Get the free Nonemployee Directors Stock Option Plan of National Surgery Centers, Inc. template

Show details

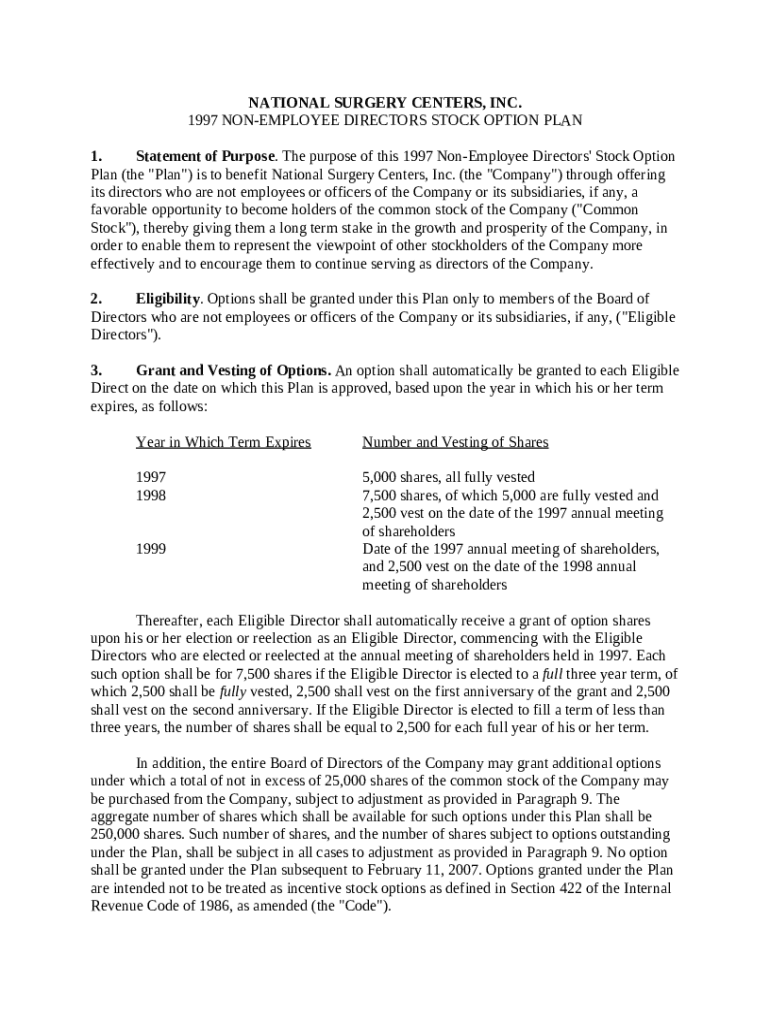

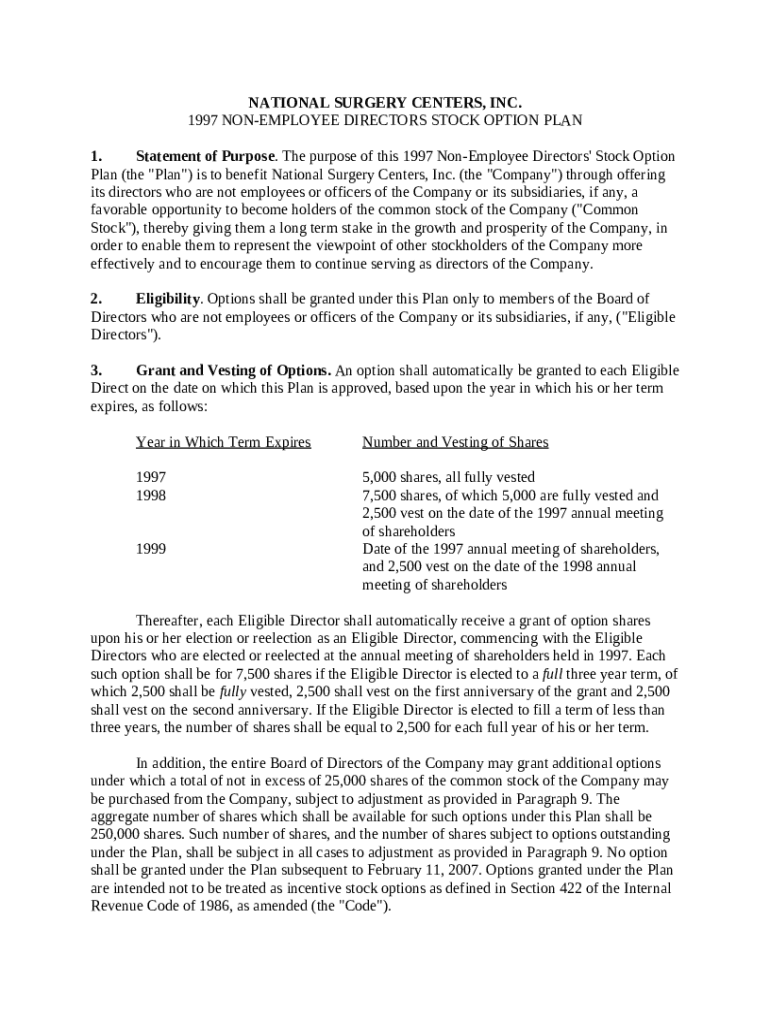

18-185C 18-185C . . . Non-employee Directors Stock Option Plan under which Class II Non-employee directors receive options for 5,000 shares, all fully vested; Class II Non-employee directors receive

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is nonemployee directors stock option

Nonemployee directors stock option refers to the rights given to nonemployee members of a company's board of directors to purchase shares of the company's stock at a predetermined price.

pdfFiller scores top ratings on review platforms

It was a very useful application. A bit expensive, though.

Great Application

ease to use tool

easy to change it own writer

it was good but the features i needed can be accessed elsewhere

great

Who needs nonemployee directors stock option?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Nonemployee Directors Stock Option Form

How to fill out a nonemployee directors stock option form

To fill out a nonemployee directors stock option form, start by understanding your eligibility and the specifics of your company's stock option plan. Gather required information, including your personal and professional details, and then access the form through pdfFiller for ease of completion and submission.

What is a nonemployee directors stock option plan?

A Nonemployee Directors Stock Option Plan is designed to grant stock options to directors who are not employees of the company. The primary objectives of the plan are to enhance shareholder value and attract talented directors, aligning their interests with those of shareholders. Stock options provide nonemployee directors with the opportunity to purchase shares of the company stock at a predetermined price, potentially leading to substantial financial gains.

Who qualifies for stock options?

To be eligible for participation in a Nonemployee Directors Stock Option Plan, individuals must hold a position as a nonemployee director. This means that only those who do not have an employment relationship with the company can receive stock options. Eligibility may also be subject to restrictions based on individual company policies, which can vary widely.

How are stock options granted and vested?

The process of granting stock options involves specific criteria and timelines that the company establishes. Typically, a stock option grant occurs during an annual meeting or a board meeting. The vesting schedule determines when the options become exercisable, often contingent upon continued service as a director or meeting performance milestones.

-

Options are granted to eligible directors based on predetermined dates and conditions established by the board.

-

Options generally vest over a set period or upon achieving specific company performance targets.

-

Annual shareholder meetings can influence the timing and conditions of stock option grants.

What should directors consider about stock options?

Holding stock options can provide significant long-term benefits for nonemployee directors, aligning their interests with the company's performance. However, there are risks involved, such as stock price volatility that could affect the potential gain from options. It is crucial for directors to fully understand the implications of exercising options, including potential tax consequences and the best timing for exercise.

-

Can align director interests with shareholders, potentially enhancing company performance and value.

-

Inherent risks related to market fluctuations and personal financial implications.

How can pdfFiller assist with stock option form management?

pdfFiller provides a host of interactive tools to help users manage their stock option documents effectively. The capabilities range from document editing to e-signing, which allows nonemployee directors to complete their stock option forms seamlessly. Step-by-step instructions within pdfFiller guide users through filling out the Nonemployee Directors Stock Option Form, ensuring a smooth process.

What are the compliance requirements for stock option plans?

Compliance with regional regulations concerning stock option plans is essential for both companies and directors. Depending on the jurisdiction, different rules may apply, affecting eligibility and tax treatments. pdfFiller can simplify compliance by automatically adjusting form fields and assisting in proper documentation.

How to fill out the nonemployee directors stock option

-

1.Open the nonemployee directors stock option form on pdfFiller.

-

2.Review the form requirements, including the company's details, the director's name, and the number of options.

-

3.Fill in the director's personal information in the designated fields, ensuring accuracy and compliance with legal requirements.

-

4.Specify the number of stock options being granted and the exercise price for those options.

-

5.Include any vesting conditions or expiration dates applicable to the stock options.

-

6.Review all entered data for accuracy and completeness before submitting.

-

7.If required, add signatures from the necessary parties to validate the document.

-

8.Once completed, download the filled form or submit it directly through pdfFiller as instructed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.