Get the free Plan of complete liquidation and dissolution template

Show details

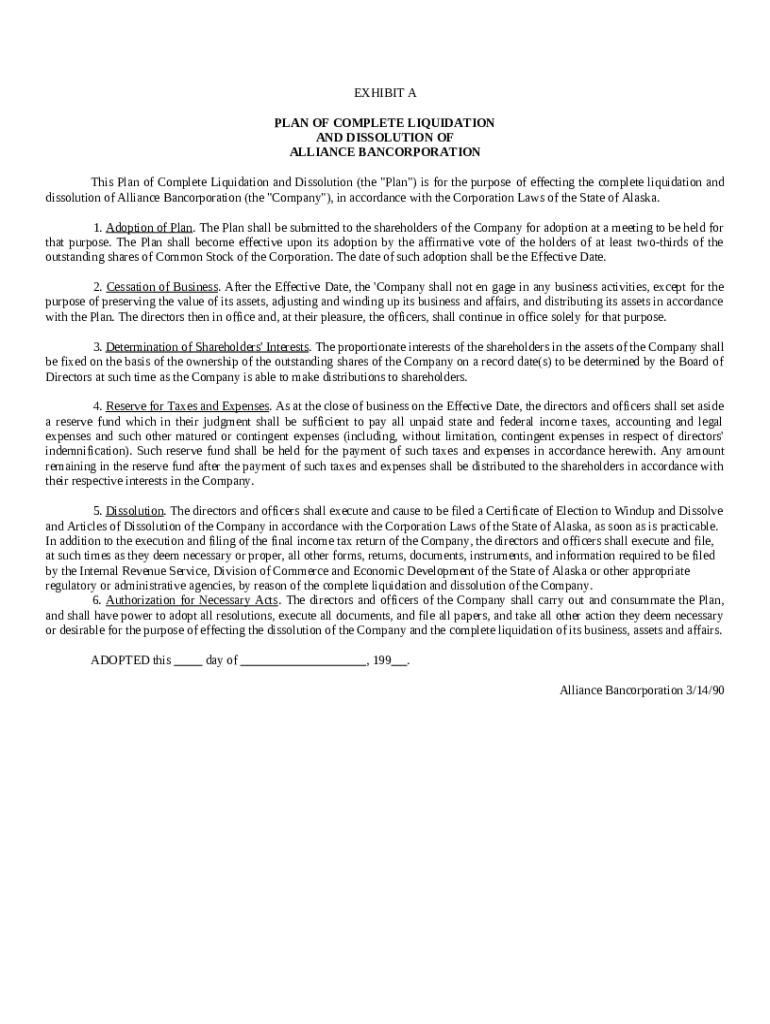

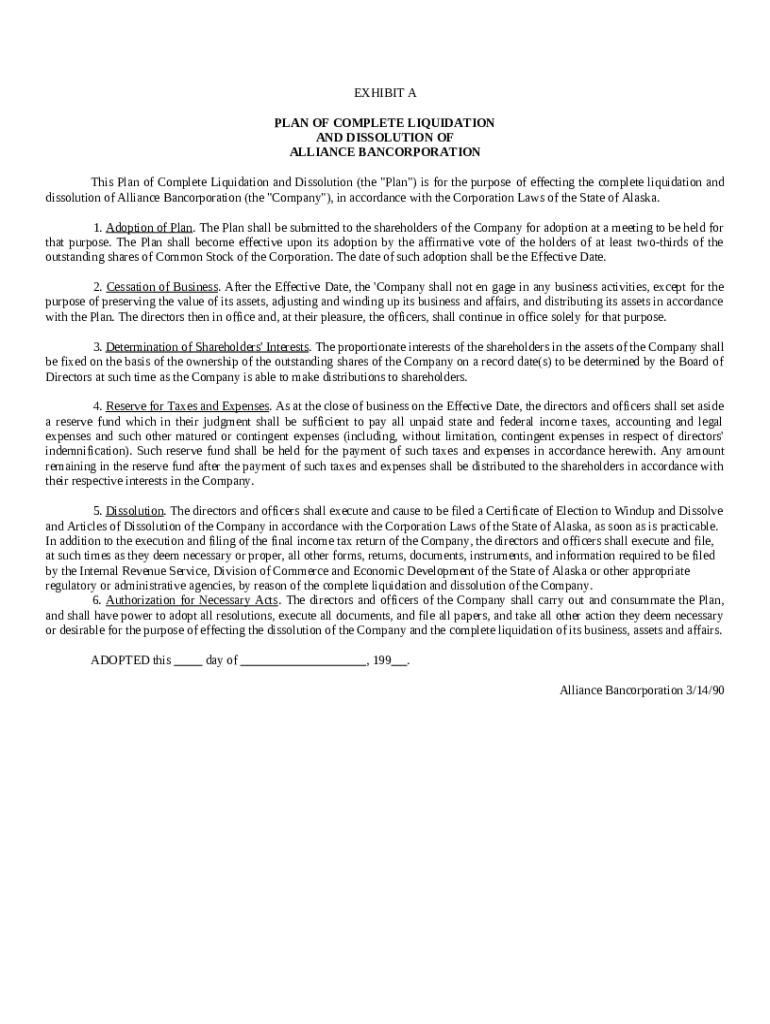

This sample form, a detailed Plan of Complete Liquidation and Dissolution document, is a model for use in corporate matters. The language is easily adapted to fit your specific circumstances. Available

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is plan of complete liquidation

A plan of complete liquidation is a legal document that outlines the process for winding up a company's affairs and distributing its assets to shareholders after a decision to dissolve the company.

pdfFiller scores top ratings on review platforms

it was very easey to used

excellent program and i love it very much

Wonderful tool. A pit pricey though

I need your service to sign & date pdf forms online.

great software

Just learning how to use it.

Who needs plan of complete liquidation?

Explore how professionals across industries use pdfFiller.

Plan of Complete Liquidation Form Guide

Understanding the plan of complete liquidation

A plan of complete liquidation is a formal document outlining how a corporation will wind down its activities and distribute its assets. This process is significant in corporate dissolution as it ensures all stakeholders understand how their interests will be managed. In [region], specific laws govern how liquidation must occur, mandating compliance to protect shareholder rights.

-

The document specifies the stages of dissolving a business and outlines the distribution of assets.

-

It formalizes the process, guides stakeholders through the dissolution, and protects against disputes.

-

Laws vary significantly; it’s crucial to understand local regulations impacting the liquidation process.

What steps to take to prepare a plan of complete liquidation?

Preparing a liquidation plan involves several crucial steps that ensure all necessary proposals are included and stakeholders are informed. Initially, recognize the need for a liquidation plan, then consult with stakeholders who will be impacted. Obtaining the required approvals from shareholders is essential before drafting the plan.

-

Assessing financial health and operational viability is crucial.

-

Ensure all voices are heard and legal thresholds for votes are met.

-

Incorporate timelines, asset valuations, and distribution methods.

What are the legal requirements for adoption?

Adopting a plan of complete liquidation requires strict adherence to various legal requirements. Shareholder approval is critical, often needing a specific voting threshold. Once the plan is adopted, several filing requirements in [region] must be navigated to ensure compliance with state and federal laws.

-

Understand how many votes are needed for the plan to pass.

-

Certain forms must be filed with local authorities to commence the liquidation.

-

A firm grasp on legal obligations ensures smooth proceedings.

What happens after the cessation of business activities?

After executing the liquidation plan, the business will officially cease operations. It’s important to manage this transition smoothly to preserve the value of the remaining assets. During liquidation, continuous communication with stakeholders is key to maintaining transparency.

-

All business operations come to a halt, and stakeholders must be informed of timelines.

-

Professional assessments can assist in maximizing final asset value.

-

Coordination of activities is crucial through the winding-down phase.

How to determine shareholders’ interests?

It is essential to accurately assess the interests of shareholders during the liquidation process. Guidelines must be followed for determining the fair value of assets and ensuring equitable distribution based on share ownership. A clear timeline for these distributions ensures that communications remain clear and timely.

-

Engaging professional appraisers can provide a neutral assessment.

-

The plan should clearly stipulate how assets are divided.

-

Regular updates must keep stakeholders informed of distribution schedules.

What should you consider when setting up reserve funds for expenses?

Establishing reserve funds during liquidation can mitigate unexpected expenses that may arise. It’s imperative to identify potential costs early on and consider best practices for creating these funds. Understanding the legal implications in [region] helps ensure that these funds are allocated appropriately.

-

Include legal fees, taxes, and other operational costs.

-

Allocate enough resources to cover uncertainties.

-

Check local laws to ensure compliance with financial regulations.

How can pdfFiller facilitate your liquidation form management?

pdfFiller offers tools for managing your plan of complete liquidation form efficiently. Users can access the form, fill it out, and eSign it, making collaboration with stakeholders straightforward. Using pdfFiller’s cloud-based platform facilitates document versioning and compliance.

-

The user-friendly interface enables easy access and completion.

-

Digital signatures ensure security and speed up the process.

-

All changes are tracked, ensuring you stay compliant.

What are the updates and ongoing compliance post-liquidation?

After liquidation, it’s crucial to monitor ongoing compliance with final filing requirements. Handling any residual legal matters and claims is also important to finalize the dissolution process. Maintaining thorough records helps in defending against any future disputes or claims.

-

Stay updated on any deadlines to avoid penalties.

-

Address any outstanding obligations as they arise.

-

Documentation may be needed for audits or legal inquiries.

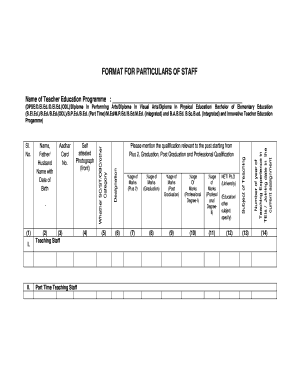

How to fill out the plan of complete liquidation

-

1.Open the plan of complete liquidation template on pdfFiller.

-

2.Begin by entering the company's legal name and registration number at the top of the document.

-

3.Provide the date of the resolution to liquidate.

-

4.List the names and titles of the individuals responsible for overseeing the liquidation process.

-

5.Outline the steps the company will take to sell its assets, including any necessary timelines.

-

6.Detail the priority of claims against the company's assets, such as creditors and shareholder payments.

-

7.Include sections for notifying relevant parties, such as employees and suppliers, about the liquidation.

-

8.Review the document for accuracy and completeness.

-

9.Save the completed document and prepare it for submission to relevant state authorities.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.