Get the free Incentive and Nonqualified Share Option Plan template

Show details

This is a multi-state form covering the subject matter of the title.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

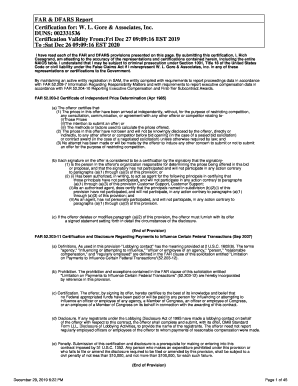

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is incentive and nonqualified share

Incentive and nonqualified shares refer to stock options that provide different tax treatments and eligibility criteria for employees and their stock options.

pdfFiller scores top ratings on review platforms

convenient filling, navigation and editing

I really liked what was offered

THE BEST I HAVE SEEN

good

easy to use

Easy to work with.

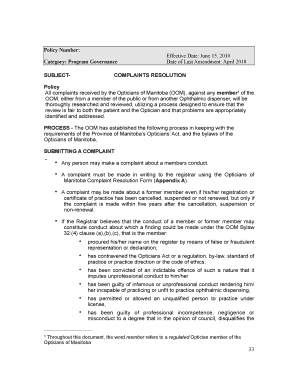

Who needs incentive and nonqualified share?

Explore how professionals across industries use pdfFiller.

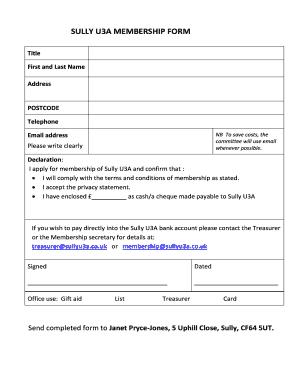

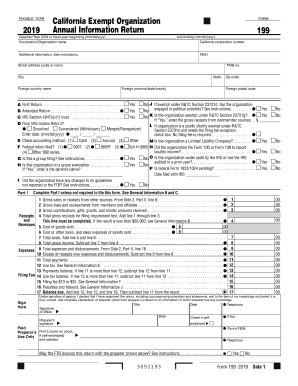

How to fill out the incentive and nonqualified share

-

1.Start by opening the specific PDF document for the incentive and nonqualified shares.

-

2.Begin by filling in the employee's full name in the designated field.

-

3.Next, enter the employee's identification number or social security number as required.

-

4.Proceed to specify the type of shares being issued, indicating whether they are incentive or nonqualified.

-

5.Fill in the total number of shares awarded to the employee in the corresponding section.

-

6.Enter the grant date, which is the date the shares are awarded to the employee.

-

7.For tax purposes, include the fair market value of the shares on the grant date in the provided field.

-

8.If applicable, fill in any vesting schedule details, indicating when the employee will fully own the shares.

-

9.Once all fields are completed, review the information for accuracy and completeness before signing.

-

10.Finally, save the filled document and submit it to the appropriate department or individual for processing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.