Get the free Plan of Reorganization template

Show details

This sample form, a detailed Plan of Reorganization document, is a model for use in corporate matters. The language is easily adapted to fit your specific circumstances. Available in several standard

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

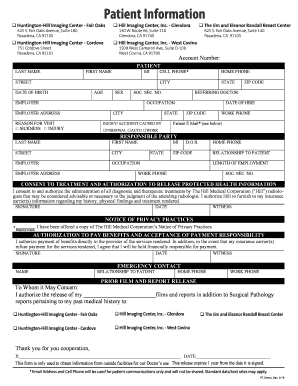

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is plan of reorganization

A plan of reorganization is a detailed proposal intended to restructure a company's debts and operational framework, often used during bankruptcy proceedings.

pdfFiller scores top ratings on review platforms

Very easy to work with and essential for completing our work and contracts!

I still find some of the features not very intuitive but maybe some training will help.

Don't like the fact it auto renews and cant work out how to undo work you have done in erro

I have used it in the past and it is very user friendly. I love it.

This works great. I would like to see if you can draw boxes and smaller circles.

In a crunch for 1099s. The help desk was a bit rude. But the program did get the job done.

Who needs plan of reorganization template?

Explore how professionals across industries use pdfFiller.

Understanding the plan of reorganization form

How does a plan of reorganization work?

A plan of reorganization form serves as a crucial instrument during corporate restructuring. It outlines how a company plans to reorganize its structure, make financial adjustments, and define asset transfers. This document is vital for engaging shareholders, as it requires their approval to implement the proposed changes and ensure long-term viability.

-

A plan of reorganization is designed to facilitate a company's transition during challenging financial times, offering a clear pathway for recovery and restructuring.

-

The form contains critical information that must be disclosed, making it legally binding once approved by shareholders.

-

Shareholders must vote on the plan, and a two-thirds majority is often needed for it to pass, highlighting their important role in corporate governance.

What steps are essential to prepare the plan of reorganization form?

Preparing a plan of reorganization form requires meticulous planning and a thorough understanding of your company’s financial and operational landscape. Taking the necessary steps ensures that the plan is comprehensive and meets all requirements.

-

Compile data on current financial health, debts, and assets to create a realistic plan.

-

Detail the new hierarchy and roles within the company to provide clarity on operational changes.

-

This approach minimizes legal risks and is crucial for IRS evaluations and tax implications.

What should you know about the approval process?

Understanding the approval process for a plan of reorganization is critical to ensuring that the plan is ratified by shareholders. Legal requirements can differ by state, so you must be aware of the rules under Virginia law.

-

Virginia law mandates specific disclosures and voting procedures that must be followed to ensure legal compliance.

-

Achieving a two-thirds majority is crucial; failure to do so can prevent the planned changes from being enacted.

-

Understanding the typical timelines can help in planning shareholder meetings and ensuring all necessary votes are secured.

What key considerations should be addressed in the proposed plan?

When formulating a plan of reorganization, there are numerous considerations to keep in mind, particularly regarding tax implications and the details of asset transfers.

-

Clearly document any transfers which can help limit liability and improve tax positions.

-

Consulting tax advisors is advisable to navigate potential tax burdens and ensure compliance.

-

Understanding the process for amending or abandoning the plan can provide flexibility after the initial submission.

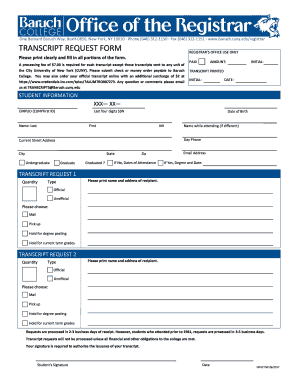

How to fill out the plan of reorganization form on pdfFiller?

Filling out the plan of reorganization form online can simplify the entire process. pdfFiller provides various tools to assist users with document management and signing.

-

Users can easily navigate through editing fields and ensure that all sections of the form are completed.

-

Collaboration features can enhance efficiency by enabling team members to work on the form simultaneously.

-

Signing electronically is legally recognized, streamlining the required approval process significantly.

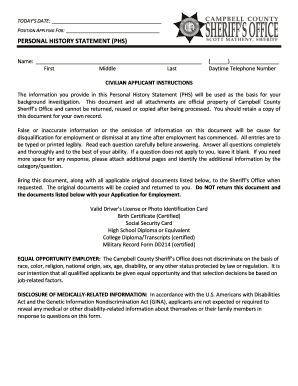

What mistakes should be avoided when completing the form?

Completing the form requires attention to detail, and avoiding common mistakes is critical to successful submission. Errors can delay the approval process or lead to legal complications.

-

Failure to provide complete information can lead to rejection of the plan and significant delays.

-

Ensure full comprehension of legal obligations to avoid potential pitfalls.

-

Understanding regulations in all applicable jurisdictions is crucial for legality.

How to finalize and submit the plan of reorganization?

Finalizing the plan of reorganization form involves the completion of several best practices to ensure a smooth submission. Legal counsel can guide this important last step.

-

Reviewing all sections of the document and ensuring accuracy will enhance credibility.

-

Involving legal experts can mitigate the risk of errors that could affect approval.

-

Understanding what happens next helps in planning for potential next steps in the restructuring process.

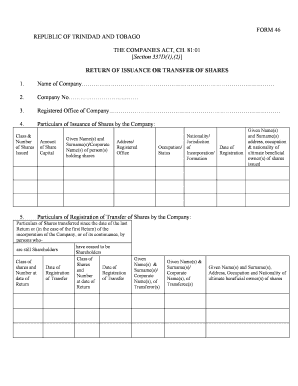

How to fill out the plan of reorganization template

-

1.Begin by downloading the plan of reorganization template from pdfFiller.

-

2.Open the template in the pdfFiller application.

-

3.Start by entering the name of the company in the designated field.

-

4.Fill in the details regarding assets and liabilities, providing accurate financial information.

-

5.Indicate the proposed changes to the company's structure, including any operational modifications.

-

6.Add sections outlining the repayment plan for creditors, detailing timelines and amounts.

-

7.Include signatures from relevant parties, such as company executives and legal representatives.

-

8.Review the filled document to ensure accuracy and completeness of all information.

-

9.Save the filled form and download or share it according to your needs.

-

10.Consider consulting with a legal advisor to finalize the document before submission.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.