Get the free Affidavit of Solvency template

Show details

An Affidavit is a sworn, written statement of facts, signed by the 'affiant' (the person making the statement) before a notary public or other official witness. The affiant swears to the truth and

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is affidavit of solvency

An affidavit of solvency is a legal document that confirms an individual's or company's ability to pay its debts as they come due.

pdfFiller scores top ratings on review platforms

love it... it has made my life much easier at work.. thanks PDFille

So far every government form I needed to complete was available and it was user friendly.

good except notes could not be edited and size of font change is difficult

Great product, I'm not sure I know all the functions available

This is a great program to get a lot of your work done.

PDF filler enables to use activities that i have found that i can put in to another language. As the resources for the children i teach are scarce PDF filler opens up more opportunities for me as a teacher of another language.

Who needs affidavit of solvency template?

Explore how professionals across industries use pdfFiller.

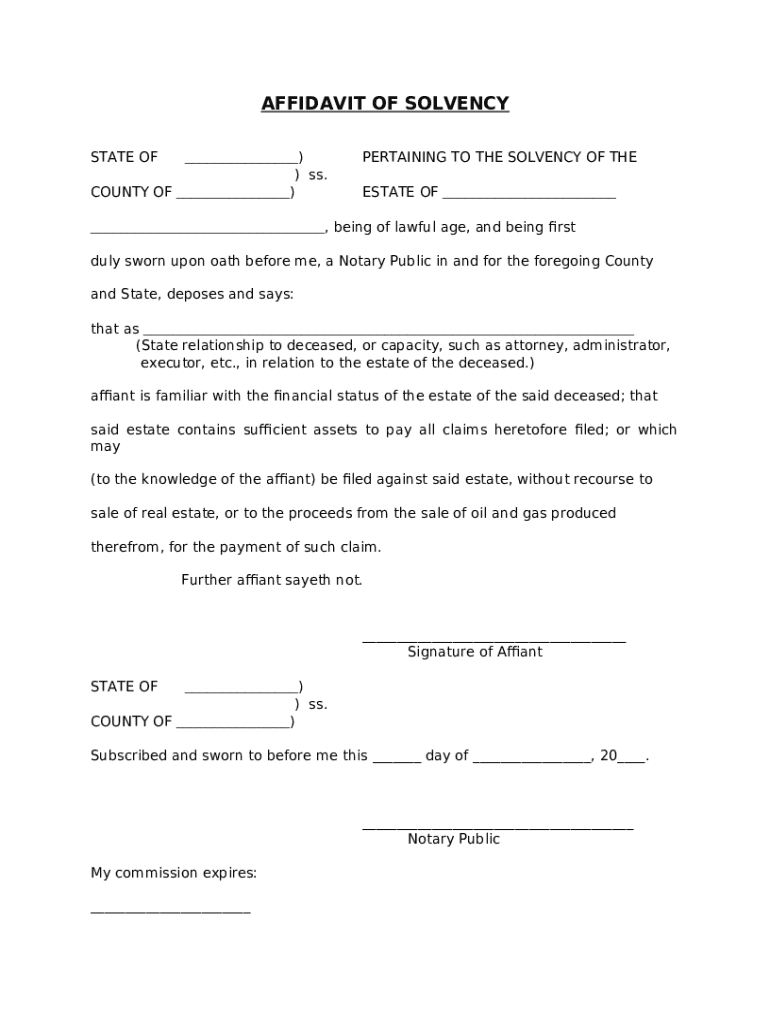

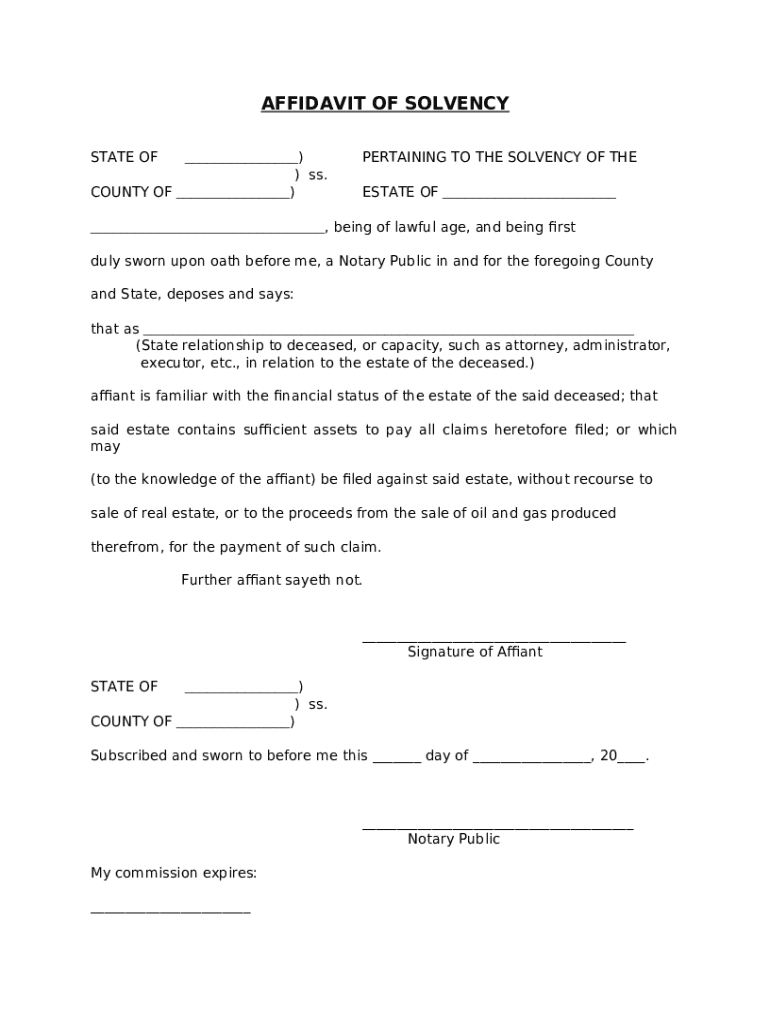

Comprehensive Guide to Affidavit of Solvency Form

The affidavit of solvency form is a legal document that declares an individual's financial status, often crucial in estate management. This guide aims to provide thorough insights on how to fill out the form, important components, and best practices.

What is an affidavit of solvency?

An affidavit of solvency is a sworn statement that declares the financial soundness of an individual or entity. This document is pivotal in several legal situations, especially regarding estate management, where it serves as a testament to the decedent's financial affairs.

Why is an affidavit important in estate management?

The affidavit of solvency ensures that the estate in question is capable of settling debts and obligations before distributing assets to beneficiaries. This legal assurance helps prevent potential conflicts among heirs and creditors, thus facilitating smoother transitions in estate management.

What are the legal requirements for affidavits of solvency?

-

Each state may have unique requirements for the affidavit format and accompanying documents.

-

The document must be signed in the presence of a Notary Public to be legally binding and credible.

What are the necessary components of the affidavit of solvency?

-

The affidavit should contain details such as the affiant's name, their relationship to the deceased, and specific estate details.

-

Affiants need to clearly express their financial status, detailing assets and liabilities to aid transparency.

-

The signature of a Notary Public is crucial as it adds a layer of authenticity to the affidavit, making it more legally enforceable.

How do fill out the affidavit of solvency form?

-

Begin by entering details about the state, county, and specific estate involved, ensuring accuracy.

-

Clearly state your financial standing and your relationship to the decedent, using straightforward language.

-

After filling out the affidavit, verify all entries and have it notarized to complete the process.

How can pdfFiller assist in editing the affidavit of solvency?

-

Users can easily upload their affidavit of solvency to pdfFiller's platform for hassle-free editing.

-

pdfFiller offers a variety of tools that allow for customization and enhancement of the document.

-

The platform provides options for eSigning and collaborating with others, facilitating a smoother completion process.

Where do submit the affidavit of solvency?

-

Affidavits are typically submitted to the probate court or relevant estate management office in the affiant's jurisdiction.

-

Different states may have unique compliance requirements during submission; it’s important to research these.

-

Failing to submit correctly can lead to legal repercussions, complications in estate distribution, and prolonged probate processes.

What are common issues with affidavits of solvency and how to resolve them?

-

Common errors include omitting necessary details and incorrect financial declarations, which can invalidate the affidavit.

-

If mistakes are found post-submission, it's important to file the appropriate amendments with the probate court.

-

If state authorities raise objections, ensure to address them promptly with clear documentation and justifications.

Where can find support and resources for affidavits of solvency?

-

It's advisable to have access to legal professionals who specialize in estate management for guidance.

-

Websites like pdfFiller offer templates and additional resources that can streamline the form-filling process.

How to fill out the affidavit of solvency template

-

1.Open the pdfFiller website and log in to your account.

-

2.Select the option to create a new document and search for 'affidavit of solvency' template.

-

3.Choose the appropriate template and open it for editing.

-

4.Fill in the required fields such as the name of the declarant, date, and relevant identification details.

-

5.Provide a detailed account of assets and liabilities, ensuring all financial information is accurate.

-

6.Review the affidavit for completeness and correctness, making any necessary changes.

-

7.Add any required signatures in the designated spaces, either electronically or by printing the document out.

-

8.Save the completed affidavit of solvency in your preferred format.

-

9.If needed, print or share the document directly from pdfFiller.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.