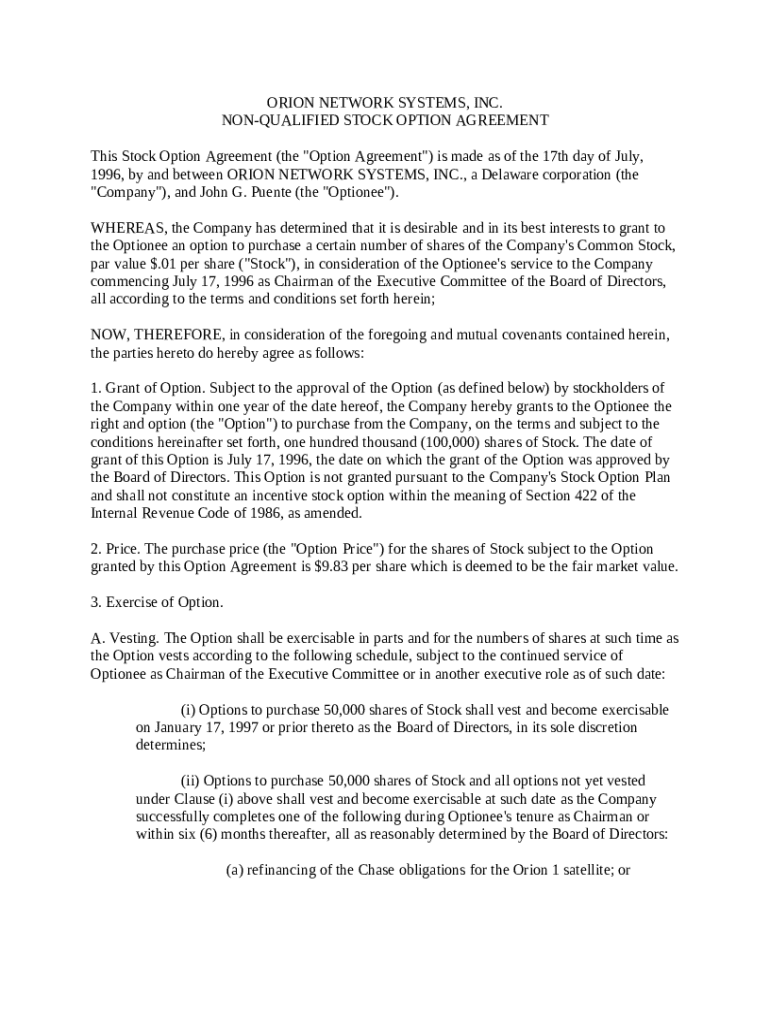

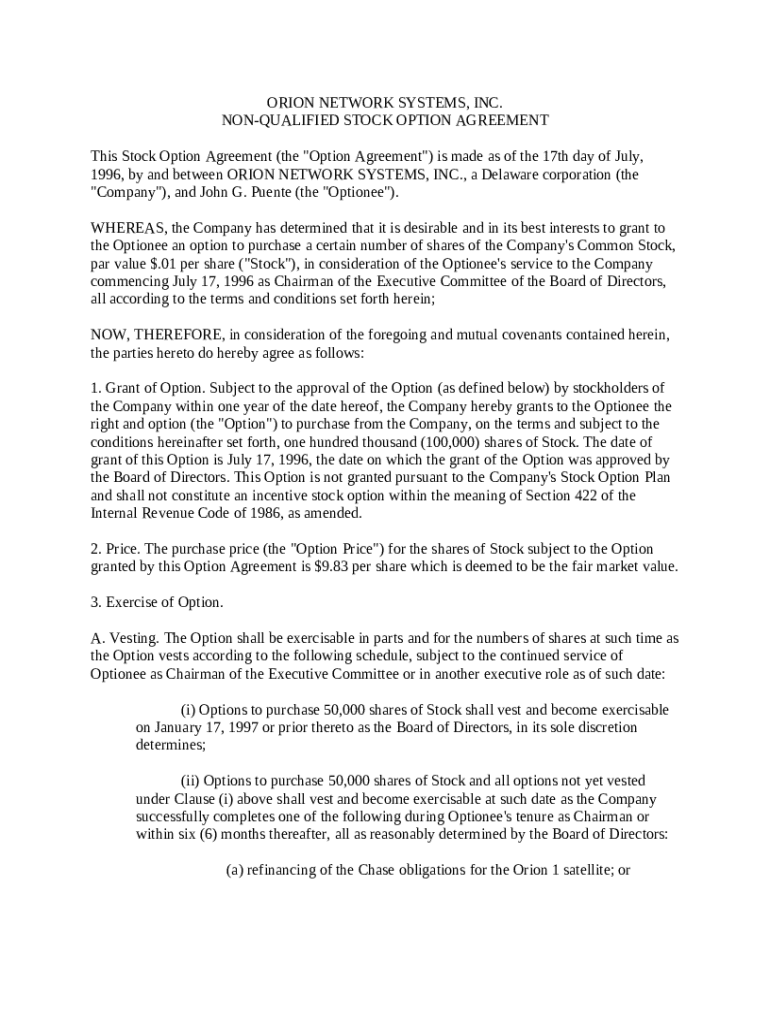

18-364B 18-364B . . . Stock Option Agreement under which corporation grants to optionee a Non-qualified Option to acquire 50,000 shares of stock immediately and an additional 50,000 shares upon successful

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is nonqualified stock option agreement

A nonqualified stock option agreement is a contract that grants employees or contractors the right to purchase company stock at a predetermined price, typically not adhering to specific tax advantages of qualified plans.

pdfFiller scores top ratings on review platforms

Very professional and good customer support

I forgot to cancel the auto renewed subscription after my free trial and they got back to me within a day and were also very responsive. I got refunded immediately even though it was my fault for not cancelling.

Great service and free trial is a long…

Great service and free trial is a long period of time verses only a few days. Simple to use and simple to cancel subscription through support center or chat.

Scan documents and instantly complete the asking form, signed doc., etc., and AI analyzes to complete, leaving very few modifications.

Way better than Adobe.

it was great thanks

I was able to do what I wanted with my documents Thanks

Who needs nonqualified stock option agreement?

Explore how professionals across industries use pdfFiller.

Nonqualified Stock Option Agreement Form Guide

How to fill out a nonqualified stock option agreement form

Filling out a nonqualified stock option agreement form involves several steps like providing details about the optionee, the number of shares, grant date, and the exercise price.

What are nonqualified stock options?

Nonqualified stock options (NSOs) allow employees to purchase company stock at a specified price, known as the exercise price. Unlike incentive stock options (ISOs), NSOs do not have to meet specific tax requirements and can be offered to a broader range of employees.

-

NSOs enable employees to acquire stocks at the exercise price, providing potential gains if the stock price increases.

-

ISOs come with favorable tax treatments but have stricter eligibility criteria, whereas NSOs can be granted to any employee without such limitations.

-

Companies often include NSOs in compensation packages to incentivize employees and retain talent, thus enhancing productivity and loyalty.

What are the key components of the nonqualified stock option agreement?

A nonqualified stock option agreement is detailed and includes various essential components that outline the terms of the option grants to the optionee.

-

The agreement specifies the parties: the company granting the option and the individual receiving it.

-

It outlines terms such as the exercise price, vesting period, and conditions of the grant.

-

This indicates when the employee can exercise their options, often aligning with performance milestones.

-

Details regarding how the shares can be purchased and conditions tied to market value must be included.

-

Most agreements require approval from the Board of Directors to affirm validity and compliance with company policies.

How do you fill out the nonqualified stock option agreement form?

Completing the nonqualified stock option agreement form accurately is crucial to avoiding legal issues later. Here’s a step-by-step guide.

-

Begin by filling in the date of grant, followed by the optionee details, which include full name and contact information.

-

Ensure you specify the number of shares granted and the exercise price clearly to avoid ambiguity.

-

Double-check for typos, especially in key areas like names and numbers, and confirm the vesting schedule is noted correctly.

-

Using pdfFiller can aid in seamlessly editing and signing the document, making the process quicker and ensuring compliance.

What legal considerations are involved?

Given the financial implications, the legal aspects surrounding NSOs must be carefully understood.

-

NSOs are subject to different tax treatment compared to ISOs; employees should be aware of these implications.

-

Each state may have its own rules regarding stock options, impacting compliance; it's vital to consult legal advice.

-

Both the company and the optionee should understand potential liabilities and tax consequences resulting from exercising NSOs.

How to manage and maintain your nonqualified stock option agreement?

Proper management of stock options is essential for maximizing their benefits and ensuring compliance.

-

Regularly tracking exercise prices and expiration dates helps in strategy formulation for exercising options.

-

With pdfFiller’s cloud-based document management, tracking and collaborating on agreements becomes streamlined.

-

Shares information on your options agreements with HR or legal teams to ensure adherence to company policies and liability management.

When should you issue a nonqualified stock option agreement?

Issuing nonqualified stock options can enhance employee engagement and retention. Here are common scenarios.

-

When hiring new employees as part of their compensation package or to incentivize current employees after strong performance.

-

Many startups use NSOs to compensate employees in lieu of higher cash salaries, allowing talent acquisition on a budget.

-

Companies often adapt their NSO offerings based on financial health and growth prospects, aiming to attract and retain top talent.

What are next steps after completing your agreement?

Understanding the follow-up process after executing the agreement is vital for your financial planning.

-

Learn the procedure to exercise your options and ensure you understand the financial commitment involved.

-

Options may be transferred under certain conditions; familiarize yourself with the steps and restrictions involved.

-

Keep a calendar of important dates, like expiration dates, to avoid losing any possible gains.

How to fill out the nonqualified stock option agreement

-

1.Download the nonqualified stock option agreement template from pdfFiller.

-

2.Open the PDF form in pdfFiller's interface.

-

3.Fill in the 'Employee Name' section with the full name of the option holder.

-

4.Enter the 'Grant Date' to specify when the option is granted.

-

5.Fill in the 'Number of Options' to indicate how many stock options are being granted.

-

6.Input the 'Exercise Price' which is the price per share to be paid.

-

7.Specify the 'Vesting Schedule' to define when the options can be exercised.

-

8.Include any specific terms and conditions in the designated section.

-

9.Review all entered information for accuracy and completeness.

-

10.Save the document and download it or share it directly with the parties involved.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.