Get the free Special Rules for Designated Settlement Funds IRS Code 468B template

Show details

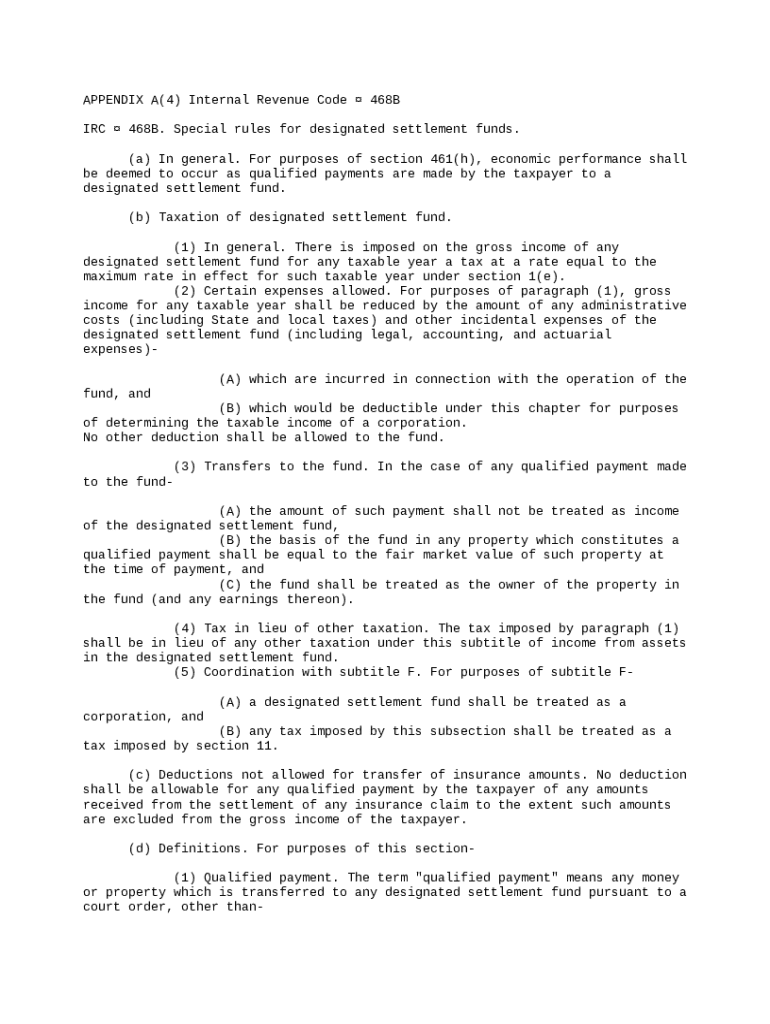

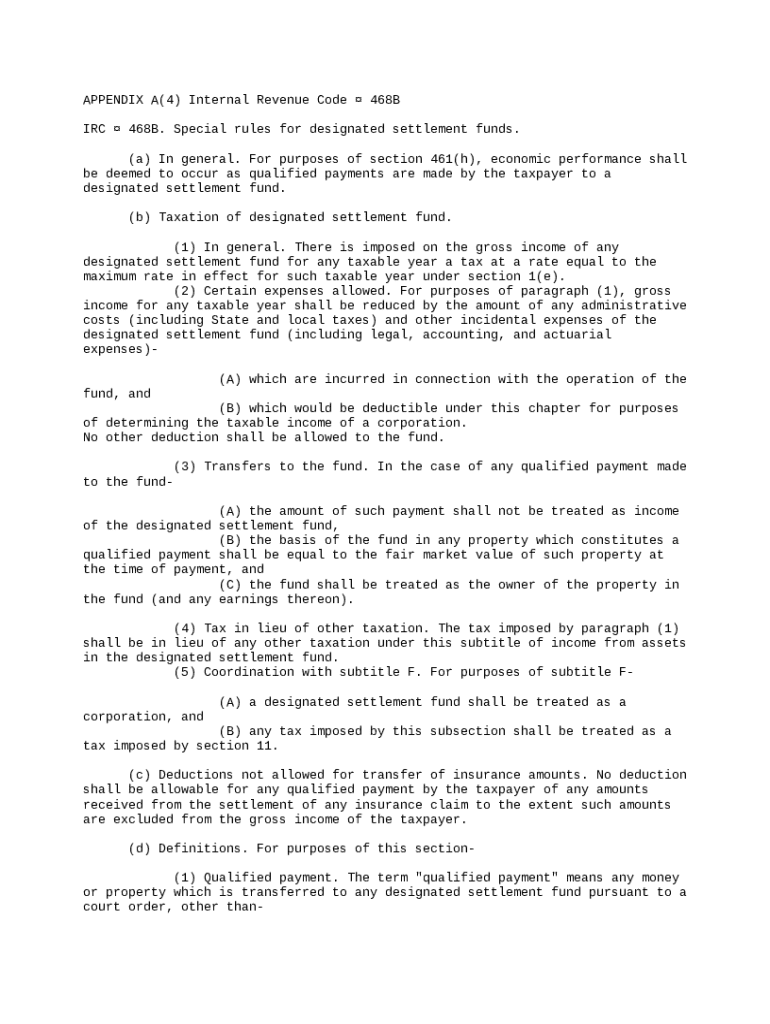

Statutory Guidelines [Appendix A(4) IRC 468B] regarding special rules for designated settlement funds.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is special rules for designated

Special rules for designated refer to specific guidelines applicable to certain individuals or entities regarding certain regulations or benefits.

pdfFiller scores top ratings on review platforms

mui bueno trbaja rápido y tiene un magnifico sorte

Had some difficulties but gotthem taken care of.

IT IS VERY FRIENDLY AND EASY TO USE. i LIKE IT

It works great. Only thing is how can I use another claim for the same clients with different dates?

Quickly created my document and now I have the appropriate paperwork for my business. Well worth the time and investment.

Makes working on the road and being away so convenient - personally and business.

Who needs special rules for designated?

Explore how professionals across industries use pdfFiller.

Understanding the Special Rules for Designated Settlement Funds

What are designated settlement funds?

Designated settlement funds are financial vehicles established to settle or manage claims in a manner that aligns with federal and state regulations. The primary purpose of these funds is to facilitate the distribution of payments from qualified settlements efficiently while adhering to specific tax laws. Understanding the history and evolution of these funds provides insight into their significance in the current landscape of tax law and compliance.

-

Designated settlement funds are intended to handle money in settlement-related situations, streamlining payment processes and ensuring compliance with tax obligations.

-

These funds have evolved to adapt to changing regulations and tax laws, ensuring that they serve their intended purpose efficiently.

-

They play a critical role in tax compliance, helping individuals and organizations understand their obligations.

What are the general economic performance rules?

The general economic performance rules outline how economic performance is recognized under tax legislation, specifically focusing on payments made from a designated settlement fund. These rules aim to clarify when expenses are deductible and the implications of qualifying payments for tax purposes. Familiarity with these criteria ensures appropriate compliance and maximization of allowable deductions.

-

Economic performance is recognized when the obligation to pay has been fulfilled according to IRS regulations.

-

Qualified payments must meet specific conditions to ensure they are adequately recognized for tax purposes.

-

Processing these qualified payments can be made easier using pdfFiller tools for document management.

What is the taxation overview of designated settlement funds?

Taxation on designated settlement funds is predicated on recognizing gross income and understanding applicable maximum tax rates. It is crucial to navigate these tax implications correctly to prevent potential legal issues with tax agencies. Efficiently tracking and reporting tax obligations can be facilitated with tools such as pdfFiller, ensuring compliance.

-

Funds must be included in gross income, impacting the overall taxable amount.

-

There are specific tax rates applicable under section e that must be adhered to when calculating liability.

-

Utilize pdfFiller tools for accurate reporting and documentation of tax obligations.

What deductions and allowable expenses exist?

Various administrative costs can be deducted when managing a designated settlement fund. This includes understanding which state and local taxes are applicable and determining what legal, accounting, and actuarial expenses are eligible for deduction. Utilizing tools such as pdfFiller can streamline the documentation process for these deductions.

-

Expenses incurred for fund management may be eligible for deductions, including staff and operational costs.

-

Both state and local tax obligations must be accounted for in the overall deductions.

-

Use pdfFiller to simplify documentation and calculation of allowable deductions.

How are transfers to a designated settlement fund handled?

Handling transfers into a designated settlement fund requires careful consideration of how qualified payments impact income and the basis of property within the fund. Understanding ownership rights and the earnings generated on property can simplify the transfer process. Certain digital tools can facilitate this process, enhancing efficiency.

-

These payments need to be correctly identified in terms of their tax implications.

-

The basis of property held within the fund affects accounting practices and potential gains.

-

Utilizing pdfFiller ensures all paperwork regarding transfers is correctly filed and tracked.

What is the tax in lieu of other taxation?

The specific tax imposed on designated settlement funds plays a crucial role in managing potential tax obligations. It is essential to recognize how this tax compares with other types, as understanding best practices for filing can mitigate risks associated with misreporting. Accessing pdfFiller's features can assist in maintaining efficient and accurate tax documents.

-

This tax must be properly calculated and reported during tax filings.

-

Assessing how this tax aligns with similar taxes can provide clarity in tax planning.

-

best practices include documenting and tracking all relevant tax information through pdfFiller's tools.

How does coordination with Subtitle F work?

Understanding the interaction of designated settlement funds with Subtitle F provisions is crucial for compliance. This coordination outlines how designated settlement funds are to be treated, impacting both users and participants involved in the funds. Ensuring compliance through robust document management features offered by pdfFiller can help streamline compliance efforts.

-

Designated settlement funds have particular procedures that must be followed to ensure compliance under Subtitle F.

-

Participants must be aware of their rights and obligations under these provisions.

-

Leveraging document management tools can help maintain compliance and assist in understanding user obligations.

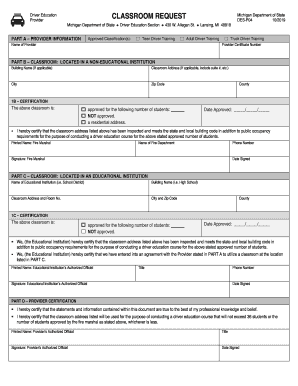

How to fill out the special rules for designated

-

1.Open the PDF document for special rules for designated.

-

2.Read the instruction section carefully to understand the specific requirements.

-

3.Locate the designated fields that need to be filled out in the document.

-

4.Begin with entering your name and contact information in the personal details section.

-

5.Proceed to fill out the section regarding your designation status, ensuring accuracy.

-

6.If applicable, provide any necessary supporting documents as indicated.

-

7.Review all entered information for correctness and completeness before submission.

-

8.Use the signature field to sign the document digitally or print it for physical signing if required.

-

9.Follow any additional instructions for submitting the form, whether electronically or by mail.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.