Get the free Split-Dollar Life Insurance template

Show details

This sample form, a detailed Split-dollar life insurance document, is a model for use in corporate matters. The language is easily adapted to fit your specific circumstances. Available in several

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is split-dollar life insurance

Split-dollar life insurance is a financing arrangement between two parties, typically an employer and an employee, where the costs and benefits of a life insurance policy are shared.

pdfFiller scores top ratings on review platforms

Was in need of form 941 and it was provided with no issues

GOOD

LOVED IT

simple easy to work and fast

It is my first time using it

It is my first time using it, but so far, so good. Very easy to use.

More late

More late. I Will do.

Who needs split-dollar life insurance template?

Explore how professionals across industries use pdfFiller.

Understanding Split-Dollar Life Insurance

TL;DR: To fill out a split-dollar life insurance form, gather required personal and policy information, accurately input these details in the designated sections of the form, and adhere to guidelines to minimize common errors.

What is split-dollar life insurance?

Split-dollar life insurance is an arrangement between an employer and an employee where both parties share the costs and benefits of a life insurance policy. Typically used for executive compensation, it allows companies to provide life insurance coverage while retaining some control over the policy. Unlike traditional life insurance, split-dollar arrangements offer both the employer and employee unique financial advantages.

-

Split-dollar insurance combines elements of employer-sponsored benefits with individual ownership of the policy.

-

Traditional life insurance is solely owned by the policyholder, while split-dollar involves shared ownership and financial obligations.

How do split-dollar agreements work?

Split-dollar agreements outline the responsibilities and benefits for the parties involved, primarily focusing on executive officers. These agreements detail the premium payment structure, typically where the employer pays the premiums and the employee has access to the benefits. Additionally, tax implications must be considered, as both the employer and employee need to adhere to specific IRS regulations.

-

Negotiated terms define how expenses are shared and under which conditions the policy pays out.

-

Premiums can be paid by the employer, employee, or both, influencing the tax treatment of the policy.

-

Events leading to the termination of the agreement, such as employment cessation, must be clearly outlined.

What are the key benefits of split-dollar life insurance plans?

One of the major benefits of split-dollar life insurance plans is the enhanced financial security they provide to executives and their families. This arrangement can lead to substantial tax advantages, allowing both corporations and individuals to optimize their financial strategies. Moreover, split-dollar life insurance can play a crucial role in estate planning, facilitating asset protection and efficient wealth transfer.

-

Executives receive significant life insurance benefits without incurring high out-of-pocket premiums.

-

Corporations may deduct premiums paid, while employees can avoid taxable income for certain benefits.

-

These plans can be integrated into broader estate planning strategies to minimize tax burdens on heirs.

What legal considerations should you navigate?

Legal implications play a significant role when establishing and maintaining split-dollar life insurance agreements. Understanding compliance requirements ensures that both parties adhere to IRS regulations and state laws, which can vary by region. Moreover, proper documentation is essential for the enforceability of the agreement and to safeguard against potential disputes.

-

Both the employer and employee must understand tax and legal obligations related to the policy.

-

Careful record-keeping and legal documentation are essential to establish and manage the agreement.

-

Identifying and addressing potential risks can prevent conflicts and financial disadvantages.

How does split-dollar life insurance fit into estate planning?

Split-dollar life insurance can be a potent tool within estate planning strategies. It allows for the effective transfer of wealth while considering tax implications and the financial needs of heirs. Real-world case studies have demonstrated how organizations utilize split-dollar arrangements to optimize estate values and provide liquidity for estates.

-

This insurance option can complement trust and other estate planning vehicles.

-

Illustrative examples of families using split-dollar life insurance to settle estate taxes efficiently.

-

Legal and financial professionals often advise integrating this tool for maximum benefit.

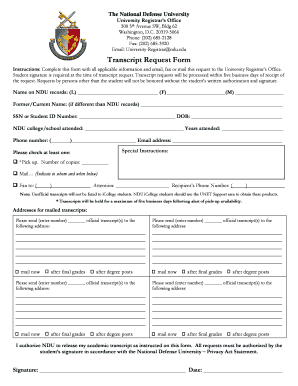

How to fill out the split-dollar life insurance form?

Filling out a split-dollar life insurance form requires careful attention to detail. Begin by gathering all necessary personal information and policy specifics before starting the form. Below are some important highlights to consider when completing the form and common pitfalls to avoid, which can be efficiently managed using tools like pdfFiller.

-

Follow a structured process to fill in each section correctly and thoroughly.

-

Provide accurate and relevant information, including beneficiary designations and payment instructions.

-

Neglecting to review the form can lead to errors or omissions that might delay processing.

How to manage your split-dollar life insurance policy?

Ongoing management of your split-dollar life insurance policy is essential to ensure that it meets evolving needs and complies with legal requirements. Regularly reviewing and adjusting your policy can help navigate changes in financial or personal circumstances. Additionally, maintaining clear communication with the employer or corporation regarding repayments and obligations is crucial.

-

Periodically assess the coverage and terms to align them with your current situation.

-

Clarify obligations and repayment responsibilities to avoid potential disputes.

-

This platform can assist in document management, ensuring all records are current and accessible.

How to fill out the split-dollar life insurance template

-

1.Open the blank split-dollar life insurance form on pdfFiller.

-

2.Begin by entering the policyholder's personal information, including name, address, and contact details.

-

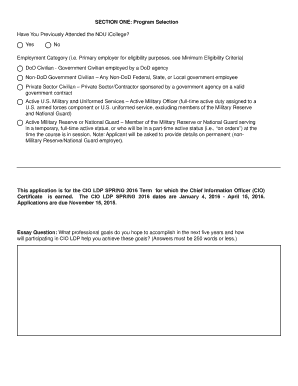

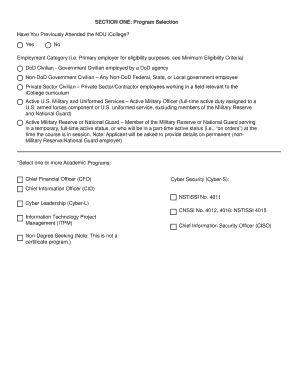

3.Next, specify the type of split-dollar arrangement being established, such as endorsement or collateral assignment.

-

4.Fill in the details of the life insurance policy, including the insurer's name, policy number, and coverage amount.

-

5.Indicate the premium payment structure, clearly stating how costs will be split between parties.

-

6.Provide the beneficiary details, ensuring the intended recipients are correctly listed.

-

7.Review all entered information for accuracy before proceeding to submit the form electronically or printing it for signatures.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.