Last updated on Feb 17, 2026

Get the free Nonqualified Stock Option Plan of the Banker's Note, Inc. template

Show details

This is a multi-state form covering the subject matter of the title.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is nonqualified stock option plan

A nonqualified stock option plan is an arrangement that grants employees the option to purchase company stock at a predetermined price, which may not meet specific IRS tax preferences.

pdfFiller scores top ratings on review platforms

The application did what i wanted it to…

The application did what i wanted it to do, no hassle so far.

Very helpful

Very helpful, easy to use and navigate

Very easy to use and the inventory of…

Very easy to use and the inventory of available forms is extensive.

Good and online help was very good too.

Extremely user friendly

Extremely user friendly. Made my job much easier.

Great programme

Great programme, I was a donut and didn't cancel my subscription and they gave a full refund no questions asked

Who needs nonqualified stock option plan?

Explore how professionals across industries use pdfFiller.

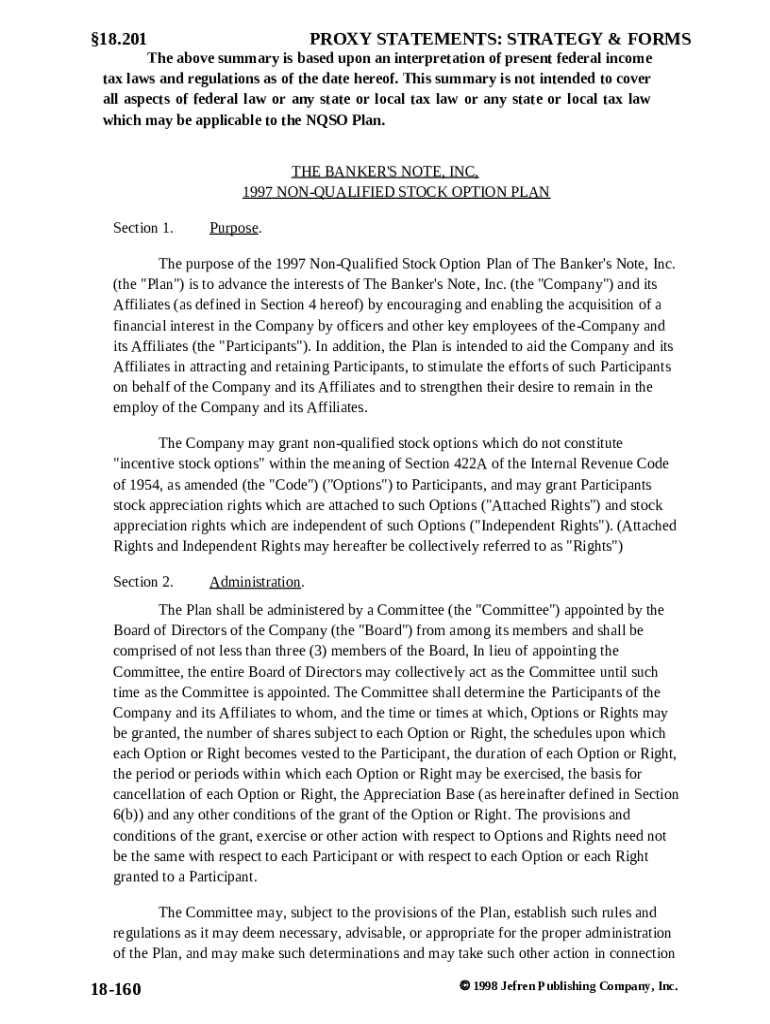

Non-Qualified Stock Option Plan Form Guide

How do non-qualified stock options (NQSOs) work?

Non-qualified stock options (NQSOs) are a type of employee equity compensation that provide the right to purchase company shares at a predetermined price. Unlike incentive stock options (ISOs), NQSOs do not meet specific IRS requirements and face different tax treatments. They offer unique benefits for both employees seeking financial growth and companies aiming to retain talent.

-

NQSOs are not subject to the same tax benefits as ISOs, which can lead to different tax implications when exercised.

-

NQSOs allow employees to gain additional income potential and companies can enhance employee retention and attraction strategies.

-

NQSOs may result in ordinary income tax upon exercise, differing from ISOs which can lead to capital gains treatment.

What is the purpose of a non-qualified stock option plan?

The primary purpose of a non-qualified stock option plan is to align employees' interests with those of the company's shareholders. By allowing employees to acquire financial interest, companies are able to motivate and retain talented individuals, ultimately boosting productivity and performance.

-

NQSOs give employees a direct stake in the company's performance, fostering a sense of ownership.

-

Offering NQSOs can make a compensation package more attractive, especially in competitive industries.

-

The potential for financial gain encourages employees to exceed their performance expectations, resulting in improved company outcomes.

What are the key components of a non-qualified stock option plan?

Several key components define a non-qualified stock option plan, influencing its effectiveness and compliance. These components outline the structure of the options granted, the eligibility of participants, and the valuation for tax purposes.

-

Understanding the difference between these types is crucial for proper option structuring and exercising.

-

Plans typically specify limits on the number of options granted and outline eligible participants.

-

Accurate valuation is necessary for compliance and affects both employee payouts and company tax obligations.

How is a non-qualified stock option plan administered?

Effective administration of a non-qualified stock option plan is vital for its success and compliance with regulatory standards. The plan is typically overseen by a dedicated committee and requires transparency in decision-making.

-

The committee is tasked with overseeing grants, ensuring fairness, and maintaining compliance with regulations.

-

The Board must endorse the plan and remain accountable for its overall effectiveness.

-

Organizations must ensure proper reporting to comply with accounting standards and tax obligations.

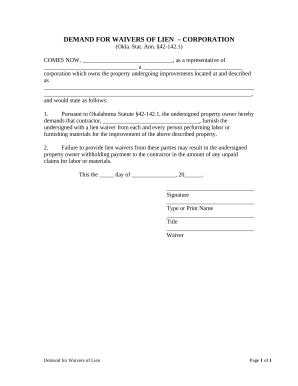

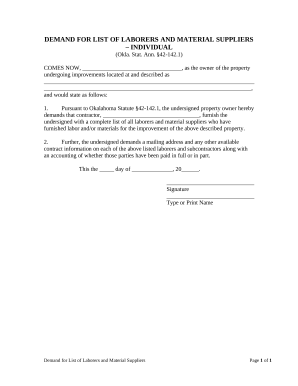

How to fill out the non-qualified stock option plan form?

Filling out the non-qualified stock option plan form can be a straightforward process if you know what to include. Here’s a step-by-step guide.

-

Visit pdfFiller's website, search for the non-qualified stock option form, and open it for editing.

-

Ensure you provide all necessary information clearly including name, contact details, and terms of the options.

-

Utilize pdfFiller's features such as spell-check and auto-suggestions to avoid common mistakes.

How can you manage your non-qualified stock options?

Proper management of non-qualified stock options is crucial for maximizing their benefits. Regular tracking, updates, and understanding the terms can enhance financial outcomes.

-

Maintain a record of your options, their values, and market conditions to inform your decisions.

-

You can edit and electronically sign any necessary documents directly through pdfFiller's online platform.

-

Familiarize yourself with your options' vesting schedules to avoid missing deadlines for exercising.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.