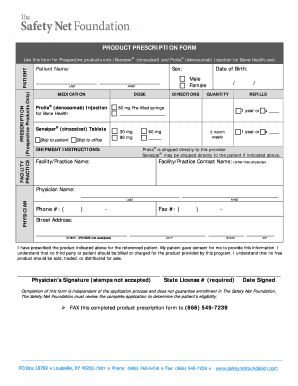

Get the free Issuer - Underwriter - Oriented Sample Stored Value Product Agreement and Disclosure...

Show details

This form is a detailed contract regarding software or computer services. Suitable for use by businesses or individual contractors. Adapt to fit your specific facts.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is issuer - underwriter

An issuer-underwriter agreement is a contract where an underwriter assists an issuer in raising capital by underwriting and selling securities to investors.

pdfFiller scores top ratings on review platforms

Easy to use. So far, it has done what I needed, but if I won't be able to keep the form once it's created, it won't fit my needs.

Great program but you have to pay before you can print

having trouble getting it to print the whole form... it's only printing the content even when I choose "print original"

Had some trouble with billing and the customer service was right on it and took care of the problem. Software is good and being able to access various pre-made docs is very nice.

This program has made converting locked PDF files more manageable.

this program is the answer to all who work with osha 300 log; thank you so much. Mahalo, and Aloha.

Kalani Whitford / Safety Officer

National Fire Protection Inc.

Who needs issuer - underwriter?

Explore how professionals across industries use pdfFiller.

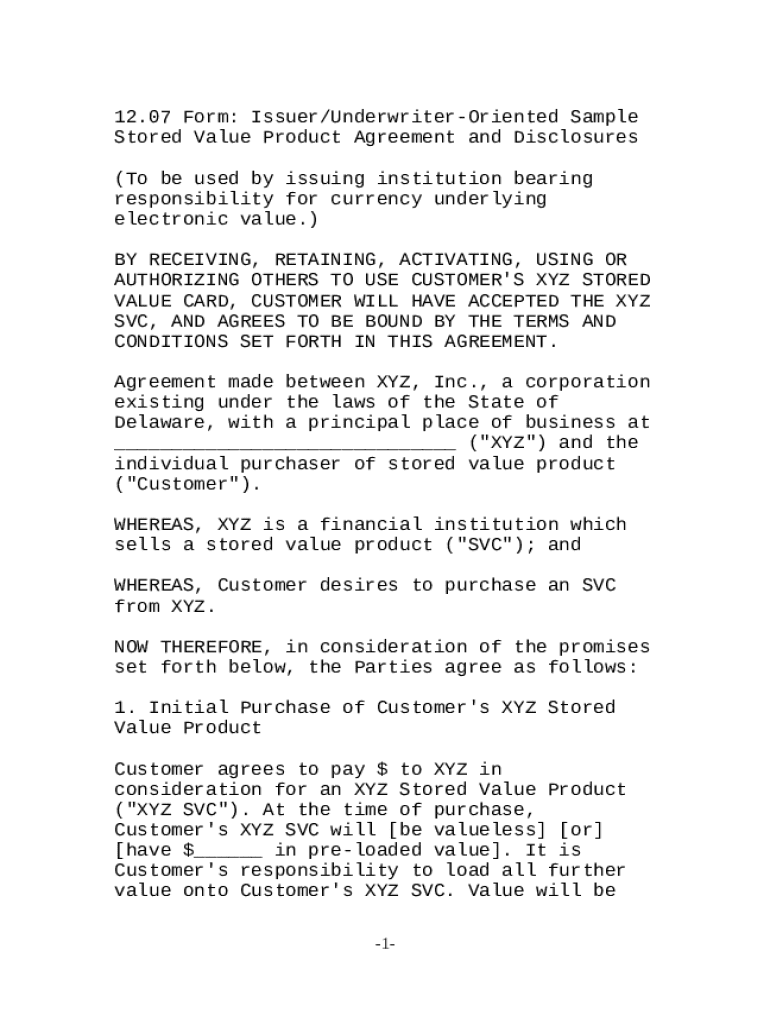

How to fill out an issuer-underwriter form

Understanding the issuer-underwriter relationship

The issuer-underwriter relationship is a crucial component in securities transactions. An issuer is an entity that makes a public offering of securities, while an underwriter assists in marketing and selling these securities to investors. Effective collaboration between these parties significantly impacts the funding process, especially in ensuring compliance with regulatory standards.

-

Understand the distinct roles of issuers and underwriters to navigate the funding process effectively.

-

Collaboration ensures that the securities are properly marketed and comply with necessary regulations.

-

The relationship directly influences the ease of obtaining funding and the success of securities transactions.

Purpose and structure of the issuer-underwriter form

The Issuer-Underwriter Form serves critical purposes in managing securities transactions. It outlines specific requirements and roles during the offering process. Understanding the structure of this form is vital for navigating its components efficiently.

-

The Form is designed to facilitate clear communication and agreement between issuers and underwriters.

-

Key components typically include issuer details, underwriter information, and terms of the offering.

-

Utilizing pdfFiller’s interactive tools can significantly enhance the experience of completing this form.

Steps for filling out the issuer-underwriter form

Filling out the Issuer-Underwriter Form can be straightforward with the right preparation. Before beginning, it is essential to gather all necessary documentation to ensure accuracy throughout the process.

-

Collect all the necessary documents including company details, financial statements, and regulatory compliance materials.

-

Follow each section methodically to ensure comprehensive completion of the form.

-

Enhance productivity by using pdfFiller’s tools for editing, signing, and managing your form.

Common mistakes to avoid when completing the form

Avoiding common errors when filling out the Issuer-Underwriter Form is critical to prevent delays. Many users overlook important details, leading to compliance issues or rejections.

-

Common mistakes include incorrect financial figures and missing signature fields, which can delay processing.

-

Always review your information for accuracy and completeness to mitigate potential fallout.

-

pdfFiller offers validation tools that can help ensure your submissions meet the required standards.

Managing and submitting your issuer-underwriter form

Efficient management of the Issuer-Underwriter Form is essential for tracking its progress. Once completed, adhering to best practices for submission can also enhance security and compliance.

-

Organize documents systematically within pdfFiller to ensure easy access during submission.

-

Utilize encrypted submission options offered by pdfFiller for safe document transfer.

-

Use tools provided by pdfFiller for tracking your submission and be proactive in follow-up communications.

Compliance and regulatory considerations

Ensuring compliance is essential in the issuer-underwriter process. Different regions and jurisdictions have specific requirements involving deadlines and documentation that's critical for maintaining compliance.

-

Detail the key regulatory guidelines relevant to issuers and underwriters to avoid pitfalls.

-

Stay informed about filing deadlines and requirements to maintain compliance and avoid penalties.

-

pdfFiller assists users in ensuring documents align with regulatory standards, thus enhancing peace of mind.

Leveraging pdfFiller for enhanced document workflows

pdfFiller provides a wealth of features to improve the document workflow for the issuer-underwriter form process. Collaborative tools can streamline how teams work together to finalize documentation.

-

Utilize pdfFiller’s collaborative capabilities to keep all stakeholders informed and involved.

-

Integrate pdfFiller with your existing software solutions for a unified document management experience.

-

Users often report substantial improvements in efficiency and accuracy when using pdfFiller throughout the issuer-underwriter process.

Final considerations and next steps

Successfully managing the issuer-underwriter form requires diligence and attention to detail. By utilizing pdfFiller’s comprehensive platform, users can enhance their documentation experience and ensure compliance.

-

Strongly consider all discussed steps for efficient management of the issuer-underwriter form.

-

Leverage the multi-functional tools on pdfFiller for ongoing documentation needs, ensuring a streamlined process each time.

How to fill out the issuer - underwriter

-

1.Obtain the issuer-underwriter form from pdfFiller.

-

2.Open the form in pdfFiller's editor.

-

3.Review each section to understand the required information.

-

4.Begin with the issuer section: input the name, address, and type of entity.

-

5.Proceed to the underwriter section: enter the underwriter's details including name and address.

-

6.Fill out the offering details, such as the type of securities and the amount being raised.

-

7.Include terms and conditions related to the underwriting agreement.

-

8.Check for any additional sections that require specific disclosures or signatures.

-

9.Review the completed document for accuracy and completeness.

-

10.Save the filled document and download or share it as needed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.