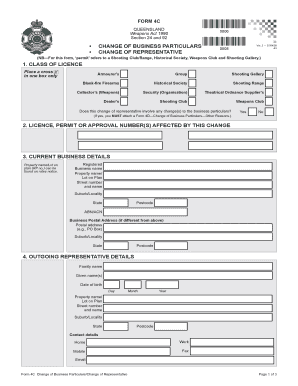

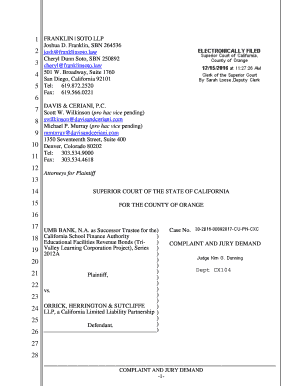

Get the free Changing state of incorporation template

Show details

This sample form, a detailed Changing State of Incorporation document, is a model for use in corporate matters. The language is easily adapted to fit your specific circumstances. Available in several

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is changing state of incorporation

Changing state of incorporation refers to the process of a corporation relocating its legal incorporation from one state to another.

pdfFiller scores top ratings on review platforms

It's a big help. A person needs to learn to use the tools and that can lead to some lost time in the beginning. Regardless, the value is great.

Overall the site is helpful. Experienced technical difficulties and it took some time to get things taken care of.

I would prefer is the numbers were automatically added.

So far... your chat feature to get support is great. I seem to be moving along just fine. I uploaded a document and completed areas of "fillable" information. I only did 4 STARS as I have not published this to my site and tested the form.

It has been useful both times that I have needed it.

Program works great for what I need; it is convenient, easy, and worth the money.

Who needs changing state of incorporation?

Explore how professionals across industries use pdfFiller.

How to change your state of incorporation: A comprehensive guide

Understanding the importance of changing state of incorporation

Changing your state of incorporation can significantly impact your business's legal and financial status. The state of incorporation refers to the jurisdiction in which a company is legally registered to operate. Many companies pursue this change for various reasons, such as seeking more favorable tax laws, improved corporate governance, or more robust legal protections.

-

This is the state where a corporation registers its business, subjecting it to that state's laws.

-

Common reasons include tax benefits, legal flexibility, and enhancing corporate governance.

-

Different states have varying laws that can affect how a company is governed and operated.

Why choose Delaware for reincorporation?

Delaware is often seen as the preferred state for business incorporation due to its business-friendly laws. Known for its flexible corporate laws and established court system, Delaware provides numerous benefits for new and established businesses.

-

Delaware has a rich legal tradition that is business-friendly, featuring established case law and corporate statutes.

-

Incorporating in Delaware offers strong investor protection and flexibility in structuring your business.

-

Delaware usually provides more advantageous laws compared to states like California, particularly for larger corporations.

Key steps to change your state of incorporation

To successfully change your state of incorporation, consider the following steps that pave the way for a smooth transition. Evaluating the necessity of this change is crucial for future success.

-

Carefully assess if the benefits outweigh the costs of changing your state of incorporation, considering tax implications and legal protections.

-

Ensure that all necessary documents, including articles of incorporation, are ready for submission.

-

Communication with all stakeholders is key, as their approval may be needed to proceed.

Legal considerations for changing your state of incorporation

Changing your state of incorporation comes with legal requirements that must be navigated carefully. Understanding these legal implications can help avoid pitfalls down the line.

-

It’s essential to understand that each state has specific laws governing the incorporation process.

-

Evaluate how changing states can affect your tax obligations, as various states offer distinct tax incentives.

-

Ensure that all Delaware regulations are met, which may include specific forms and fees to submit.

Navigating the reincorporation process with pdfFiller

pdfFiller provides tools and resources to simplify the reincorporation process. By utilizing their interactive tools, you can manage documents more efficiently.

-

Creating and managing your documents through pdfFiller's user-friendly interface can streamline your efforts.

-

Follow precise instructions offered by pdfFiller to ensure all fields are accurately completed.

-

pdfFiller’s e-signature features allow for quicker document approval and processing.

Interactive tools for managing your reincorporation journey

Managing your documentation through interactive digital tools enhances collaboration during reincorporation. pdfFiller provides robust services to navigate this journey effectively.

-

Take advantage of various templates that simplify drafting the necessary corporate forms.

-

Engage teams effectively with collaboration features that support remote teamwork.

-

Monitor document edits through real-time tracking, ensuring every change is accounted for.

Post-reincorporation: What comes next?

After successfully changing your state of incorporation, it's important to outline what actions must follow. Maintaining compliance and effective communication with stakeholders are essential.

-

Develop clear communication plans to update stakeholders about the change and its implications.

-

Stay informed about Delaware laws to ensure your business aligns with state requirements.

-

Implement governance strategies that adapt to the new legal environment following your reincorporation.

Compare your options: Delaware vs other states

When considering where to incorporate, comparing Delaware with other states can help clarify the best choice for your business. Understanding the corporate climate in different states aids in making an informed decision.

-

Review various states' incorporation benefits, such as tax rates and business laws.

-

Examine the differences in legal structures and corporate laws between Delaware and California.

-

Evaluate how Delaware's business environment stacks up against other commonly chosen states for incorporation.

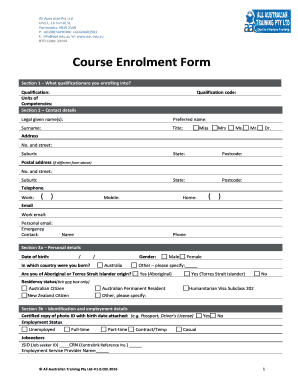

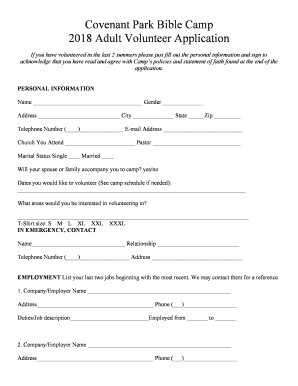

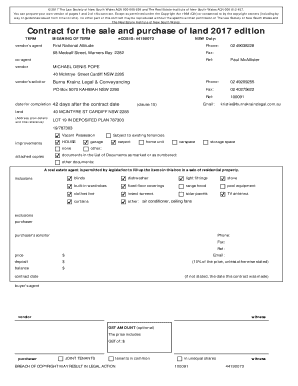

How to fill out the changing state of incorporation

-

1.Start by downloading the appropriate form for changing the state of incorporation from pdfFiller.

-

2.Open the form in pdfFiller and review the required fields carefully.

-

3.Enter the current name of the corporation in the designated section.

-

4.Provide the new state of incorporation to which the business will relocate.

-

5.Fill out the address of the new registered office in the new state.

-

6.Include details of the corporate officers and the registered agent in the new state as required.

-

7.Review the document for accuracy and completeness before submission.

-

8.Once completed, save the document within your pdfFiller account or download it for filing with the state authorities.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.