Get the free 501(c)(1) Non-Profit Charter School Student Agreecment for Use of the Internet and E...

Show details

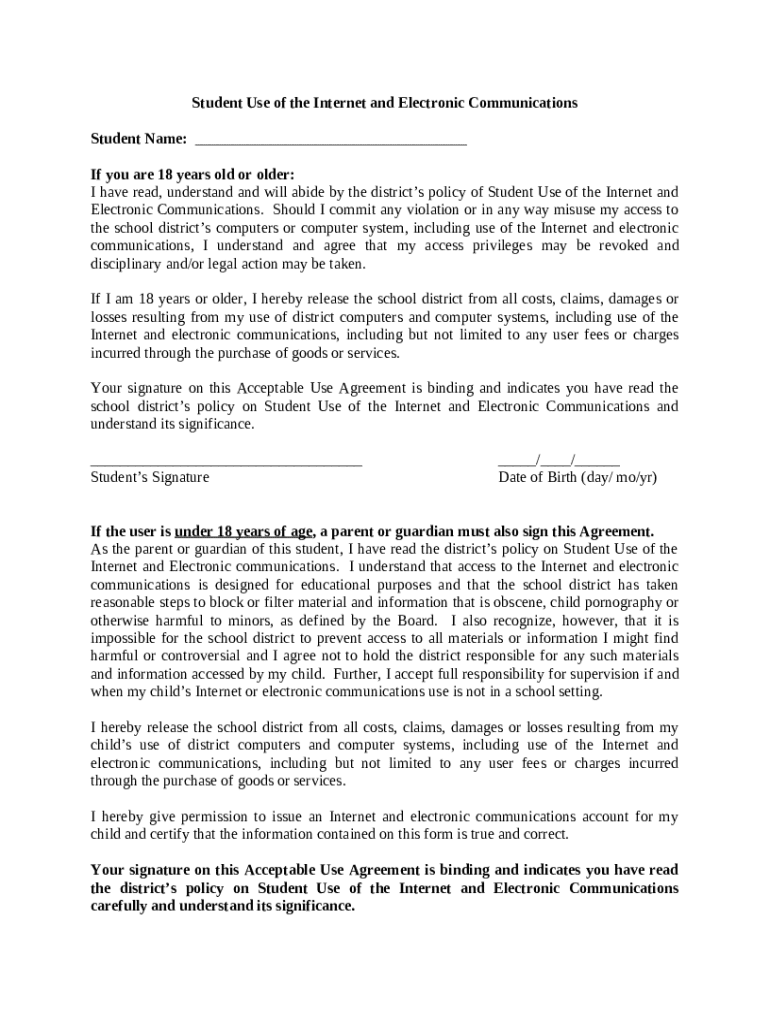

An acknowledgement and agreement to the 501(c)(1) non-profit charter school's internet and electronic communication policy.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is 501c1 non-profit charter school

A 501c1 non-profit charter school is an educational institution that operates as a non-profit organization under Section 501(c)(1) of the Internal Revenue Code, primarily focusing on providing quality education to students.

pdfFiller scores top ratings on review platforms

I have enjoyed pd filler, but I dont use it enough to continue after the trial. Thanks

it's a life saver, especially for having too upload documents. im glad I stumbled upon the website.

PDF filler is great, my cc info got hacked though!

this has been awesome experience from working at home

This system is amazing, but I have trouble with the 40 per month fee, but I will notify my supervisors at the business, it would be a great investment for the company as a whole.

I haven't had any problems. I'm learning.

Who needs 501c1 non-profit charter school?

Explore how professionals across industries use pdfFiller.

How to fill out a 501()(1) non-profit charter school form

What is 501()(1) status and why is it important for charter schools?

501(c)(1) status refers to a specific classification within the Internal Revenue Code that recognizes certain organizations as non-profit and tax-exempt. For charter schools, obtaining this status can be pivotal in securing funding, enhancing credibility, and ensuring the ability to operate without the burden of federal income tax. This classification is especially beneficial for those looking to provide quality education while maintaining fiscal responsibility.

What is the application process for obtaining 501()(1) status?

-

Gather required documentation, such as organization bylaws and a statement of purpose, to demonstrate your charter school's mission and operational framework.

-

Complete Form 1023, the Application for Recognition of Exemption, which requires detailed information regarding your school's structure, funding sources, and governance.

-

Submit your application to the IRS, along with the required fee, and await the determination of your tax-exempt status.

What are the benefits of being recognized as a 501()(1) non-profit charter school?

By being recognized as a 501(c)(1) non-profit, charter schools can access a plethora of benefits. These include exemption from federal income tax, eligibility to receive tax-deductible donations, and the ability to apply for various grants specifically available to non-profit organizations. Additionally, this status can increase a school’s credibility among stakeholders, fostering goodwill and support from the community.

What are the key components of the 501()(1) form?

-

This includes the name, address, and purpose of the charter school, along with the identification of any affiliated organizations.

-

Detailing the school's board of directors, policies, and procedures that govern the organization is crucial for IRS review.

-

Include a budget and financial statements that better illustrate your non-profit status and illustrate your expected revenues and expenses.

How should complete the 501()(1) form accurately?

Completing the 501(c)(1) form can seem daunting, but it is manageable with careful attention. Start by breaking the application into sections, ensuring that you fill in each required field completely. Pay particular attention to the eligibility criteria to avoid common mistakes such as misrepresenting your school's purpose or organizational structure, which could delay approval.

-

Review IRS guidelines for Form 1023 thoroughly to make sure all areas are addressed.

-

Utilize online editing tools from pdfFiller to ensure your form is clean and professional.

-

Consider seeking feedback from peers or accountants familiar with non-profit applications before submission.

How can pdfFiller assist in managing your 501()(1) form?

pdfFiller simplifies the entire process of form management, allowing users to upload, edit, and sign documents online. With user-friendly editing tools, you can revise your application efficiently, making necessary adjustments before submitting. Moreover, the eSigning features expedite the approval process, enabling quicker turnaround with your board and stakeholders.

What are best practices for submitting your 501()(1) form?

-

Confirm that all information is accurate and that you have included all necessary attachments before sending your application to the IRS.

-

While eFiling is faster, paper submissions may be necessary in some circumstances; make sure you choose the most appropriate method for your school's needs.

-

Use tracking features available on pdfFiller to monitor the status of your submission and respond promptly to any inquiries from the IRS.

How to maintain compliance after receiving your 501()(1) status?

Maintaining compliance is critical once your 501(c)(1) status is granted. Key requirements include the ongoing submission of annual returns and ensuring that your organization stays aligned with its declared purpose. Keeping meticulous records and documentation is essential for financial audits and for ensuring adherence to IRS regulations, which can help avoid costly penalties.

-

Organize financial statements and grants documentation systematically to facilitate easy access and audits.

-

Schedule regular compliance checks to verify that the school's operations align with its mission and governmental regulations.

When should seek expert assistance for 501()(1) forms?

Navigating the complexities of 501(c)(1) forms can be challenging, making expert guidance invaluable. Seeking help from a financial consultant or legal expert is recommended when you encounter uncertainties in the application process or require clarification on compliance regulations. Additionally, many resources through pdfFiller provide workshops and webinars that can equip you with deeper insights and assist your application process.

How to fill out the 501c1 non-profit charter school

-

1.Begin by accessing the pdfFiller platform and logging into your account.

-

2.Select the 'Create New Document' option, and search for the '501c1 non-profit charter school' template.

-

3.Once you find the template, click on it to open the form for editing.

-

4.Fill in the required fields, including the name of the school, the mission statement, and the detailed description of educational programs offered.

-

5.Provide information about the governing body, including board member names and their qualifications.

-

6.Input financial data such as funding sources and budget estimates for the school.

-

7.If applicable, attach any additional documents required for compliance with state regulations.

-

8.Review the completed form for accuracy and completeness, ensuring all necessary fields are filled.

-

9.Save your work frequently to avoid losing any information, and when satisfied, click on the 'Submit' button to finalize your charter school application.

-

10.Follow any post-submission instructions provided for next steps, including potential meetings or reviews.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.