Last updated on Feb 17, 2026

Get the free Clauses resulting in Additional Rent template

Show details

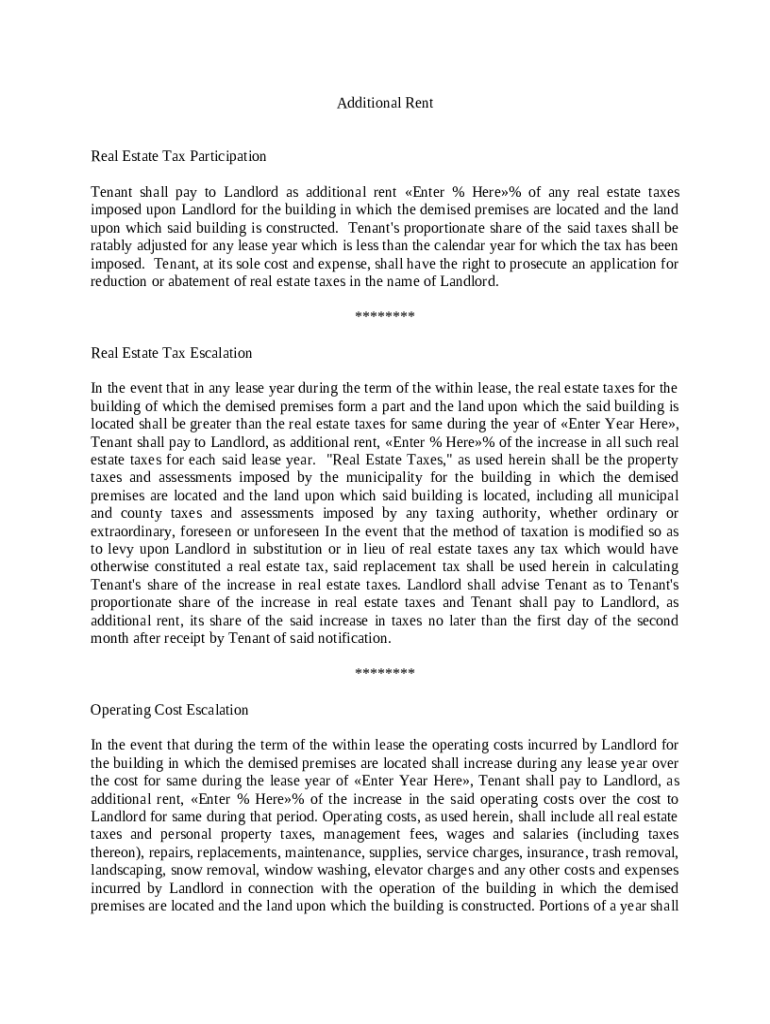

Used as examples of clauses resulting in Additional Rent fees. Included are: Real Estate Tax Participation Clause, Real Estate Tax Escalation Clause, Operating Cost Escalation, Cost of Living Adjustment

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is clauses resulting in additional

Clauses resulting in additional refer to supplemental provisions added to a legal document that clarify, modify, or expand upon existing terms and conditions.

pdfFiller scores top ratings on review platforms

All working good

excellent tool

Fantastic app

Fantastic app. I advice eall white collar persons.

easy & nice to use

very effective

I had to work on and sign some pdf…

I had to work on and sign some pdf documents urgently. I signed up for pdfFiller and, without any instructions, I navigated the software myself and finished my work within an hour.

Who needs clauses resulting in additional?

Explore how professionals across industries use pdfFiller.

Understanding clauses resulting in additional rent for real estate taxes

If you're navigating the complexities of real estate leases, understanding clauses resulting in additional rent due to real estate taxes is essential. These clauses can significantly impact your financial obligations as a tenant or landlord. This guide will cover the intricacies of these clauses and aid in comprehension and negotiation.

-

These clauses in lease agreements specify situations where the tenant may owe extra payments for costs incurred beyond the base rent, particularly for property-related taxes.

-

Understanding these clauses is crucial for both tenants and landlords. They can affect overall leasing costs and responsibilities, bringing transparency in negotiations.

-

Depending on the clause's wording, either the tenant or the landlord may be responsible for property tax liabilities.

What are key components of real estate tax participation?

Understanding tenant obligations in real estate tax participation is vital. Typically, tenants are required to pay a proportionate share of property taxes based on the total leased space.

-

Tenants must be informed about their obligations to pay a share of real estate taxes, which is often detailed in the lease.

-

Tax calculations usually take into account the tenant's proportional share according to the leased space relative to the entire property.

-

There are various assessments considered real estate taxes, such as municipal or regional taxes, which could directly impact rental costs.

How do tenant rights impact tax abatement applications?

Tenants generally possess rights regarding tax reduction or abatement applications. These rights empower them to initiate requests that may lead to reduced tax liabilities.

-

Tenants can initiate applications for tax reductions, contributing to fiscal relief on their real estate tax obligations.

-

The procedure often involves filing on behalf of the landlord, which may involve certain agreements or stipulations.

-

There are numerous situations in which tenants might pursue abatement, such as significant property changes or miscalculated assessments.

What is real estate tax escalation?

Real estate tax escalation procedures dictate how tax increases during the lease term can affect financial obligations. These escalations can create unexpected cost burdens for tenants.

-

There's typically a method for calculating how tax increases are applied, which should be clearly understood by tenants.

-

It's crucial to determine the conditions under which tenants are responsible for increased taxes to avoid surprises.

-

Various methods of taxation exist, and understanding them can provide insights into potential costs over time.

How to navigate complex lease agreements?

Navigating lease agreements can be challenging, especially regarding additional rent clauses. It's essential to be equipped with strategies to ensure favorable terms.

-

Have clear negotiation strategies in place to secure better terms related to additional rent clauses.

-

A few common pitfalls exist when reviewing lease terms, such as overlooking hidden charges or ambiguous wording.

-

Using tools like pdfFiller can greatly assist in managing lease documents for comprehensive tracking and strategic editing.

What interactive tools assist with document management?

Interactive tools streamline the management of forms and documents. With solutions like pdfFiller, users can leverage features that enhance document collaboration.

-

pdfFiller provides intuitive editing features that allow users to modify documents efficiently, suiting their needs.

-

A cloud-based platform offers enhanced collaboration opportunities, making it easier to manage documents from any location.

-

The tools offered can significantly simplify lease management tasks, saving users both time and effort.

What compliance considerations should be made for real estate taxes?

Compliance with local laws regarding real estate taxes is critical for landlords and tenants. Staying updated can prevent legal complications.

-

Each region has specific requirements that must be adhered to in relation to real estate taxes.

-

Staying current with changes in tax legislation can help in effective financial planning and compliance.

-

Adhering to best practices on compliance can safeguard both tenants' and landlords' interests in lease agreements.

How can template features enhance lease documents?

Utilizing available templates for lease agreements can simplify the process, ensuring all necessary clauses are included.

-

pdfFiller offers various templates tailored to specific lease agreement needs, helping users get started quickly.

-

Users can follow step-by-step instructions for effectively utilizing templates for real estate tax clauses.

-

The platform allows for extensive customization of lease agreements to fit unique requirements, ensuring clarity and compliance.

How to fill out the clauses resulting in additional

-

1.Open pdfFiller and upload the document you want to add clauses to.

-

2.Select the 'Edit' feature to modify your document.

-

3.Identify the section where additional clauses are needed.

-

4.Click on the 'Add Text' option and position it accordingly.

-

5.Type in the additional clauses you wish to include, ensuring they are clear and concise.

-

6.Review the added clauses for accuracy and legal clarity before finalizing.

-

7.Save your changes and download or share the updated document as needed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.