Get the free pdffiller

Show details

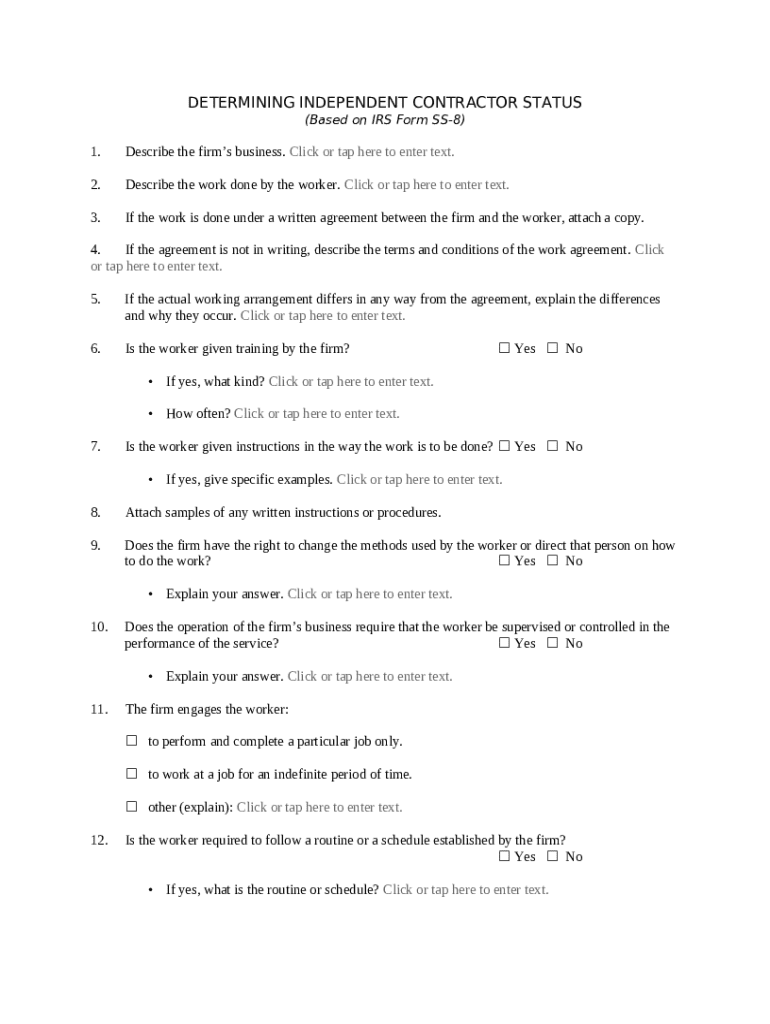

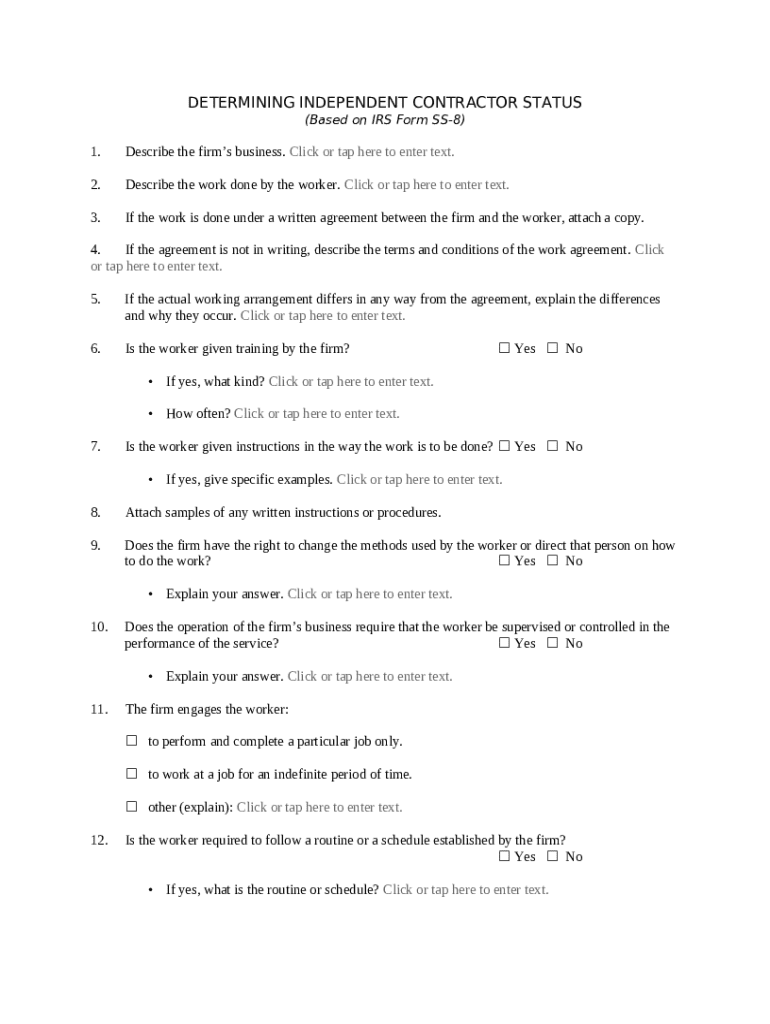

This AHI checklist is used to determine the status of an independent contractor. The form is based on the IRS form SS-8.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is determining self-employed independent contractor

Determining self-employed independent contractor refers to the process of identifying whether an individual qualifies as a self-employed contractor rather than an employee based on specific criteria.

pdfFiller scores top ratings on review platforms

easiest way to fill forms!

I like it and I recommend it to anyone who works with Forms that cannot be edited using another softwares.

In my job we need to complete a LOT of forms (we are a law firm specialized in tax and corporate law so we need to complete a lot of forms that come in PDF format) and some of them doesn´t allow us to make any edit in the regular PDF program so PDFFiller is our salvation. It is super easy to use and it allows you to edit the entire document using only this software. You can add text or even delete parts that you don´t need. It is a software that doesn´t require any effort to understand because everything is as simple as upload the document, make the changes and save as pdf or print the document. I use it every day and I find it very complete for the things that I need.

You are not able to use it in several computers, so if by mistake you open your session on another computer you may loose your work.

Very useful to fill PDF and Edit them On the Go.

PDF Filling and operations just got easier. PDFfiller is a good software for regular usage as well.

1. Beautiful UI and Editing features.

2. The export feature is very useful and Smart. PDF to Word Export is just a Jiff.

I faced a few issues with Multi Format and Locked PDF but worked like a charm in Premium Version. Thanks

pdffiller

I like that you can make PDF Forms Fillable

Wish it had more options to edit pdfs forms

Default At Company

I like that I can read-only PDFs straight from Gmail - previewing with PDFfiller is way easier than having to download through Adobe.

I feel like there is nowhere to go if you need assistance or a homepage to see all of the PDFs that you have viewed.

Easy way to fill in forms online

Easy to get things filled in and returned to customers without having to print, write and then scan or fax back. Saves a lot of time in getting payment information from guests.

This software doesn't really do anything else except for fill in PDF files. If this is all you need then great but it would be nice if it could do some other tasks with PDF files as well.

It is my alternative for quick editing of pdf documents

I edit PDF documents quickly

It's software is quite intuitive. It is easy to handle. To fill out forms is great. Also to add the signatures to the documents

Once I wrote to technical support and I'm still waiting for an answer. It's the only negative I can say. In the end I solved the problem I had in another way

Who needs pdffiller template?

Explore how professionals across industries use pdfFiller.

How to determine your self-employed independent contractor form

Filling out the form for determining if you're a self-employed independent contractor is crucial. This form helps clarify your working status and ensures proper tax compliance.

What defines self-employment and independent contractor status?

Self-employment refers to working for oneself instead of as an employee for someone else. An independent contractor operates on a contractual basis, providing services to clients without the same legal obligations as employers. Correctly determining your status is significant because misclassification can lead to tax penalties and legal challenges.

-

Working independently and being your own boss.

-

Ensures proper tax filings and avoids penalties.

-

Independent contractors usually have more flexibility but fewer benefits.

How do you sign and fill out the form?

Accessing the contractor form is straightforward with pdfFiller—an online service for editing and signing PDFs. Filling out the key fields requires attention to detail to ensure accuracy.

-

Visit pdfFiller and search for the independent contractor form to start.

-

Follow clear instructions for each field to accurately complete the form.

-

pdfFiller offers helpful tools that can guide and simplify the document editing process.

What should you know about IRS Form SS-8?

The IRS Form SS-8 is essential for determining the employment status of a worker. It includes specific sections designed to address various aspects of your work habits and business practices.

-

It contains fields that pertain to your business operations, such as remuneration structure and the nature of services provided.

-

The form specifically asks about the level of control you have over your work and relationship with clients.

-

Many individuals think the form is overly complicated - however, it provides clear guidance if tackled section by section.

What factors influence independent contractor status?

Identifying if someone is an independent contractor hinges on several aspects including control and independence. The nature of work arrangements can also significantly impact one's status.

-

A contractor typically enjoys greater independence than an employee.

-

Written contracts generally offer a more robust foundation for establishing status.

-

Different roles, such as freelance writing versus consulting, may demonstrate varied levels of independence and control.

How does training and supervision affect contractor status?

The nature of training and supervision provided to independent contractors can influence their classification. The more training and oversight a contractor receives, the more they may resemble an employee.

-

Extensive training can imply an employee-like relationship, which affects status determination.

-

Regular supervision might blur the line between independent contractor and employee.

-

Assess situations where enforced training indicates a controlled environment.

What are the legal and tax implications of self-employment?

As an independent contractor, it is crucial to understand the tax obligations associated with your earnings. This includes knowing about filing requirements and the potential penalties for misclassification.

-

Self-employed individuals are responsible for both income and self-employment taxes.

-

You must file Form 1099-NEC and make estimated tax payments quarterly.

-

Incorrectly classifying a worker can result in substantial penalties and back taxes.

What are the best practices for engaging independent contractors?

Establishing clear agreements with independent contractors is key to a successful working relationship. Utilizing platforms like pdfFiller can streamline contract preparation and management.

-

Ensure agreements outline deliverables, payment structure, and deadlines.

-

pdfFiller provides templates for contracts that can save you time.

-

Develop strategies to maintain clear communication and set expectations.

What are the next steps after determining your status?

Once you've filled out the necessary forms and received documentation like Form 1099-NEC, it's vital to maintain proper records. Using pdfFiller for document management can help streamline this process.

-

Follow up with proper tax filings and maintain personal records of your earnings.

-

Stay organized by keeping all receipts and documents related to your independent contractor status.

-

Utilize pdfFiller’s tools for ongoing management of your documents.

How to fill out the pdffiller template

-

1.Open the PDF file containing the determination form on pdfFiller.

-

2.Begin by filling out the contractor's personal information at the top of the form, including their full name, address, and contact details.

-

3.Next, delineate the type of services offered or the nature of the work performed by the contractor in the designated section.

-

4.Proceed to check the appropriate boxes that apply to the contractor’s work relationship with the business, including control over work hours, equipment used, and whether they can hire others.

-

5.Provide any additional context or explanations needed in the space provided for remarks or notes.

-

6.Review all filled sections carefully for accuracy and completeness before finalizing the document.

-

7.Once satisfied with the entries, save the document and consider downloading a copy for your records.

-

8.Finally, submit the completed form to the relevant authority or keep it for internal records as needed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.