Get the free Borrowers Certificate template

Show details

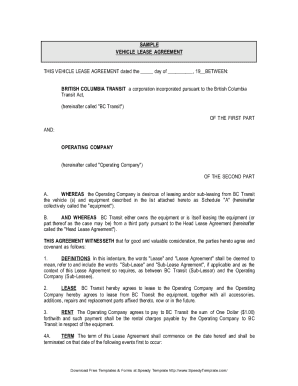

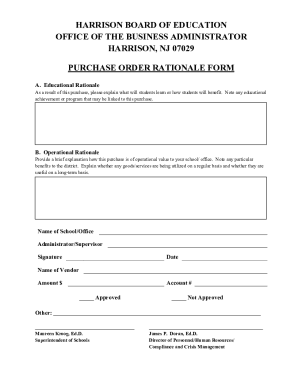

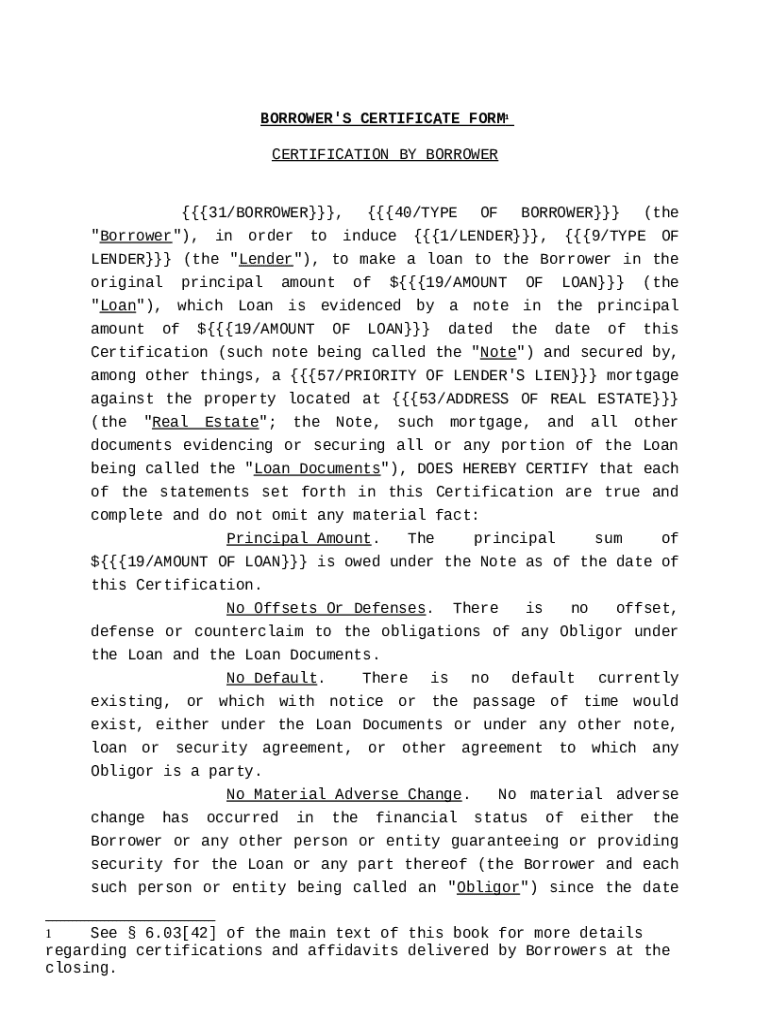

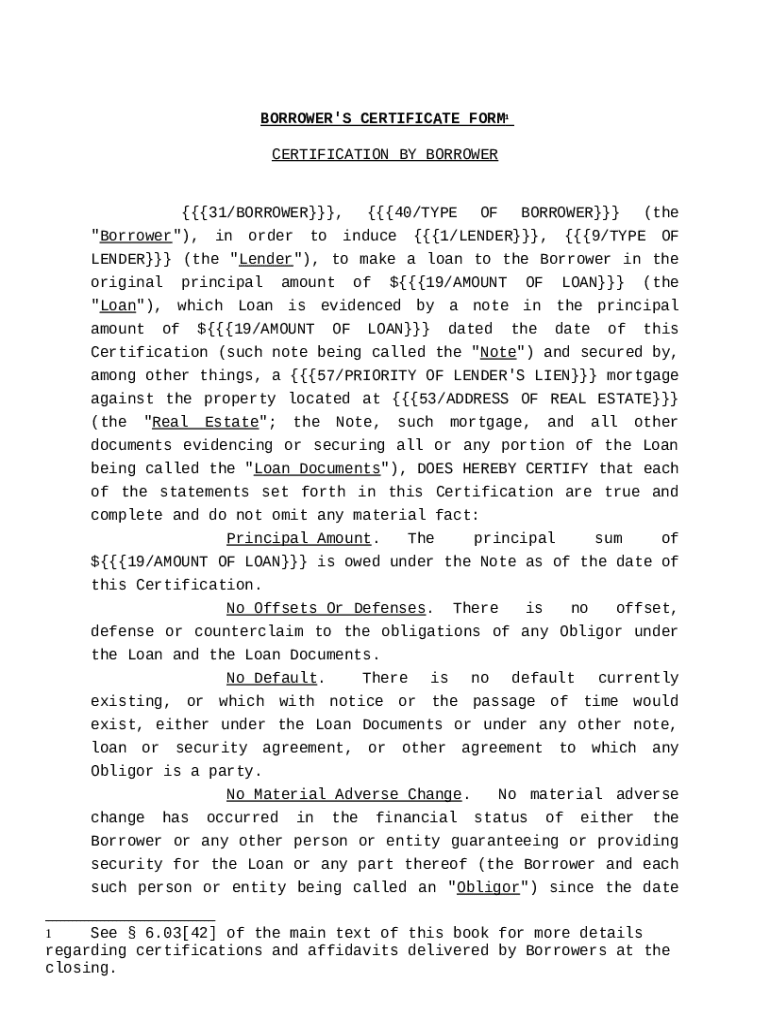

"Borrowers Certificate Form" is a American Lawyer Media form. This is form is a borrowers certificate that is used for the borrowers certification.

We are not affiliated with any brand or entity on this form

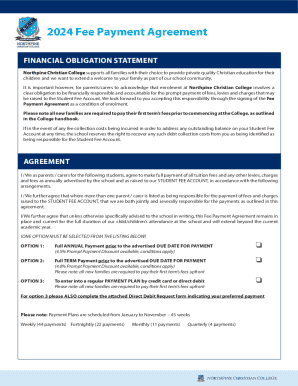

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is borrowers certificate form

A borrower's certificate form is a document that certifies an individual's request for a loan and provides necessary borrower information.

pdfFiller scores top ratings on review platforms

Once I figured out how to format what I needed the result were impressive. 100% recommended.

This is super helpful to sign form electronically and draft and share contracts.

Easy overall: navigating website, finding forms, downloading, etc.

I've been very impressed with this programme to date.

It worked very well and was easy to use.

Easy to use and unlocks everything I have needed.

Who needs borrowers certificate template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Borrower's Certificate Form

What is a borrower's certificate form?

A borrower's certificate form is a vital document used in loan agreements to certify important details about the borrower. It ensures transparency between the borrower and lender, outlining the key terms of the loan. Understanding this form is essential for anyone seeking financial assistance.

-

The form serves to formally record the borrower's commitment and details regarding the loan.

-

It validates the terms agreed upon and protects both parties involved.

-

Submitting false information on this form can lead to legal consequences and potential forfeiture of the loan.

What are the key components of the borrower's certificate form?

A borrower's certificate form consists of several key components that outline the relationship and agreements between the borrower and lender. Grasping these components will help ensure that the form is filled out correctly.

-

Understanding the dynamics between borrower and lender is crucial for ensuring compliance and successful loan processing.

-

Details regarding the loan amount, including interest rates and repayment terms, need to be crystal clear.

-

This outlines the lender's legal right to claim the property in case of default, which is critically important for borrowers.

-

The specific property address ties the loan to a physical asset, safeguarding the lender’s interests.

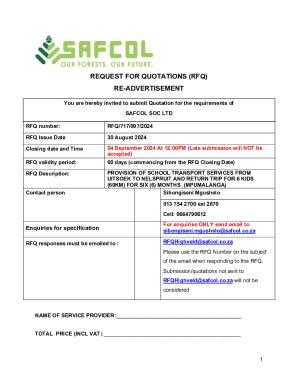

How can you complete the borrower's certificate form?

Completing the borrower's certificate form correctly is essential for smoother processing. Here are step-by-step instructions to help guide you through the process.

-

Collect all necessary documents beforehand, such as identification and financial statements.

-

Follow the form’s structure meticulously, ensuring each section is accurately filled.

-

Double-check your entries to prevent mistakes that could delay your loan.

-

Different borrower types, such as individuals vs. corporations, may have specific nuances in the form.

What are the best practices for filing and managing the borrower's certificate form?

Properly filing and managing the borrower's certificate form is essential for compliance and record-keeping. Here are several best practices to follow.

-

Always double-check your certificate for any discrepancies before submission.

-

Understand various submission options, including online or physical filings.

-

Utilize tools like pdfFiller for efficient document management and tracking.

-

Know when and how to make changes if your loan terms or personal information alters.

What compliance considerations are important for the borrower's certificate form?

Compliance is crucial when completing a borrower's certificate form to avoid legal challenges. Understanding specific requirements helps mitigate risks.

-

Be aware of the regulations governing the completion of the form to remain compliant.

-

Compliance requirements can vary by state or region, so ensure you are familiar with local laws.

-

Failure to adhere to legal requirements can result in severe penalties, including the voiding of the loan.

How to troubleshoot common issues with the borrower's certificate form?

Even after careful preparation, issues can arise with the borrower's certificate form. Here’s how to troubleshoot and resolve them effectively.

-

If rejected, contact your lender for feedback on necessary corrections.

-

Clarify any discrepancies with lenders immediately to prevent delays.

-

Know your legal rights and obligations related to the loan to navigate disputes effectively.

What features does pdfFiller offer for enhanced documentation management?

Taking advantage of pdfFiller can simplify the process of managing your borrower's certificate form and other documents. Here are some of the useful features.

-

pdfFiller allows users to easily edit PDFs, enhancing the efficiency of completing necessary forms.

-

Work with teams effortlessly on document management, ensuring everyone is on the same page.

-

Legally sign documents online, facilitating a seamless process for approving the borrower's certificate form.

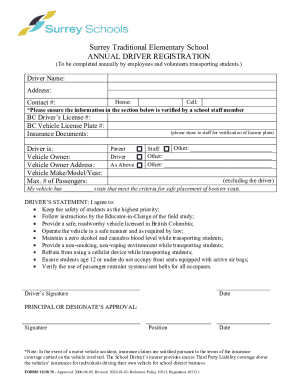

How to fill out the borrowers certificate template

-

1.Open the borrowers certificate form in pdfFiller.

-

2.Begin by entering your full name in the designated field.

-

3.Next, input your current address, including city, state, and ZIP code.

-

4.Fill in your Social Security Number for identity verification.

-

5.Provide your contact details such as phone number and email address.

-

6.Indicate the purpose of the loan in the specified section (e.g., home purchase, education).

-

7.Fill out your employment information, including your employer's name and your position.

-

8.Add your annual income and any additional income sources if applicable.

-

9.Review all entered information for accuracy before submitting.

-

10.Save the completed form and download a copy for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.