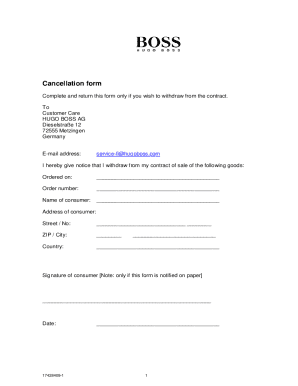

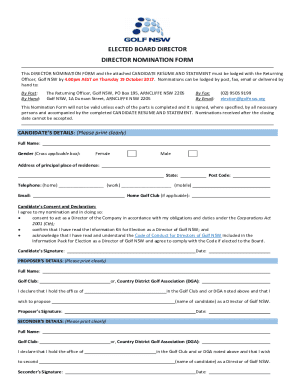

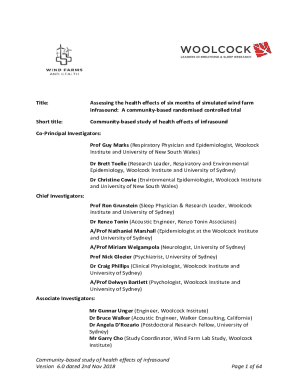

Get the free Directors and officers liability insurance template

Show details

This sample form, a detailed Directors and officers liability insurance document, is a model for use in corporate matters. The language is easily adapted to fit your specific circumstances. Available

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is directors and officers liability

Directors and officers liability refers to insurance that protects corporate directors and officers from personal losses due to legal actions arising from their managerial decisions.

pdfFiller scores top ratings on review platforms

This is an amazing application! Well worth money

straight forward, easy to use, very helpful!

Very easy to use, document which can be edited is exact as the original.

Haven't used the product enough yet. But so far, I have been pleased with the ease of use and how user-friendly it is.

so far it seems to do what they say it will do, I'm still working with the program.

No nonsense, lets me fill out as I want, invaluable tool

Who needs directors and officers liability?

Explore how professionals across industries use pdfFiller.

How to fill out a directors and officers liability form form

Navigating the directors and officers (D&O) liability form can be challenging. Understanding the key components of this form is crucial for ensuring that your organization is adequately protected against legal liabilities that directors and officers may face in the course of their duties. This guide outlines the various aspects of D&O liability insurance and provides actionable steps to help you fill out the form correctly.

What is directors and officers liability insurance?

Directors and officers liability insurance is a type of insurance that protects the personal assets of corporate directors and officers in the event they are sued for wrongful acts while managing a company. It's essential for mitigating the financial risks associated with managerial decisions and protecting both the company and its executives.

-

D&O insurance provides coverage for legal fees, settlements, and other costs incurred in legal proceedings.

-

This insurance is vital as it enables companies to attract qualified executives without the fear of personal financial loss.

-

Key coverages include legal fees for defense against lawsuits, judgments against the directors and officers, and reimbursement for costs incurred.

What are the key features of &O insurance policies?

Understanding the key features of D&O insurance is important for both informed decision-making and effective coverage. Not all policies are the same, so being aware of what's available will help ensure your needs are met.

-

Aetna, CIGNA, Chubb, and others are prominent insurers, each offering varied coverage options that cater to different organizational needs.

-

Excess coverage is available to provide additional layers of protection beyond the primary policy limits, ensuring higher risk scenarios are adequately covered.

-

Certain policies may be long-term, while others require annual renewals; understanding this can help you manage your coverage effectively.

How do you navigate the &O liability application process?

Filling out a D&O liability form requires care and attention to detail. A clear understanding of the required information and the structure of the application will streamline the process.

-

When filling out a liability form, begin with the basic company information, then move to details regarding directors and officers, avoiding errors that could delay processing.

-

Key details needed often include the company's structure, financial statements, and previous claims history.

-

Utilize checklists and guides to ensure no detail is missed, and consider consulting with a legal expert familiar with the D&O process.

What special considerations are there for nonprofit vs. for-profit entities?

The coverage needs for nonprofit organizations can significantly differ from those of for-profit companies. Tailoring D&O insurance to fit these differences is essential for adequate protection.

-

Nonprofits may need specific clauses to protect volunteer board members, as they often face different legal exposures than for-profit executives.

-

Assess whether your organization is public or private to customize the D&O insurance appropriately, ensuring all exposures are managed.

-

Stay informed about legal requirements that differ for nonprofits; noncompliance can lead to additional risks.

What are the implications of the indemnification clause?

The indemnification clause in a D&O policy outlines the responsibilities for legal defense and expenses in the event of a lawsuit.

-

This clause potentially allows companies to reimburse directors and officers for legal expenses stemming from claims against them.

-

By-laws may specify indemnification rights and obligations, influencing directors' and officers' approaches toward risk.

-

Examples include legal fees incurred during a securities litigation process, which can significantly impact financial stability.

How can you manage your &O insurance documentation effectively?

Efficient document management is crucial for maintaining D&O insurance records. Utilizing the right tools can simplify the process.

-

pdfFiller allows for easy editing and management of D&O documents. You can also store and retrieve forms quickly, enhancing productivity.

-

With eSigning features, team members can collaborate on documents instantly, ensuring timely updates and approvals.

-

The cloud-based nature of pdfFiller means you can access your D&O insurance records from any location, making it convenient for busy professionals.

When to renew and update your &O liability policies?

Regular review and renewal of D&O insurance are essential to avoid coverage gaps and ensure your policy aligns with current business needs.

-

Establish a timeline to review your D&O coverage, ideally at least annually or whenever significant changes occur within the company.

-

Efficiently renew coverage by soliciting quotes from various providers and understanding policy differences to optimize costs.

-

Ensure that policies are renewed without interruption, as lapses may leave directors and officers vulnerable to claims.

How to fill out the directors and officers liability

-

1.Access the pdfFiller platform and log in to your account.

-

2.Search for 'directors and officers liability' in the template library.

-

3.Select the appropriate form that suits your needs and click on it to open.

-

4.Begin filling in the required fields, including the company name, address, and date.

-

5.Provide details of the directors and officers, including names, titles, and contact information.

-

6.Enter information regarding the nature of the company's business and specific liabilities covered.

-

7.Review the sections regarding coverage limits and premiums.

-

8.Ensure all information is accurate and complete, then save your progress.

-

9.Once finished, submit the form for approval, or download a copy for your records.

-

10.If needed, consult with an insurance advisor for guidance on your selections.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.