Get the free Loan Deposit Renewal Checklist Application template

Show details

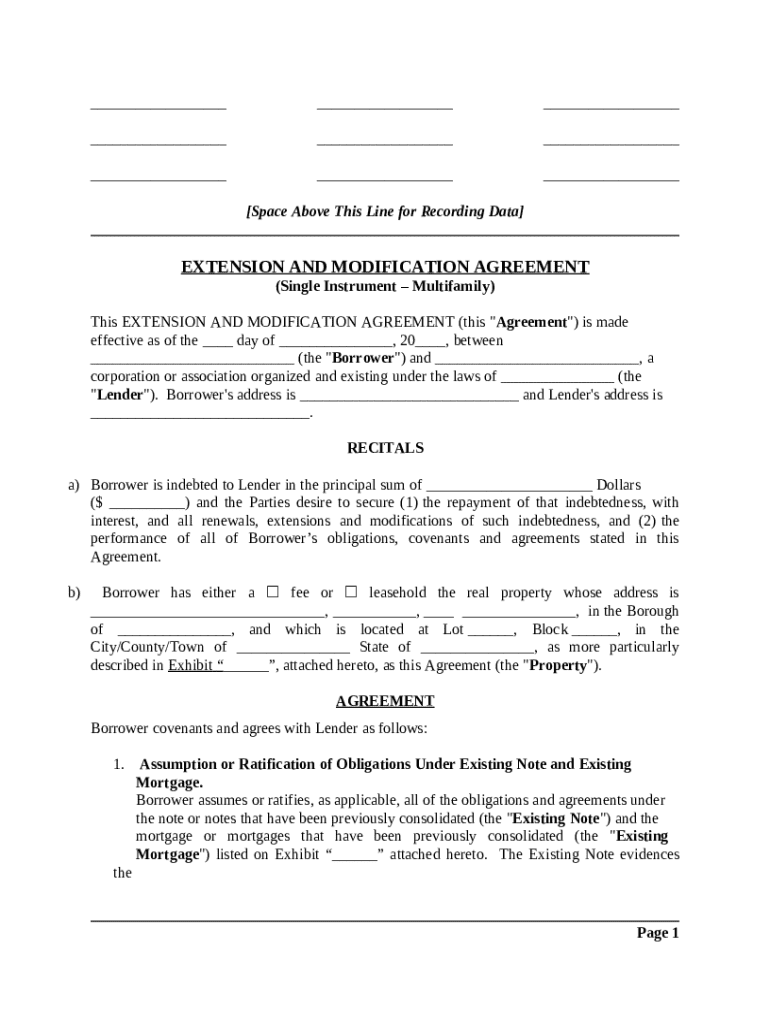

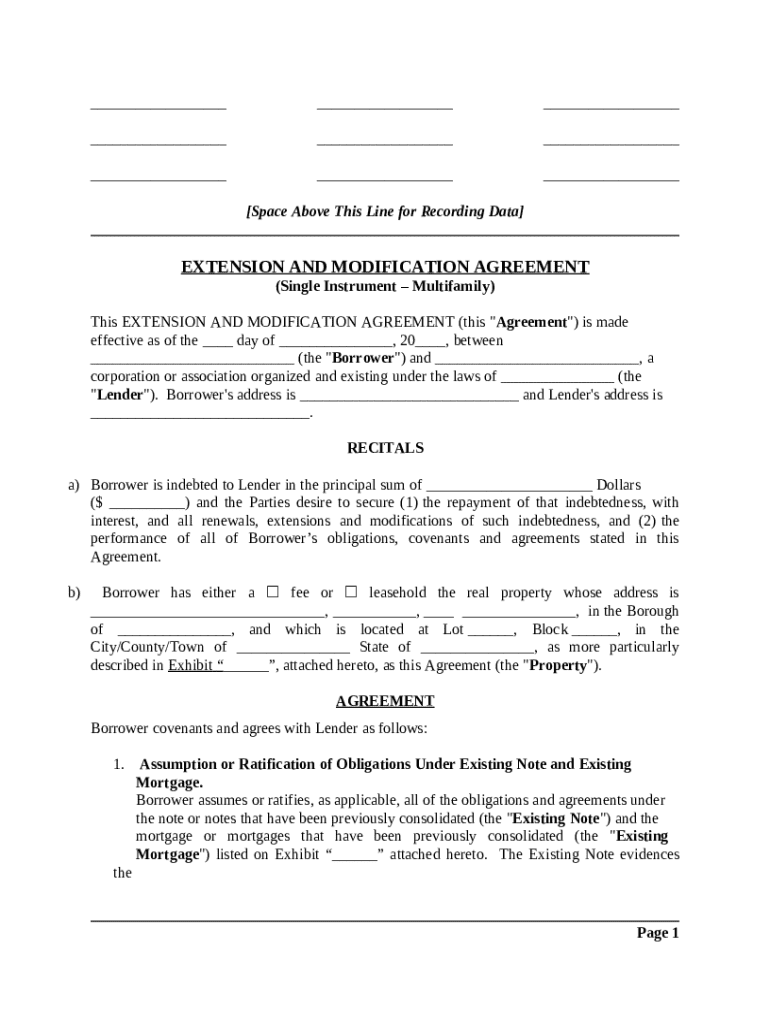

A loan modification agreement and extension for an existing loan that either has modifications to the agreement or if the loan agreement has been extended.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is loan deposit renewal checklist

A loan deposit renewal checklist is a document used to ensure all necessary steps and requirements are met when renewing a loan deposit.

pdfFiller scores top ratings on review platforms

I love PDF filler. I can save a form and then type the information directly on the and make it look professional.

So far it has been simple to navigate and achieve overall goals

I just started, I also using Dochub for electronic signing.

Your features of creating folders and unlimited storage is great.

Sending documents to mobile phone is a great feature.

I haven't explore the rest. All the best to your team. Good Luck.

I used PDF filler to complete a URLA form because the one I was sent by a loan officer was so small I couldn't fit the information in it. PDFfiller made it very easy for me to see and complete the form. I feel that this service would be good for a small business owner because there are many documents available as well as documents that explain the documents you are completing.

I'm still learning to navigate this program but has made my job easiest

While attending Air Force SNCO Academy, this is a huge time saver while taking notes. So much easier to take notes on the document itself.

Who needs loan deposit renewal checklist?

Explore how professionals across industries use pdfFiller.

Loan Deposit Renewal Checklist Form

To complete a loan deposit renewal checklist form, gather the necessary documentation and carefully follow the steps outlined in this guide. Ensuring accuracy in the information submitted will streamline the renewal process and avoid potential issues.

What is the loan deposit renewal process?

The loan deposit renewal process is pivotal for maintaining your funding opportunities. Timely renewal can prevent lapses in financing, which can adversely affect your financial standing.

-

Delays can lead to penalties or affect your credit score.

-

Include documentation, confirmation of terms, and compliance with lending standards.

-

Missing signatures or incorrect forms can hinder the completion of your renewal.

What documents do you need for renewal?

Understanding the required documentation is a cornerstone of the renewal process. Essential documentation often includes identity verification, previous agreements, and financial statements.

-

Provide with a valid government ID and proof of residency.

-

Have specific forms ready, ensuring they meet lender requirements.

-

Be aware of any laws specific to your region impacting loan renewals.

How do you fill out the loan deposit renewal checklist form?

Completing the checklist form accurately is key to a successful renewal. The form includes several sections where attention to detail is paramount.

-

Start from the top and work your way down, ensuring all fields are completed.

-

Double-check numbers and names to avoid clerical errors.

-

Missing a signature or failing to date the form can delay your process.

How can pdfFiller help in customizing your checklist?

pdfFiller provides interactive tools that allow you to edit and customize your loan deposit renewal form easily. This ensures that you can tailor the document to your specific needs.

-

With pdfFiller, making amendments is quick and straightforward.

-

Use features that enhance the usability of your forms.

-

Engage other stakeholders in the editing process to ensure all details are accurate.

How to manage and sign your renewal agreement?

Once your form is complete, the next step is to manage and eSign your renewal agreement. This process not only secures the document but also ensures that it is legally binding.

-

Utilize the eSignature features on pdfFiller to streamline this process.

-

Stay updated on any changes made before final signing.

-

pdfFiller incorporates security measures that protect your signed agreements.

What are the fees and requirements?

Understanding the fees associated with loan deposit renewals is crucial in making informed decisions. This helps you avoid unexpected costs.

-

Some lenders may charge processing fees for renewals.

-

Always verify with your lender to ensure you have all necessary components.

-

In [region], specific laws could influence renewing fees.

How to navigate the renewal process effectively?

Navigating through the renewal process efficiently can save time and reduce stress. pdfFiller's intuitive navigation options empower you to access forms and tools seamlessly.

-

Locating your forms quickly can streamline the process.

-

These help track your progress from creation to submission, minimizing confusion.

-

Quick access to relevant information can speed up your workflow.

What support and resources are available for borrowers?

For borrowers needing assistance, pdfFiller offers customer support and additional resources. These can clarify aspects of loan agreements and assist in the renewal process.

-

Expert assistance is just a contact away through pdfFiller.

-

Utilize guides and articles to fortify your understanding of loan agreements.

-

Local regulations may have resources that aid financial inquiries.

What important legal provisions should you know?

Familiarizing yourself with legal provisions regarding loan modifications is vital for a smooth renewal process. Knowing key terms can secure your agreements and make you aware of your rights.

-

Identify key terms that could impact your renewal.

-

Certain conditions may apply uniquely within your region.

-

Always review state laws thoroughly during your loan deposit renewal.

In conclusion, utilizing the loan deposit renewal checklist form effectively can streamline your renewal process. By following the outlined steps and utilizing pdfFiller's capabilities, you can successfully manage loans and avoid common pitfalls.

How to fill out the loan deposit renewal checklist

-

1.Open the loan deposit renewal checklist template on pdfFiller.

-

2.Begin with the header section; enter your name, account number, and the loan deposit type.

-

3.Review the requirements section; ensure you have all necessary documents and information ready for renewal.

-

4.Fill in the loan deposit details, including initial deposit amount, renewal term, and interest rate information.

-

5.Check any additional options available for your renewal, such as auto-renewal preferences or alternative terms.

-

6.Include your signature and the date at the bottom of the form to validate your request.

-

7.Double-check all filled information for accuracy and completeness before submitting.

-

8.Save the completed checklist for your records and submit it to the respective financial institution or advisor.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.