Get the free Purchase by company of its stock template

Show details

This sample form, a detailed Purchase by Company of its Stock document, is a model for use in corporate matters. The language is easily adapted to fit your specific circumstances. Available in several

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is purchase by company of

A 'purchase by company of' document outlines the agreement where a company acquires goods or services from a vendor.

pdfFiller scores top ratings on review platforms

They have been very helpful and provided at least 90% of the files I have requested.

eally great program. Definitely handy for reports.

Your service is amazing and I spoke with the kindest gentleman who so graciously helped in my time of need. Ray I believe was the representatives name. I am unemployed single mother of 2 boys going through a nightmare of a custody battle with my x husband. I was confused and distraught and having trouble finding fillable forms online. Ray was my angel. Promote him! Exlnt.customer service skills. Thank You Ray,

Kristi Waters

This is the easiest tool to use for converting PDF's or signing contracts.

VERY USEFUL, but i wish you would offer per/document or per/use or even per/page service.

Easy. Questioned why we had to pay Scouts; but considered it is a donation for their service.

KAG

Who needs purchase by company of?

Explore how professionals across industries use pdfFiller.

How to manage the purchase by company of form form

How does a stock purchase proposal work?

A stock purchase proposal outlines the terms and conditions under which a company offers to buy back its shares from existing shareholders. This process is crucial for stockholders as it can enhance their investment's value and provide liquidity. The Board of Directors plays a significant role in this decision, ensuring that proposals align with shareholder interests and company strategy.

-

The primary purpose is to manage the company’s equity structure and provide an opportunity for stockholders to liquidate their investments.

-

Such proposals can help maintain or increase stock price by reducing the number of shares on the market.

-

The Board assesses market conditions and makes recommendations on the timing and amount of buybacks.

Who is eligible to participate in stock payouts?

Eligibility to sell shares during a buyback program typically depends on the number of shares owned and the length of ownership. Shareholders with less than the specified threshold may face restrictions or be encouraged to hold onto their shares for greater future returns. Expressing interest in a buyout usually involves formal communication with the company's investor relations.

-

Generally, stockholders must own a minimum quantity of shares as specified in the buyback announcement.

-

Those with fewer shares may have reduced opportunities due to company policies.

-

It's advisable for shareholders to directly contact the company, providing their ownership details.

What strategic factors influence share sales?

Understanding the motivations behind a company’s stock purchase program is essential for shareholders. Factors like market sentiment, economic conditions, and company performance can influence the decision to sell shares. Moreover, stock delisting poses significant implications on trading, potentially decreasing liquidity and increasing uncertainty for shareholders.

-

Companies buy back stocks to improve earnings per share and return capital to shareholders.

-

Changes such as economic downturns can lead investors to rethink their holdings.

-

If a stock is delisted, it can hinder trading operations for shareholders, affecting liquidity.

What are the financial impacts of selling stocks?

When considering selling shares back to the company, stockholders must weigh numerous factors. While they may receive benefits such as immediate liquidity and potential tax advantages, costs such as brokerage fees also need consideration. Comparing this process to traditional market sales highlights differences in timing, pricing, and convenience.

-

Selling shares back can provide immediate cash, which might be used for reinvestment or other needs.

-

Costs, such as brokerage commissions or possible tax implications, can affect overall returns.

-

Selling through a buyback may offer a fixed price but lacks the flexibility of the stock market.

How can stockholders provide feedback on proposals?

Gathering feedback from stockholders is vital for the Board to assess community sentiment about stock purchase proposals. Companies typically offer various methods—surveys, direct communication, or feedback forms—to collect opinions. Ensuring confidentiality allows stockholders to provide honest insights, directly impacting Board decisions.

-

Common avenues include email, online surveys, and shareholder meetings to discuss concerns.

-

Stockholder feedback can lead to adjustments in proposals, promoting shareholder trust.

-

Protecting feedback sources encourages transparency and honesty in opinions.

How can pdfFiller aid in streamlining stock transactions?

pdfFiller can significantly enhance the efficiency of document management when it comes to stock transactions. By utilizing this platform, users can fill out, edit, and eSign forms quickly and securely. The collaborative features ensure that stakeholders can manage documents from anywhere, facilitating a smoother transaction process.

-

Users save time and reduce errors in document handling, increasing overall productivity.

-

Step-by-step guides are available to assist users in completing necessary paperwork.

-

The ability to eSign and collaborate in real-time makes pdfFiller an optimal choice for teams.

How to manage shareholder expectations during the purchase process?

Communication is key in managing shareholder expectations as companies navigate stock buyback proposals. Clear disclosures regarding motivations and timelines foster transparency and trust. Establishing frameworks within which shareholders can understand the success criteria of the buyback can help manage any uncertainties.

-

Regular updates can keep shareholders informed of progression and any changes in proposals.

-

Setting clear goals allows for better understanding of what success looks like for the buyback initiative.

-

Being transparent boosts trust among stockholders, making them more likely to support initiatives.

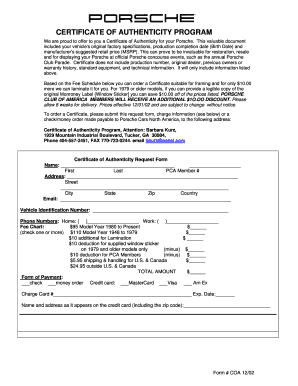

How to fill out the purchase by company of

-

1.Open pdfFiller and upload the 'purchase by company of' document.

-

2.Select the specific fields that need to be filled in, such as company name, address, and date.

-

3.Enter the required information accurately, including details of the product or service, quantity, and price.

-

4.If applicable, include any terms and conditions relevant to the purchase.

-

5.Review all entered information for accuracy and completeness before submission.

-

6.Once finalized, save the document on your device or share it directly with the vendor.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.