Get the free Directors' Stock Deferral Plan for Norwest Corp. template

Show details

20-111C 20-111C . . . Directors' Stock Deferral Plan which allow participants to defer to later year certain compensation which would otherwise be includable in income for tax purposes in year in

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is directors stock deferral plan

A directors stock deferral plan is a program that allows corporate directors to defer income from stock compensation to reduce their current tax liability.

pdfFiller scores top ratings on review platforms

I love it. I was a member a year or so ago, but you guys have changed and updated the system that I really-------love. Thank you again.

I like it.. I just can't figure out if I can fill a docment and save it and go back and change it. I also don't like that it is challenging to get data squarely in the center of each square in form. Even if you try to do one square at time so you can manipulate, it connects them and then you can only use them as one field.

Good forms but software doesn't tally numbers and should.

Helps to get my work down more smoothly and without having to search all over the web for forms

need additional instructions for processing multiple of the same form.

I just started using this product but love it so far.

Who needs directors stock deferral plan?

Explore how professionals across industries use pdfFiller.

How to effectively manage your directors stock deferral plan form

How do fill out a directors stock deferral plan form?

To fill out a directors stock deferral plan form, ensure you first confirm your eligibility as a director under the specific plan and understand the compensation you wish to defer. Complete the irrevocable election form by selecting the amount to defer and your payment preferences, then submit it by the deadline. Utilize interactive tools on pdfFiller for a seamless experience.

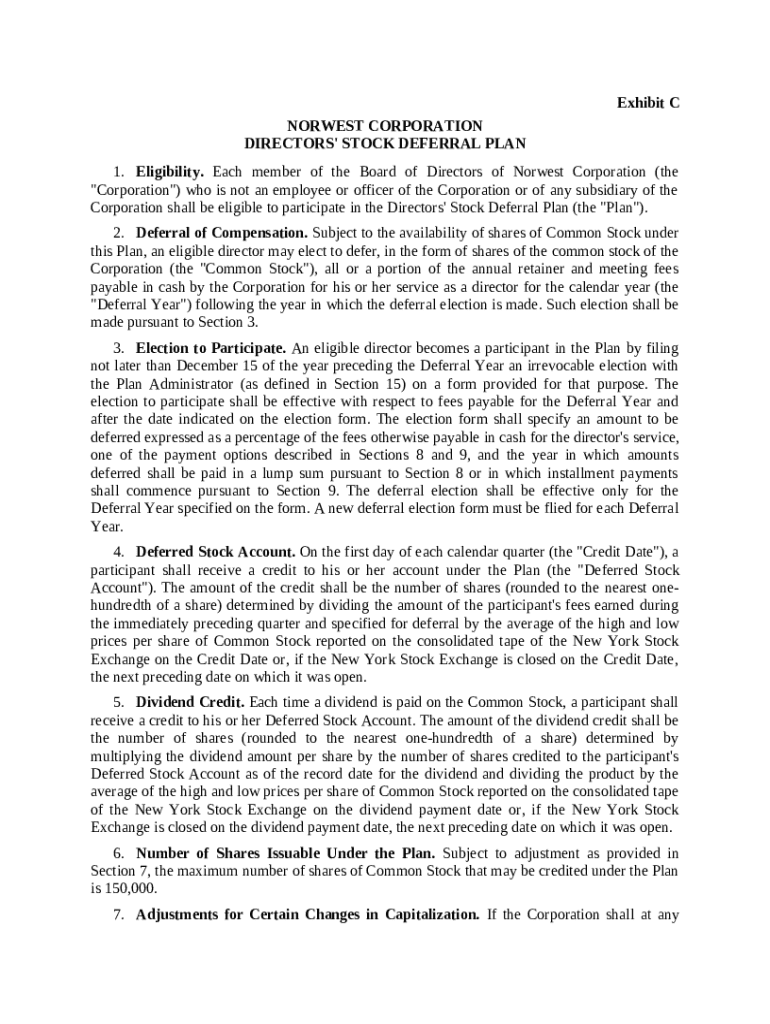

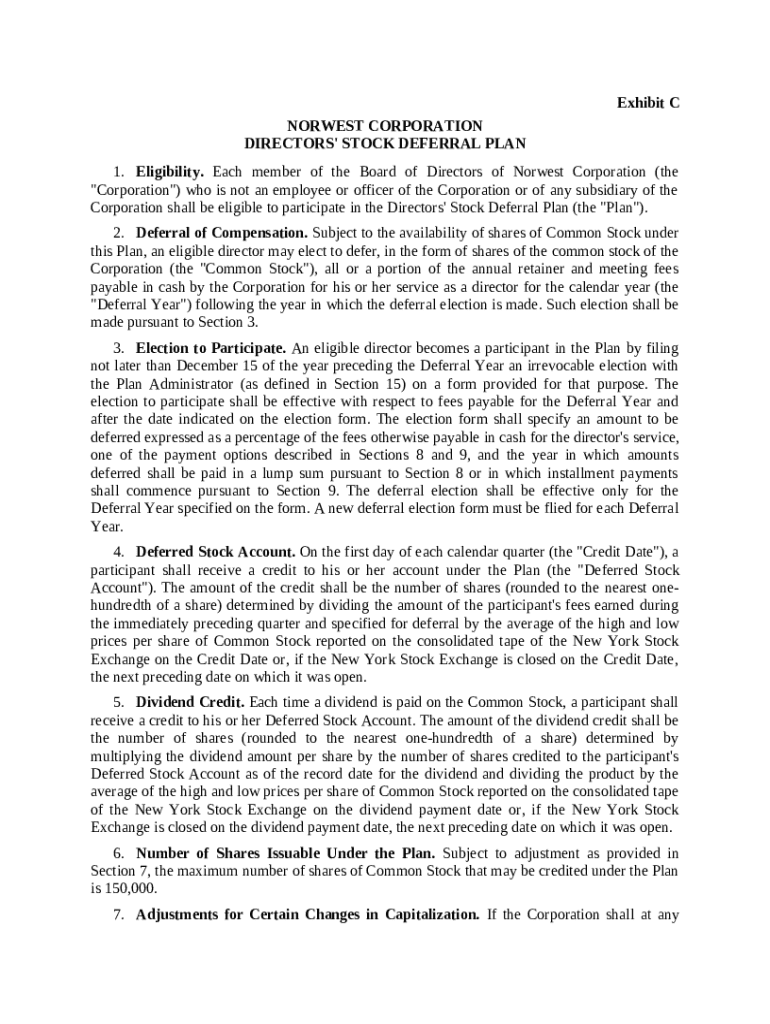

Understanding the directors' stock deferral plan

The Directors' Stock Deferral Plan offers eligible directors a way to manage their stock compensation efficiently. This plan allows directors to defer some of their compensation to future years, ultimately benefiting their financial strategy by postponing the tax impact of their earnings. The primary components that make up such a plan include Deferred Compensation and criteria that determine who qualifies.

-

The plan is designed to strengthen the alignment between directors’ interests and those of shareholders.

-

Directors can elect to defer part of their compensation until a designated future date.

Who is eligible to participate?

Only designated eligible directors under the Norwest Corporation Directors' Stock Deferral Plan can participate. This excludes employees or officers of the corporation or its subsidiaries, emphasizing that eligibility requires specific status as a director.

-

You must be recognized as a director to join the plan.

-

Employees or officers are not eligible, ensuring only directors make the election.

-

Verify your eligibility before making any deferral elections.

How does the deferral of compensation work?

Eligible directors can elect to defer compensation to manage their tax liability and investment strategy. The plan can be affected by the availability of shares, and various types of eligible compensation can be deferred, including annual retainers and meeting fees. Understanding these factors is crucial for effective financial planning.

-

Annual retainers and meeting fees are common forms of compensation eligible for deferral.

-

The availability of shares of common stock may affect your deferral options.

What are the steps to elect participation?

Directors must adhere to specific timelines for participating in the plan. Notably, the election form must be submitted by December of the preceding year. Clearly defined instructions guide directors through filling out and submitting the form to the Plan Administrator, ensuring compliance with all procedural requirements.

-

Submit your election form by December to participate for the following year.

-

Follow the guidelines for completing the irrevocable election form.

-

Specify the amount you wish to defer and your preferred payment options.

How are deferral elections and payment preferences managed?

Understanding how deferred amounts are paid is crucial for directors, with choices generally falling between lump sum and installment payments. This section covers various factors that influence selection and highlights the significance of submitting the correct form for each Deferral Year.

-

Directors can choose lump sum payments or installments as payment preferences.

-

Many factors, including personal financial goals, can influence the election process.

-

Each Deferral Year requires a new submission to confirm choices.

How to manage your deferred stock account?

Once elections have been made, effective management of deferred stock accounts is key. Maintaining compliance within the context of the plan can help directors maximize their benefits, including navigating the implications of fluctuating stock market conditions on the value of deferred compensation.

-

Understanding how to manage and understand your deferred stock accounts is crucial.

-

Stay informed about both market trends and personal financial goals.

What interactive tools are available for managing your form?

pdfFiller offers a suite of interactive tools for filling out, editing, and signing the Directors' Stock Deferral Plan form. These tools allow for real-time collaboration and enhance the document management process through cloud-based features, making it easier for directors to stay organized.

-

Utilize pdfFiller's interactive tools designed for efficient document management.

-

Enjoy collaborative management and editing through cloud integration.

Why are compliance and regulations important?

Compliance with regulations is fundamental for directors engaging in stock deferral plans. Understanding local legal requirements, as well as best practices for adherence, can protect directors from future liabilities and ensure ongoing participation in the deferral plan aligns with regulatory framework.

-

Stay informed about compliance considerations specific to stock deferral plans.

-

Localizing compliance requirements can significantly impact your planning.

How to fill out the directors stock deferral plan

-

1.Obtain the directors stock deferral plan form from your company's HR or compliance department.

-

2.Open the PDF form in pdfFiller, and ensure you have a compatible PDF viewer.

-

3.Begin filling out the form by entering your personal details, including name, title, and the date.

-

4.Indicate the number of shares you wish to defer and the period until you receive them, based on your company's plan options.

-

5.Review the terms and conditions laid out in the document carefully to understand the implications of deferring your stock grants.

-

6.If applicable, include any additional comments or requests for exceptions or clarifications in the designated section.

-

7.Sign and date the form electronically within pdfFiller to finalize the submission.

-

8.Submit the completed form to the designated HR or compliance officer for processing, and keep a copy for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.