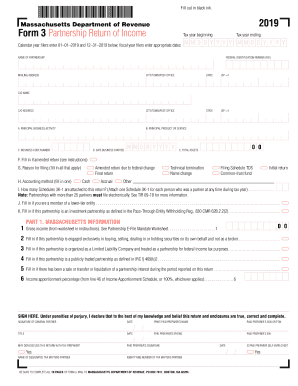

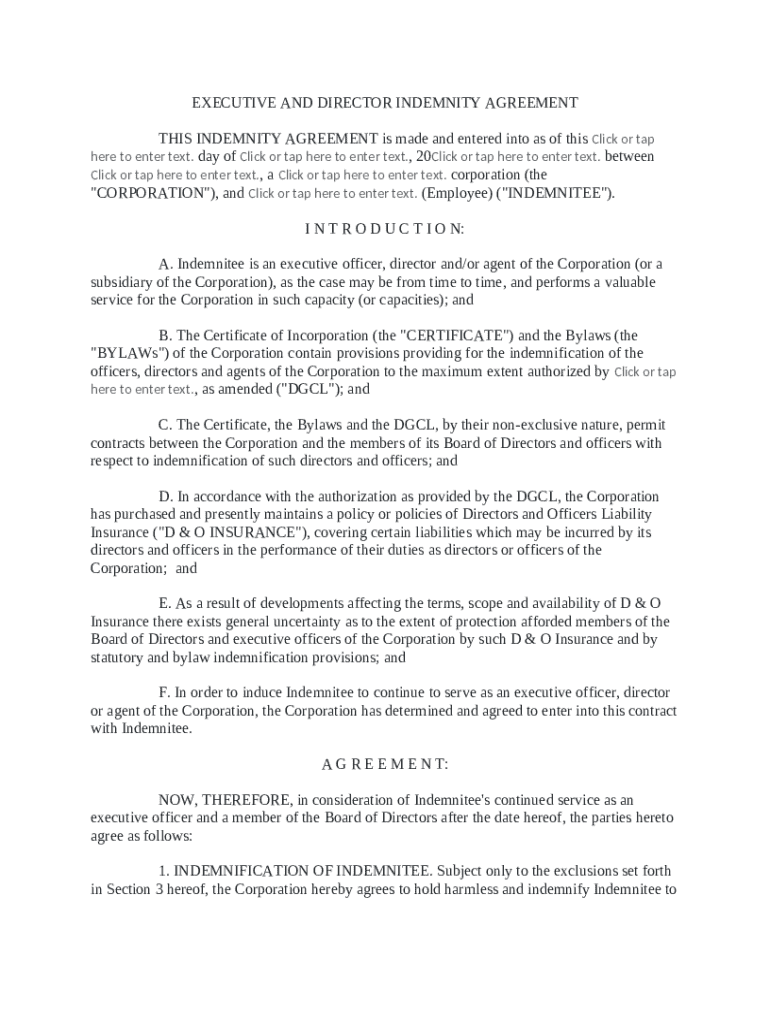

Get the free Executive and Director Indemnity Agreement template

Show details

This is a sample Executive and Director Indemnity Agreement. An indemnity agreement is a contract that protects one party of a transaction from the risks or liabilities created by the other party

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is executive and director indemnity

Executive and director indemnity is a form of insurance that protects company executives and directors from personal losses due to legal actions taken against them in their capacity as company leaders.

pdfFiller scores top ratings on review platforms

I know that most IRS forms are free and can be saved to my files, however sometimes trying to download the forms is difficult to do. PD Filler is much more user friendly and easy to follow.

Using the paid version and it works well. Love having the extra options over the free version. Worth the year subscription.

OIT was good but I still need more experience with it to get a higher rate,

Now it is a tool I use in my work. Has been very useful.

WOULD HAVE BEEN NICER TO BE ABLE TO PUT ALL MY 1099-MISC IN JUST 1 PDF THOUGH

I keep having trouble returning to my document in progress. Other than that I really like this form maker.

Outstandingly useful and so easy to use!

Who needs executive and director indemnity?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide on Executive and Director Indemnity Form

What is an executive and director indemnity agreement?

An executive and director indemnity agreement is a legal document designed to protect corporate leaders from potential liabilities incurred while performing their official duties. It serves as a safeguard to ensure individuals in these roles are not financially or legally disadvantaged when acting on behalf of the corporation. This is particularly crucial in corporate governance, where decisions may expose directors and executives to lawsuits or claims.

-

An indemnity agreement is a contract that provides protection against loss or damage. In this context, it assures directors and executives that they will be defended against claims related to their corporate actions.

-

The primary purpose of such agreements is to foster a sense of security among directors and executives, encouraging them to make decisions that benefit the corporation without fear of personal liability.

-

Typically, the stakeholders covered include current and former directors and officers, employees, and sometimes, third parties, ensuring comprehensive protection within the organization.

What provisions are typically included in an indemnity agreement?

Indemnity agreements commonly feature a variety of provisions that outline eligibility conditions and protections offered. These clauses play a vital role in defining the scope of indemnity, helping individuals understand their rights and the limitations of their coverage.

-

Eligibility often depends on the individual’s conduct, such as acting in good faith and in the best interests of the corporation. It's essential to understand that breaches of duty or illegal acts may void indemnification.

-

Corporate bylaws and articles of incorporation play a significant role in shaping the indemnity framework. They may impose additional requirements or guidelines on how indemnity is administered within the organization.

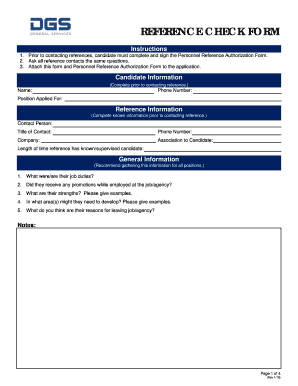

How to fill out the executive and director indemnity agreement?

Filling out an executive and director indemnity agreement can seem daunting, but a structured approach makes it manageable. Key fields must be accurately filled to ensure the document serves its purpose effectively.

-

Clearly state the full legal name of the corporation to establish the entity responsible for the indemnity.

-

The date on which the indemnity provision becomes effective should be clearly mentioned to avoid confusion regarding coverage.

-

You must identify the individual(s) to be indemnified, ensuring there are no ambiguities about who is entitled to protection under the agreement.

How does &O insurance relate to indemnity agreements?

Directors and Officers (D&O) Liability Insurance is a crucial aspect of corporate risk management that works in tandem with indemnity agreements. While indemnity agreements provide contractual protection, D&O insurance offers an additional layer, safeguarding against financial losses.

-

D&O insurance protects financial assets when directors and officers are sued for alleged wrongful acts while managing a company.

-

D&O insurance complements indemnity agreements by covering defense costs, settlements, and judgments that may arise, providing comprehensive protection.

-

It’s important to note that D&O insurance may have limits and exclusions, especially regarding coverage for criminal acts or fraudulent behavior.

What are best practices for implementing an indemnity policy?

To ensure an effective indemnity policy, following best practices helps reinforce corporate governance and bolster legal compliance. Crafting a strong indemnity policy can prepare your organization against potential claims.

-

A well-drafted policy should clearly lay out coverage parameters, eligibility conditions, and procedures for making claims.

-

Frequent assessments of indemnity agreements and policies can help organizations adapt to new legal standards and business environments.

-

Engaging legal counsel is essential to ensure that indemnity agreements comply with local regulations and are enforceable.

How to manage and track indemnity agreements effectively?

Managing indemnity agreements requires vigilance and good practices to ensure compliance and accessibility. Using tools like pdfFiller can streamline the process and improve efficiency.

-

Utilizing pdfFiller allows users to easily manage versions of indemnity documents, ensuring clarity regarding the most current terms.

-

eSigning functionalities facilitate swift approvals, ensuring that indemnity agreements are executed promptly, minimizing risk.

-

Using collaboration features within pdfFiller enhances teamwork, allowing legal teams to review and provide feedback efficiently.

What are the compliance and legal considerations for indemnity agreements?

Navigating the legal landscape surrounding indemnity agreements can pose challenges, especially in varying jurisdictions. Understanding local laws is critical for effective policy implementation.

-

Indemnity agreements must comply with regional regulations that govern corporate governance and liability. Staying informed can help mitigate legal risks.

-

Organizations should anticipate legal challenges that could arise from indemnity agreements and prepare defense strategies to address them.

-

Ongoing monitoring of the legislation affecting indemnity is essential for all organizations, ensuring adherence to new compliance requirements.

When to consider alternative indemnity solutions?

There are scenarios where organizations might need to explore alternative solutions to traditional indemnity agreements. Emerging practices may offer more tailored protections.

-

Amending standard agreements may be necessary when circumstances change, ensuring adequate protection for evolving risks.

-

Organizations are increasingly looking into alternative indemnity solutions, such as captives or risk retention groups, which may provide enhanced coverage options.

-

Studying past case studies can provide insights into how organizations responded to liability claims and their indemnity frameworks.

How to fill out the executive and director indemnity

-

1.Open the executive and director indemnity form on pdfFiller.

-

2.Review the form fields to understand required information.

-

3.Begin by filling in the basic details such as the company name, address, and contact information.

-

4.Provide the names and titles of the executives or directors to be covered by the indemnity.

-

5.Fill in the specific information regarding the scope and amount of coverage desired.

-

6.Include any necessary clauses or stipulations that are relevant to the indemnity.

-

7.Review all entered information for accuracy and completeness.

-

8.Save the document to avoid losing any progress and make any edits as needed.

-

9.Once all information is finalized, proceed to submit the form for review or print it for signatures.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

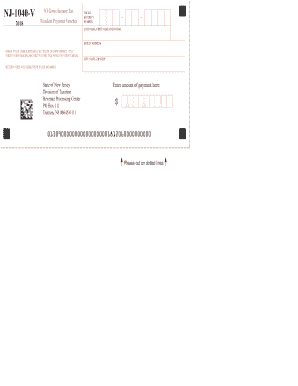

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.